Robotic Process Automation (RPA) – How it can Transform your Business?

You may have heard of Robotic Process Automation (RPA) and wondered how this can transform your business. In this article, we will explain to you what it is and the benefits that come with it. We will also share some tips for implementing it into your company’s processes so that you are getting all the benefits from RPA without any of the troubles.

Robotic Process Automation (RPA) is the use of software technology to handle repetitive, rule-based digital tasks such as filling in the same information in multiple places, reentering data, or copying and pasting by automating business processes.

Studies show that RPA adoption can yield an ROI of 30% to 200% in the first year, with long-term savings reaching 300% (Flobotics). By minimizing human errors and increasing productivity, RPA allows employees to focus on higher-value tasks. To successfully implement RPA, businesses should understand their processes (AutomationEdge), secure stakeholder buy-in (DashDevs), and start with small pilot projects before scaling. With the right strategy, RPA can transform business operations and drive long-term success.

Below there are 4 ways, Robotic Process Automation can transform your business.

The wave of digital transformation sweeping across industries has especially resonated within the banking and financial industry. At the forefront of this revolution is Robotic Process Automation (RPA). As financial institutions strive for efficiency, RPA in banking is becoming an integral part of automating banking processes, ensuring accuracy, and increasing productivity.

1. Increasing Productivity Through Automation

The use of RPA in banking enables the automation of mundane tasks, leading to an immediate boost in efficiency. By implementing RPA technology, most of the tasks which previously consumed hours, such as data validation, report automation, and the creation of financial statements, can now be accomplished in a fraction of the time. This not only saves on time-efficiency costs but also allows bank employees to focus on more strategic initiatives, rather than getting bogged down with manual tasks.

Furthermore, RPA bots, especially in the banking RPA sector, are equipped with UI automation capabilities, allowing them to interact seamlessly with legacy systems, gather data, and produce error-free reports. Such accounts, when handled manually, are prone to human errors. However, with RPA solutions, the banking system gets an upgrade, reducing the scope for mistakes and enabling faster decision-making.

2. Reinventing Banking Processes

The banking sector, often fraught with manual processes, has many areas ripe for automation. With RPA implementation, banking operations like customer onboarding, which previously required manual data entry, verification of employment, and handling of digital copy physical form, can be streamlined. Likewise, the mortgage loan application process, credit card processing, and even the account closure process can be made more efficient, reducing the turnaround time and enhancing customer satisfaction.

3. Financial Process Automation and Security

Financial process automation through RPA tools ensures the banking and financial industry maintains its integrity. Given the delicate nature of financial transactions, RPA tools meticulously handle every aspect. One significant advantage of using RPA in banking operations is the assurance of digital security. The granular nature of RPA technology means that data is isolated during operations, drastically minimizing the risk of information leaks between divisions.

Additionally, for financial institutions, compliance is paramount. RPA bots can be employed for compliance banking, ensuring regulatory compliance, and generating compliance reporting RPA style. This not only ensures that the bank data adheres to regulatory standards but also reduces the manual efforts required by compliance officers.

4. Advanced Applications of RPA in Banking

Beyond the simple but monotonous process, RPA solutions have found applications in more advanced banking processes. For instance, using optical character recognition, RPA bots can convert unstructured data from scanned documents into a usable format, aiding in the KYC process. RPA in banking also plays a pivotal role in fraud detection, anti-money laundering measures, and customer data analysis, all crucial in maintaining the integrity of financial institutions.

Furthermore, integrating RPA with legacy data systems can optimize the financial sector’s workflows. This not only allows for a more efficient banking system but also paves the way for business growth by leveraging the insights gained from successful RPA implementation.

5. Enhancing Customer Experience in the Financial Sector

As banks and other financial institutions move towards more customer-centric models, the role of RPA becomes even more vital. Everyday customer queries can be addressed faster, account closure requests can be processed efficiently, and overall, the customer experience is enhanced. With the elimination of repetitive processes, bank employees can focus on more nuanced customer interactions, furthering the goals of customer satisfaction.

Conclusion

In summary, RPA, especially robotic process automation for banks, is a game-changer. As financial institutions, especially in the finance industry, continue to evolve, the integration of RPA solutions will be key in determining their competitiveness, efficiency, and ability to deliver unparalleled customer service.

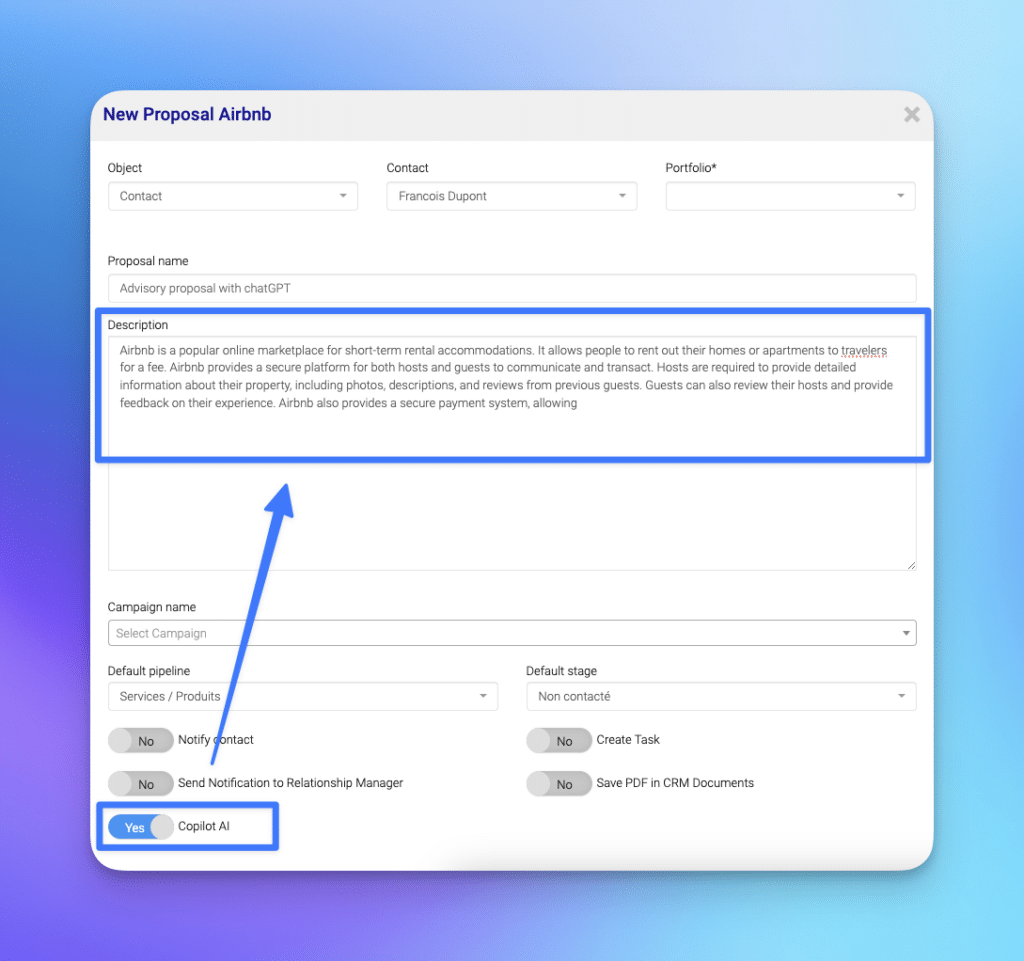

InvestGlass, a key player in the financial services industry, is well-positioned to leverage the power of intelligent automation through its advanced RPA software. With the ability to implement RPA into various banking processes, it offers financial institutions a robust RPA solution that can exponentially boost automation, efficiency, and ultimately profitability.

1. Automating Repetitive Tasks

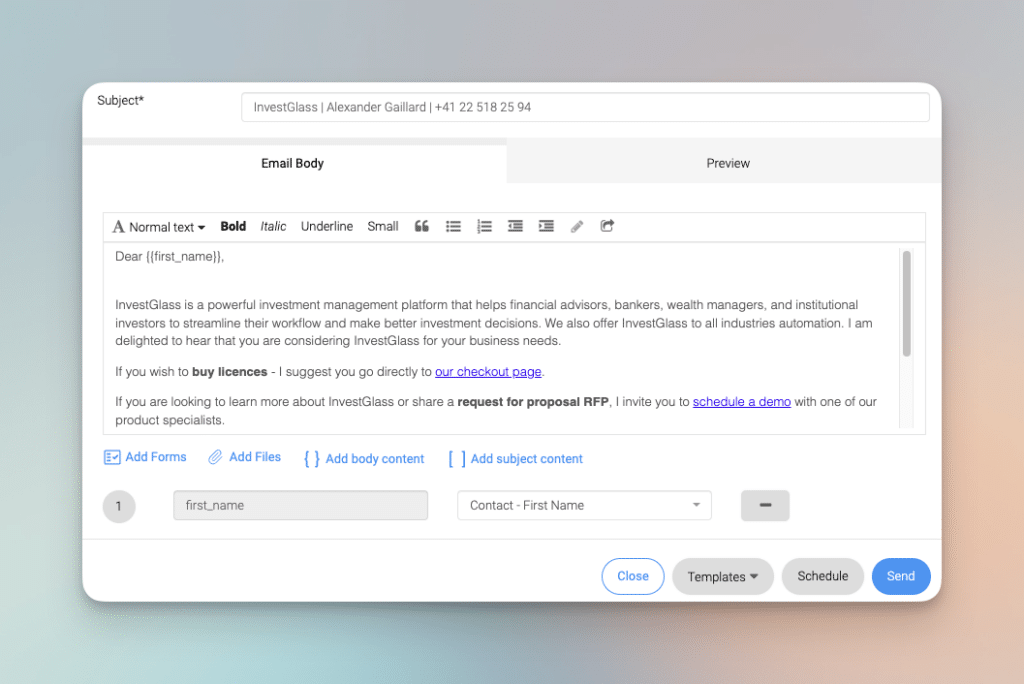

The banking industry is laden with repetitive and mundane tasks, from employment verification to managing accounts payable. The rpa software provided by InvestGlass can automate banking processes, freeing up human employees to focus on value-driven tasks rather than getting caught in the rigmarole of routine. By eliminating the need for human intervention in these repetitive tasks, the chances of human error are substantially reduced, ensuring more accurate and reliable outcomes.

2. Streamlining Banking Automation

Banking automation, powered by InvestGlass, not only takes over repetitive tasks but also introduces a higher level of efficiency. For instance, banking RPA bots can be deployed to manage large volumes of data, swiftly process accounts payable, or handle customer inquiries. The capability to integrate RPA within the existing systems of a financial institution ensures a seamless transition, allowing for immediate benefits without significant disruption.

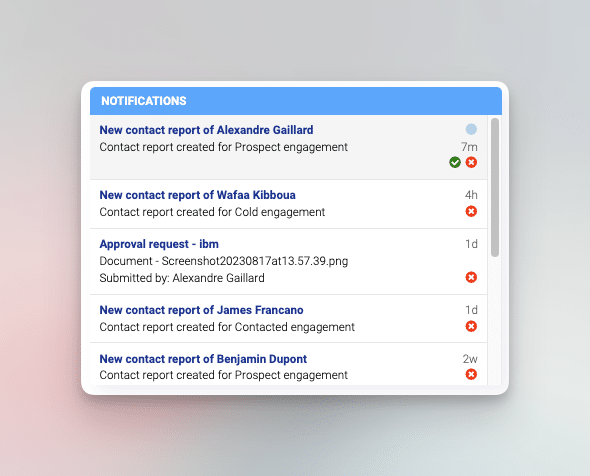

3. Maintaining Automation Workflows

InvestGlass’s RPA system provides tools to maintain automation workflows effectively. The intuitive design ensures that any updates or changes in the banking automation processes can be integrated quickly, ensuring that the financial services sector always remains agile and responsive to the ever-evolving market dynamics.

4. Enhancing Profitability

By choosing to implement RPA solutions from InvestGlass, financial institutions can achieve substantial cost savings. Reduced human error, faster processing times, and the ability to handle large volumes of tasks without increasing the workforce mean that operational costs go down. When combined with the increased efficiency and enhanced customer service, this directly translates into increased profitability for the institution.

The integration and deployment of InvestGlass’s RPA software in the banking industry mark a significant leap towards intelligent automation. As the financial services sector continues its journey towards digital transformation, solutions like those provided by InvestGlass will be instrumental in shaping a more efficient, error-free, and profitable future for financial institutions.