#1 AI GPT Portfolio management tool for Financial Advisors and Wealth Managers

InvestGlass offers a powerful and flexible sales automation solution.

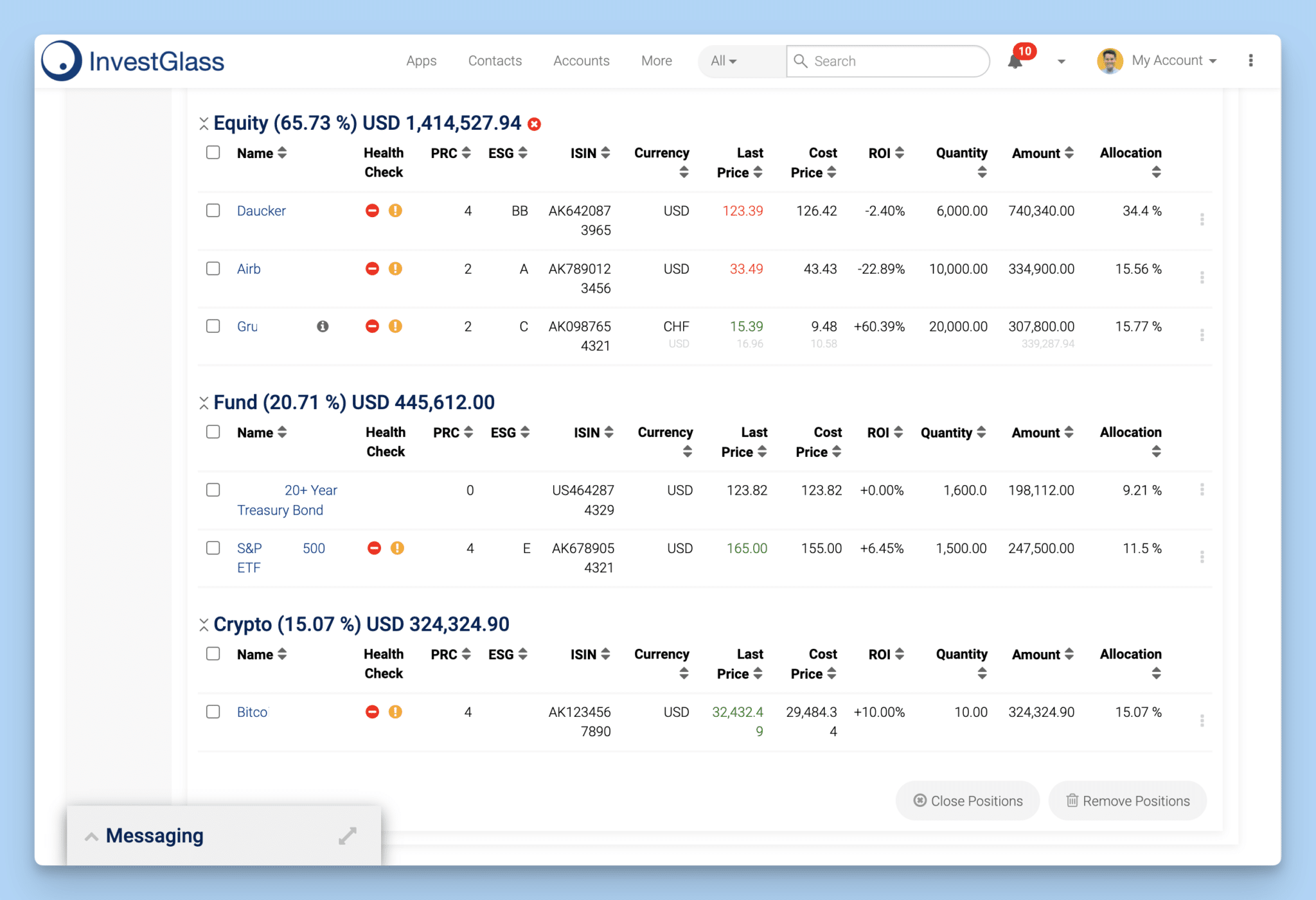

Modular PMS

Is Key to Succeed

If you’re a financial professional, then you know that a good PMS is essential to success. And one of the best ways to stay ahead of the curve is by using InvestGlass tools. Our portfolio manager tool allows you to keep track of your holdings and make informed decisions quickly and easily.

Portfolio Management System

InvestGlass offers a unique combination of CRM and PMS. Our software is dedicated to small and medium-sized advisory firms. It is the only tool on the market that offers both a customer relationship management (CRM) system and a portfolio management system (PMS) in one single application. View reconciled cash balance and projections in real-time.

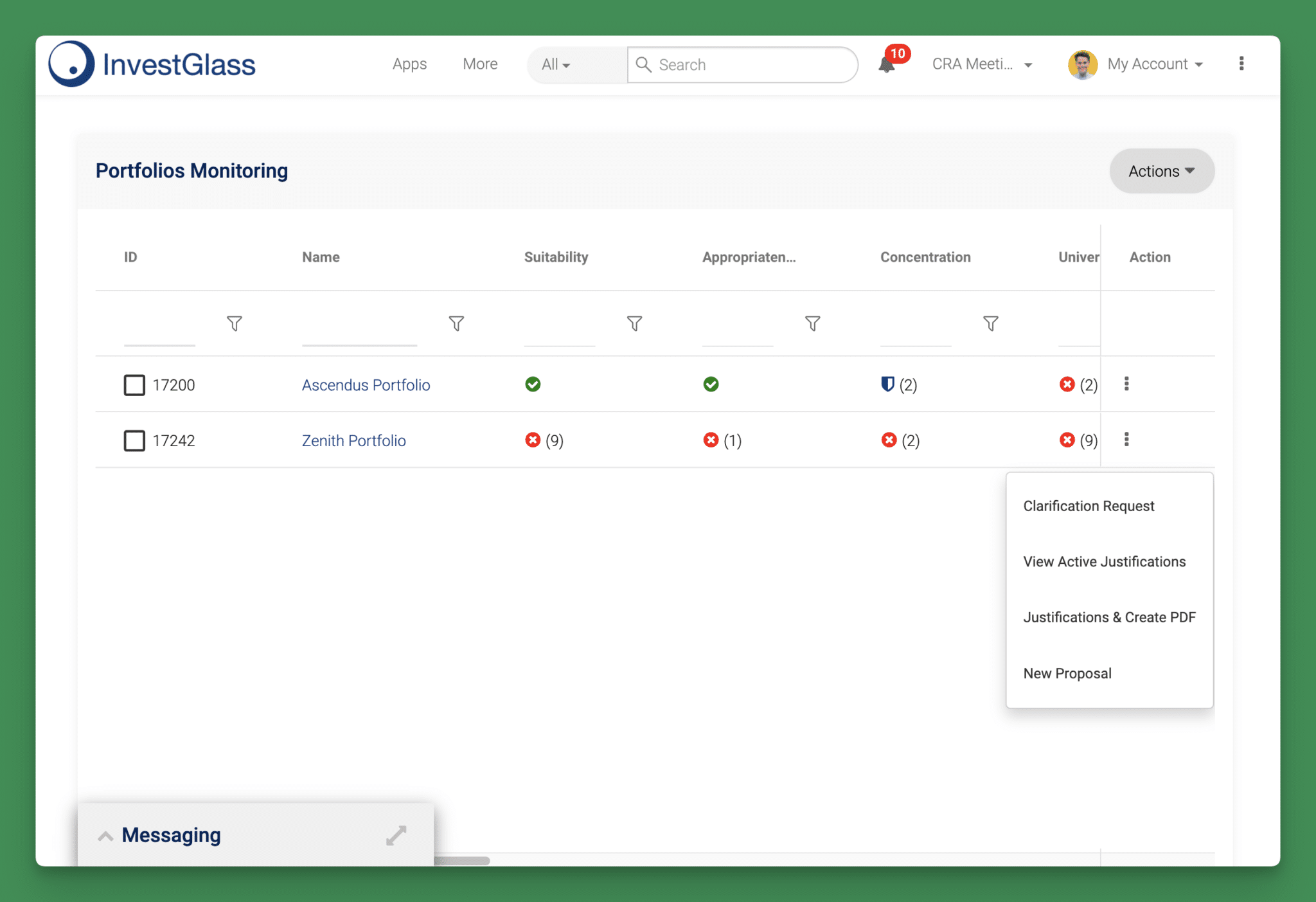

Risk management and compliance

InvestGlass provides a comprehensive view of your positions and risks but also helps you to zero in on exposures across every single portfolio with its industry-leading risk models. The tools is ready for MIFID, LSFIN FIDLEG reporting.

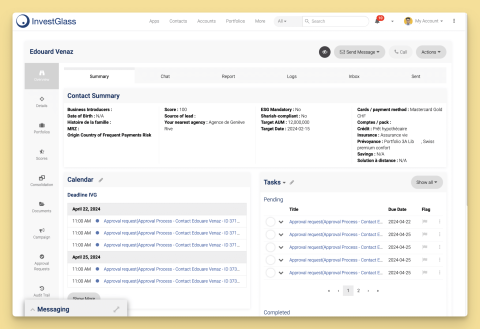

CRM built for financial advisors

InvestGlass is the only platform in its category to offer such high-quality services, connecting advisors with individual investors through cutting-edge technology.

InvestGlass innovative tools and sophisticated data analysis empower both sides of this relationship – helping professionals grow their clientele while also giving consumers more choices when it comes time for retirement planning or creating a new income stream

Model Portfolio

The best way to make smart investment decisions is with InvestGlass PMS. Seamlessly model orders across one or many portfolios, including rebalancing as needed so you can keep up with markets and stay ahead of the competition.