Setting Up a Neobank From Scratch

Build it with InvestGlass!

The world is changing and so are the ways in which we build digital banks. The newest trend in online banking services, neo banking, has been growing exponentially over the last few years. This article will walk you through some of the secrets to setting up a neo bank from scratch. We’ll cover everything from what type of software you need, to how you should price your services.

New start up will benefit from banking as a financial service providers’ plug and play approach.

1. What is a neobank versus a traditional banks?

Neobanks, compared to traditional banks, represent a shift towards digital-first financial services, emphasizing user experience and accessibility over the traditional banking model with physical branches and a broader array of banking and lending products. Unlike traditional banks, which operate under their own banking licenses and offer a comprehensive suite of financial services including savings accounts, loans, and checking accounts through physical and online channels, neobanks primarily operate online and often rely on partnerships with established financial institutions to provide their services. This distinction allows neobanks to offer innovative services like personal loans, trading, and mortgage advice without the need for a physical presence or their own banking license. However, the regulatory landscape for neobanks varies significantly across countries.

In some regions, neobanks can operate under a “banking license umbrella” provided by a partner financial institution, simplifying the entry into the banking sector. In contrast, other countries may require neobanks to navigate a more complex regulatory process to offer certain financial services, influencing their business models and the range of services they can provide. This variance highlights the importance of understanding specific national regulatory environments for neobanks, as it directly impacts their operational capabilities, the services they can offer, and their growth strategies. Examples of neobanks like WeBank by Tencent, Yolt, and Moven illustrate the global reach and diverse approaches within the neobanking sector, reflecting different regulatory and market dynamics across countries..

2. Why setting up your own bank might be beneficial to you – do you need a banking license?

You don’t need a full baking license to start your neo challenger bank. You can create your digital bank without your own banking license. Most challenger banks started with simple core banking systems and an umbrella license. An umbrella license is a license you are sharing with a traditional bank.

A banking license can be extremely expensive and long to obtain. Finding the right banking partner, or financial institution can be an easy way to start your business.

For card issuing, you’ll find in most countries local vendors that will produce prepaid cards and even offer a technology infrastructure and reporting tools.

3. Setting up a neobank from scratch which product do you need with traditional bank infra?

The objective is to be a one stop shop. Building digital will start with digital tools such as a CRM and the client onboarding digital form and good digital marketing tool to efficiently manage distribution channels. You must have a powerful CRM because this is key to collect future client data.

The rest is composable architecture. It is key that your neo bank service provider offers a lightning-speed digital account opening process. You should also look into payments processing solutions and KYC remediation. InvestGlass team is glad to share with you our knowledge.

4. Things to consider before opening a digital bank (security, fees, interest rates)

When considering the launch of a digital bank, several critical factors beyond initial funding must be evaluated to ensure the venture’s success. Security, fees, and interest rates are paramount, but leveraging innovative growth strategies and differentiating from traditional banks also play a crucial role.

Security is a cornerstone for digital banks, requiring investment in robust cybersecurity measures and cloud computing solutions to protect customer data and financial transactions. A secure digital banking platform not only builds trust with users but also complies with stringent regulatory requirements. Implementing advanced encryption, multi-factor authentication, and continuous monitoring can help mitigate risks and safeguard the digital banking solutions ecosystem.

In terms of fees and interest rates, competitive pricing is key to attracting and retaining customers. Digital banks have the advantage of lower operational costs due to the absence of physical branches, allowing them to offer more attractive rates on savings accounts and loans, as well as lower or no fee structures for account management and transactions. Transparent pricing models and clear communication about fees and benefits can enhance customer satisfaction and loyalty.

Growth hacking presents an unconventional avenue for customer acquisition and brand visibility. By employing creative, low-cost strategies to ‘hack’ rapid growth—such as viral marketing campaigns, social media engagement, and leveraging analytics for targeted offerings—digital banks can achieve significant growth without the substantial marketing expenditures typical of traditional banks.

Furthermore, while digital banks inherently operate online, considering the integration of physical touchpoints or pop-up experiences can enrich the customer relationship, offering tangible interactions in a predominantly virtual world. This hybrid approach can see conventional banks cater to a broader audience, including those who may still value occasional in-person banking interactions.

Differentiation of neo banks from traditional banks and legacy systems is crucial. This can be achieved by focusing on the customer journey and experience, from account opening to day-to-day management and beyond. Features like personalized financial advice, seamless integration with payment and financial management apps, and innovative products tailored to specific customer needs can set a digital bank apart. Emphasizing user experience, with a clean, intuitive app design and responsive customer service, further distinguishes digital banks from their traditional counterparts.

In conclusion, launching a digital bank requires a multifaceted approach, focusing not just on the foundational aspects of security, fees, and interest rates, but also on innovative growth strategies, customer experience, and the potential for hybrid digital-physical service models. By addressing these areas, new digital banks can position themselves for success in the competitive financial services landscape.

5. Steps for opening an account with the neobank of your choice and getting started

1. Research and Choose the Right Neobank

The initial step involves thorough research to identify a top neobank app development, that aligns with your financial needs or business model. Consider factors such as the range of banking and financial services offered, regulatory compliance, security measures, user interface of the neobank app, and customer service quality. Look into reviews, compare features, and ensure the neobank targets the niche market or underserved segment you’re interested in serving with your start-up.

2. Initial Contact and Consultation

Reach out to the neobank development, or a consulting firm experienced in digital bank development for an initial consultation. This conversation should focus on understanding the prerequisites for account opening, the types of accounts and services available, and any specific business model considerations for those looking to enter the neobank space themselves. Leverage this opportunity to gain insights into the regulatory environment and how to navigate it without a traditional banking license.

3. Onboarding and Identity Verification

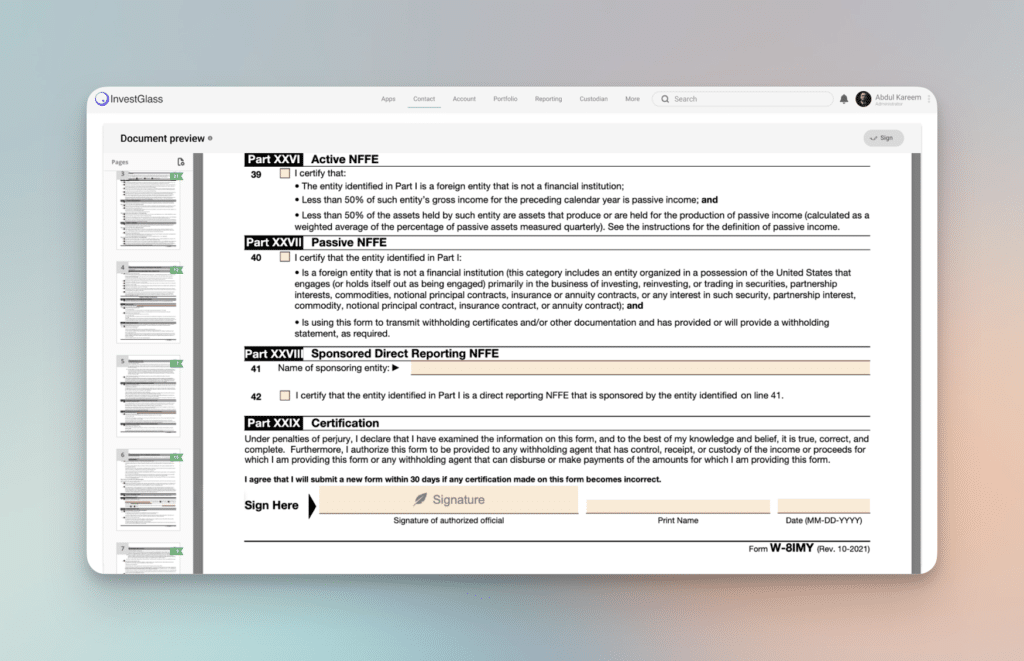

Neobanks typically offer a streamlined digital onboarding process, which includes identity verification. This step is crucial for regulatory compliance and to protect against fraud. Be prepared to provide necessary documentation, which may include a government-issued ID, proof of address, and in some cases, additional verification for business accounts. The process leverages advanced technology, such as biometric verification and AI-driven checks, to ensure security and efficiency.

4. Exploring Pre-Integrated Features and Services

Once your account is set up, take the time to explore the pre-integrated features and services your neobank offers. This could include: mobile banking app functionality, payment processing solutions, account management tools, and more. For those looking to establish their own neobank, understanding these features is critical for identifying what you’ll want to incorporate into your digital banking solution. Services like Investglass offer a suite of tools designed for modern financial services, from CRM systems to automated compliance checks.

5. Customizing Your Banking Experience

Customize your banking experience by setting up account preferences, exploring additional financial products, and integrating third-party services as needed. For entrepreneurs, this step is about envisioning how your customers will interact with your neobank platform. Consider how you can differentiate your offerings from traditional banking services by focusing on user experience, the convenience of online banking, and innovative financial products.

6. Regulatory Environment Navigation

For those interested in launching their own neobank, navigating the regulatory environment is a critical step. Seek advice from experts and leverage partnerships with other financial institutions to understand the landscape. This includes understanding the implications of banking licenses, the General Data Protection Regulation (GDPR), and other applicable regulations. Tailoring your business model to comply with these requirements from the outset is crucial for long-term success.

7. Market Analysis and Growth Strategy

Finally, conduct a thorough market analysis to understand the demand within your target niche or underserved market segments. Develop a growth strategy that leverages digital marketing, innovative product offerings, and customer service excellence to attract and retain users. Continuous innovation and adaptation to customer feedback are key to growing your neobank at a faster pace.

Starting with a neobank or launching your own digital banking platform requires a strategic approach, understanding of the financial industry’s regulatory environment, and a focus on delivering an exceptional digital banking experience. By following these steps, individuals and entrepreneurs alike can navigate the process more effectively, ensuring a solid foundation for personal banking or a successful neobank software startup.

Starting Your Neobank Journey

To launch a neobank, start by defining your business model, target audience, and the range of digital banking services you intend to offer. Consider the competitive landscape of the finance industry, focusing on niches or underserved market segments. Ensure your platform includes essential features for modern financial services, like seamless account opening, secure payment processing, and effective customer data management.

Collaborate with experienced partners, whether in banking, fintech, or technology, to navigate the complex regulatory environment and leverage their expertise for your to start a neobank’s development. Keep in mind that establishing a neobank is an ongoing process that requires continuous innovation, regulatory compliance, and a commitment to delivering exceptional digital banking experiences.

In conclusion, setting up a neobank from scratch is a challenging yet rewarding endeavor that represents the future of the financial industry. By focusing on digital innovation, customer experience, and regulatory compliance, entrepreneurs can create successful digital banks that challenge traditional banking models and meet the evolving needs of today’s consumers.

InvestGlass can help you build a neobank or any financial institutions faster with connected banking services

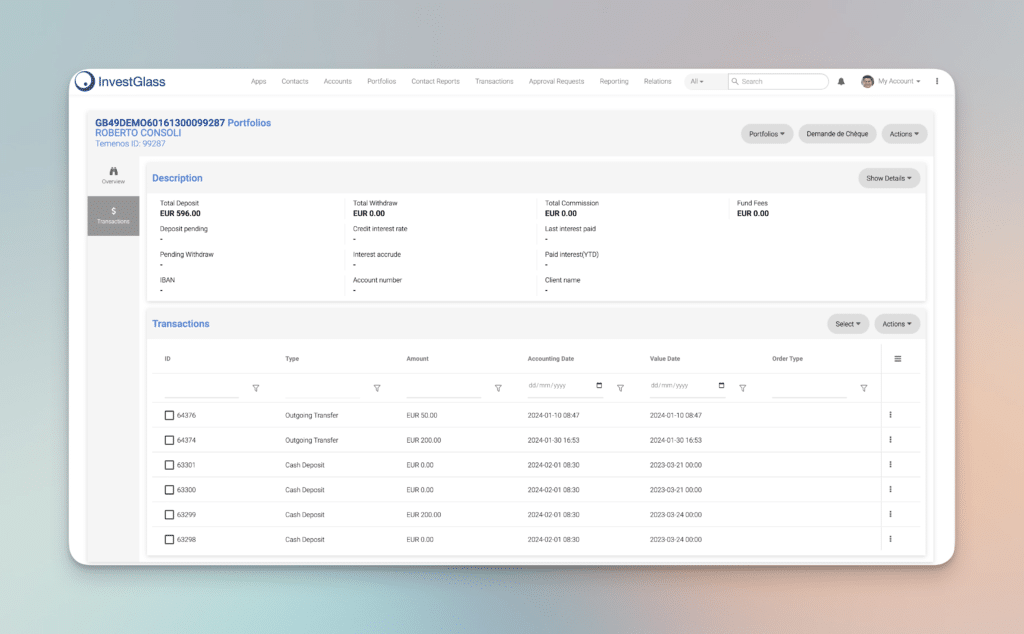

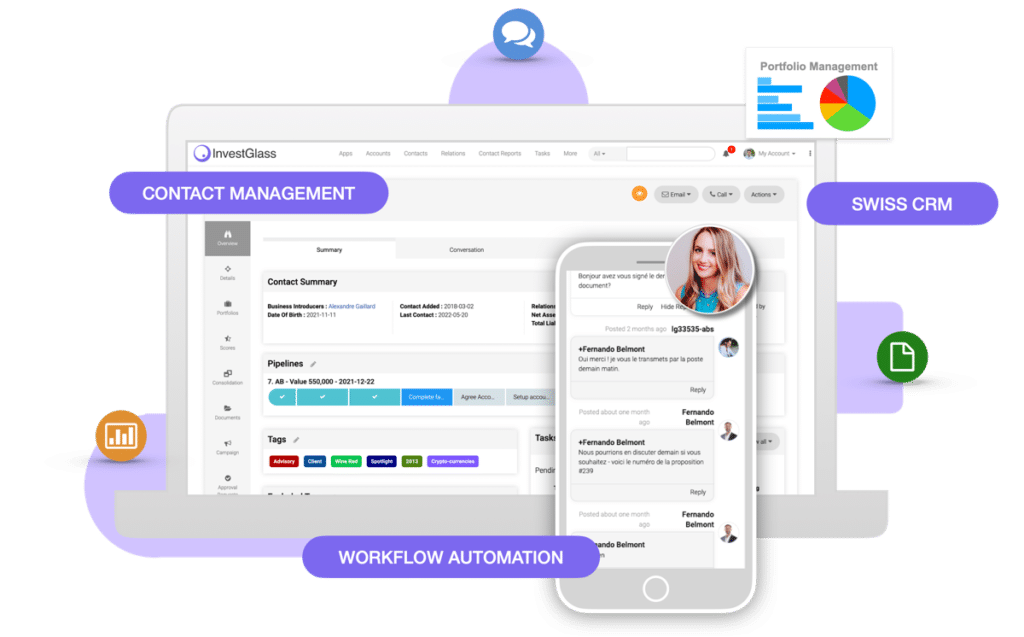

InvestGlass is a powerful Swiss digital tool designed to streamline the creation and operation of neobanks, offering a suite of features that can significantly accelerate the neobank app development cost and process. By leveraging InvestGlass, entrepreneurs can build a neobank faster by utilizing its integrated platform for CRM (Customer Relationship Management), sales automation, and digital onboarding, among other functionalities. Here’s how InvestGlass facilitates the rapid development of a neobank:

1. CRM and Client Onboarding

InvestGlass provides a robust CRM system tailored for financial services. This system enables neobanks to manage customer relationships efficiently, from initial contact to ongoing account management. The platform automates the digital onboarding process, making it seamless for customers to open new bank accounts. This includes collecting necessary documents, performing identity verification, and ensuring compliance with regulatory requirements—all in a streamlined, user-friendly manner.

2. Automated Compliance and KYC

Compliance with regulatory standards and Know Your Customer (KYC) requirements is crucial for neobanks. InvestGlass automates these processes, reducing the risk of human error and ensuring that the neobank adheres to the applicable laws and regulations. This automation includes real-time checks and balances, alerting the neobank to any discrepancies or issues that need to be addressed, thus speeding up the compliance process and making it more reliable.

3. Sales Automation and Digital Marketing

InvestGlass’s sales automation and digital marketing tools enable neobanks to reach their target audience more effectively. The platform offers capabilities for email marketing, campaign management, and lead generation, all integrated within the CRM. This allows neobanks to tailor their marketing efforts to specific customer segments, improve engagement, and drive growth—all while reducing the manual effort required for these tasks.

4. Customizable Financial Products and Services

The platform offers tools to create and manage a wide range of financial products and services, from savings accounts to loans and investment options. This flexibility enables neobanks to quickly adapt their offerings to meet the evolving needs of their customers and the market, without the need for extensive backend development.

5. Integration with Third-party Services

InvestGlass supports integration with various third-party services, including payment processors, banking software, and other fintech solutions. This interoperability allows neobanks to expand their ecosystem, offering customers a comprehensive range of services while minimizing development time and costs.

6. Scalability and Security

As neobanks grow, the need for a scalable and secure platform becomes paramount. InvestGlass is designed to scale with the business, accommodating an increasing number of customers and transactions without compromising performance or security. The platform’s robust security measures ensure that customer data is protected, aligning with the neobank’s need to build trust and comply with data protection regulations.

In summary, InvestGlass provides a comprehensive, integrated platform that addresses the key operational, compliance, and marketing needs of neobanks. Its advanced process automation features, combined with the ability to customize and rapidly deploy financial products and services, make it an invaluable tool for anyone looking to enter the neobanking space efficiently and effectively.