How do you overcome regulatory compliance?

Regulatory compliance is a crucial aspect of the financial services industry. By managing risk, ensuring transparency, and maintaining accurate records, financial institutions can secure their reputation and foster a healthy business environment. InvestGlass CRM is an industry leader offering a comprehensive customer relationship management solution tailored for corporate and investment banking, private equity, and wealth management professionals. In this article, we’ll explore the features of InvestGlass CRM that make it an ideal choice for businesses in need of a financial services cloud platform with capital markets grade security.

InvestGlass CRM: Integrated Compliance Management

InvestGlass CRM provides a full customer engagement platform, incorporating industry-specific business logic to streamline various aspects of compliance, such as regulatory reporting, project management, and client relationships. Key features include:

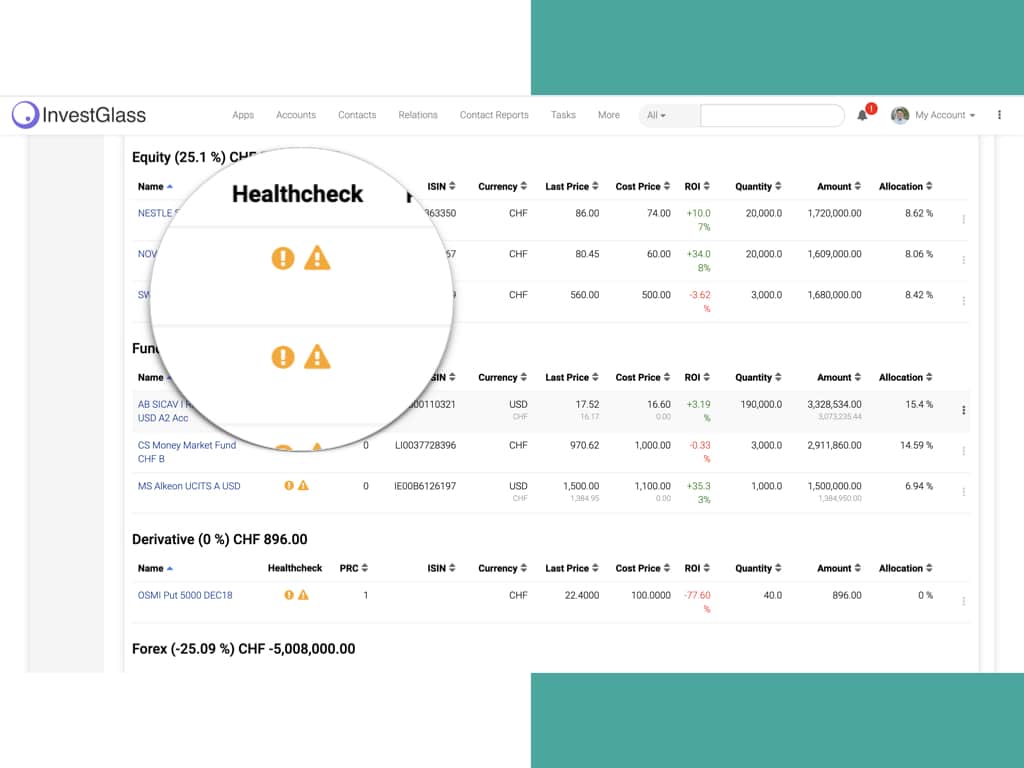

Portfolio Management and Customer Relationship Management

InvestGlass CRM offers a seamless integration between portfolio management and customer relationship management (CRM), allowing financial professionals to efficiently manage their clients’ portfolios and proactively target new opportunities.

Financial Services Cloud: Capital Markets, Private Equity, and Investment Banking

With a robust financial services cloud platform, InvestGlass CRM caters to businesses operating in capital markets, private equity, and investment banking. This tailored solution offers rapid custom application development to support the unique needs of financial institutions in these sectors.

Capital Markets Grade Security

InvestGlass CRM ensures the highest level of security for sensitive data, meeting the stringent requirements of capital markets grade security. This ensures that businesses can trust the platform with their most confidential information.

Deal Management for Private Equity Firms and Investment Management Professionals

InvestGlass CRM simplifies deal management for private equity firms and investment management professionals, enabling them to optimize their deal flow and maximize revenue growth. The platform provides tools for deal sourcing, proactive targeting strategy, and deal teams collaboration, empowering senior bankers to make informed decisions.

Regulatory Compliance and Integrated Content Management

InvestGlass CRM provides a comprehensive suite of tools to help businesses ensure regulatory compliance while reducing manual processes and eliminating manual data entry. The platform offers integrated content management, which simplifies the management of all compliance-related documentation.

Marketing Campaigns and Client Communication

InvestGlass CRM supports compliant marketing campaigns and client communication, empowering businesses to build brand loyalty and customer ROI while adhering to industry regulations.

Transforming Financial Institutions with InvestGlass CRM

InvestGlass CRM offers a comprehensive solution for financial institutions, including banking operations, credit unions, and mortgage professionals. The platform enables businesses to streamline their sales process, achieve digital transformation, and improve sales performance. By adopting InvestGlass CRM, financial institutions can focus on their core competencies, such as innovative product development, agile product innovation, and real-time data analysis.

Conclusion

InvestGlass CRM is a global leader in providing customer relationship management solutions tailored to the unique needs of financial institutions. By incorporating industry-specific business logic and offering capital markets grade security, InvestGlass CRM empowers businesses to efficiently manage their portfolios, ensure regulatory compliance, and build strong client relationships. The platform’s versatility and comprehensive feature set make it an ideal choice for businesses operating in corporate and investment banking, private equity, and wealth management sectors.