What are key drivers for innovation in banking?

Innovation is a critical component of success for any business, but particularly in the banking industry. As customer expectations continue to evolve, banks must continually adapt and innovate to stay competitive. Key drivers for innovation in banking include digital transformation, regulatory changes, customer demand for seamless experiences, and advancements in artificial intelligence and blockchain technology. One way to accelerate innovation is through the use of a core banking platform, which enables financial institutions to modernize operations, enhance customer service, and streamline compliance. According to McKinsey & Company, banks that invest in digital transformation and innovative technologies see higher customer engagement and operational efficiency.

A core banking platform is a comprehensive banking software solution that allows banks to manage their day-to-day operations, as well as provide a range of services to customers. Here are some ways in which a core banking platform can help accelerate innovation in the banking industry:

- Digital transformation: A core banking platform can help banks accelerate their digital transformation by providing a range of digital services and capabilities, such as online banking, mobile banking, and digital payments. This can help banks meet the evolving needs of their customers and stay ahead of the competition.

- Open banking: A core banking platform can facilitate open banking, which is the practice of sharing customer data and services between banks and third-party providers. This can help banks offer new and innovative services to their customers, and can also create new revenue streams.

- Agile development: A core banking platform can facilitate agile development, which is a software development methodology that emphasizes flexibility, collaboration, and rapid iteration. This can help banks quickly develop and deploy new products and services, and can also help them respond more quickly to changes in the market.

- Analytics and insights: A core banking platform can provide banks with powerful analytics and insights into customer behavior and market trends. This can help banks identify new opportunities for innovation, as well as optimize their existing products and services.

- Collaboration: A core banking platform can facilitate collaboration between different departments within a bank, as well as with external partners and vendors. This can help banks work more effectively and efficiently, and can also help them tap into new sources of innovation and expertise.

A core banking platform can help banks accelerate innovation by providing them with the tools and capabilities they need to stay ahead of the competition, meet the evolving needs of their customers, and respond quickly to changes in the market. By embracing innovation and leveraging technology to drive growth and success, banks can position themselves for long-term success in the years to come.

What are key drivers for innovation in banking?

Innovation is a critical component of success in the banking industry. Here are some key drivers for innovation in banking:

- Customer expectations: Customer expectations are a key driver of innovation in banking. As customers increasingly demand convenient and personalized banking services, banks must innovate in order to meet these expectations.

- Technological advancements: Technological advancements, such as artificial intelligence, blockchain, and cloud computing, are driving innovation in banking. These technologies are creating new opportunities for banks to improve efficiency, reduce costs, and offer new and innovative products and services.

- Regulatory changes: Regulatory changes are also driving innovation in banking. For example, the introduction of open banking regulations has created new opportunities for banks to collaborate with third-party providers and offer new services to their customers.

- Competition: Competition is another key driver of innovation in banking. As new players, such as fintech startups, enter the market, banks must innovate in order to stay ahead of the competition and retain their customers.

- Internal culture: Internal culture is also a key driver of innovation in banking. Banks that foster a culture of innovation and experimentation are more likely to succeed in developing new and innovative products and services.

Innovation in banking is driven by a range of factors, including customer expectations, technological advancements, regulatory changes, competition, and internal culture. By staying attuned to these drivers and leveraging technology to drive growth and success, banks can position themselves for long-term success in the years to come.

What is the goal of core banking system?

The goal of a core banking system is to provide a centralized and comprehensive platform for managing the day-to-day operations of a bank, including processing transactions, managing customer data, and providing a range of banking services. Core banking systems are designed to be robust and scalable, and can handle a high volume of transactions while ensuring the security and reliability of the banking system.

Some specific goals of a core banking system include:

- Efficiency: Core banking systems are designed to streamline and automate banking processes, reducing the need for manual intervention and improving efficiency. This can help banks reduce costs and improve their bottom line.

- Integration: Core banking systems are designed to integrate with other banking systems and third-party providers, enabling banks to offer a wider range of services and create new revenue streams.

- Security: Core banking systems are designed to ensure the security and integrity of banking data and transactions, protecting against fraud, data breaches, and other security threats.

- Customer service: Core banking systems are designed to provide a high level of customer service, enabling banks to offer personalized and convenient banking services to their customers.

The goal of a core banking system is to provide banks with a comprehensive and reliable platform for managing their day-to-day operations, while also enabling them to innovate and offer new and innovative products and services to their customers.

What are the difference if you are building a neobank, a credit company, or a universal bank?

When it comes to building a financial institution, there are several key differences between a neobank, a credit company, and a universal bank.

- Neobank: A neobank is a digital-only bank that operates entirely online, without any physical branches. Neobanks typically offer a limited range of banking services, such as checking and savings accounts, loans, and credit cards. Because neobanks are built from the ground up as digital-first institutions, they tend to be more agile and innovative than traditional banks, and may be able to offer more competitive rates and fees. However, they may not have the same level of brand recognition and trust as more established institutions.

- Credit company: A credit company is a financial institution that focuses primarily on lending, such as personal loans, credit cards, and lines of credit. Credit companies may also offer other financial services, such as savings accounts or investment products. Unlike neobanks, credit companies may have physical branches or offices, and may have been in business for longer. However, they may be less innovative than neobanks, and may not offer the same level of digital convenience and accessibility.

- Universal bank: A universal bank is a traditional bank that offers a wide range of financial services, including checking and savings accounts, loans, credit cards, investment products, and more. Universal banks typically have a physical presence, with branches and offices in multiple locations. They also tend to have more established brands and a higher level of trust among customers. However, universal banks may be slower to innovate and adopt new technologies, and may not offer the same level of digital convenience as neobanks.

The differences between building a neobank, a credit company, or a universal bank come down to the specific focus and business model of the institution. Neobanks prioritize digital innovation and agility, credit companies focus primarily on lending, and universal banks offer a wide range of financial services with a physical presence.

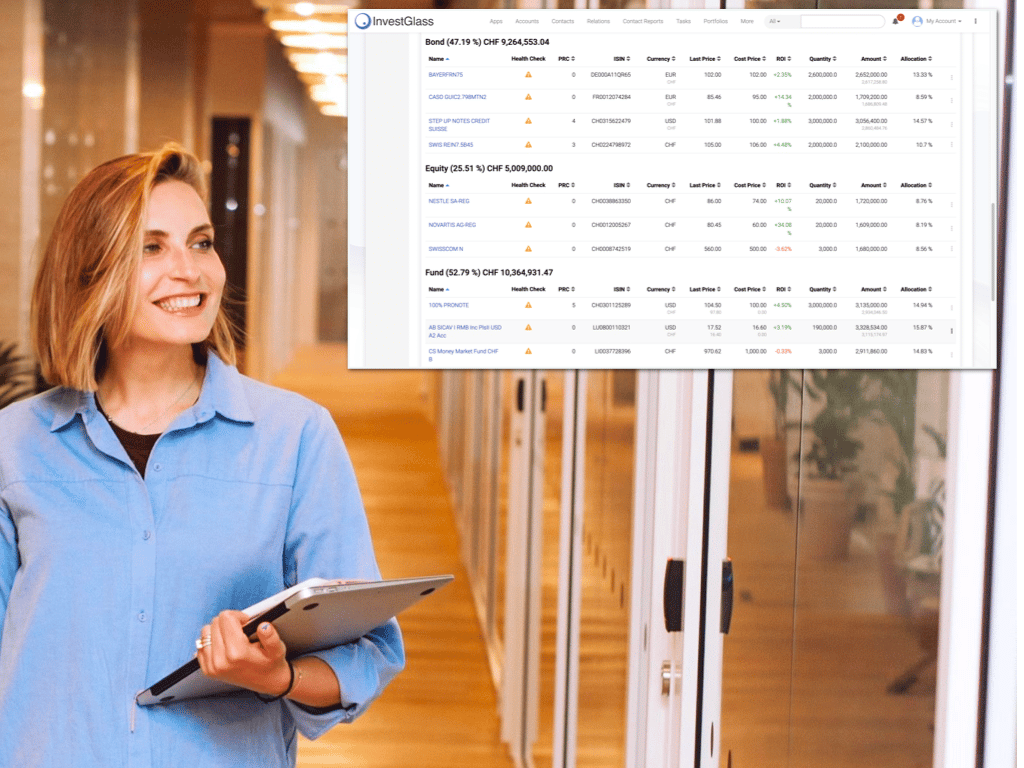

How can InvestGlass help you build you core banking platform?

InvestGlass is a financial technology company that offers a range of solutions for building a core banking platform. Here are some of the ways InvestGlass can help:

- Integration: InvestGlass can help you integrate your core banking platform with a range of third-party providers, such as payment processors, fraud prevention systems, and more. This can help you offer a wider range of services to your customers and create new revenue streams.

- Automation: InvestGlass offers powerful automation tools that can help you streamline and automate key banking processes, such as customer onboarding, transaction processing, and more. This can help you reduce costs and improve efficiency.

- Analytics: InvestGlass offers advanced analytics tools that can help you gain insights into customer behavior, market trends, and more. This can help you make data-driven decisions and optimize your banking services.

- Customization: InvestGlass offers a highly customizable platform that can be tailored to meet the specific needs of your institution. Whether you’re building a neobank, a credit company, or a universal bank, InvestGlass can help you create a platform that fits your unique business model.

- Security: InvestGlass offers robust security features to protect your banking data and transactions against fraud, data breaches, and other security threats. This can help you ensure the integrity of your banking system and build trust with your customers.

InvestGlass can help you build a core banking platform that is innovative, efficient, and secure, enabling you to offer a wide range of banking services to your customers and stay ahead of the competition.