Optimizing Digital Onboarding with InvestGlass: Revolutionizing Customer Experiences for Financial Services

Digital onboarding has transformed the financial services industry, offering a seamless, efficient, and customer-friendly alternative to traditional processes. At InvestGlass, we provide a Swiss sovereign CRM platform that simplifies and automates digital onboarding while ensuring compliance with stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Let’s explore how digital onboarding reshapes financial services and how InvestGlass stands at the forefront of this revolution.

How Digital Onboarding Reduces Costs for Banks

Digital onboarding reduces operational expenses by automating labor-intensive processes. Here’s how:

- Automation of Processes: Digital onboarding minimizes human intervention, reducing staffing needs and human errors.

- Streamlined Operations: Automation eliminates redundant paperwork, cutting operational costs.

- Enhanced Efficiency: Real-time data processing allows faster onboarding of multiple clients simultaneously.

- Reduced Compliance Costs: Automated systems ensure consistent adherence to regulatory standards, avoiding penalties and legal fees.

- Improved Customer Retention: A smooth onboarding experience encourages customer loyalty, reducing acquisition costs.

Understanding the Digital Onboarding KYC Process with InvestGlass

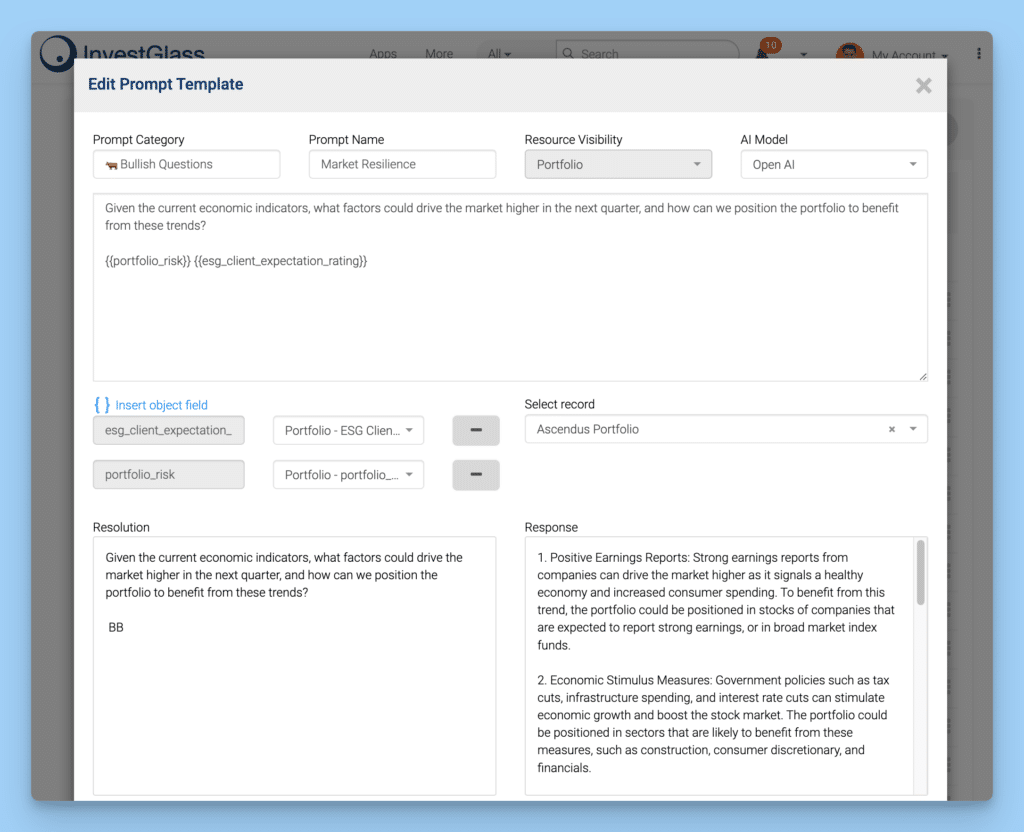

Digital onboarding is a transformative approach to streamline the KYC (Know Your Customer) process, enabling financial institutions to authenticate customer identities efficiently and securely. InvestGlass takes this process a step further with cutting-edge tools like ChatGPT LLM for interactive client interactions and a robust approval workflow system to manage and verify customer data effectively.

Key Steps in the Digital Onboarding KYC Process

Enhanced Due Diligence (EDD)

For higher-risk clients, InvestGlass offers deeper scrutiny options, integrating tools like sanction checks, politically exposed persons (PEP) screening, and adverse media searches. The platform’s approval workflows help streamline and document EDD processes with precision.

Identity Verification

Customers provide government-issued IDs or leverage biometric tools, such as facial recognition, for swift and secure identity validation. InvestGlass integrates AI-driven document verification with seamless biometrics, ensuring a frictionless and accurate onboarding experience.

Customer Due Diligence (CDD)

InvestGlass employs a combination of automated risk profiling and AI-supported analytics to evaluate customer data for potential fraud or illicit activities. With customizable workflows, financial institutions can tailor due diligence steps to meet specific compliance and business requirements.

Ongoing Monitoring

Continuous monitoring tools ensure that customer activities remain compliant with AML (Anti-Money Laundering) and KYC regulations. InvestGlass automates these checks using advanced alerts and tracking systems, allowing institutions to stay ahead of regulatory demands.

How AI and Machine Learning Enhance Digital Onboarding

Artificial Intelligence (AI) and Machine Learning (ML) are transforming digital onboarding by automating complex processes, improving accuracy, and enhancing security. With InvestGlass, these technologies are seamlessly integrated to create a streamlined and compliant onboarding experience for banks and financial institutions.

Key Areas Where AI and ML Add Value

- Identity Verification

AI-driven identity verification simplifies and accelerates the process by:- Matching photo IDs with customer biometrics (e.g., facial recognition).

- Verifying documents in real-time, reducing manual intervention.

- Detecting inconsistencies or tampering in documents with high precision.

- Fraud Detection

ML algorithms proactively prevent fraud by:- Identifying forged documents and detecting patterns indicative of fraudulent behavior.

- Continuously learning from data to adapt to emerging fraud tactics.

- Employing passive fraud detection technologies to ensure smooth customer experiences.

- Regulatory Compliance

AI enhances compliance processes by:- Automating AML checks, including sanction screening, PEP monitoring, and adverse media analysis.

- Ensuring consistent adherence to global regulatory frameworks.

- Generating detailed audit trails for regulatory reporting.

How InvestGlass Automates Digital Onboarding Processes

InvestGlass leverages AI and ML to automate key aspects of digital onboarding, enabling financial institutions to focus on customer satisfaction and compliance:

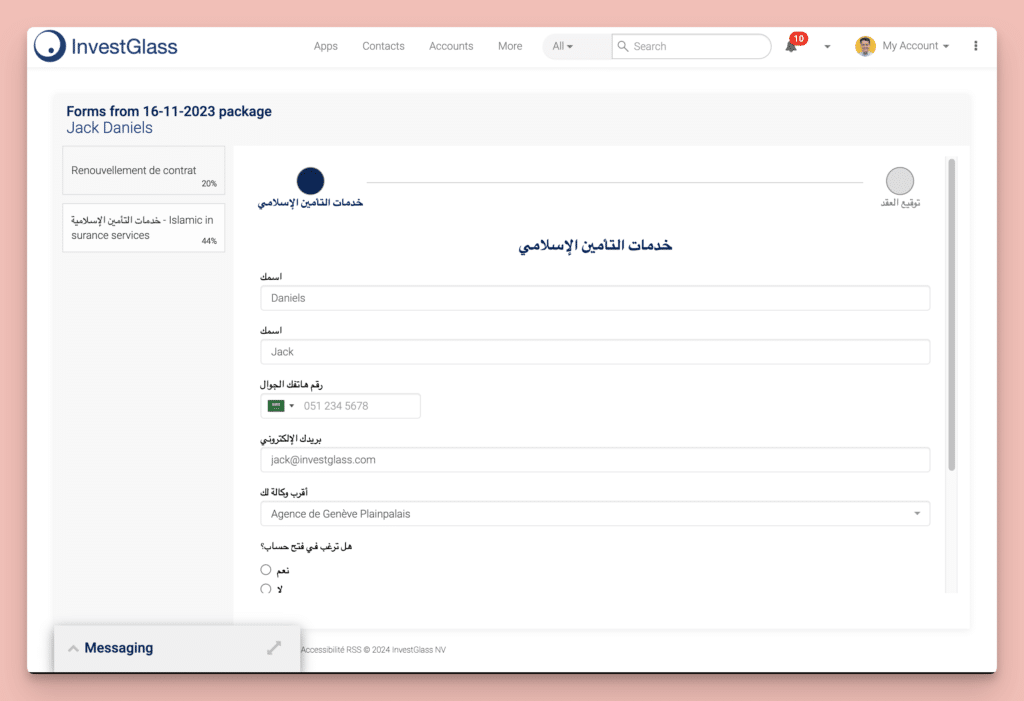

- Data Collection and Processing:

InvestGlass’s no-code forms allow financial institutions to gather customer data efficiently, ensuring accuracy and completeness through validation checks powered by AI. - Dynamic Risk Assessment:

AI evaluates customer data in real-time to assign risk profiles, automatically escalating higher-risk cases for enhanced due diligence. - Approval Workflows:

The platform automates multi-step approvals, routing customer applications to the appropriate stakeholders based on predefined rules and risk levels. - Fraud Monitoring and Prevention:

Integrated fraud detection systems identify anomalies during onboarding and flag potential risks without disrupting the customer journey. - KYC/AML Compliance Automation:

AI processes vast amounts of customer data to ensure compliance, reducing the need for manual reviews while maintaining accuracy.

Benefits of Digital Onboarding for Banks with InvestGlass

Enhanced Customer Experience

- Customers can complete onboarding entirely online, removing the need for in-person visits.

- AI-powered chatbots guide users through the process, addressing queries in real-time.

Increased Customer Acquisition

- Simplified and intuitive workflows reduce onboarding friction, minimizing abandonment rates.

- Multi-language support and mobile-friendly forms broaden accessibility for diverse customer bases.

Regulatory Compliance

- Real-time data validation ensures that banks meet KYC and AML regulations efficiently.

- Automated reporting tools simplify compliance management and audits.

Cost Efficiency

- AI and ML reduce the need for manual labor in data processing, fraud detection, and compliance checks.

- Automation leads to significant savings in operational costs.

Challenges and Solutions in Digital Onboarding

While digital onboarding offers transformative benefits, it also presents unique challenges. InvestGlass addresses these with robust solutions:

- Compliance Complexities:

InvestGlass simplifies compliance with automated KYC/AML workflows and real-time alerts for regulatory changes. - Fraud Prevention:

Advanced ML models detect and prevent fraudulent activity without introducing friction to the user experience. - User Experience:

Mobile-optimized, customizable forms and AI-assisted chatbots ensure a smooth and intuitive process for customers.

Conclusion: Empower Your Digital Onboarding with InvestGlass

InvestGlass stands as the ultimate solution for financial institutions seeking to revolutionize their onboarding processes. With its customizable no-code forms, AI-driven tools for secure identity verification, and approval workflow automation, InvestGlass simplifies complex processes while ensuring compliance and enhancing customer experience.

The platform’s mobile compatibility guarantees a seamless experience across all devices, catering to the modern customer’s demand for convenience. Additionally, InvestGlass delivers these transformative features at a highly competitive rate, making it an accessible and cost-effective choice for institutions of all sizes.

By integrating InvestGlass into your operations, you can streamline onboarding, foster customer satisfaction, and maintain stringent regulatory compliance. Embrace the future of digital onboarding and position your institution for success with InvestGlass’s innovative solutions.

Transform your onboarding journey today and experience unparalleled efficiency and growth and exceptional customer experiences.

Step into the future of digital banking with InvestGlass!