#1 Portfolio Management for Private Equity hosted in Switzerland

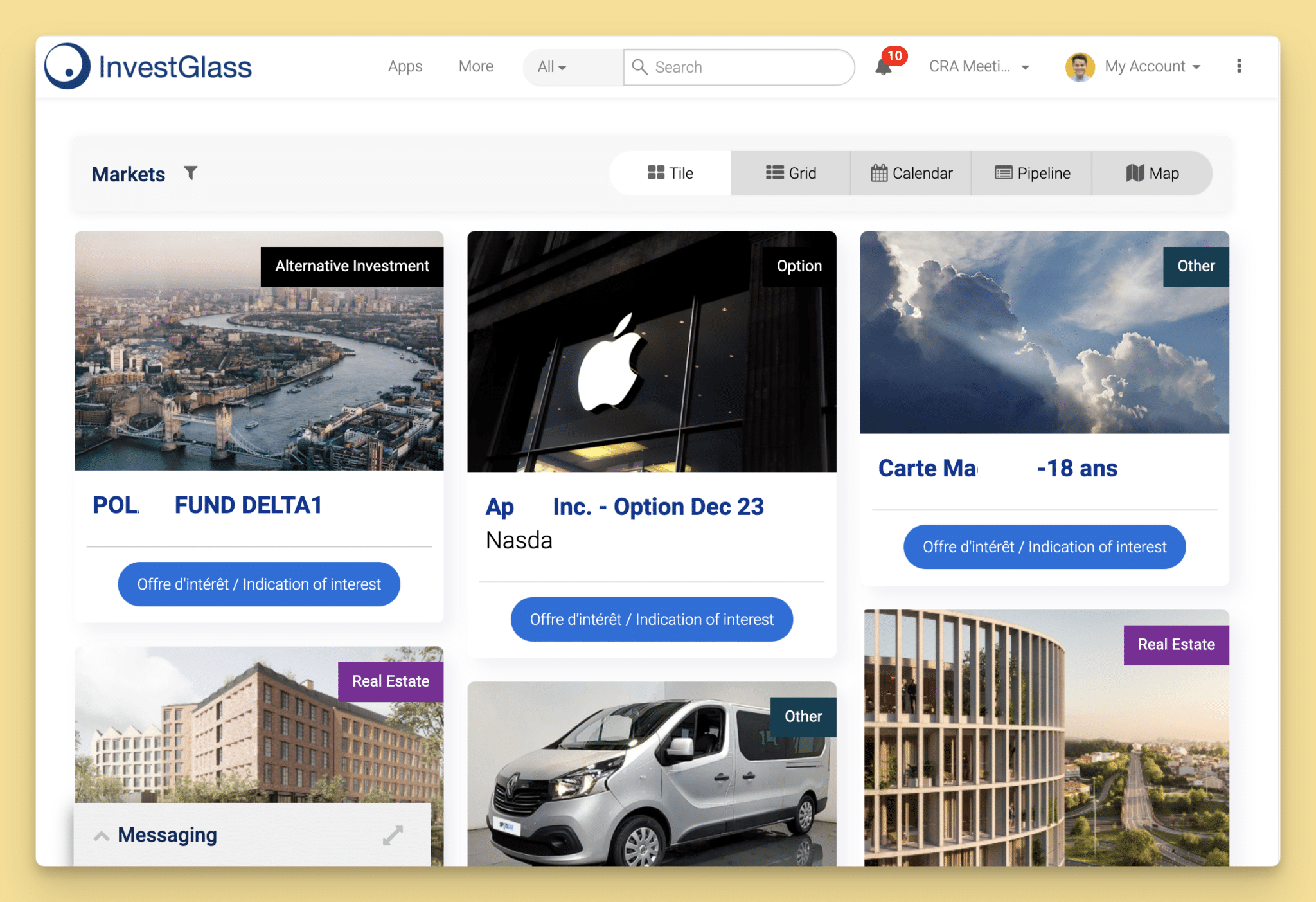

Private Equity Stakeholders meet in a branded PE portal

InvestGlass community tool will help you collect two distinct sets of stakeholders the General Partner (GP) and Limited Partners (LP).

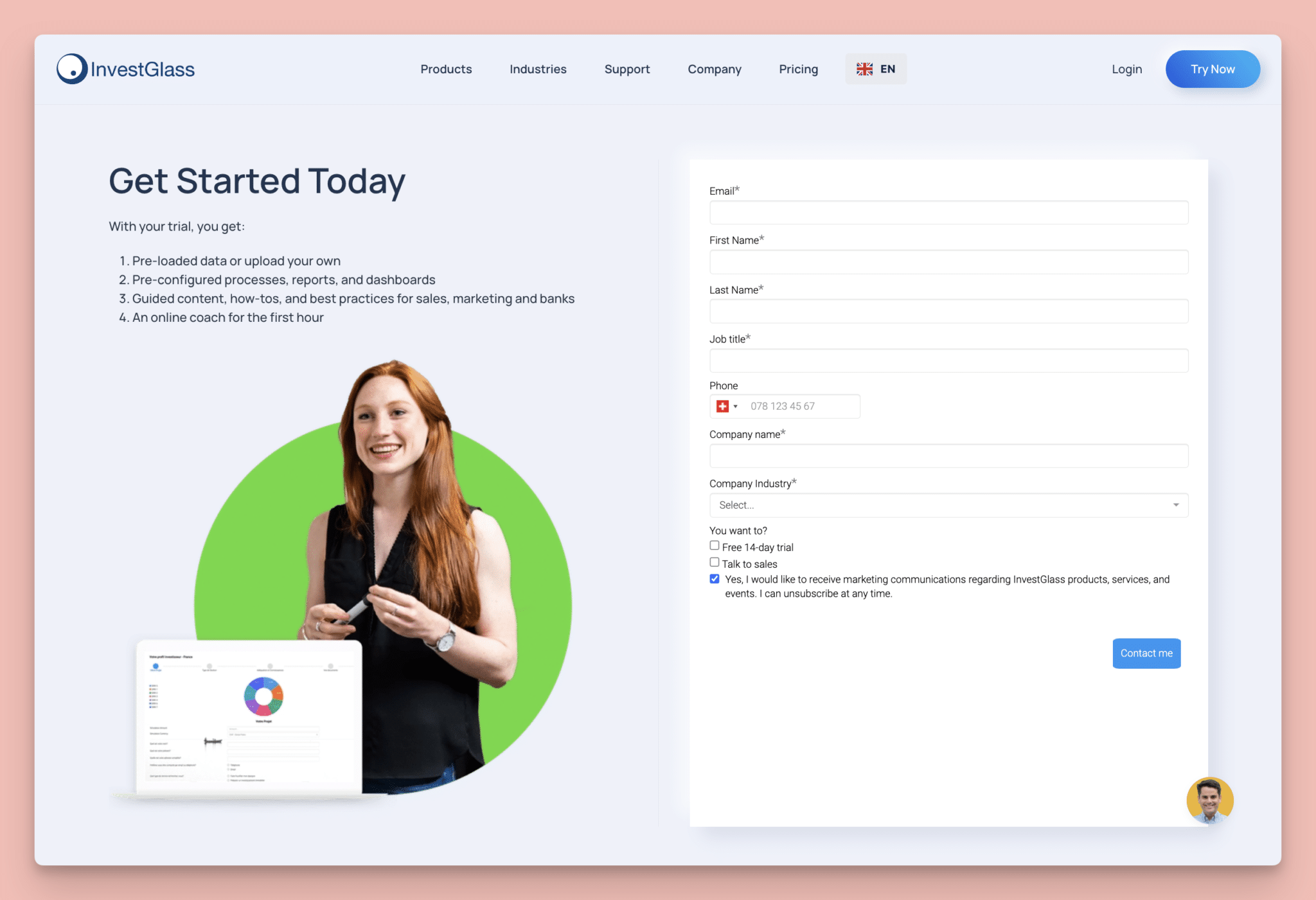

Private equity firms onboarding

InvestGlass digital forms will facilitate that collection, as well as name, check off your LPs and GPs. InvestGlass is connected to multiple anti-money-laundering tools to perform due diligence on companies working with you. You will leverage your network to back-channel your next big deal with confidence.

No programming is needed to create a digital onboarding form. Digital on boarding form will facilitate managers’ day-to-day operations as your contact will help you collect corporate information and store it directly into your InvestGlass CRM.

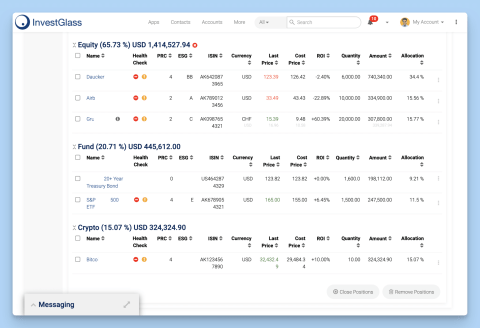

Strong PMS for PE

InvestGlass portfolio management tool will help private equity firm in their reporting: cash flow management, TVPI (Total Value to Paid In), internal rate of return (IRR), public companies reporting, cash flows, stock market benchmark, residual value, ESG significant impact, acquisition history, debt financing impact, portfolio strategy benchmark and more.

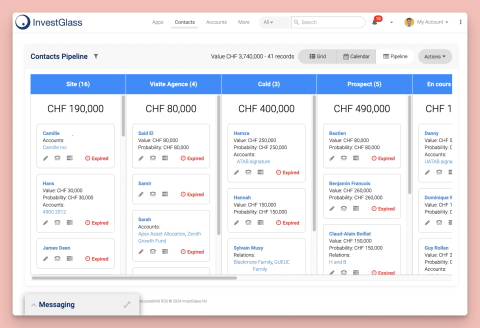

The Swiss-hosted CRM

All personal data are stored on Swiss servers in Geneva and Lausanne. All the data of portfolio companies are stored with a server and software that is not submitted under the Cloud ACT 2018. Vast majority CRM in PE industry are not US-based independent.

InvestGlass offers a full CRM which will prevent crossing wires. Deals ownership is always linked to a manager. This will improve the performance of your PE firm. InvestGlass helps you manage new private equity deal thanks to a clear deal pipeline with smart lists and pipeline board view.

You’re in control of your privacy thanks to Investglass CRM record permissioning.