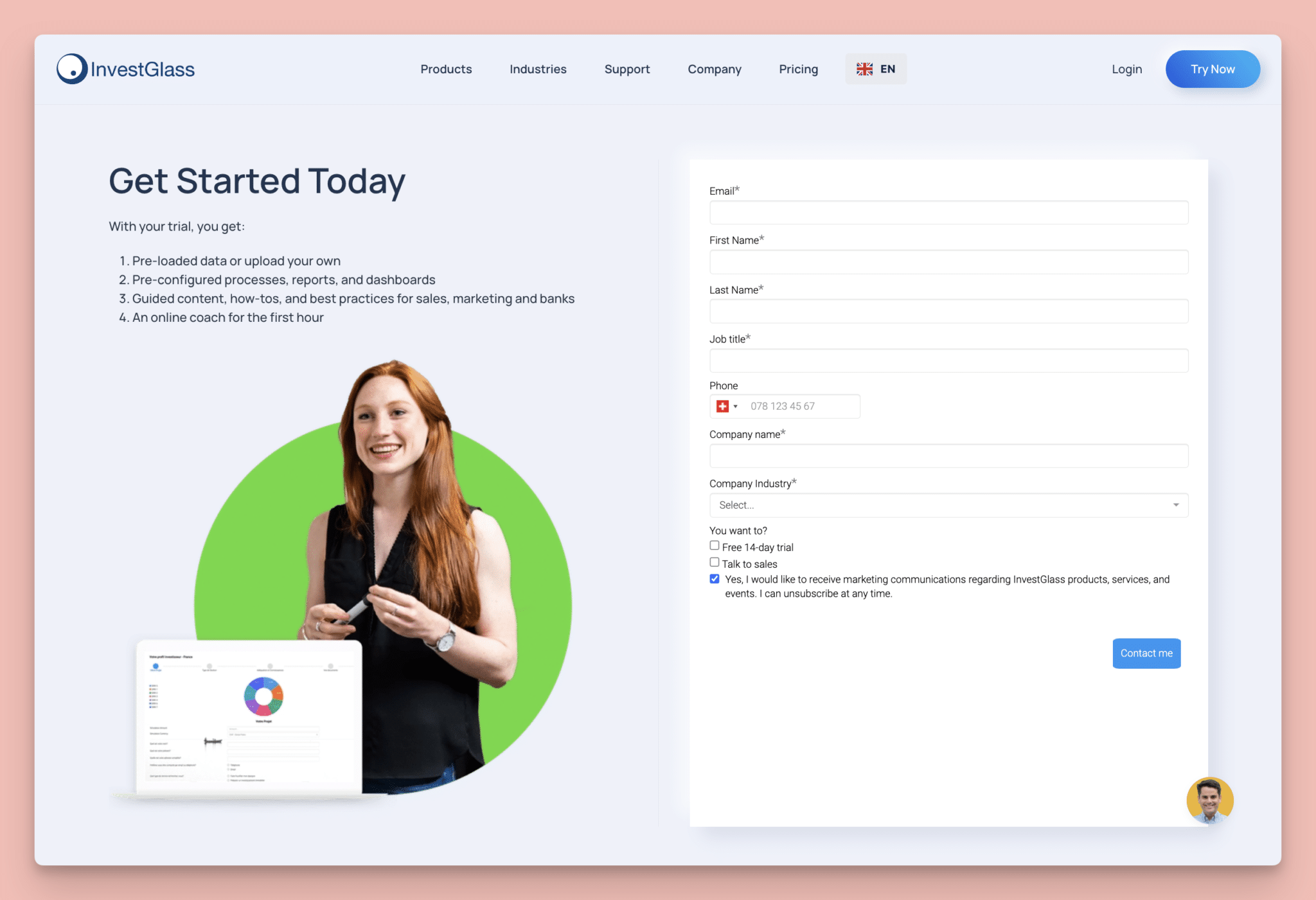

Simple and Powerful Digital Forms Builder

What Is Digital Onboarding & How Does It Work?

Online quiz maker

Feedback form

Application form

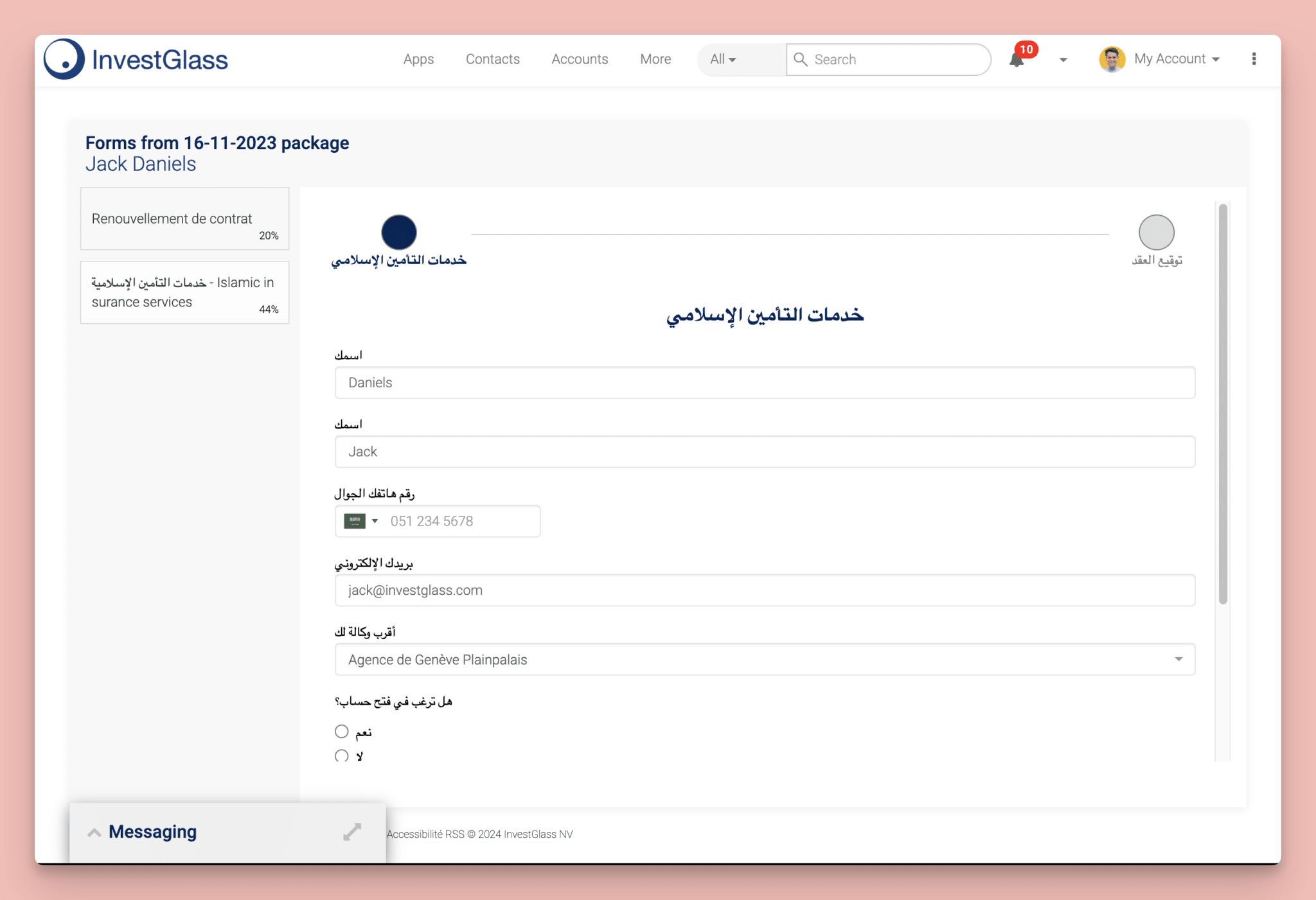

KYC remediations

Human Resources (HR) Surveys

Financial institutions

Simplify Your Workflow

From Start to End

From Start to End

Turn your paper into digital

InvestGlass offers effortless onboarding forms that streamline time-consuming processes. Enhance efficiency with personalized forms, surveys, and templates. Their expertise emphasizes the significance of customization in financial platforms.

Pre-built digital onboarding forms

Digital onboarding collects data from prospects and clients through personalized, logic-based forms. These forms ask targeted questions and request necessary document uploads. Examples of documents include IDs, driving licenses, and proof of residence.

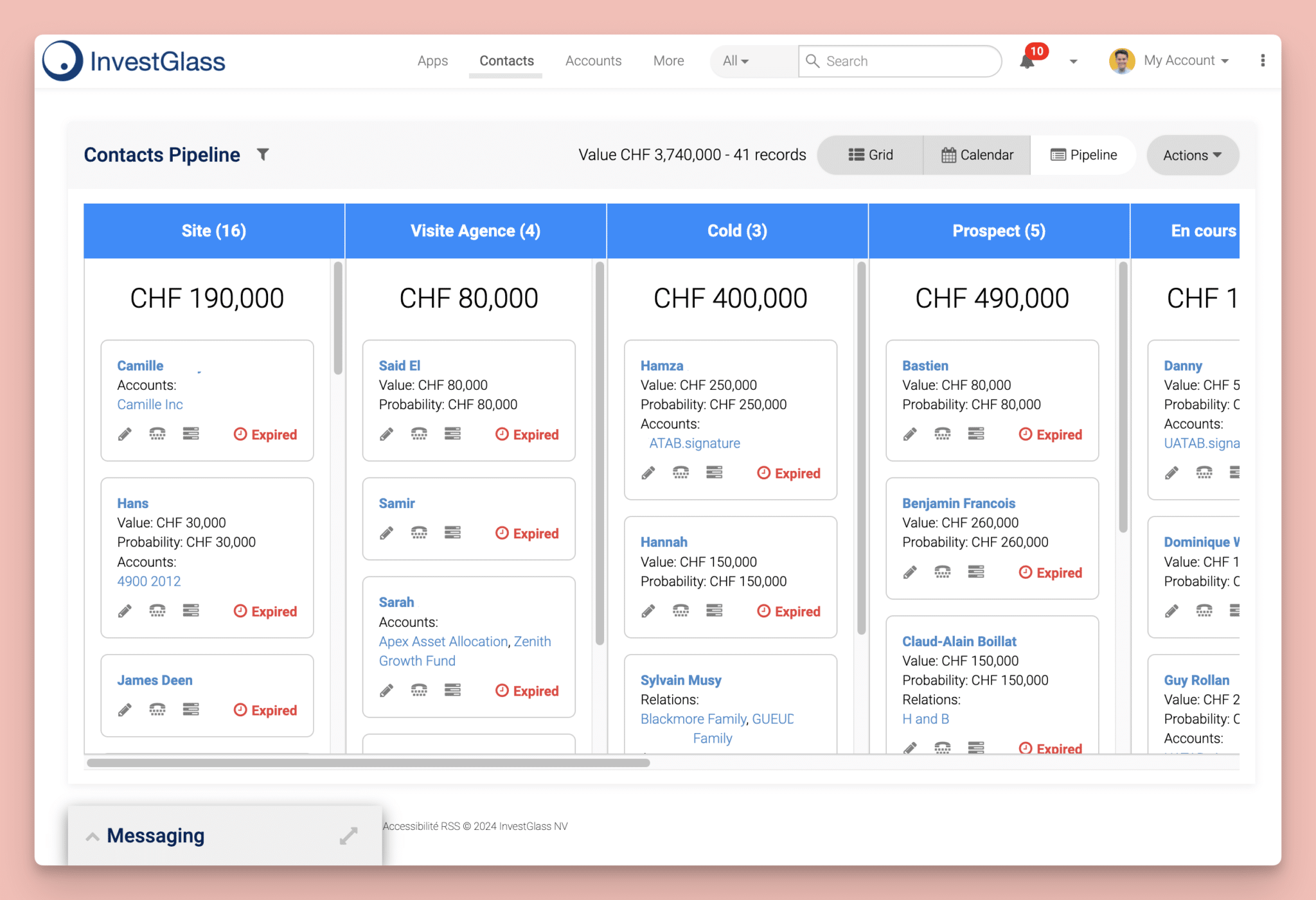

From customer acquisition to deal closing

InvestGlass’s CRM, integral to its digital forms, facilitates customer onboarding and life cycle management. The CRM stores customer data, auto-populating forms with prior responses.

Digital onboarding score and fraud detection

InvestGlass integrates with multiple APIs for fraud and identity checks, aiding banks and insurance firms in simplifying compliance. It enables risk assessment of clients and automated, personalized responses based on scores such as emails or SMS.

Packed With Features

Your Team Will Love

Your Team Will Love

API & Webhooks

Integrate API and Web hooks for seamless CRM data synchronization and real-time updates.

PDF Document Generator

Effortlessly generate professional PDF documents with our intuitive Document Generator.

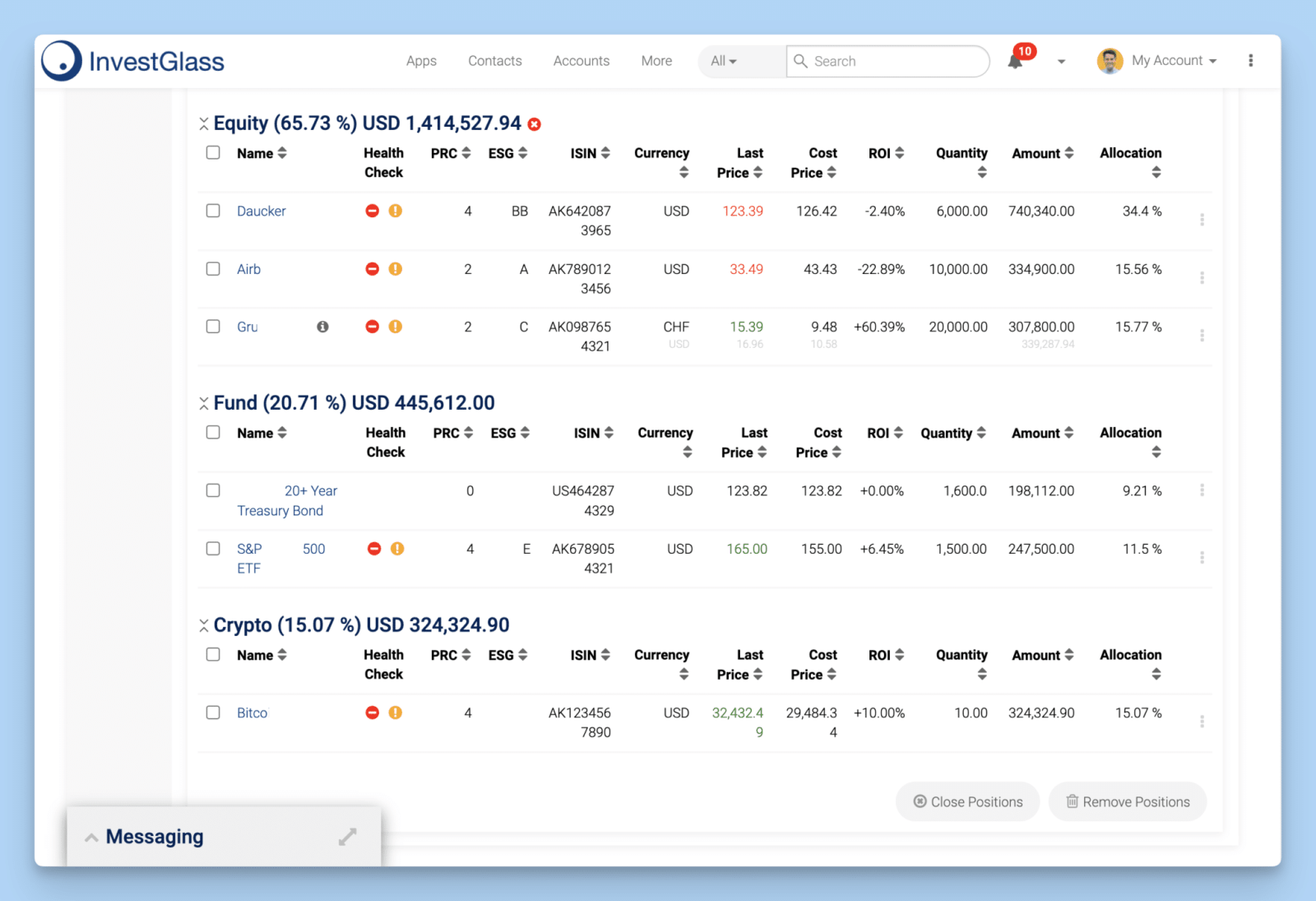

Built for robo advisory

Invest Glass offers automated investment strategies for streamlined wealth management.

Mobile-Responsive Forms

Create user-friendly mobile-responsive forms for seamless interaction across all devices.

Task automation

Simplify your workflow with efficient task automation, saving time and boosting productivity.

Cloud Storage in Switzerland

Securely store your data in Switzerland’s trusted cloud infrastructure for enhanced privacy and compliance.