3 Steps to Launch a Robo-Advisor Software Platform

A Comprehensive Guide to Building Your Own Robo-Advisor

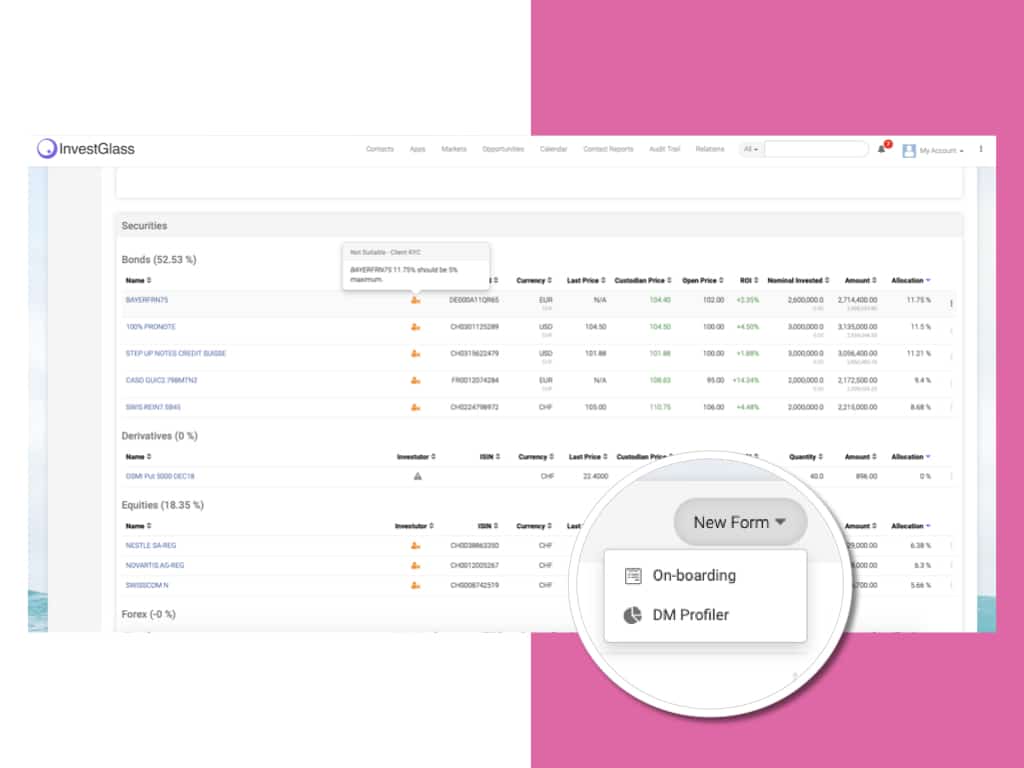

Introduction: Robo-advisors have revolutionized the world of financial planning and wealth management. These innovative platforms use algorithms and machine learning for automated investment management to automatically manage investment portfolios, offering a cost-effective and convenient alternative to traditional human financial advisors. Automated portfolio management is a core function of robo-advisors, enabling them to create, monitor, and adjust investment portfolios automatically based on user profiles, risk tolerance, and investment goals. A robo advisory platform plays a crucial role in financial planning and wealth management by integrating user data collection, algorithmic investment strategies, and various technologies to enhance its functionality. Leveraging these platforms can help users work towards achieving financial freedom by providing greater independence and control over their finances. If you’re considering building your own robo-advisor, it’s essential to understand the various factors involved. In this guide, we’ll discuss the key aspects of creating a successful robo-advisor platform, from the technology and features to the advantages and potential challenges. InvestGlass includes risk metrics and ESG screening to respect clients and strategy suitability and appropriateness.

Understanding Robo-Advisors and Their Importance in Financial Planning

Robo-advisors are digital platforms that use algorithms to manage and create investment portfolios for clients. They’ve gained popularity in recent years due to their lower fees compared to traditional financial advisors and their ability to provide access to investment management tools and financial planning tools that were once only available to wealthy investors. By automating the investment process, robo-advisors help clients develop and manage their investment strategies efficiently. During onboarding, users typically complete an online survey to provide their financial data, risk tolerance, and investment goals. This process includes a risk assessment to help tailor the investment portfolio to individual client preferences, ensuring alignment with their financial goals. Robo-advisors create diversified portfolios by allocating investments across different asset classes such as stocks, bonds, and real estate, often using low-cost investment vehicles like index funds. This makes robo-advisors a valuable addition to the financial planning landscape.

Understanding the Target Market

Identifying and understanding your target market is the game-changing foundation that separates successful robo advisor platforms from the competition. Most robo advisors are purpose-built to delight individuals seeking automated, cost-effective investment management solutions—particularly those who’ve been underserved by traditional financial advisors due to smaller portfolios or their preference for digital-first experiences that deliver real value. This powerhouse audience includes millennials, Gen Z, and tech-savvy younger investors who demand convenience, transparency, and cutting-edge financial services that actually work for them.

To unlock massive growth potential with this audience, you need deep insights into their financial goals, risk tolerance, and investment preferences that drive real results. Conducting comprehensive market research, leveraging targeted online surveys, and analyzing market data transforms your understanding of what motivates your ideal clients. For example, younger investors prioritize game-changing features like seamless account setup, ultra-low management fees, and access to diversified investment portfolios perfectly tailored to their risk tolerance and long-term wealth-building objectives.

By aligning your robo advisor platform’s investment strategies and user experience with the specific needs and expectations that matter most to your target market, you can differentiate your offering and build unbreakable client relationships. This laser-focused approach doesn’t just enhance client satisfaction—it positions your robo advisor for explosive, sustainable growth in today’s competitive landscape.

Features of a Robo-Advisor Platform

To build your own robo-advisor, you’ll need to implement a variety of features that cater to the needs of your clients. These may include comprehensive robo advisor services and investment services, providing automated, algorithm-driven financial planning, portfolio management, and wealth management solutions.

Portfolio management: Robo-advisors should offer automated portfolio construction and management, focusing on asset allocation to maintain the desired asset allocation and optimize financial strategies. The platform automatically rebalances portfolios to ensure the target distribution of assets is preserved according to each client’s risk profile and investment goals. This might involve the use of exchange-traded funds, mutual funds, or other investment vehicles, with algorithms tailoring the investment portfolio based on clients’ profiles and regularly rebalancing to align with target allocations. Additionally, the platform leverages advanced algorithms and data analysis to generate personalized investment recommendations for clients.

Financial planning tools: These tools can help clients set financial goals, plan for retirement, or manage their personal finances. Examples include goal planning, retirement accounts, and net worth tracking.

Tax loss harvesting: This feature can help clients minimize their tax liabilities by strategically selling investments that have lost value to offset gains in other assets. The platform also offers tax optimization features, such as tax-loss harvesting and portfolio rebalancing, to further reduce tax liabilities and enhance long-term returns.

Diversified portfolio options: A robust robo-advisor platform should offer a variety of portfolio options to cater to different client preferences, including exposure to various asset classes such as stocks, bonds, and real estate through ETFs, to create balanced, risk-adjusted portfolios. The platform provides a range of investment options, including those aligned with ESG criteria and personalized strategies, as well as private equity, and more.

Human financial advisor integration: Some clients may still desire the personal touch of a human advisor other will agree on using artificial intelligence. Providing the option to connect with a human financial advisor can help bridge the gap between automated and traditional advisory services.

Mobile experience: A user-friendly mobile app can enhance the overall client experience, allowing them to monitor their investments and access financial planning tools on the go.

The Role of Human Financial Advisors in a Robo-Advisor Platform

While robo-advisors offer many advantages, they don’t necessarily replace the need for human financial advisors. Robo-advisors manage investments through a robo advisor investment account, charging account management fees as a percentage of the invested amount. Instead, they can complement the services provided by human advisors, who can focus on offering personalized advice, addressing complex financial situations, and building long-term client relationships. By integrating human advisors into your robo-advisor platform, you can cater to clients who prefer a hybrid approach to financial planning.

Technical Requirements included in InvestGlass robo for automated investing

Robo advisor development is a process that combines technical and financial expertise to create a custom robo advisor application tailored to automated investment needs. Building a robo advisor requires a blend of technical expertise and financial acumen. The technical foundation of a successful robo advisor platform involves several key components:

First, you’ll need proficiency in programming languages such as Python, Java, or C++. These languages are essential for developing the core algorithms that drive automated investing and portfolio management. Additionally, robust data storage and management solutions, including SQL and NoSQL databases, are crucial for handling vast amounts of financial data. It is especially important to securely process and manage the user’s financial data, such as holdings, transactions, and overall financial situation, to personalize and optimize robo advisor services.

Machine learning algorithms and libraries, such as TensorFlow or Scikit-Learn, play a pivotal role in creating intelligent investment strategies. These tools enable the robo advisor to analyze historical market data and make data-driven decisions. When working with financial time series data, such as stock prices, it is necessary to preprocess this data—using techniques like lagging, rolling windows, or resampling—to ensure accurate model training and reliable investment decision-making. Cloud infrastructure, provided by services like Amazon Web Services (AWS) or Microsoft Azure, ensures scalability and reliability, allowing your platform to handle a growing number of users and transactions.

Security is paramount in the financial industry. Implementing encryption and firewalls protects sensitive customer data and financial transactions from cyber threats. Additionally, integrating external data sources, such as financial APIs and market data feeds, enriches the platform’s capabilities, providing real-time insights and updates.

A user-friendly interface is essential for customer interaction. Developing an intuitive and responsive interface ensures that clients can easily navigate the platform, monitor their investment portfolios, and access financial planning tools. Furthermore, implementing risk management and compliance features is critical to adhere to regulatory standards and protect both the platform and its users.

Given the complexity of these technical requirements, assembling a skilled technical team is indispensable. This team should possess expertise in software development, data analytics, machine learning, and cybersecurity to build a robust and reliable robo advisor platform.

Swiss Security and European Compliance for portfolio management

Security and compliance aren’t just non-negotiable pillars—they’re your competitive advantage in the robo advisor space! Protecting user data and ensuring rock-solid financial transaction integrity becomes your platform’s secret weapon, especially when you’re handling the most sensitive personal and financial information that clients entrust to your robo advisor. When you implement cutting-edge security measures like end-to-end encryption, bulletproof firewalls, and intelligent intrusion detection systems, you’re not just safeguarding client accounts—you’re building an unshakeable foundation of trust that sets your platform apart from the competition.

But here’s where you really shine: your strict adherence to financial regulations becomes a massive competitive edge! Your robo advisor doesn’t just comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements—you excel at them through thorough data validation and verification processes that don’t just prevent fraud, they guarantee the legitimacy of every single user on your platform. And when you nail compliance with regulations like the Investment Advisers Act of 1940, you’re not just operating within legal bounds—you’re delivering legally sound investment advice that clients can count on with complete confidence.

By making security and compliance your top priorities, your robo advisor platform doesn’t just protect user data and maintain regulatory approval—you establish yourself as the gold standard for reliability and integrity in the financial services industry. That’s how you build a reputation that drives growth, attracts premium clients, and positions your platform as the trusted leader that everyone wants to work with!

Challenges of Building a Robo Advisor

Building a robo advisor is a multifaceted endeavor that presents several significant challenges. One of the foremost challenges is developing a robust and accurate algorithm capable of providing personalized investment advice. This requires a deep understanding of financial markets, investment strategies, and the ability to analyze vast amounts of historical market data.

Ensuring the security and integrity of customer data and financial transactions is another critical challenge. With the increasing prevalence of cyber threats, implementing advanced security measures, such as encryption and firewalls, is essential to protect sensitive information and maintain customer trust.

Compliance with regulatory requirements and industry standards is a non-negotiable aspect of building a robo advisor. Navigating the complex regulatory landscape requires a thorough understanding of financial regulations and the ability to implement compliance features within the platform.

Scalability is another challenge that cannot be overlooked. The robo advisor must be capable of handling a large volume of customers and transactions without compromising performance. This necessitates a robust cloud infrastructure and efficient data management solutions. Traditional wealth management services often have high minimum investment requirements, which can limit access for many potential clients. A well-designed robo advisor can lower this barrier, making investment services more accessible to a broader audience.

Creating a user-friendly interface is crucial for customer satisfaction. The platform should be intuitive and easy to navigate, allowing clients to monitor their investment portfolios and access financial planning tools seamlessly.

Overcoming these challenges requires a skilled technical team with expertise in machine learning, data analytics, and software development. Additionally, a deep understanding of financial markets, investment strategies, and regulatory requirements is indispensable to build a successful robo advisor platform. Ultimately, building a robo advisor is about launching a sophisticated robo advisor business that demands expertise in both finance and technology.

Cost and Revenue Models

You’ll discover that a brilliantly structured cost and revenue model transforms your robo advisor platform into a powerhouse of long-term success! Most robo advisors generate impressive revenue primarily through management fees, which represent just a small percentage of your client’s investment portfolio. These fees deliver exceptional value by staying significantly lower than traditional financial advisors charge, making your robo advisor platform the smart choice for savvy investors who demand cost-effective investment management that actually works.

Beyond those core management fees, you can supercharge your income through multiple revenue streams including interest on uninvested cash balances, profitable securities lending, and lucrative referral partnerships with other financial services providers. The magic of automated investment management empowers you to slash operational costs dramatically by eliminating expensive human intervention, which directly fuels your ability to offer competitive pricing that wins clients and drives growth.

However, you’ll want to recognize that building and maintaining your robo advisor platform demands strategic ongoing investments in cutting-edge technology, dynamic marketing, and exceptional customer support. Mastering the perfect balance between keeping costs manageable and delivering high-quality services becomes your key to creating a sustainable business model that delivers outstanding results for both your platform and delighted clients who keep coming back.

Benefits and Drawbacks of Building Your Own Robo-Advisor

When considering whether to build your own robo-advisor, it’s essential to weigh the potential benefits and drawbacks:

Benefits

Lower fees: Robo-advisors typically charge a lower management fee compared to traditional financial advisors, making them more attractive to cost-conscious investors. Management fees are a key factor in evaluating the cost-effectiveness of robo-advisors, as they are usually calculated as a percentage of the investment amount. Some platforms, such as Schwab Intelligent Portfolios, offer automated investing without charging advisory fees, making them even more cost-effective.

Broader access: Automated platforms can serve a wider range of clients, including those with lower account minimums or less investable assets. Robo-advisors can also accommodate both taxable accounts and retirement accounts, providing flexibility in account types.

24/7 accessibility: Clients can access their investment portfolios and financial planning tools at any time, providing a more convenient experience.

Drawbacks

Initial investment: Building a robo-advisor platform requires significant upfront costs for technology, infrastructure, and regulatory compliance.

While robo-advisors offer automation and lower costs, some investors may still prefer the personalized service and tailored advice provided by a traditional financial advisor.

Launch and Growth

Launching a robo advisor requires a meticulously planned strategy and flawless execution. The launch plan should encompass marketing and promotion efforts to create awareness and attract potential clients. Effective customer acquisition strategies are essential to build a solid user base from the outset. Understanding and targeting the right target audience is critical, as it allows you to tailor the platform’s features and messaging to attract investors who are most likely to benefit from your services.

Starting with a minimum viable product (MVP) is a prudent approach. An MVP allows you to test the platform’s core functionalities and gather valuable feedback from early users. This feedback is instrumental in refining and enhancing the platform before a full-scale launch. During onboarding, opening a robo advisor account typically involves providing personal information, linking a bank account to fund the new account, and completing an onboarding quiz to personalize the investment portfolio.

A well-defined growth strategy is crucial for the long-term success of your robo advisor. Expanding the customer base and increasing assets under management are primary objectives. Enhancing the user experience through continuous improvements and the development of new features, such as tax loss harvesting and retirement planning, can significantly boost client satisfaction and retention. Robo advisory firms are making investment services more accessible to a broader range of clients, especially those with lower initial capital, compared to traditional financial advisors.

Continuous monitoring and evaluation of the platform’s performance are essential to ensure it meets its goals and objectives. Regular updates and enhancements based on user feedback and market trends will keep the platform competitive and relevant.

The launch and growth of a robo advisor require a deep understanding of the financial industry, effective marketing strategies, and efficient customer acquisition techniques. By focusing on these areas, you can successfully build and grow a robo advisor platform that meets the evolving needs of your clients and stands out in the competitive financial landscape.

Continuous Monitoring and Improvement from data collection

To stay ahead of the competition and deliver game-changing results, your robo advisor platform must embrace relentless monitoring and continuous improvement. This means diving deep into market trends, economic shifts, and client insights to supercharge your investment strategies and transform portfolio management. By harnessing the power of historical market data and precisely assessing each client’s risk appetite, your robo advisor can make smart, data-driven adjustments to asset allocation and ensure every investment portfolio stays perfectly aligned with your clients’ financial dreams.

Staying on top of regulatory changes and industry innovations isn’t just important—it’s absolutely critical for maintaining bulletproof compliance and exceeding evolving client expectations. When you integrate cutting-edge technologies like machine learning and advanced data analytics, your robo advisor becomes a powerhouse that delivers ultra-personalized financial advice, optimizes tax strategies like a pro, and drives portfolio performance through the roof.

By making ongoing evaluation and enhancement your top priority, your robo advisor platform will deliver world-class investment management, build unshakeable client loyalty, and fuel explosive long-term business growth in the fast-moving world of automated investing.

Conclusion

In conclusion, building your own robo-advisor is an ambitious and potentially rewarding endeavor that can help revolutionize financial planning and wealth management for your clients. However, navigating the complexities of technology, feature integration, and compliance with various banking regulatory landscapes can be challenging. This is where InvestGlass comes in.

As an experienced and trusted partner in the fintech industry, InvestGlass can help you build a custom robo-advisor platform tailored to your specific needs and requirements. Our team of experts will guide you through every step of the process, ensuring that your platform is compliant with banking regulations, optimized for user experience, and equipped with the latest investment management tools and financial planning features.

By partnering with InvestGlass, you can harness the power of robo-advisory to provide a more efficient, cost-effective, and accessible solution for your clients’ financial needs, while also staying competitive in the ever-evolving world of finance. With our expertise and support, you can successfully build a robo-advisor that stands out in the market and positions your business for long-term growth and success.