5 Things to Know before your Build your Own Robo Advisor

Robo-advisors have transformed financial planning by using machine learning and algorithms to automate investment management, offering a cost-effective alternative to human advisors. Platforms like Betterment provide personalized investment strategies with minimal human intervention (Betterment – Wikipedia). The rise of robo-advisors has democratized wealth management, making financial planning accessible to a wider audience (Robo-advisor – Wikipedia).

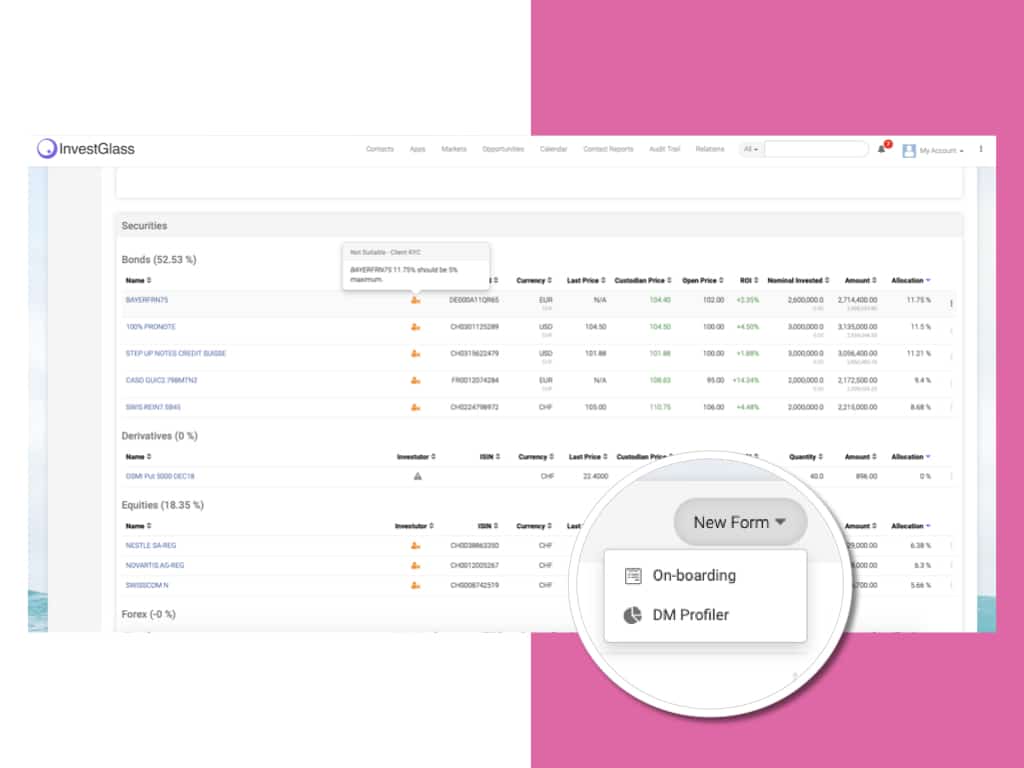

If you’re considering building your own robo-advisor, it’s essential to understand the various factors involved. In this guide, we’ll discuss the key aspects of creating a successful robo-advisor platform, from the technology and features to the advantages and potential challenges. InvestGlass includes risk metrics and ESG screening to respect clients and strategy suitability and appropriateness.

Understanding Robo-Advisors and Their Importance in Financial Planning:

Robo-advisors are digital platforms that use algorithms to manage and create investment portfolios for clients. They’ve gained popularity in recent years due to their lower fees compared to traditional financial advisors and their ability to provide access to investment management tools and financial planning tools that were once only available to wealthy investors. By automating the investment process, robo-advisors help clients develop and manage their investment strategies efficiently. These platforms assess a user’s risk tolerance through onboarding quizzes to tailor investment portfolios to individual client preferences, ensuring alignment with their financial goals. This makes robo-advisors a valuable addition to the financial planning landscape.

Features of a Robo-Advisor Platform:

To build your own robo-advisor, you’ll need to implement a variety of features that cater to the needs of your clients. These may include:

Portfolio management: Robo-advisors should offer automated portfolio construction and management, focusing on asset allocation to maintain the desired risk profile and optimize financial strategies. This might involve the use of exchange-traded funds, mutual funds, or other investment vehicles, with algorithms tailoring the investment portfolio based on clients’ profiles and regularly rebalancing to align with target allocations.

Financial planning tools: These tools can help clients set financial goals, plan for retirement, or manage their personal finances. Examples include goal planning, retirement accounts, and net worth tracking.

Tax loss harvesting: This feature can help clients minimize their tax liabilities by strategically selling investments that have lost value to offset gains in other assets.

Diversified portfolio options: A robust robo-advisor platform should offer a variety of portfolio options to cater to different client preferences, including socially responsible investing, private equity, and more.

Human financial advisor integration: Some clients may still desire the personal touch of a human advisor other will agree on using artificial intelligence. Providing the option to connect with a human financial advisor can help bridge the gap between automated and traditional advisory services.

Mobile experience: A user-friendly mobile app can enhance the overall client experience, allowing them to monitor their investments and access financial planning tools on the go.

The Role of Human Financial Advisors in a Robo-Advisor Platform:

While robo-advisors offer many advantages, they don’t necessarily replace the need for human financial advisors. Robo-advisors manage investments through a robo advisor investment account, charging account management fees as a percentage of the invested amount. Instead, they can complement the services provided by human advisors, who can focus on offering personalized advice, addressing complex financial situations, and building long-term client relationships. By integrating human advisors into your robo-advisor platform, you can cater to clients who prefer a hybrid approach to financial planning.

Technical Requirements for Building a Robo Advisor:

Building a robo advisor requires a blend of technical expertise and financial acumen. The technical foundation of a successful robo advisor platform involves several key components:

First, you’ll need proficiency in programming languages such as Python, Java, or C++. These languages are essential for developing the core algorithms that drive automated investing and portfolio management. Additionally, robust data storage and management solutions, including SQL and NoSQL databases, are crucial for handling vast amounts of financial data.

Machine learning algorithms and libraries, such as TensorFlow or Scikit-Learn, play a pivotal role in creating intelligent investment strategies. These tools enable the robo advisor to analyze historical market data and make data-driven decisions. Cloud infrastructure, provided by services like Amazon Web Services (AWS) or Microsoft Azure, ensures scalability and reliability, allowing your platform to handle a growing number of users and transactions.

Security is paramount in the financial industry. Implementing encryption and firewalls protects sensitive customer data and financial transactions from cyber threats. Additionally, integrating external data sources, such as financial APIs and market data feeds, enriches the platform’s capabilities, providing real-time insights and updates.

A user-friendly interface is essential for customer interaction. Developing an intuitive and responsive interface ensures that clients can easily navigate the platform, monitor their investment portfolios, and access financial planning tools. Furthermore, implementing risk management and compliance features is critical to adhere to regulatory standards and protect both the platform and its users.

Given the complexity of these technical requirements, assembling a skilled technical team is indispensable. This team should possess expertise in software development, data analytics, machine learning, and cybersecurity to build a robust and reliable robo advisor platform.

Challenges of Building a Robo Advisor:

Building a robo advisor is a multifaceted endeavor that presents several significant challenges. One of the foremost challenges is developing a robust and accurate algorithm capable of providing personalized investment advice. This requires a deep understanding of financial markets, investment strategies, and the ability to analyze vast amounts of historical market data.

Ensuring the security and integrity of customer data and financial transactions is another critical challenge. With the increasing prevalence of cyber threats, implementing advanced security measures, such as encryption and firewalls, is essential to protect sensitive information and maintain customer trust.

Compliance with regulatory requirements and industry standards is a non-negotiable aspect of building a robo advisor. Navigating the complex regulatory landscape requires a thorough understanding of financial regulations and the ability to implement compliance features within the platform.

Scalability is another challenge that cannot be overlooked. The robo advisor must be capable of handling a large volume of customers and transactions without compromising performance. This necessitates a robust cloud infrastructure and efficient data management solutions.

Creating a user-friendly interface is crucial for customer satisfaction. The platform should be intuitive and easy to navigate, allowing clients to monitor their investment portfolios and access financial planning tools seamlessly.

Overcoming these challenges requires a skilled technical team with expertise in machine learning, data analytics, and software development. Additionally, a deep understanding of financial markets, investment strategies, and regulatory requirements is indispensable to build a successful robo advisor platform.

Benefits and Drawbacks of Building Your Own Robo-Advisor:

When considering whether to build your own robo-advisor, it’s essential to weigh the potential benefits and drawbacks:

Benefits:

Lower fees: Robo-advisors typically charge a lower management fee compared to traditional financial advisors, making them more attractive to cost-conscious investors. Management fees are a key factor in evaluating the cost-effectiveness of robo-advisors, as they are usually calculated as a percentage of the investment amount.

Broader access: Automated platforms can serve a wider range of clients, including those with lower account minimums or less investable assets.

24/7 accessibility: Clients can access their investment portfolios and financial planning tools at any time, providing a more convenient experience.

Drawbacks:

Initial investment: Building a robo-advisor platform requires significant upfront costs for technology, infrastructure, and regulatory compliance.

Launch and Growth:

Launching a robo advisor requires a meticulously planned strategy and flawless execution. The launch plan should encompass marketing and promotion efforts to create awareness and attract potential clients. Effective customer acquisition strategies are essential to build a solid user base from the outset.

Starting with a minimum viable product (MVP) is a prudent approach. An MVP allows you to test the platform’s core functionalities and gather valuable feedback from early users. This feedback is instrumental in refining and enhancing the platform before a full-scale launch.

A well-defined growth strategy is crucial for the long-term success of your robo advisor. Expanding the customer base and increasing assets under management are primary objectives. Enhancing the user experience through continuous improvements and the development of new features, such as tax loss harvesting and retirement planning, can significantly boost client satisfaction and retention.

Continuous monitoring and evaluation of the platform’s performance are essential to ensure it meets its goals and objectives. Regular updates and enhancements based on user feedback and market trends will keep the platform competitive and relevant.

The launch and growth of a robo advisor require a deep understanding of the financial industry, effective marketing strategies, and efficient customer acquisition techniques. By focusing on these areas, you can successfully build and grow a robo advisor platform that meets the evolving needs of your clients and stands out in the competitive financial landscape.

Conclusion

In conclusion, building your own robo-advisor is an ambitious and potentially rewarding endeavor that can help revolutionize your clients’ financial planning and wealth management. However, navigating the complexities of technology, feature integration, and compliance with various banking regulatory landscapes can be challenging. This is where InvestGlass comes in.

As an experienced and trusted partner in the fintech industry, InvestGlass can help you build a custom robo-advisor platform tailored to your specific needs and requirements. Our team of experts will guide you through every step of the process, ensuring that your platform is compliant with banking regulations, optimized for user experience, and equipped with the latest investment management tools and financial planning features.

By partnering with InvestGlass, you can harness the power of robo-advisory to provide a more efficient, cost-effective, and accessible solution for your clients’ financial needs, while also staying competitive in the ever-evolving world of finance. With our expertise and support, you can successfully build a robo-advisor that stands out in the market and positions your business for long-term growth and success.