How Do I Create a Digital Banking Platform?

Creating a digital banking platform is a highly sought-after objective in today’s modern financial landscape. With an increasing number of digital banks emerging, the demand for efficient and convenient digital banking services and banking software continues to grow. In this article, we will guide you through the process of building a digital banking platform and discuss how InvestGlass CRM and digital portal solution can significantly boost your productivity.

What is Digital Banking?

Digital banking refers to the online and mobile banking services offered by financial institutions, allowing customers to manage their financial transactions, accounts, and services remotely. It encompasses a range of digital channels, including online banking platforms, mobile banking apps, and digital wallets. In essence, digital banking transforms traditional banking services into a seamless, accessible, and efficient experience for users.

Definition and Overview of Digital Banking

Digital banking is a type of banking that leverages digital channels to provide financial services to customers. It involves the use of technology, such as the internet, mobile devices, and digital platforms, to facilitate banking transactions, manage accounts, and offer a variety of financial services. Digital banking platforms provide a comprehensive suite of services, including account management, bill payments, fund transfers, and loan applications, all accessible from the comfort of your home or on the go.

Benefits of Digital Banking Platforms

Digital banking platforms offer several benefits to customers, including:

- Convenience: Digital banking platforms allow customers to access their accounts and conduct transactions remotely, at any time and from any location.

- Speed: Digital banking platforms enable fast and efficient transactions, reducing the need for physical visits to bank branches.

- Cost-effectiveness: Digital banking platforms reduce the need for physical infrastructure, resulting in lower costs for banks and customers.

- Personalization: Digital banking platforms can offer personalized services and recommendations to customers, based on their financial behavior and preferences.

These benefits make digital banking an attractive option for both customers and financial institutions, driving the growth and adoption of digital banking services worldwide.

Step 1: Define your Business Model and Value Proposition

Before diving into the technical aspects of building a digital banking platform, it is crucial to define your business model and value proposition. This includes understanding your target audience, the services you want to provide (such as personal loans, payment services, or mobile banking solutions), and what sets you apart from existing digital banks and traditional banks. Additionally, creating a comprehensive technological infrastructure is essential when building a digital bank from scratch to address the growing demand for digital banking solutions among Millennials.

Step 2: Conduct Market Research

Conduct thorough market research to understand the needs and preferences of your target audience. This will help you tailor your digital banking platform to their needs and ensure your success in the highly competitive banking sector. Additionally, integrating various features and third-party services within the mobile banking platform is crucial to enhance user experience and effectively manage user financial data.

Identify the Target Audience and Market Needs

To develop a successful digital banking platform, it is essential to identify the target audience and market needs. This involves conducting thorough market research to understand the demographics, financial behavior, and preferences of your potential customers. By identifying the specific needs and pain points of your target audience, you can tailor your digital banking platform to address these issues effectively. Additionally, market research helps in identifying gaps in the market and opportunities for innovation and differentiation, ensuring your platform stands out in the competitive landscape.

Analyze Competitors

Analyzing competitors is crucial in developing a successful digital banking platform. This involves researching the digital banking platforms offered by competitors, identifying their strengths and weaknesses, and understanding their market share and customer base. By conducting a comprehensive competitor analysis, you can identify areas where your platform can differentiate itself and offer unique value propositions. This strategic approach enables you to develop a competitive and innovative digital banking platform that meets the needs of your target audience while standing out in the market.

Step 3: Acquire a Banking License and Ensure Regulatory Compliance

Acquiring a banking license is essential to operate as a legitimate financial service provider. This process may involve significant initial capital and meeting regulatory requirements such as anti-money laundering (AML) and two-factor authentication (2FA) for customer data security. You might want to consider first a license shelter before you receive your own e-money and payment institution license.

Step 4: Choose Your Core Banking System and Technology Stack

Your core banking system is the foundation of your core banking platform. It is responsible for managing customer accounts, transactions, and other banking services. When choosing your core banking system, consider factors such as scalability, ease of integration, and the level of customization required. There is a significant shift from traditional core banking systems to more modern, flexible, and cloud-based solutions that cater to the needs of digital banking, enabling a superior customer experience and operational efficiency.

In addition, select a technology stack that is robust and scalable. This includes choosing a programming language, database, and other key components necessary for building your digital banking platform.

Step 5: Develop the Digital Banking App and Integrate Third-Party Services

Develop a user-friendly digital banking app that provides a seamless banking experience. Consider integrating third-party services, such as payment infrastructure and mobile phone verification, to enhance the functionality and convenience of your platform. Effective software development is crucial in building and customizing your digital banking app, ensuring that security measures are integrated throughout the development life cycle and agile methodologies are employed for rapid updates and improvements.

InvestGlass CRM and Digital Portal Solution: The Ultimate Boost for Productivity

InvestGlass offers a comprehensive suite of tools that can significantly enhance the operational efficiency of your digital banking platform. By leveraging the power of InvestGlass, you can build a more robust, feature-rich, and efficient digital bank.

Sales Tools made for digital banks

With InvestGlass Sales Tools, you can automate your sales processes, track customer interactions, and manage your customer base effectively. This enables you to provide a personalized banking experience to your clients and enhance customer satisfaction.

Automation Tools

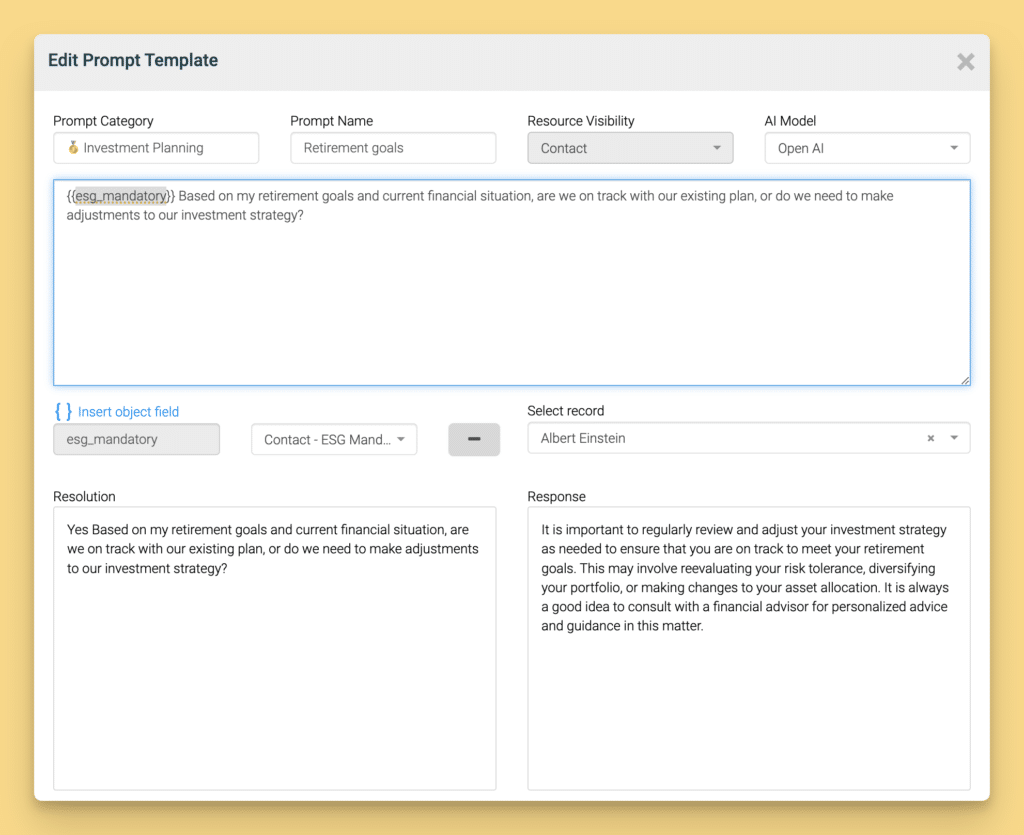

InvestGlass Automation Tools help automate repetitive tasks, freeing up your staff to focus on more critical aspects of your digital banking platform. These tools include transaction management, reporting, and more. The tools are ready for financial service providers in retail or private banking. The solution includes suitability, appropriateness and 10+ risk metrics to warn bankers and compliance officers.

Marketing Tools

Maximize your digital bank’s reach and engage customers with InvestGlass Marketing Tools. They provide email marketing, lead scoring, and other features to help you grow your customer base and increase brand awareness.

Collaborative Portal

InvestGlass Collaborative Portal allows your team to collaborate effectively, streamlining the development process and ensuring a more cohesive end product.

Digital Onboarding for any digital bank

Speed up customer acquisition with InvestGlass Digital Onboarding. Their seamless onboarding process ensures your clients have a smooth and hassle-free experience when joining your digital bank. The digital onboarding tool will mimic any paper contract and fulfil online banking onboarding needs.

On-premise, Swiss Servers or Dubai Servers

InvestGlass can be hosted on Dubai servers, ensuring that the data will stay where you need. This is a unique advantage we are offering as tech giants are always hosted in AWS, AZURE or US-based servers. Then all clients’ data and sensitive data stay next to your tech stack.

Conclusion

InvestGlass is a Swiss family-based company which will understand your expectation of digital transformation. The solution can be connected to your existing technology stack and core technology. It’s not only for fintech companies…. The portfolio management system is connectable to your transaction history and reporting tools too. We have proved to be faster and respect time to market. If you are start up bank or a traditional bank we will help you upgrade your banking product and physical branches.