Building a winning AI neobank

The banking industry, particularly with the rise of digital-only neobanks, has recently experienced significant transformations. While traditional banks face high entry barriers, including substantial fixed costs and extended timelines—often five to seven years—to reach breakeven (McKinsey), neobanks are disrupting this model by dramatically reducing startup costs and accelerating growth.

Leveraging technology, neobanks achieve customer acquisition rates nearly three times higher than traditional banks, challenging the industry’s established norms and rapidly reshaping customer expectations (Forbes).

Not only are these challenger banks operating at a fraction of the costs borne by traditional banks, but their strategy and execution plans are also distinctively disruptive. They offer more transparent pricing structures with minimal hidden charges, making the competitive pool increasingly vast. Yet, for these digital banks, the overarching quest is about solidifying their competitive advantage. They aim to grab a larger slice of the consumer’s financial pie and drive substantial profits.

A key part of the answer rests in the in-depth integration of data analytics and AI across all operations. Neobanks deepen customer relationships by formulating intelligent value propositions that solve unmet needs. They also harness the power of data to deliver hyper-personalized services, catering to evolving customer expectations and enhancing cross-selling opportunities. The pursuit is not just about financial performance but about delivering actual business value.

Consider the successful neobanks that have either scaled significantly or turned profitable. They all exhibit several unique features:

Rapid Product Rollouts:

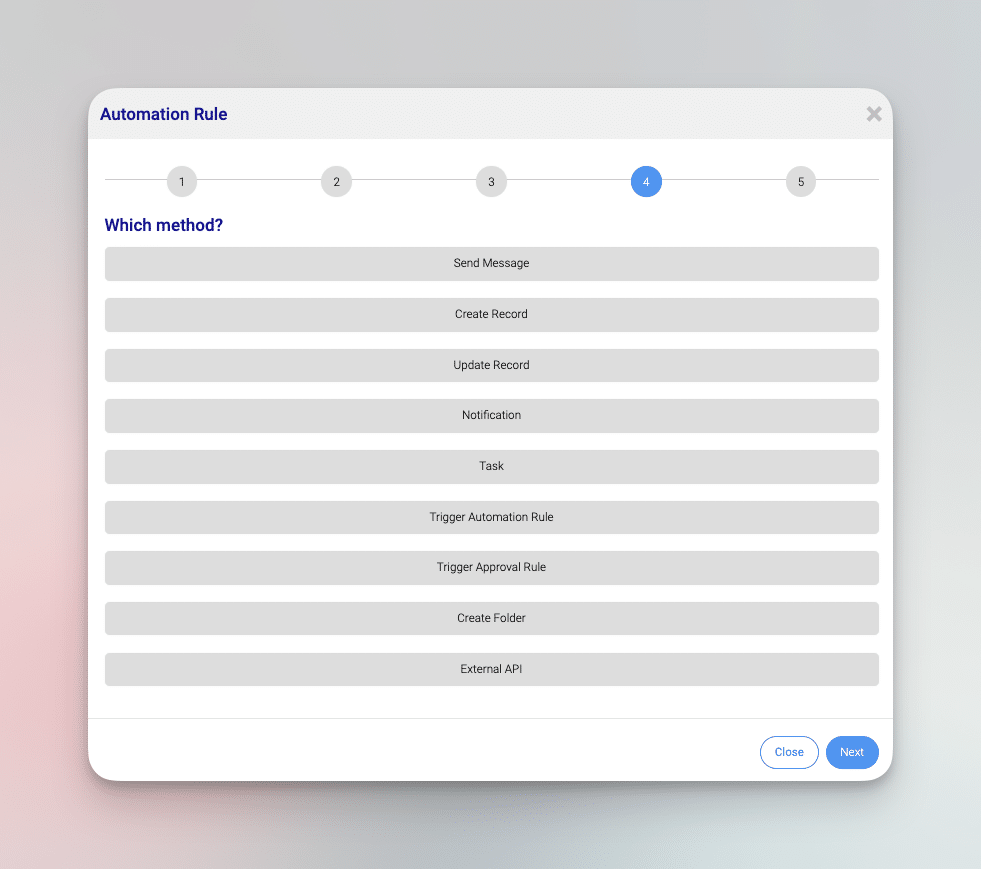

In the ever-evolving landscape of virtual banks, only a handful rise above the rest. How? They prioritize product innovation. It’s more than just serving customers. By analyzing extensive customer data, these neobanks quickly determine consumer purchase patterns. This allows them to swiftly introduce new products that address evolving market trends. Furthermore, they maintain flexible tech platforms, ensuring they can adapt to change. By doing so, they not only improve financial performance but also drive customer delight.

With InvestGlass you can build on the top of the cloud solution new products.

Stellar Customer Engagement:

The global banking sector save for a few, often fails to offer more than just traditional services. Leading neobanks, however, do more than just meet expectations. They leverage their platform to offer solutions that entertain and educate. From insights about market trends from market research provider Statista to offering games that relate to finance, they keep their customers engaged and informed.

Advanced Personalization – maximizing customer lifetime:

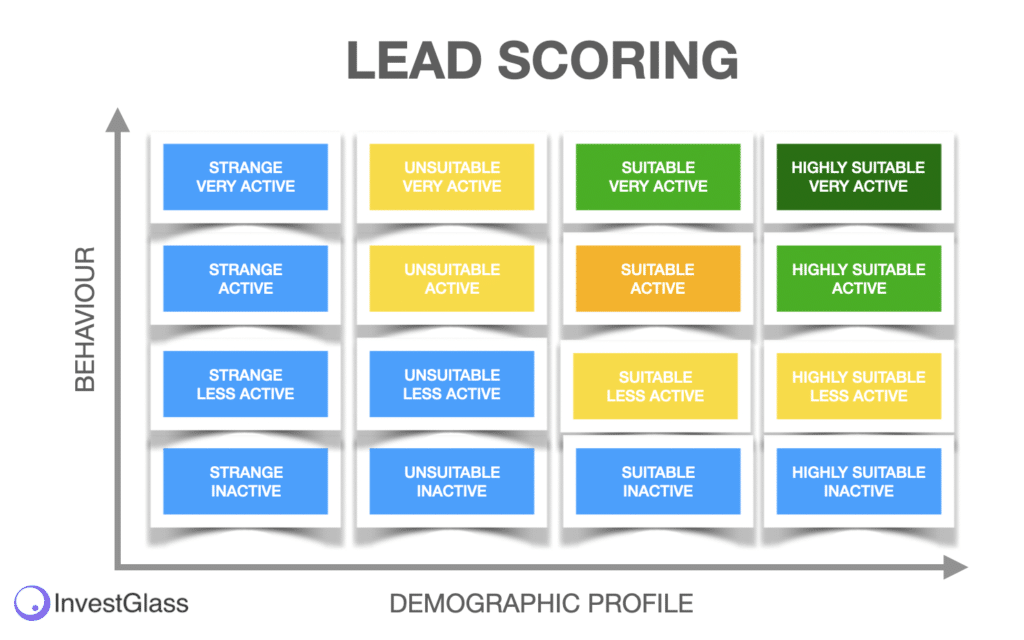

By analyzing customer data, these virtual banks are at the forefront of providing hyper-personalized services. They delve into consumer purchase patterns, ensuring they offer appropriate shopping recommendations and services, matching customers’ present context. We suggest you to have a look at the lead scoring process and automation process from the first day of your neobank setup.

Conversational Interfaces for hybrid customer relationships:

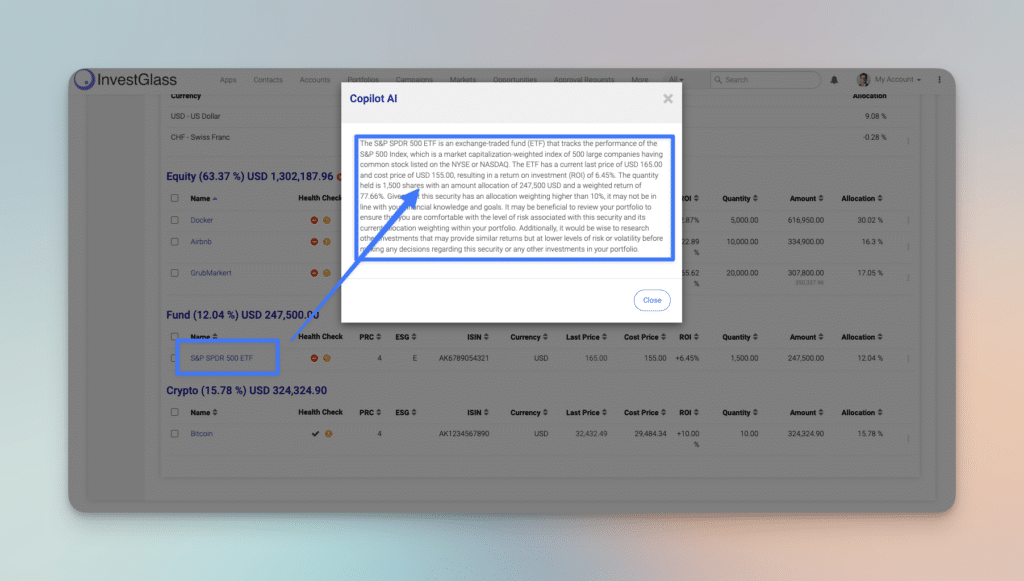

In the rapidly evolving landscape of banking, conversational interfaces stand out as a defining feature of modern customer engagement. Traditional balance sheet metrics, while essential, no longer solely dictate the success of banks. Instead, in today’s digital age, how a bank interacts and engages with its customers is of paramount importance. Virtual banks, especially successful neobanks and challenger banks, recognize this shift and are at the forefront of embracing these new modes of communication.

For these virtual banks, the goal extends beyond merely addressing customer queries. Instead, by leveraging customer context, these AI-centric institutions take customer engagement to the next level. It’s not just about responding; it’s about understanding, anticipating, and evolving with the customer’s needs.

Digital banks utilize innovative technologies like chatbots and voice tech to ensure each interaction is not just helpful but also interactive and engaging. Such tools don’t merely respond; they converse. They can gauge customer mood, understand underlying needs, and even anticipate queries based on prior interactions and market trends. This proactive approach not only deepens customer engagement but also opens doors for enhanced cross-selling. By understanding a customer’s context, banks can offer products and services that align perfectly with individual needs, further cementing their position in the customer’s financial journey.

Furthermore, the rapid launch of these conversational interfaces by digital banks indicates their commitment to staying agile and responsive to market trends. Challenger banks, in particular, use these tools to set themselves apart in a crowded market, ensuring they’re not just another bank but a partner in their customers’ financial endeavours.

In essence, conversational interfaces, powered by AI and context-aware algorithms, are more than just communication tools. They are the heart of customer engagement in the digital banking era, ensuring every interaction is a step towards a stronger, more meaningful relationship.

Open Banking Integration:

Rather than keeping customers tied to separate account, innovative virtual banks provide platforms where customers can manage all their banking needs. This holistic approach gives a comprehensive view of one’s financial health.

Open Banking Integration, embracing a model that has been steadily gaining traction in the world of innovative virtual banks. Traditional banking often confines customers to siloed experiences, where each account or service exists separately, leading to fragmented and often cumbersome user experiences.

In contrast, Open Banking Integration allows financial institutions to offer a more unified, connected experience. InvestGlass is aiming to implement this by providing a platform where customers aren’t limited to just one account or service. Instead, they can integrate multiple accounts, services, and even financial products from different institutions into a single platform.

The benefits of this integration are manifold. For customers, it translates to a more seamless banking experience, where all their banking needs, be it checking balances, making transfers, or even seeking financial advice, are accessible from a unified interface. It eliminates the need for juggling multiple apps or web interfaces, thereby reducing the friction that can sometimes deter individuals from engaging more proactively with their finances.

Moreover, this holistic approach ensures that customers have a comprehensive view of their financial health. By having all their banking data aggregated in one place, they can make more informed decisions, track their financial goals more effectively, and even spot potential issues or opportunities they might have missed in a more segmented setup.

In essence, InvestGlass’s move towards Open Banking Integration aligns with the broader shift in the financial sector towards more customer-centric solutions. It promises not only to streamline banking operations for individual users but also to redefine the very nature of the customer-bank relationship, making it more integrated, transparent, and beneficial for all parties involved.

Strategic Partnerships:

It’s not just about offering digital banking services. By forming strategic alliances, these neobanks embed their services across payments platforms and digital commerce avenues. This not only boosts their discoverability but also allows them to deliver complementary services to their customers.

Customer Lifetime Value (LTV) as a Cornerstone:

In the traditional banking industry, much emphasis has historically been placed on typical balance sheet metrics. These metrics, though valuable, often miss the nuances of customer relationships and evolving customer needs in the digital age. On the other hand, virtual banks, especially those affiliated with pioneers like the payment technology company BPC, are transforming this mindset.

Digital banks, particularly challenger banks, prioritize customer-centric metrics over traditional indicators. They invest time and resources into observing and reporting on customer LTV curves. By doing this, these banks gain deeper insights into customer engagement and can develop intelligent value propositions that align with market trends and customer preferences.

The focus on LTV allows these virtual banks to create strategies that reduce customer acquisition costs and enhance customer lifetime value. As a result, they can rapidly launch new banking services that cater to the evolving customer landscape. Product innovation becomes more agile and in tune with what the customer truly wants. Enhanced cross selling emerges as a byproduct of these strategic moves, serving as a testament to the bank’s ability to anticipate and solve unmet customer needs.

InvestGlass stands out in this milieu, primarily with its digital onboarding and CRM tools. The key to profitability in the realm of digital only banks lies in streamlining customer interactions and ensuring consistent engagement. InvestGlass’s Digital Onboarding system simplifies the entry process for new customers, ensuring that from the very first interaction, the customer feels valued and understood. It’s not just about resolving customer queries; it’s about fostering lasting relationships.

Furthermore, the CRM offered by InvestGlass plays a pivotal role in deepening customer relationships. By tracking customer interactions, preferences, and feedback, the CRM allows banks to tailor their offerings and ensure continuous engagement. This is crucial for virtual banks and successful neobanks aiming to maximize the lifetime value of each customer.

In essence, tools like InvestGlass’s Digital Onboarding and CRM systems are not just supplementary tools; they are the backbone of a profitable strategy. They allow banks to stay ahead of market trends, improve financial performance, and deliver actual business value both for the institution and its clientele.

Building a winning AI Neobank with InvestGlass

In the broader spectrum, it’s clear that the landscape of banking, especially with the rise of challenger banks, is undergoing a transformative phase. The ability to rapidly respond to market dynamics, coupled with a focus on customer delight and leveraging data analytics, will determine the leaders in this evolving space.

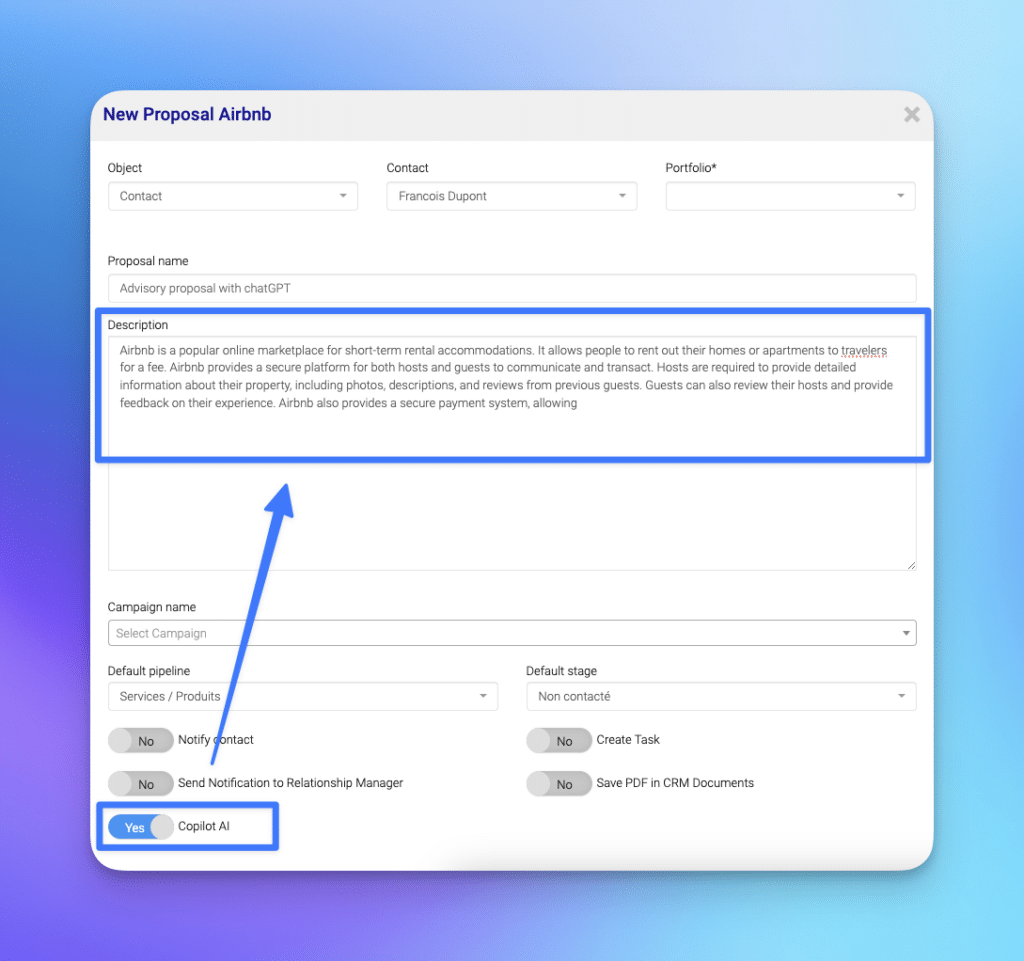

Enter InvestGlass. With its embedded ChatGPT, it is positioned to help construct profitable AI Neobanks. How? For one, maximizing customer lifetime value becomes an achievable goal. The platform’s capabilities allow for a deep understanding of various customer segments, enabling tailored strategies for customer acquisition and retention. InvestGlass ensures a seamless customer experience, with features that allow users to manage all their bank accounts efficiently. Moreover, the ability to gather and interpret data on customer preferences offers a unique advantage in rapidly launching innovative products and services that cater to the needs of diverse customer segments.

Unlike many traditional banks that may fall behind due to conventional methods, AI-focused neobanks, with the aid of platforms like InvestGlass, own exclusively digital plays, ensuring they remain agile in the competitive banking landscape. They can also leverage partner ecosystems effectively, tapping into vast reservoirs of partner data to further refine their offerings. Moreover, with features like automatic savings, customers not only get to experience convenience but also financial empowerment.

In conclusion, as the banking sector continues to evolve, tools and platforms like InvestGlass, combined with AI capabilities like ChatGPT, will be instrumental in shaping the future of Neobanks. They provide the edge needed to meet customer expectations, innovate rapidly, and ultimately, to lead in the digital banking revolution.