Manage your insurance policies

InvestGlass Solutions offers all the features that allow you to modernise the management of your insurance policies. Reduce your management costs, avoid low-value-added manual tasks and focus on distribution and growth.

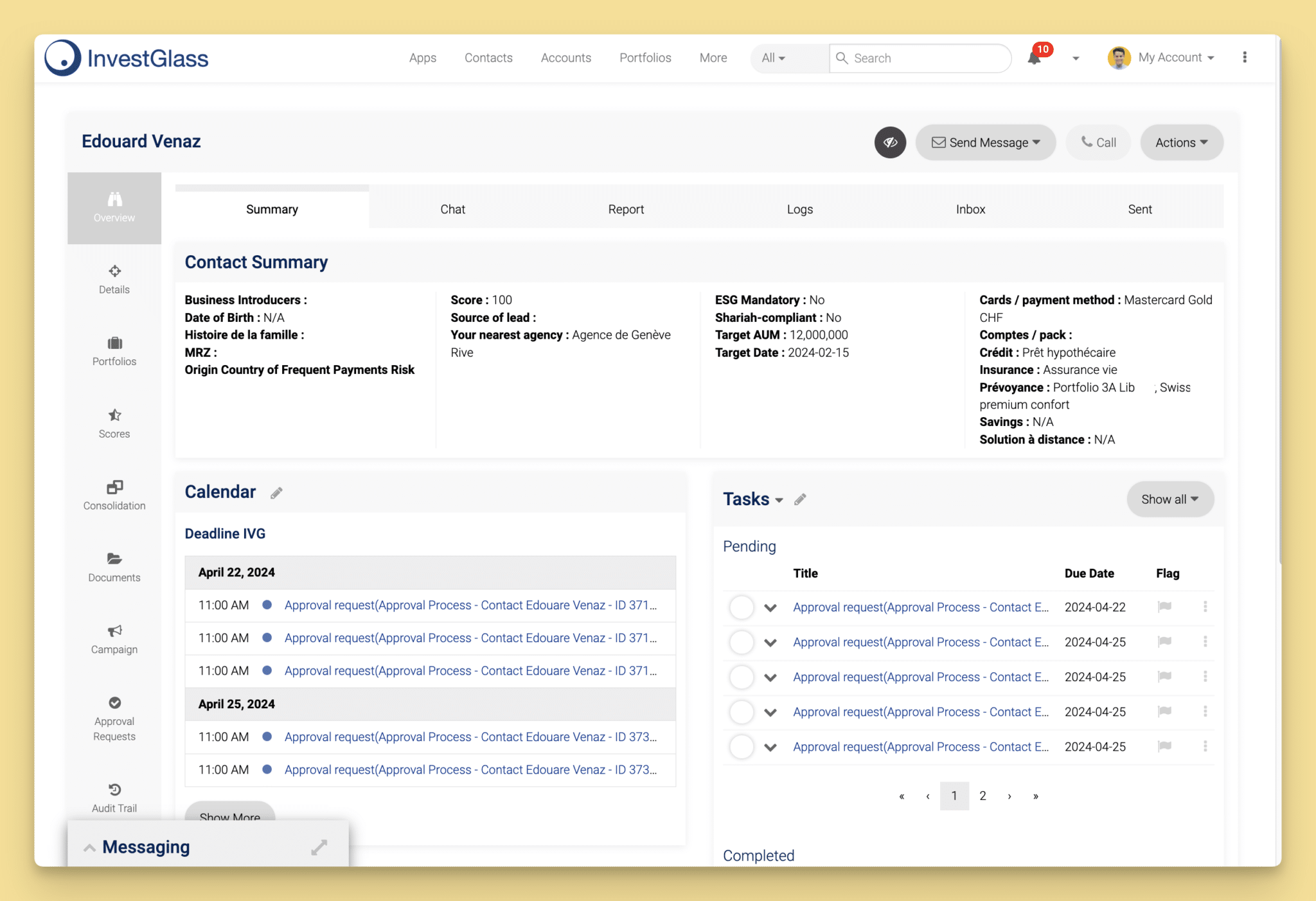

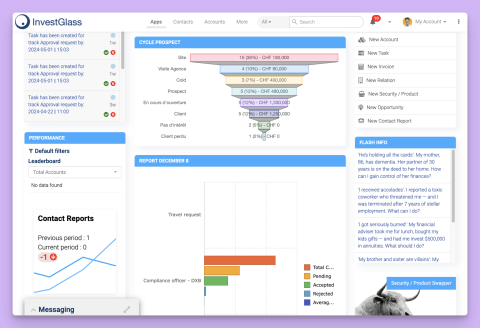

Customer Data Management

Customer profiles in InvestGlass provide comprehensive records of client information, including personal details, policy history, claim history, and interaction history. InvestGlass’s data integration ensures all customer data is up-to-date and accessible from a single platform, facilitating a 360-degree view of the client.

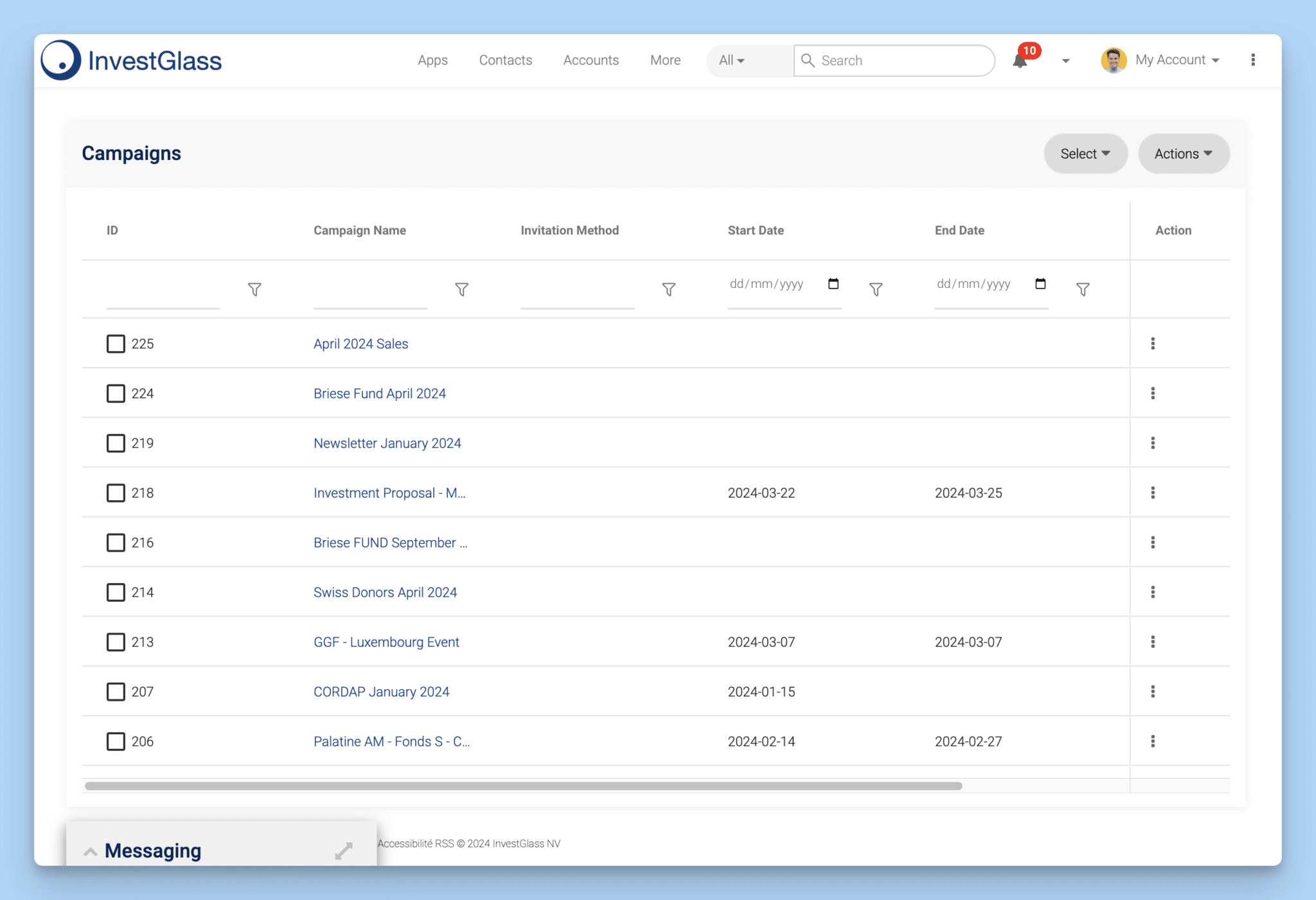

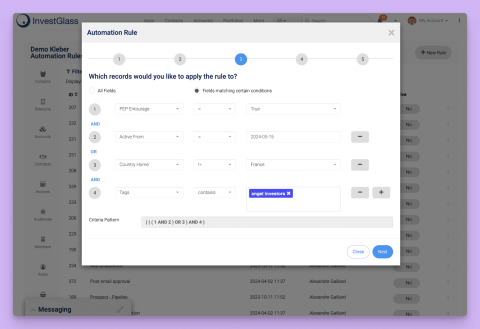

Sales and Marketing Automation

InvestGlass’s lead management tools capture, nurture, and convert leads into policyholders effectively. Its campaign management automates marketing campaigns, including email marketing, social media marketing, and targeted advertising. The sales tracking feature in InvestGlass monitors sales activities, tracks performance, and forecasts sales, ensuring a streamlined and efficient sales process.

Customer Service and Support

InvestGlass incorporates a ticketing system to manage customer inquiries, complaints, and support requests seamlessly. The platform’s knowledge base serves as a repository of information and FAQs, aiding customer service representatives and clients alike. InvestGlass supports multichannel communication, providing support through various channels such as phone, email, chat, and social media, ensuring comprehensive customer support.

Policy and Claims Management

InvestGlass handles policy administration, managing the entire policy lifecycle from issuance to renewal, including endorsements and cancellations. The claims processing feature streamlines the claims process, from filing to settlement, with tracking and documentation capabilities. Additionally, InvestGlass offers risk management tools that assess and manage risk, improving underwriting decisions.

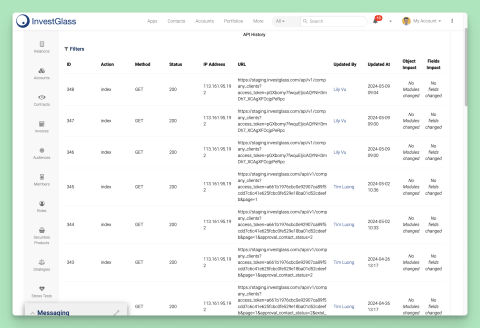

Analytics and Reporting

InvestGlass provides performance analytics tools to analyze sales performance, marketing campaign effectiveness, and customer service metrics. Its customer insights feature analyzes customer behavior, preferences, and trends, identifying opportunities for cross-selling and upselling. Moreover, InvestGlass ensures regulatory compliance by generating necessary reports for audits, helping companies adhere to regulatory requirements.