Maximizing Client Relationships: Top CRM Private Banking Solutions for 2025

How can CRM systems enhance private banking? CRM private banking solutions manage client interactions and data, streamline operations, and ensure compliance, all while delivering personalized service to enhance client satisfaction. This article reviews top CRM tools for private banking, highlighting their key features and benefits.

Introduction to CRM in Private Banking

Customer Relationship Management (CRM) is a strategic framework and technological solution aimed at managing, analyzing, and enhancing client interactions in the private banking sector. The primary purpose of CRM in private banking is to provide a personalized and efficient banking experience for high-net-worth individuals and entities. By leveraging CRM systems, private banks can strengthen client relationships, streamline operations, and drive sustainable business growth.

In the competitive landscape of private banking, CRM systems serve as the backbone for managing client interactions and data. These systems enable private banks to offer tailored financial solutions, ensuring that each client’s unique needs and preferences are met. By centralizing client data, CRM systems facilitate a comprehensive understanding of each client’s financial journey, allowing relationship managers to deliver personalized services that enhance client satisfaction and loyalty.

Moreover, CRM systems play a crucial role in operational efficiency. By automating routine tasks and providing instant access to pertinent client information, these systems reduce the administrative burden on relationship managers, allowing them to focus on building and maintaining strong client relationships. This not only improves productivity but also ensures that clients receive timely and accurate financial advice.

Key Takeaways

CRM systems in private banking enhance client relationships by managing interactions, analyzing data, and providing personalized service to high-net-worth clients.

Effective CRM solutions feature centralized data management, automation of routine tasks, and robust compliance tools, ensuring operational efficiency and improved client satisfaction.

The future of CRM in private banking will be shaped by emerging technologies like AI, machine learning, and blockchain, necessitating ongoing updates and training for effective implementation.

The Role of CRM in Private Banking

In the realm of private banking, customer relationship management (CRM) systems are instrumental in orchestrating client engagements, monitoring transactional activities, and dissecting vital client information. These platforms aim to foster and nurture enduring associations with affluent clients by methodically gathering, organizing, and leveraging client data. This enables private banks to more effectively cater to their clientele’s distinct preferences. These platforms enable private banks to deliver personalized service, ensuring that each client’s unique needs and preferences are met.

Operational efficiency is another significant advantage offered by CRM systems within this sector. By managing analyses and fine-tuning interactions with clients—coupled with providing instant access to pertinent data—they streamline subsequent actions enhancing productivity through improved deal tracking as well as optimizing workflow procedures. For high net worth individuals who anticipate bespoke yet efficient service delivery from their financial institutions, these CRM solutions have become essential tools.

Lastly, the individualized insights derived from CRM technologies empower banks with a deeper understanding of consumer behavior patterns alongside prevailing market dynamics. Thus aiding them in furnishing custom-made services while maintaining a competitive edge through proactive anticipation of their customers’ needs. With continuously advancements in technology, the future continues to promise even greater enhancements, both in sustaining robust client relationships and bolstering streamlined bank operations.

Understanding Client Expectations

In the private banking sector, clients expect personalized services, tailored to their unique financial needs and goals. They demand a high level of expertise, discretion, and responsiveness from their relationship managers. To meet these expectations, private banks must have a deep understanding of their clients’ financial journeys, risk tolerance, and investment preferences. A well-implemented CRM system can help private banks capture and organize client-specific data, enabling them to deliver targeted communication, personalized services, and actionable insights.

High-net-worth clients often have complex financial portfolios and diverse investment strategies. They expect their private banks to provide bespoke financial planning and wealth management solutions that align with their long-term goals. CRM systems enable relationship managers to track and analyze client interactions, transactions, and preferences, providing a 360-degree view of each client’s financial landscape. This comprehensive understanding allows private banks to anticipate client needs and offer proactive solutions, enhancing the overall client experience.

Furthermore, CRM systems facilitate seamless communication between clients and relationship managers. By integrating multiple communication channels, CRM systems ensure that clients receive consistent and timely updates, regardless of their preferred mode of communication. This omnichannel approach not only improves client satisfaction but also strengthens the trust and loyalty that are essential for long-term client relationships.

Key Features of Effective Private Banking CRM Systems

Private banking relies heavily on CRM systems that come equipped with essential capabilities, making them a vital tool in the industry. These features encompass:

The organization of customer information within a centralized database to offer services tailored to individual needs

Instant access to all pertinent client data and transaction history

Effortless navigation for managing customers

Strengthened bonds with clients

The ability to deliver personalized service tailored to individual client needs

Such functionalities allow institutions specializing in private banking to proficiently oversee their interactions with clients while elevating the quality of service delivered.

CRM systems augment customer service by providing robust support and efficient handling of cases. They automate various workflows including those related to welcoming new customers and processing loans, which increases operational efficiency and diminishes reliance on manual tasks.

The ability of these systems to conduct detailed analysis on client data aids private banks in determining each client’s risk tolerance through scrutiny of their transaction records. Omnichannel integration facilitates communication across multiple platforms favored by clients, offering an uninterrupted banking experience.

Lastly, adept management of documents is facilitated by CRM software. It ensures quick retrieval not just for regular customer files, but also compliance-related documentation—this boosts productivity levels while confirming adherence to regulatory standards.

Overcoming Challenges with CRM in Private Banking

Introducing CRM solutions in the private banking sector brings about particular challenges, especially concerning regulatory compliance and securing customer data. A CRM system consolidates client information and monitors interactions to uphold regulatory standards effectively. Robust features for safeguarding data within these systems are crucial for mitigating risks related to maintaining precise customer information and adhering to compliance mandates.

A well-constructed banking CRM can facilitate adherence to private banking’s distinct regulatory obligations. Custom-built CRM platforms simplify conformity with specific legal requirements through their alignment capabilities, while allowing financial institutions flexibility in configuring security protocols tailored to their individual risk considerations.

The role of advanced analytics along with automation technologies is pivotal in surmounting these hurdles by furnishing banks the capability of extracting insights from voluminous datasets more efficiently, concurrently diminishing time consumption as well as potential inaccuracies during manual entry operations. Additionally, delivering personalized service can be challenging but is essential for meeting client expectations and enhancing satisfaction.

Cloud-enabled CRMs afford instantaneous adjustments pertaining to privacy and defense mechanisms responsive to evolving regulations. With such rigorous attention paid to legislative conformance driving digital transformation initiatives within the finance industry, it’s anticipated that crm systems will persistently advance so as not only meet but exceed those emerging needs.

Enhancing Client Relationships Through Personalized Services

In the realm of private banking, crafting personalized services is fundamental for nurturing trust and fidelity among clientele. CRM technologies bolster customer devotion by empowering banks with the capability to offer bespoke services that address distinct client requirements, cementing the trust and allegiance critical to thriving private bank-client associations.

The adoption of CRM platforms can amplify consumer contentment through anticipatory resolution of issues. The analytical and reporting functionalities within these systems furnish insights into patron habits and engagement tactics, equipping financial institutions with the means to refine their methods accordingly. Tailor-made CRM solutions afford private banks access to in-depth data on clients, which proves indispensable for delivering customized financial offerings.

CRM tools also expedite communication workflows via automation, guaranteeing prompt responses and alerts for relationship managers. For example, Pegasystems prides itself on intensifying client bonds using AI-driven management utilities tailored for personalization.

Banking’s digital overhaul aspires to deliver exceptionally personalized experiences designed around each individual’s preferences. Employing such instruments enables private banking entities to extend exemplary services that not only satisfy but surpass what their customers anticipate.

Streamlining Operations for Better Financial Planning

Private banks utilize CRM systems to enhance their portfolio management and financial planning capabilities. By centralizing customer data, these institutions are able to refine client interactions and elevate the quality of service they provide by having all essential information at their disposal, which in turn improves operational efficiency and supports informed decision-making. By delivering personalized service, private banks can better align their financial planning strategies with individual client needs.

CRM solutions play a critical role in boosting operational efficiency by automating routine tasks such as manual data entry and managing customer services. This automation lessens the burden of manual workloads while also reducing errors, thereby ensuring that financial advisors have access to more precise and dependable data. These systems can be seamlessly integrated with current workflows for optimized task automation without excessive reliance on manual input.

By linking CRM tools with financial planning software, private banks ensure uniformity in handling data across multiple platforms. Such integration offers a comprehensive perspective of each client’s interaction history, investment preferences, and past financial activities. As a result, this enables financial advisors to craft personalized finance solutions accurately aligned with individual needs. Through streamlining operations via sophisticated CRM systems implementation, private banks can significantly improve their offering of tailored advisory services, leading not only to superior portfolio management but ultimately driving increased satisfaction among clients.

Top CRM Software Solutions for Private Banks

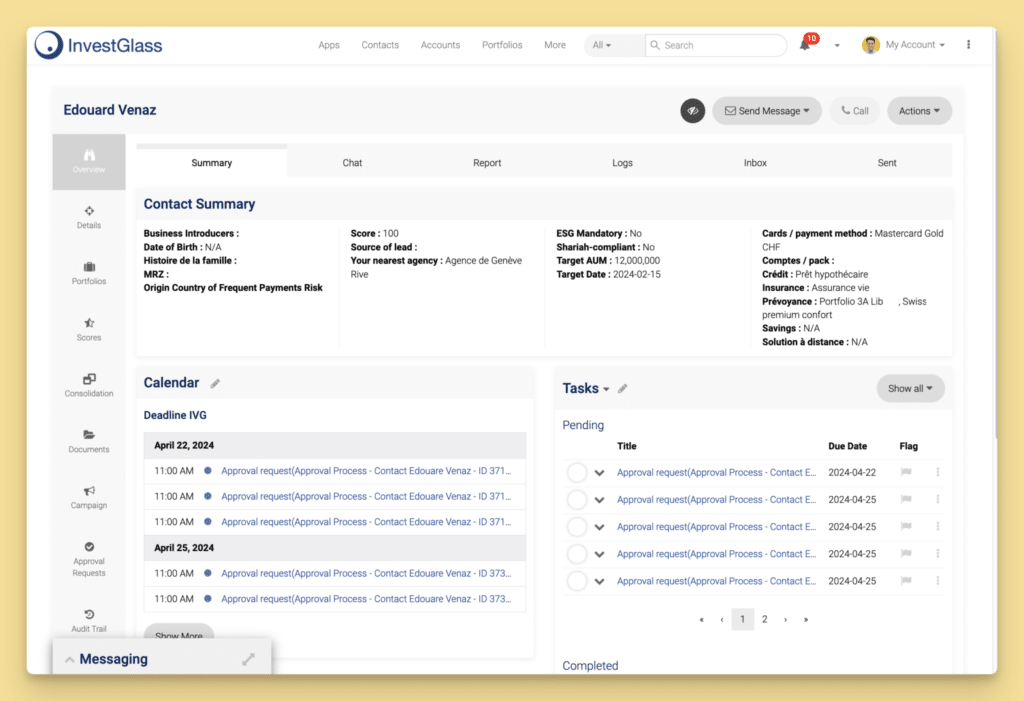

By 2025, a number of prominent CRM software solutions have emerged as key players for private banks, each delivering distinct features and advantages. These top-tier CRM platforms are designed to improve user experience by incorporating centralized document management capabilities which include streamlined deal document organization, task automation, and instantaneous insights in managing client relationships. These top-tier CRM platforms are designed to improve user experience by incorporating features that enable personalized service.

Salesforce Financial Services Cloud, Microsoft Dynamics 365 Finance, and Pegasystems rank among the frontrunners in this space. They provide customized options crafted specifically for the requirements of private banking institutions. Subsequent sections offer an analysis of these solutions by outlining their principal functionalities, advantages they bring to financial services providers as well as any potential challenges that might be encountered when implementing them.

Salesforce Financial Services Cloud

Salesforce Financial Services Cloud provides bespoke solutions for the financial services industry, improving customer engagement through AI-powered insights. Esteemed organizations such as RBC Wealth Management, Rocket Mortgage, and Morgan Stanley utilize this platform to cultivate client relationships and offer customized services. By harnessing these intelligent insights, financial advisors gain a deeper understanding of their clients’ desires and inclinations, facilitating the provision of more individualized financial planning options within an overarching wealth management solution.

The entry-level cost for accessing Salesforce Financial Services Cloud stands at $225 USD monthly per user. While some entities may view price as a barrier, the returns gained in terms of enhanced customer engagement and relationship handling justify its adoption as an investment.

Private banks that adopt AI-powered insights are able to improve how they interact with customers significantly while providing distinguished services that cater precisely to distinct client requirements.

Microsoft Dynamics 365 Finance

Microsoft Dynamics 365. Finance serves as a sophisticated CRM solution designed specifically for the private banking sector. With a subscription cost of $180 per user each month, it provides streamlined features to facilitate compliance and powerful reporting tools. Although its pricing structure may be prohibitive for smaller enterprises and pose difficulties for emerging companies, the system’s customizable options enable private banks to fine-tune it to meet their particular requirements.

While integrating with external systems not part of Microsoft can prove challenging, Dynamics 365 Finance boasts seamless integration capabilities with other offerings from Microsoft that amplify ease of use. The initial configuration might present complexities for those not well-versed in Microsoft ecosystems. Upon successful setup, the software accommodates both traditional financial practices and models based on subscriptions.

In summary, as an extensive toolset tailored towards optimizing financial planning processes and managing client relationships effectively within private banking institutions, Microsoft Dynamics 365 Finance offers robust functionality.

Pegasystems

Pegasystems employs artificial intelligence to improve customer management and engagement strategies. The AI-powered insights enable private banks to automate responses and personalize client interactions according to their unique preferences, offering a degree of personalization that is especially valuable for high net worth clients who seek customized financial solutions.

The utilization of advanced analytics and automation by Pegasystems aids in fostering stronger relationships with clients while crafting highly individualized banking experiences. This platform assists private banks in delivering tailored solutions designed to address the distinct needs of each client, thereby boosting overall satisfaction and allegiance among clientele.

Integration and Customization: Tailoring CRM to Your Bank’s Needs

It’s vital for private banks to tailor and integrate CRM solutions to cater to their specific operational requirements. Personalizing CRM systems serves the unique demands of investment banking, leading to improved efficiency in operations. Such customizations allow these financial institutions to adjust the functionality of CRMs, thereby increasing user contentment and guaranteeing that the system corresponds with their distinct business workflows.

Seamless incorporation of CRM systems into pre-existing bank frameworks is key for uninterrupted procedures. This type of integration offers a unified perspective on all client interactions while ensuring easy access to essential information within a single platform.

By adjusting CRM solutions to fit their particular needs, private banks can boost operational productivity, deliver superior service quality, and ultimately increase customer satisfaction levels.

Future Trends in CRM for Private Banking

In the private banking sector, emerging technologies are transforming how client relationships are managed. Artificial intelligence and machine learning tools assist private banks in analyzing data trends to make well-informed decisions and offer tailored financial solutions. The integration of IoT within banking is improving both accessibility and security by enabling real-time financial transactions. Personalized service will remain a key trend, driven by advancements in AI and machine learning.

Blockchain technology represents a significant innovation, challenging traditional practices in the banking sector while enriching service capabilities. Enhanced analytical functions within CRM systems grant these institutions the power to extract valuable insights that guide their marketing strategies and refine their product offerings.

To stay relevant in an evolving market landscape, it is crucial for private banks to regularly assess and upgrade their CRM system. This continuous improvement ensures they keep pace with industry changes, thus maintaining a competitive edge while delivering outstanding services to clients.

Implementing a CRM Solution: Best Practices

To successfully implement a CRM solution within the realm of private banking, meticulous preparation and implementation are essential. It’s important to maintain data integrity and adhere to regulatory requirements through persistent training for employees. Such continuous education is pivotal in optimizing the utility of the CRM system. The process of transferring data should encompass purifying it and accurately charting its course to facilitate an effortless shift. Establishing well-defined goals before putting the CRM into operation is fundamental for achieving favorable outcomes.

Ensuring the CRM system supports personalized service is essential for meeting client expectations and enhancing satisfaction.

Adhering to these recommended procedures guarantees that private banks will effectively implement their chosen CRM solution, resulting in more efficient operations, enriched interactions with clients, and heightened overall client satisfaction.

Conclusion

In conclusion, CRM is a critical component of private banking, enabling banks to deliver personalized services, improve operational efficiency, and drive business growth. By understanding client expectations and leveraging CRM systems, private banks can strengthen client relationships, manage risk, and maintain a competitive edge in the market. As the private banking sector continues to evolve, the importance of CRM will only continue to grow, making it essential for private banks to invest in robust CRM solutions that meet the unique needs of their clients.

The integration of advanced technologies such as AI, machine learning, and blockchain into CRM systems will further enhance their capabilities, allowing private banks to offer even more personalized and efficient services. By staying ahead of technological advancements and continuously refining their CRM strategies, private banks can ensure that they remain at the forefront of the industry, providing exceptional value to their clients and achieving sustainable business success.

Summary

To sum up, the role of CRM systems in the private banking sector is indispensable. These systems are pivotal for handling client interactions, monitoring transactions, and dissecting data to bolster both client relationship management and operational efficiency. Features like unified data control, automated workflows, and seamless omnichannel communications are crucial in delivering personalized services that heighten customer satisfaction. Tackling hurdles pertaining to regulatory compliance and ensuring robust data security are essential. Here’s where sophisticated analytics tools coupled with automation come into play. Personalized service is a key benefit of CRM systems, enhancing client satisfaction and loyalty.

Looking ahead at the evolution within this domain brought on by advanced technologies such as AI (Artificial Intelligence), IoT (Internet of Things), and blockchain, will Enhance CRM capabilities necessary for exceptional client relationship management. It’s imperative for private banks aiming at refining operations, better financial planning strategies – all while offering peerless services tailored to their clients’ specific preferences – to adopt best practices during CRM deployment. With a promising future unfolding for CRMs within private banking, those who leverage these emerging tech trends stand a chance at being frontrunners in providing unmatched experiences to their clientele.

Frequently Asked Questions

What is the primary purpose of CRM in private banking?

The primary purpose of CRM in private banking is to cultivate and strengthen long-term relationships with high-net-worth clients by effectively managing interactions, tracking deals, and analyzing data to enhance service delivery.

This focus on relationship management ultimately improves client satisfaction and loyalty.

What are some key features of effective private banking CRM systems?

Effective private banking CRM systems should include centralized data management, robust customer service functionalities, workflow automation, integration of omnichannel communications, and comprehensive document management.

These features enhance client understanding and streamline banking operations.

How do CRM systems help private banks overcome challenges?

CRM systems enable private banks to effectively navigate challenges by ensuring regulatory compliance, enhancing data security, managing risks related to data accuracy, and utilizing advanced analytics and automation for improved data management.

How can personalized services enhance client relationships in private banking?

Personalized services significantly enhance client relationships in private banking by fostering trust and loyalty through tailored solutions and proactive communication.

By understanding individual client needs, banks can provide more relevant and timely support, ultimately strengthening the client relationship.

What are the future trends in CRM for private banking?

The future trends in CRM for private banking involve integrating AI and machine learning for enhanced data analysis, utilizing IoT for better accessibility and security, and applying blockchain technology to transform traditional banking models.

Additionally, ongoing evaluation and updates of CRM systems will be essential to meet evolving business requirements.