How neobanks can increase their profitability?

If you’re looking to increase your profits, Neonanks has the products you need. Here are five of our most popular items that can help you achieve success. This is based on our current customers’ experience with the InvestGlass cloud solution. We work closely with our clients to improve bank profitability and financial performance in a world where interest rate risk is a perilous danger

In today’s competitive financial landscape, achieving profitability remains a significant challenge for neobanks. Despite generating over $40 billion in global revenue in 2023, approximately 80% of neobanks are still unprofitable, primarily due to high customer acquisition costs.

This underscores the importance of strategic product offerings and efficient operations to enhance financial performance..

1. Buy now pay later

Buy now pay later (BNPL) is a type of financing that allows consumers to purchase items now and pay for them over time. It’s a form of credit, and it often comes with interest rates and fees. BNPL can be used for a variety of things, such as clothing, furniture and appliances.

Apple has started to offer a Buy now pay later service in order to increase profitability. This will allow customers to purchase items with no money down and then pay for them over time. This new solution is a major threat for fintech players that bet big time on this product.

2. Digital, hybrid investment automating financial institutions offer

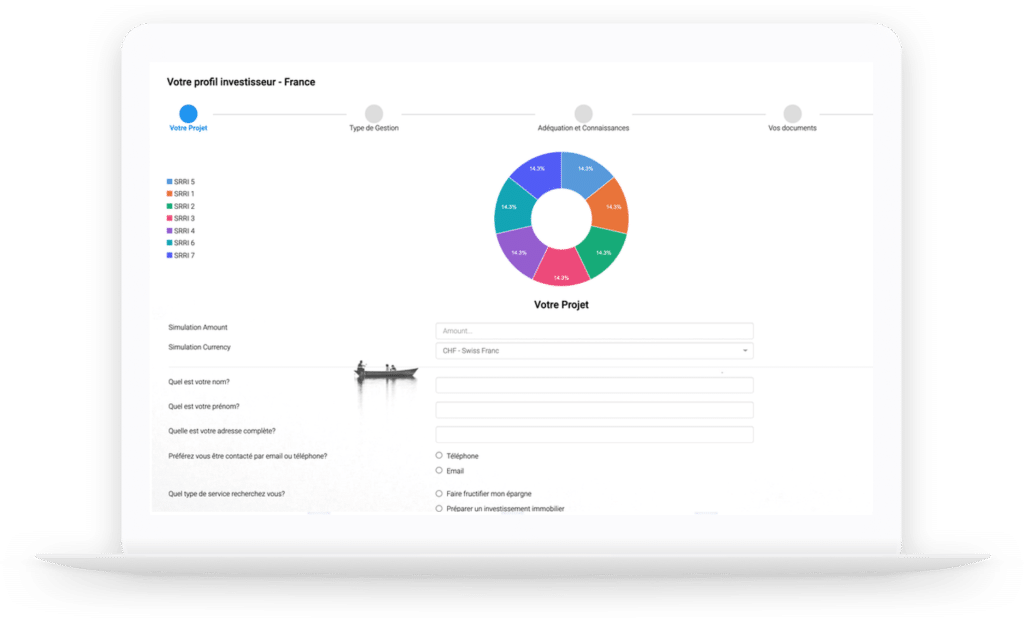

Neobanks should be able to offer a range of digital and hybrid solutions such as robo-advisory. Robo advisory service is an automated financial planning service that provides recommendations for investments, saving, and spending. It’s often used by people who want to invest but don’t have the time or knowledge to do it themselves. InvestGlass offers a no-code robo adivsory for builder. No code is needed and you can connect this tool to your investment portfolio and start managing discretionary portfolio mandate.

3. Cryptocurrencies to compete with the traditional financial services sector

Neobanks should give access to cryptocurrencies including wallets. A cryptocurrency wallet is a digital wallet where you can store your cryptocurrencies. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and control the creation of new units.

4. Digital mortgage to boost profitability for neobanks

Neobank must offer real estate financing solutions such as digital mortgages. A digital mortgage is an online platform that allows you to apply for a mortgage and track the progress of your application online. This type of mortgage is becoming increasingly popular as more people are comfortable doing their banking and financial transactions online.

Digital mortgages can be tricky are interest rates are moving. In the low-interest rate environment, the situation was quite tense, now that interest rates are increasing the market is now more attractive for neobank looking to manage first-time mortgages and rollover. Most banks have the capacity to do fixed-rate loans and they just haven’t run the numbers. A neobank should be careful of credit risk if we are entering into a great recession. Net interest income came under further pressure as margins continued to decline. With DSP2 PSD2 and other open banking it’s now easier to analyse company balance sheets and external factors to reduce risk even in a non-economic growth era.

5. Artificial intelligence built with pre-built banking industry compliance rules

Artificial intelligence AI is a must-have for neobanks to know their customers better, detect financial crimes and also improve customer service. AI is a broad term that covers a range of technologies, including machine learning, natural language processing and computer vision. The AI helps to manage risk appropriately. You should be careful not to be to opened in the “Get out There” phase otherwise you will have to offboard cusotmers in the “get rich” phase…

Artificial intelligence is also used for financial advisory, this is usually the most profitable part of banking but without AI it is impossible to offer this type of service. Risk management is not something neobank can afford. Your artificial intelligence can replace several relationship managers’ tasks thanks to automation and efficient partnership with fintech solution providers covering sub-asset class : mortgaged-back securities, real estate, private equity, and structured products.

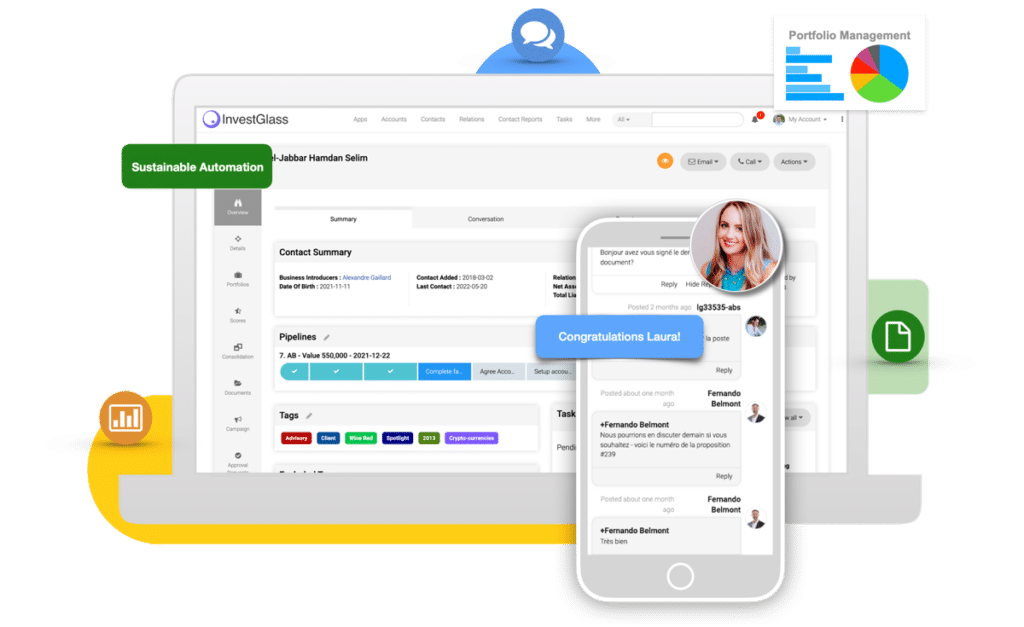

Artificial intelligence can also be used for managed portfolios or DPM. InvestGlass PMS is connected to the banking system to receive daily positions and transactions. The machine will automatically rebalance the portfolio, and suggest changes to investors or to relationship managers when you are offering hybrid banking. Banking profitability is made possible when all those repetitive tasks are automated.

Get out there, get reach, get rich

As with several neo banks it is important to deliver the right features are the right time. We are helping your teams to make sure that the minimum viable product will be delivered in due time. InvestGlass team orchestrates fintech parties to improve operational efficiency.

As the world moves towards a more digital era, it’s important for neobanks to offer a range of digital solutions in order to stay competitive. This includes services such as buy now pay later, robo-advisory and access to cryptocurrencies. They should also offer digital mortgages as this type of mortgage is becoming increasingly popular. However, it’s important to note that interest rates are moving so borrowers need to be careful when taking out a digital mortgage. All this is possible with InvestGlass Cloud.

InvestGlass is a cloud-based artificial intelligence software company that offers a range of services such as robo-advisory, buy now pay later, and access to cryptocurrencies trading. They also offer digital mortgages, which is becoming increasingly popular. InvestGlass is the only Swiss based solution running on the cloud with no impact on the Cloud Act.

Let’s build it together!