What is AML and LCB FT in France or CFT?

KYC PROCEDURES: WHY VERIFY CLIENT IDENTITY?

Why are we asking so much information during a know-your-client procedure? As a financial institution, we are legally obliged to implement customer due diligence measures, in order to comply with international anti-money laundering and countering the financing of terrorism (AML/CFT) regulations or in french LCB FT.

In this post, we will explain what is know-your-client procedure as well as the french AML / LCB-FT.

KYC procedure is used in the banking, payment, and insurance industries as part of the customer due diligence measures required by law. This measure is necessary in order to comply with international anti-money laundering and countering the financing of terrorism (AML/CFT) regulations.

In France, the legal framework for AML / CFT measures is set out in articles L561-2. The KYC is for people. The KYB or “know your business” is for companies.

The main purpose of the KYC procedure is to prevent financial institutions from being used, intentionally or unintentionally, by criminal elements for the purpose of money laundering or terrorist financing. The KYC process also allows banks and other financial institutions to better understand their customers and their financial dealings.

Governed by European and Swiss legislation come out the KYC key elements are similar in most national legislations. Procedures adopted by Prudential supervision bodies will enforce increased monitoring of traditional payments but also cryptocurrencies related. Most investment firms are adopting the European Union regulatory framework.

What is the purpose of the KYC procedure for financial institutions?

The KYC procedure consists of collecting data and information about the customer in order to:

– Verify the customer’s identity

– Understand the customer’s business activities and profile

– Determine the customer’s risk profile

– Monitor the customer’s transactions

The data is checked against multiple databases. InvestGlass team connects your CRM to statistical data and risk assessment tools to ensure compliance. Each firm can manage different countries’ risk so the final decision to open an account is often your decision. Unless your operations are running under the umbrella of another company, then you have to comply with joint guidelines.

InvestGlass customers are always using the digital onboarding forms to collect information such as surname, first name, postal address, email, mobile phone… but also collect the following elements ID or Passport + Proof of address of less than 3 months.

For legal entities, firms will collect a copy of an identity document of the legal representative, the KBIS extract of less than 3 months, the copy of the statutes for example…

The business identity cart or “Extrait Kbis” includes more information than before. An Extrait Kbis card is established for each business registered with the Chambre de Commerce or Chambre de Metiers. This official document is called KBIS and attests to the identity and address of the business, its activity, its management or control, and the existence or not of collective proceedings against the business. This document is updated to reflect changes affecting the business.

For limited companies such as EURL, SARL, SAS, SASU it will indicate :

- The extent of the powers of the liquidator, if applicable.

- The date and location of the original registration if the business was transferred to a different area.

- A reference to the reconstruction of capital, if applicable.

A face-to-face meeting could be needed but we build our solution to facilitate collect of documents with smart forms. KBIS might not be sufficient to spot the last beneficial owner of a company. FAFT guidance and organized crime filtering need a bit more control than public authorities’ document.

Who is affected by KYC in the financial sector?

KYC procedures is important in Europe since 2015 terrorist attacks in Paris. The 4th EU Anti-Money Laundering Directive (4AMLD) requires Member States to ensure that customer due diligence (CDD) measures are carried out when firms enter into business relationships, and on an ongoing basis.

DSP 1 and DSP2 increase the need for AML and LCB-FT checks for firms. DSP2 is more stringent than DSP1 and requires firms to take into account both the customer’s business activities and their geographical location.

If a firm does not comply with KYC requirements, it may face financial penalties or be required to cease doing business with the customer in question. In extreme cases, firms may have their operating licenses revoked.

If you want to learn more about the directive 2015/849 then by the 5th Directive of May 30, 2018 known as 2018/843 and soon the “new and future” 6 AML.

Is KYC systematic for AML and LCB-FT ?

Yes, it is systematic for all financial institutions.

In Europe, the 4th EU Anti-Money Laundering Directive (4AMLD) requires Member States to ensure that customer due diligence (CDD) measures are carried out when firms enter into business relationships, and on an ongoing basis. Suspicious transactions are then reported to authorities via STR – Suspicious Transaction Reports. Credit institutions are conducting KYC on a daily basis.

Why is KYC and anti-money laundering necessary?

Of course, you want to spot suspicious transactions. Of course, you want to remove all high-risk clients… but in the same time your need to operate in a “normal” and fluid way. European banking authorities understand that effective implementation in the financial system can be very complex. They are building a new European identity verification which should simplify your procedure. The European parliament is also pushing for more information exchange.

Opening bank accounts should be made easier from what we understood from the European supervisory authorities… let’s see! Payment service providers will still conduct risk-sensitive basis tests and the financial intelligence unit will still be stressed when national authorities conduct on-site inspections. The UK National law is another challenge that most fintech companies are working on. As the UK is outside the European banking authority since the Brexit, the new EBA directive is not applicable. The 5th Directive of 2018/843 is currently being implemented in the UK.

How to detect money laundering?

To detect money laundering you can use InvestGlass transaction automation. It will help you to monitor, in real-time, all your client’s transactions, and cross them with the data of the financial intelligence database. The intelligence behind automation can be setup by your compliance team without any programming knowledge. Illegal activity can be spotted, the machine will identify funds behavior, then send a message to your colleagues.

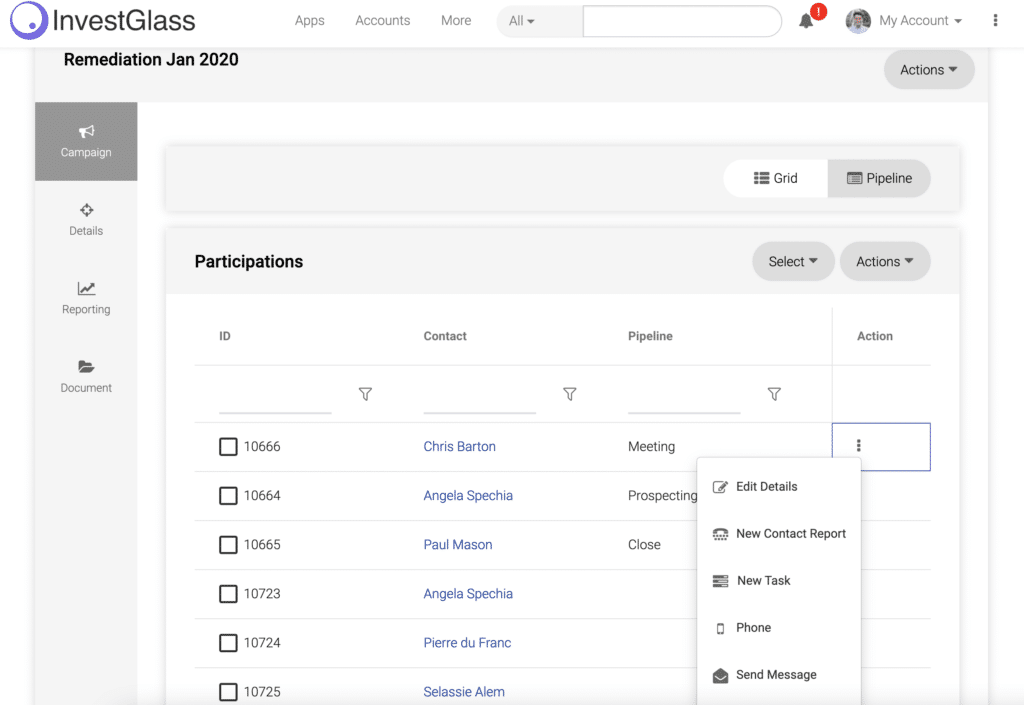

AML LCB FT measure can be used on new and existing clients. Internal controls are connected to the InvestGlass approval process and task management to develop a common understanding of what the risk-based approach involves when financing operations or any business relationship you will carry.

Is the information collected secure?

For InvestGlass, information storage quality is a priority. Our servers are hosted on bank-grade servers. By default, InvestGlass servers are hosted in Switzerland in two sites. You can also ask InvestGlass to be hosted on your servers. For more information please contact us.

InvestGlass is also subject to Swiss data protection and European GDPR. GDPR is a regulation in the EU in response to the UK’s Data Protection Act 1998. It strengthens EU data protection rules by giving individuals more control over their personal data, and establishing new rights for individuals. Credit institutions and banks care about GDPR because of the risks associated with non-compliance, including significant fines.

New ideas in combating money laundering?

- The first step is to make sure that you eliminate high-risk third countries and that you collect quality statistical data.

- The second step is to build a good risk assessment process where you can open bank accounts easily and eliminate terrorism, fraud, and organized crime easily.

- The third step is to automate anti-money laundering and terrorist financing with the CRM automation. If the business fails to verify the identity of a client with reasonable certainty it will not establish a business relationship or proceed with the transaction.

- The fourth step is to setup a smart connection to an approved local ID check to identify the person or company

- The fifth step is to build the onboarding forms, connect to the API with respect to your risk-based approach, spotting the beneficial owner clearly

- The sith step is to update your AML CFT, AML LBC FT on a monthly basis to make sure that your process is respecting technical standards

- Last but not least, setup the automation for reporting suspicious transactions

InvestGlass CRM and KYC remediation tools are built to help any financial system. InvestGlass has been built for the financial sector and can be adapted to any industry. Investment firms will appreciate that InvestGlass is hosted and incorporated in Switzerland.

InvestGlass beneficial owners are Swiss which is another security for most financial institutions looking for a non US ownership. We are updating the InvestGlass AML template to help build modern credit institutions, modern neo banks, and more.

InvestGlass offers connections to multiple electronic identification fintech including ONFIDO, Basis ID, Credas and more. Those solutions are adapted to electronic money issuers and crypto broker-dealers too. Combating money laundering is easier thanks to those amazing Fintech solutions.

InvestGlass risk assessment machine is flexible which is great for financial institutions’ operations in a variety of financial sectors. Then the AML CFT process will be adapted to fit your regulatory technical standards.

LCB FT, lutte contre le blanchiment des capitaux et le financement du terrorisme