Unlocking the Potential of Generative AI for Banks

The banking industry is undergoing a transformative shift with the advent of generative AI, a groundbreaking technology that is revolutionizing various aspects of the sector. From fraud prevention to personalized financial advice, banks can harness the power of this innovative technology to become more efficient, customer-centric, and competitive. In this blog post, we will explore the potential of generative AI for banks and delve into its real-world applications, highlighting the benefits, challenges, and strategies to successfully adopt it.

Key Takeaways

- Generative AI is set to revolutionize banking with improved fraud detection, risk management and customer experience.

- Banks must ensure data privacy and security while navigating regulatory frameworks in order to maximize the advantages of generative AI.

- Real world examples show how generative AI can provide personalized portfolio management solutions tailored to individual customer needs.

Generative AI: A Game Changer for the Banking Industry

Gen AI, also known as generative AI, supported by machine learning models, is poised to disrupt the financial services industry, with its potential to improve:

- Fraud detection

- Risk management

- Financial forecasting

- Customer experience

One of the key factors behind this disruption is the generative ai model, which plays a significant role in enhancing these aspects of the industry.

As the banking sector evolves, the need for innovative solutions becomes paramount, and generative AI tools offer numerous opportunities to enhance banking services and promote growth.

However, the adoption of generative AI in banking is not without its challenges. Ensuring data privacy and security, adhering to regulatory frameworks, and managing potential risks are some of the critical concerns that banks must address to harness the full potential of this transformative technology. This article will explore the assorted applications and benefits of generative AI in banking, and suggest strategies to surmount these challenges.

Fraud Prevention and Detection

Generative AI can significantly enhance fraud prevention and detection efforts in the banking industry by identifying unusual patterns and updating detection algorithms. With the ever-increasing sophistication of fraudsters and the growing pressure from regulatory authorities, banks must deploy advanced systems to protect customer interests and thwart fraudulent attempts.

By leveraging generative AI models, banks can effectively identify suspicious transactions, thereby preserving customer trust and satisfaction. The potential risks tied to the use of innovative tools, which can be exploited by malicious actors for fraud and deception, necessitates vigilant monitoring to avoid making detection even more challenging.

Risk Management and Credit Scoring

Generative AI can revolutionize risk management and credit scoring in the banking industry by:

- Analyzing vast amounts of data and identifying potential risks

- Accessing a broader range of data from multiple sources

- Enabling banks to create a more comprehensive financial profile of loan applicants

- Facilitating credit risk assessment and making better-informed lending decisions

By utilizing the capabilities of generative AI, banks can improve their risk management processes and enhance their credit scoring systems.

In addition to credit scoring, generative AI can enhance risk management by:

- Detecting potential risks in capital markets

- Forecasting market trends

- Providing timely warnings

- Allowing banks to take corrective action to minimize or even avert losses.

Financial Forecasting and Analysis

Generative artificial intelligence, also known as generative AI, can play a pivotal role in financial forecasting and analysis by utilizing historical data and creating synthetic data for risk assessments. The technology offers a broad spectrum of advantages, including fraud detection and risk assessment, as well as the formation of customized financial products and services.

Moreover, generative AI in banking can:

- Accelerate digital transformation

- Offer hyper-personalized products and services

- Augment human capabilities with AI chatbots

- Enhance overall efficiency and automation within financial institutions.

The ability to predict market trends and recognize potential risks makes generative AI an invaluable tool for banks in their quest for growth and innovation.

Enhancing Customer Experience with Generative AI

In today’s competitive banking landscape, customer experience is paramount, and generative AI has the potential to greatly enhance it. By offering AI-powered chatbots and personalized financial advice, banks can cater to the evolving needs of their customers and provide a seamless, customized experience.

AI-powered chatbots and personalized financial advice not only improve customer satisfaction but also boost the overall efficiency of banking services, as they enable banks to process and analyze large volumes of customer data in real-time.

Subsequent sections will detail how generative AI can enhance the banking customer experience using these innovative solutions.

AI-Powered Chatbots

AI-powered chatbots with natural language processing capabilities can provide human-like customer support, personalizing the customer experience and cross-selling products. Some benefits of using AI-powered chatbots in customer engagement include:

- Enhanced conversations

- Quicker response times

- Language versatility

- Originality in customer engagement

Banks can leverage generative AI models to offer these benefits and improve their customer service.

Collaborations between financial institutions and AI companies, such as the partnership between Morgan Stanley and OpenAI, focus on the development of AI chatbots or virtual assistants, further highlighting the promising potential of generative AI in enhancing customer experience.

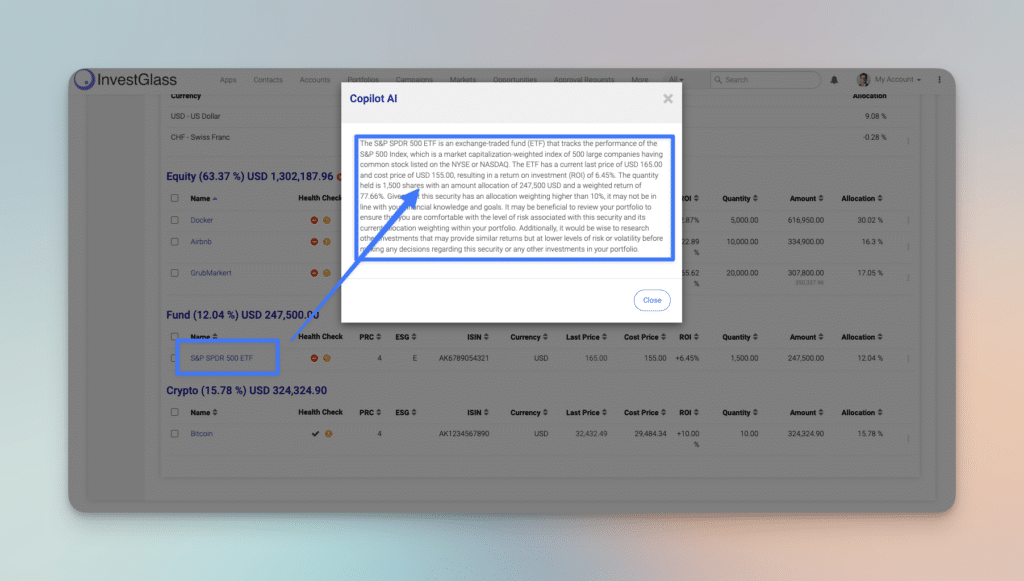

Personalized Financial Advice

Generative AI can offer personalized financial advice to customers based on their financial goals, risk profiles, and spending habits, empowering financial advisors to make smarter decisions. Providing tailored investment advice, budgeting guidance, and other financial support can significantly enhance the banking experience for customers.

With 72% of customers perceiving products as more valuable when tailored to their individual needs, the potential of generative AI in offering personalized financial advice is immense. Banks can foster a more customer-centric approach, resulting in increased customer satisfaction and loyalty, by utilizing this technology.

Overcoming Challenges in Implementing Generative AI in Banking

While the adoption of generative AI in banking presents considerable opportunities, it is important to be aware of and manage the associated challenges and risks. Data privacy and security are of paramount importance to avoid biased AI models, which can lead to inaccurate outcomes and unfair decisions.

Navigating regulatory frameworks is another critical aspect of implementing generative AI in banking, as banks must adhere to existing regulations and be prepared for potential future modifications. The following sections will delve into these challenges in detail and suggest strategies to mitigate them.

Ensuring Data Privacy and Security

Banks must prioritize data privacy and security when implementing generative AI to protect sensitive customer information and maintain trust. Robust security measures, such as encryption, access control, and data masking, should be deployed to safeguard customer data. Moreover, conducting regular testing and monitoring of AI systems can help detect potential security risks.

However, the use of generative AI in banking also raises concerns about potential exposure or mishandling of sensitive information, even unintentionally. Therefore, banks must strike a balance between harnessing the benefits of generative AI and ensuring the utmost data privacy and security.

Navigating Regulatory Frameworks

Understanding and adhering to regulatory frameworks is essential for banks utilizing generative AI, as non-compliance can lead to legal and financial repercussions. When deploying AI models in the banking sector, banks must ensure compliance with relevant risk models and enterprise risk frameworks.

Banks should never allow generative AI to make ultimate decisions regarding loan approvals and other consequential decisions that impact customers. Instead, AI should handle the bulk of the work, while financial experts make the definitive decisions. This approach ensures compliance with regulations while still harnessing the power of generative AI.

Preparing Banks for the Generative AI Revolution

To stay competitive and benefit from the generative AI revolution, banks must develop a strong AI strategy and invest in employee training and skill development. A robust AI strategy can enhance operating revenues, simplify operations, reduce operating expenses, and improve efficiency and profitability.

Collaboration across various departments is vital in order to maximize the potential of AI within an organization.

- Technical teams

- Compliance officers

- Legal experts

- Other business units

We must all work together to benefit from generative AI as this technology continues to evolve, utilizing the gen ai tool to its full potential.

The significance of forging a robust AI strategy and investing in employee training and skill development will be discussed in the following sections.

Developing a Strong AI Strategy

A comprehensive AI strategy is paramount for banks to successfully adopt generative AI and maximize its potential benefits. To harness the power of generative AI, banks should assess how to make the most of their current investments in Responsible AI, data governance, and FinOps, and evaluate how to modify their infrastructure and operating models to maximize the advantages of scaling generative AI capabilities.

Banks can gain a competitive edge, enable business transformation, and reap the multifaceted benefits of generative AI, ranging from enhanced customer experience to improved operational efficiency, by crafting a robust AI strategy.

Investing in Employee Training and Skill Development

Investing in employee training and skill development related to AI, machine learning, data science, and other relevant technologies is crucial for banks to effectively implement generative AI and ensure a smooth transition to AI-driven processes. Banks can stay competitive, cut expenses, and boost customer experience by instilling necessary skills and knowledge in their employees.

Examples of banks investing in employee training include Bank of America, which has implemented a program to educate its employees in AI and machine learning, resulting in improved fraud detection capabilities. Such investments demonstrate the importance of preparing the workforce for the generative AI revolution in the investment banking industry.

Real-World Applications of Generative AI in Banking

Generative AI has already found numerous practical applications in the banking sector, ranging from personalized customer engagement to fraud detection and risk management. These real-world applications showcase the transformative potential of generative AI in enhancing banking services and promoting growth.

The following case studies will showcase successful implementations of generative AI in banking. With a focus on AI-based fraud detection and personalized portfolio management, we’ll illustrate how this innovative technology can drive positive outcomes for banks and their customers.

Case Study: AI-Based Fraud Detection

AI-based fraud detection systems have proven effective in identifying and preventing fraudulent activities, saving banks time and resources. By utilizing artificial intelligence, these systems can detect and deter fraudulent activities, ultimately protecting customers and preserving their trust in the banking institution.

Examples of AI-based fraud detection in banking include Barclays Bank, which has deployed an AI tool for fraud detection, and Discover Financial Services, which has partnered with an AI company to improve credit underwriting. These successful implementations highlight the potential of generative AI in combating fraud and safeguarding customer interests.

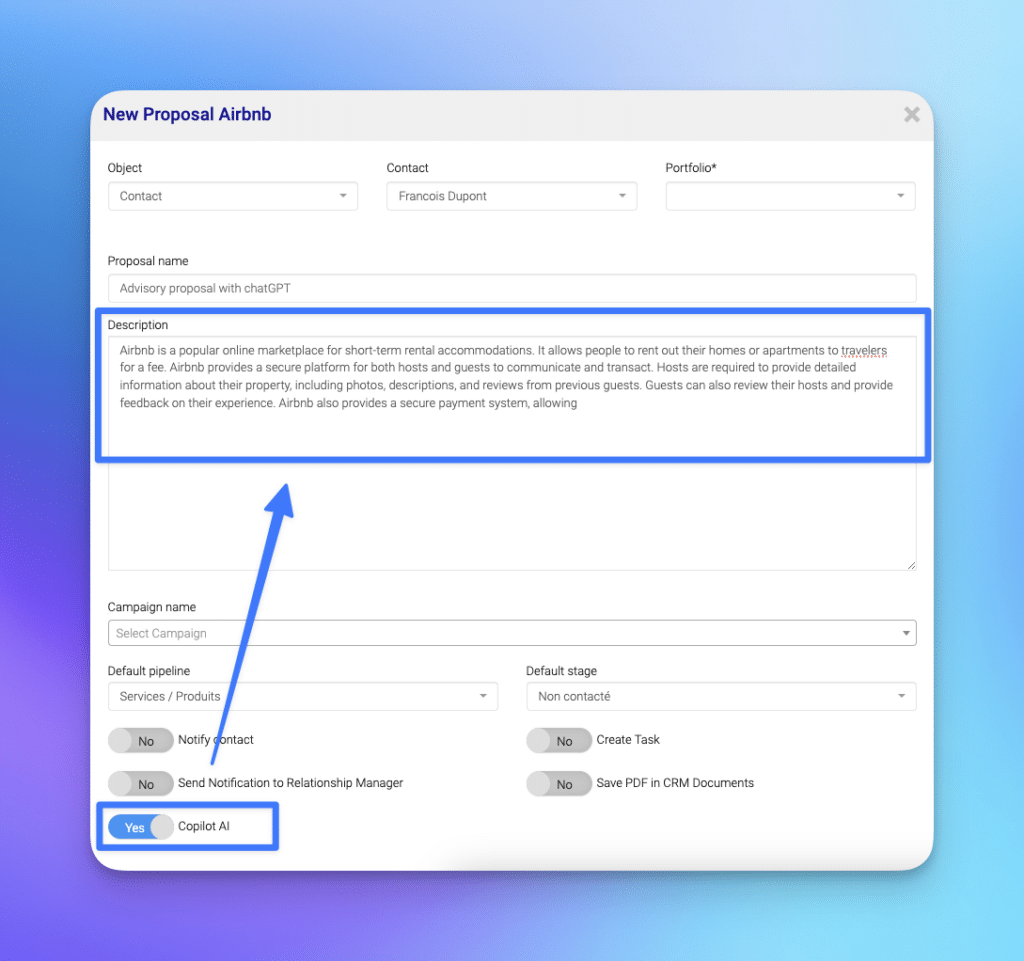

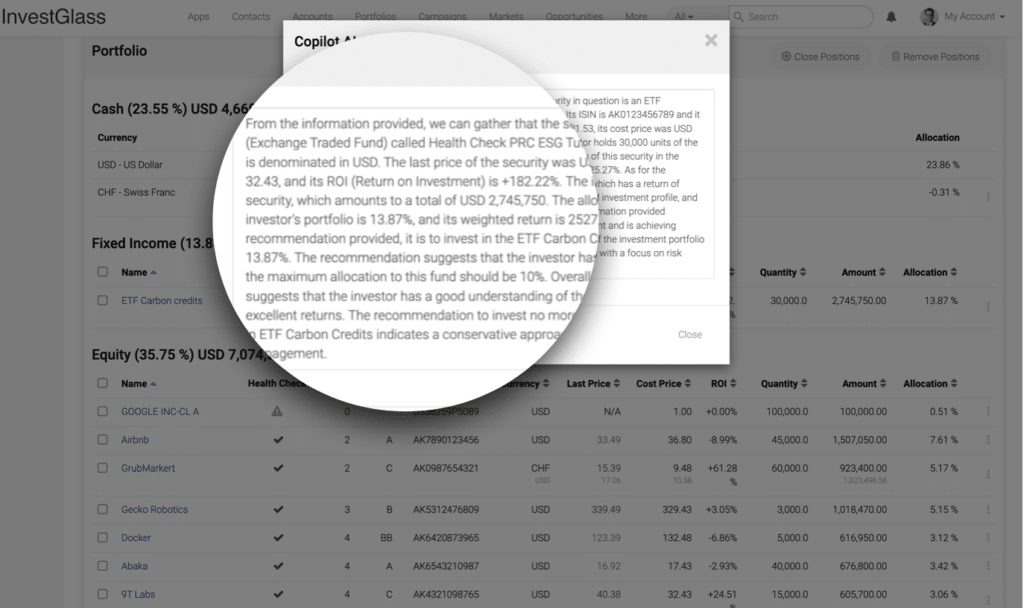

Case Study: Personalized Portfolio Management

Personalized portfolio management powered by generative AI can provide customers with:

- Tailored investment strategies based on their unique financial goals and risk profiles

- Customized portfolio strategies that cater to individual customer needs

- Utilization of a variety of economic data and financial variables

By leveraging generative AI, customers can receive personalized investment strategies that align with their specific requirements.

Real-world examples of generative AI in personalized portfolio management include Bank of America’s Glass, a platform that consolidates market data with proprietary models and machine learning techniques, and Santander’s Kairos, an AI tool that provides insights into how corporate clients could be affected by economic events. These applications demonstrate the power of generative AI in offering personalized financial solutions that cater to the evolving needs of banking customers.

InvestGlass is you CRM partner with a AI powered PMS (Portfolio management System)

In conclusion, generative AI presents a revolutionary opportunity for banks to enhance their services, improve customer experience, and drive growth. Despite the challenges associated with data privacy, security, and regulatory compliance, the benefits of adopting generative AI in banking far outweigh the risks.

By developing a strong AI strategy, investing in employee training, and successfully navigating regulatory frameworks, banks can harness the full potential of generative AI and lead the way in the transformative shift towards AI-driven banking.