The Future of Corporate Banking: Adapting to the Evolving Landscape

Corporate banking is a specialized segment of the financial services industry that caters to the financial needs of large corporations and businesses. With the ever-evolving global financial landscape, the future of corporate banking is set to undergo significant transformations. This article delves into the key trends shaping the future of corporate banking, the role of corporate bankers, and how financial institutions are gearing up to adapt to these changes.

Emerging Trends in Corporate Banking

As the world of corporate banking advances, a few key trends have emerged:

- Digital Transformation: Corporate banks are increasingly leveraging technology to streamline their banking services, automate processes, and offer personalized solutions to their corporate clients. This includes cash management, trade finance, and other basic financial services.

- Focus on Small Businesses: In addition to catering to large corporations, corporate banks are also extending their services to small businesses. As smaller businesses continue to grow, they require a similar level of support as their larger counterparts, creating a demand for corporate banking services tailored to their needs.

- Collaboration with Fintech Companies: Traditional financial institutions, including corporate banks, are partnering with fintech companies to enhance their service offerings and stay competitive in the market.

- Evolving Role of Corporate Bankers: The role of corporate bankers is evolving as they adopt new skills, such as financial modeling, to meet the changing demands of their clients. This also includes diversifying their expertise to cater to the specific needs of small businesses and multinational corporations alike.

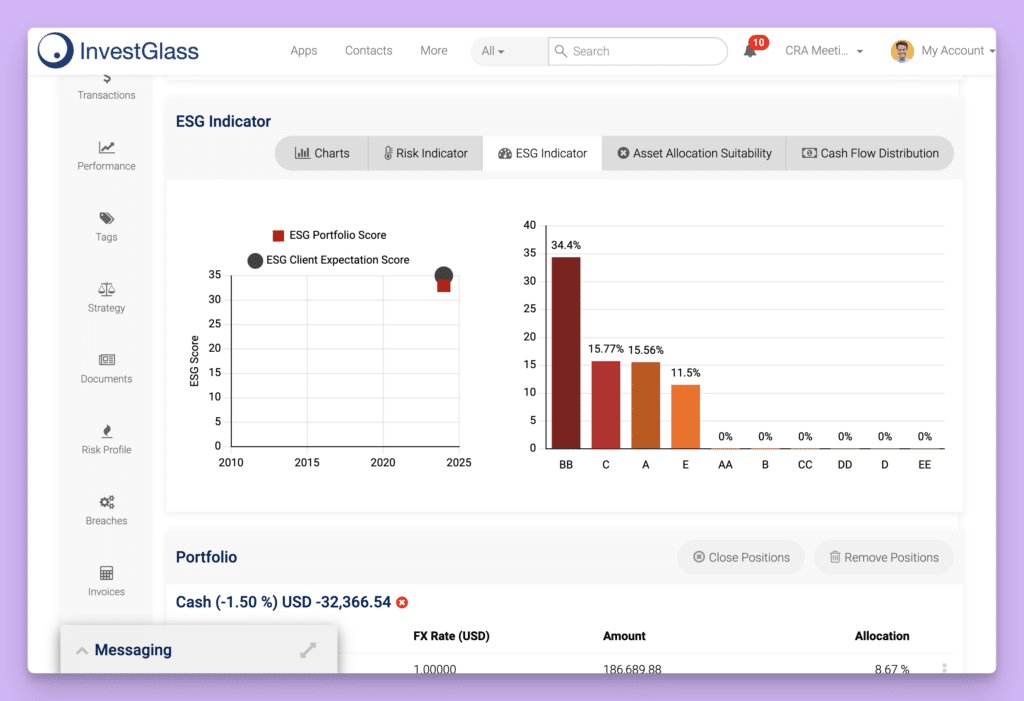

- Sustainable Finance: With a growing focus on environmental, social, and governance (ESG) factors, corporate banks are increasingly offering sustainable finance solutions to help their clients achieve their ESG goals.

The Corporate Banking Team of the Future

As the corporate banking landscape evolves, so do the teams that drive the industry forward. Corporate banking teams will need to adopt new skills and expertise, particularly in areas such as digital innovation, data analytics, and ESG compliance. Additionally, they will need to focus on strengthening relationships with other financial institutions, fintech firms, and potential clients.

A competitive corporate banking salary and attractive compensation packages are crucial factors in attracting and retaining top talent in this ever-changing industry. In order to stay ahead, corporate banks, as well as commercial and investment banks, will need to invest in employee development and provide ample opportunities for career growth. This includes offering a variety of corporate banking exit opportunities, which can range from transitioning into roles at investment banks or other financial institutions to exploring new ventures within the realm of fintech.

Corporate bankers will need to excel in negotiating and closing deals, as their ability to secure successful corporate bankers’ deals will be a key determinant of their career trajectory. As the lines between corporate banks, commercial banks, and investment banks continue to blur, collaboration and cross-functional expertise become increasingly important. Professionals in the corporate banking sector must be agile and adaptable, able to navigate the complex landscape of the financial industry while delivering exceptional value to their clients.

In conclusion, the future of corporate banking lies in the hands of highly skilled and adaptable teams that are not only well-versed in traditional banking functions but also equipped with the knowledge and expertise to navigate emerging trends and challenges. By prioritizing employee development, fostering collaboration, and embracing innovation, corporate banks can ensure a successful and sustainable future in an increasingly competitive landscape.

Salary and Compensation in Corporate Banking

As the role of corporate bankers expands and evolves, so does their compensation. Corporate banking salaries are expected to see a steady increase as the demand for skilled professionals grows. Corporate banking base salaries and bonuses will likely continue to be competitive, with senior bankers such as managing directors, vice presidents, and investment bankers commanding high compensation packages.

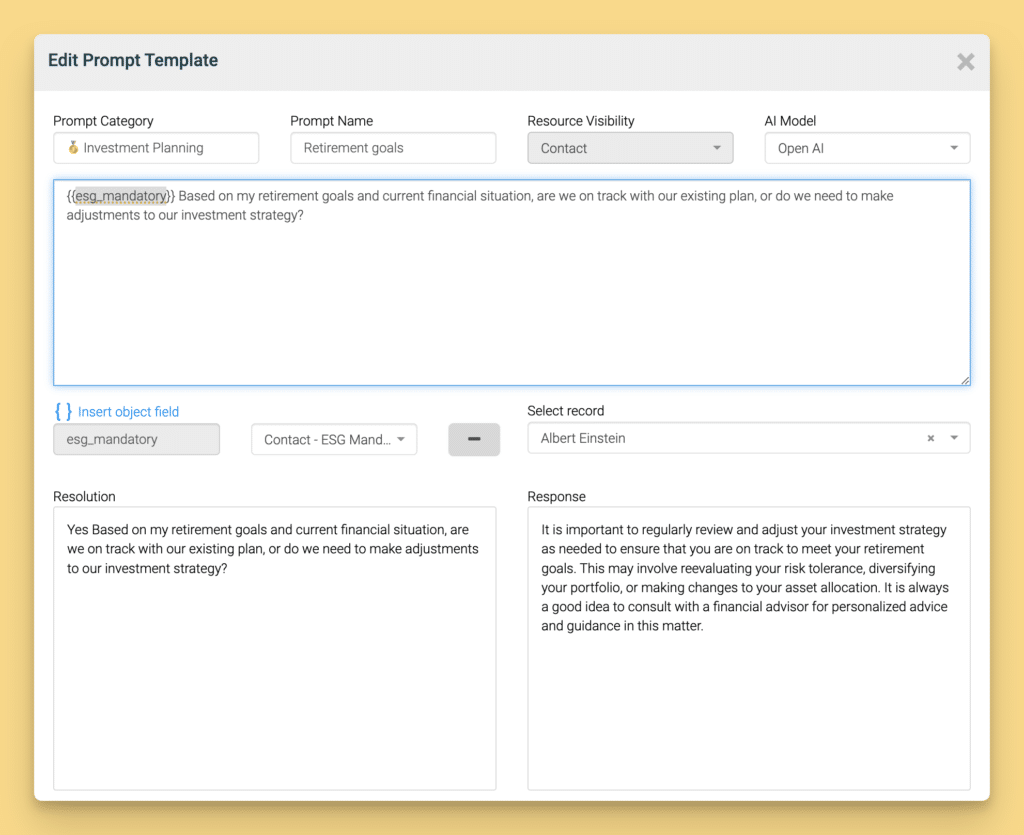

The advent of AI-driven technologies like ChatGPT has the potential to significantly impact the remuneration system in the corporate banking sector. AI-powered tools can help streamline and automate many of the core processes in banking, such as risk assessment, credit analysis, and customer service. As a result, the value and skill set of banking professionals may shift towards more strategic and analytical roles, which could lead to changes in compensation structures.

Moreover, AI-driven solutions can enable banks to develop more accurate and personalized performance assessment metrics, which may impact remuneration decisions. By leveraging AI to analyze employee performance and contribution, banks can create a more transparent and fair system for determining compensation. This could lead to a more meritocratic remuneration system, where employees are rewarded based on the tangible value they bring to the organization, rather than just their hierarchical position or tenure.

In summary, the integration of AI technologies like ChatGPT into the corporate banking sector could significantly influence the way professionals are compensated. As AI streamlines various banking processes and helps to create more accurate performance assessments, the remuneration system may evolve to become more merit-based and reflective of the changing skill sets required for success in the industry.

How financial institutions vary from one continent to another

Financial institutions engaged in corporate banking across Asia, Europe, and the United States have key differences in their operations and market focus. In Asia, the corporate banking landscape is dominated by large commercial banks that provide a wide range of services, from retail banking to investment banking, with an emphasis on capital markets, debt capital markets, and asset management. These banks typically cater to the needs of small businesses and large companies alike. Corporate banking salaries and compensation packages in Asia tend to be competitive, and there is a growing focus on corporate banking products that cater to the region’s unique economic landscape.

In Europe, corporate banking is marked by a strong presence of global banking institutions, including investment banks and commercial banks that offer corporate finance, private equity, and treasury services. Corporate bankers in Europe are expected to possess an in-depth understanding of the region’s diverse regulatory environment, as well as expertise in areas like liquidity management, hedging strategies, and financial models. The job description of a corporate banker in Europe often involves working with corporate development teams and managing relationships with other banks.

In the United States, corporate banking is characterized by a mix of large commercial banks and specialized financial institutions that focus on specific aspects of corporate finance, such as lending money, managing customer deposits, and providing corporate loans. Corporate banking roles in the US often involve collaborating with credit analysts, loan officers, and other financial professionals to ensure effective cash flow management and balance sheet optimization for their clients. Interest rates, commitment fees, and other credit products are key factors in the American corporate banking landscape. The corporate banking division of a US bank may also work closely with retail banks to offer other services tailored to the needs of larger companies.

What are commercial banking services versus investment banks?

Commercial banking, a crucial segment of the financial services industry, caters to the financial needs of individuals and small businesses. As opposed to investment banks and corporate banks, which focus on larger corporations and complex financial transactions, commercial banks provide essential services such as deposit accounts, loans, and credit services. Commercial bankers work closely with loan officers and credit analysts to lend money to small businesses and assess their creditworthiness. Salaries in commercial banking, including base salary and compensation packages, vary based on the role, with managing directors and vice presidents typically earning higher than entry-level positions. The debate of corporate banking vs. commercial banking primarily revolves around the size of clients and the complexity of services offered. While commercial banking focuses on everyday financial needs, corporate banking handles more intricate financial transactions and relationships with larger businesses.

Challenges and Opportunities in Corporate Banking

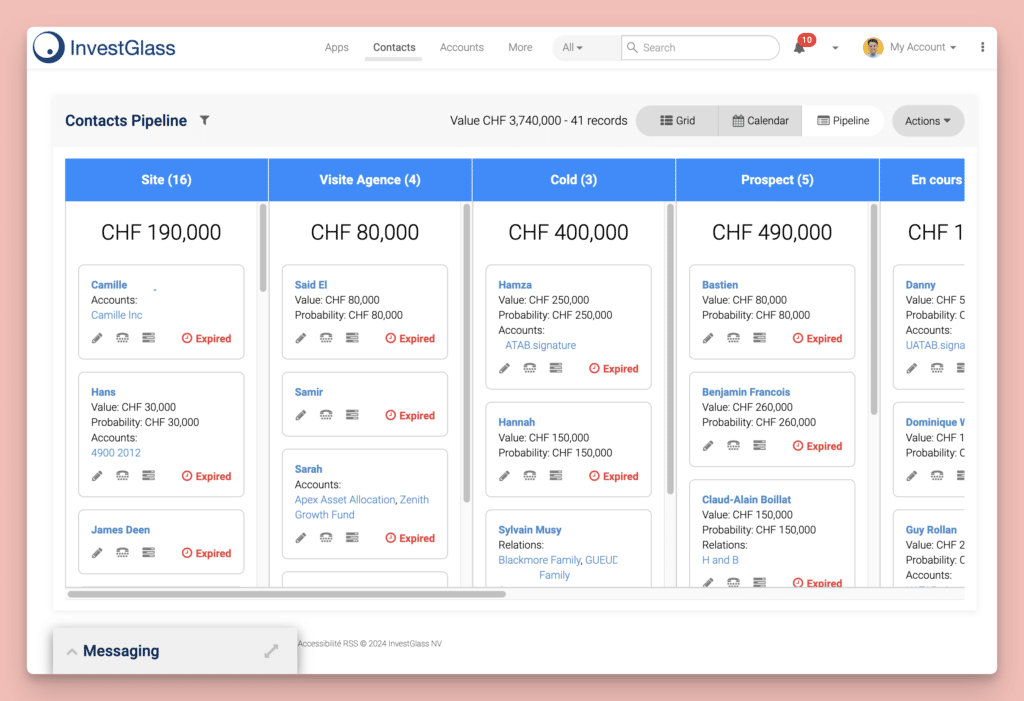

Corporate banking faces several challenges, including adapting to the digital transformation, managing regulatory changes, and meeting the evolving demands of clients. However, these challenges also present opportunities for corporate banks to expand their service offerings, partner with fintech companies, and develop innovative solutions to meet the needs of their clients.

Conclusion for modern corporate bankers

The future of corporate banking is dynamic, with rapid advancements in technology, shifting client expectations, and increasing focus on sustainability. As corporate banks and their teams adapt to these changes, they will continue to play a vital role in meeting the financial needs of businesses, both large and small. By embracing innovation and fostering collaboration with other financial institutions and fintech companies, corporate banks can ensure a thriving and sustainable future for the industry.

One such fintech company, InvestGlass, offers innovative solutions to automate corporate banking processes, streamlining client interactions, and enhancing overall efficiency. By integrating InvestGlass’s powerful automation tools, corporate banks can effectively manage their client portfolios, monitor transactions, and analyze customer data to deliver more personalized and efficient services. Furthermore, InvestGlass’s robust platform can assist corporate banks in their digital transformation journey, enabling them to stay competitive and meet the evolving needs of their clients in the ever-changing financial landscape.