#1 Swiss CRM for Venture Capital

InvestGlass is a venture capital CRM platform that can help you maximise investment efficiency. This powerful tool lets you easily manage investment opportunities, stay up-to-date with changing regulations, and safeguard investor data privacy.

Simplify Your Workflow

From Start to End

Automated workflow

Venture capital CRM software enables automated workflows, email notifications, and data sharing among advisors, clients, and other systems. This valuable tool helps you stay organized, streamline communication, and optimize efficiency.

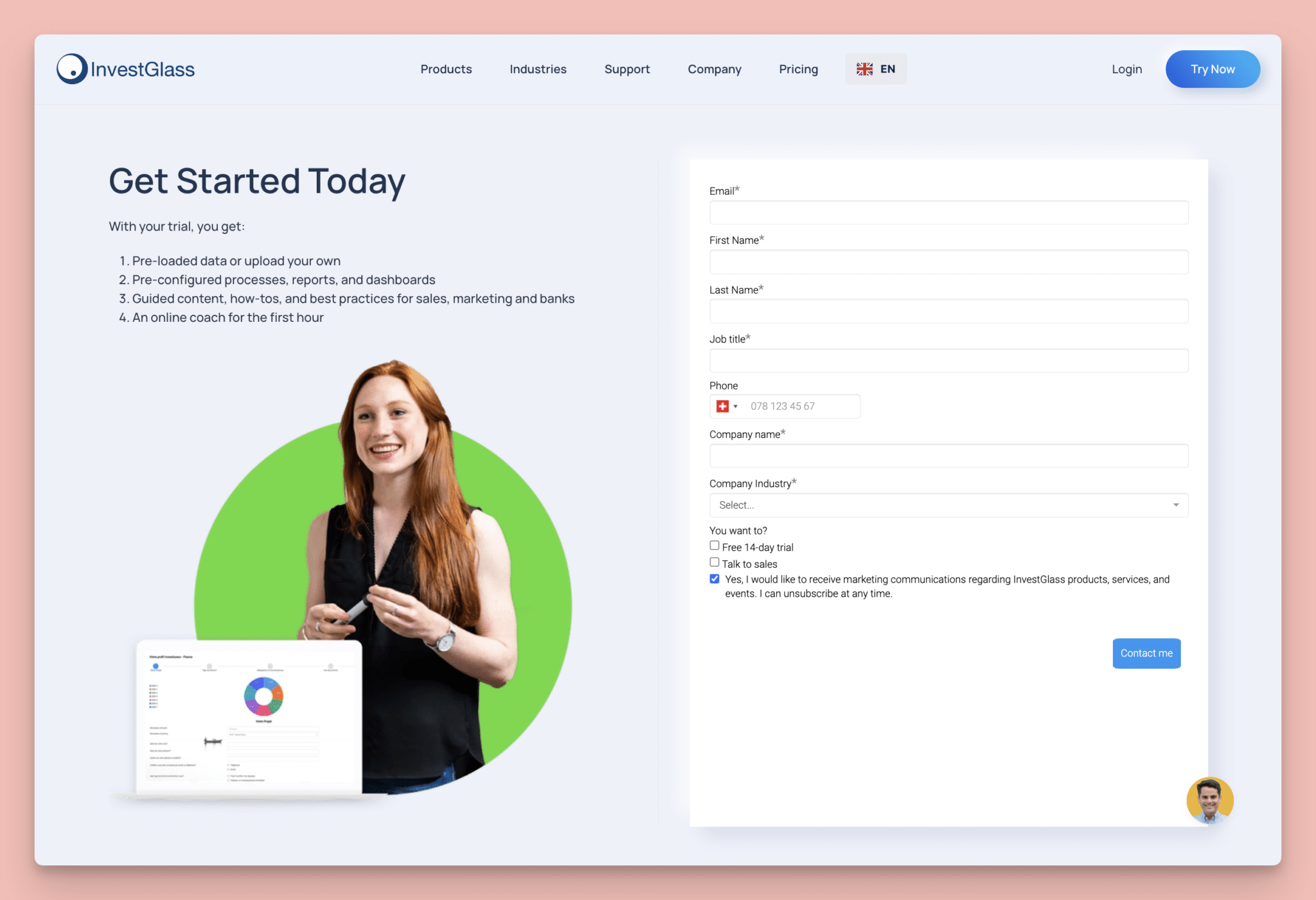

Digital onboarding

InvestGlass simplifies the investor onboarding process with its digital forms and signature feature. It allows you to collect information from prospects and clients quickly and easily without printing or mailing documents. With InvestGlass, you can save time and streamline your investment process.

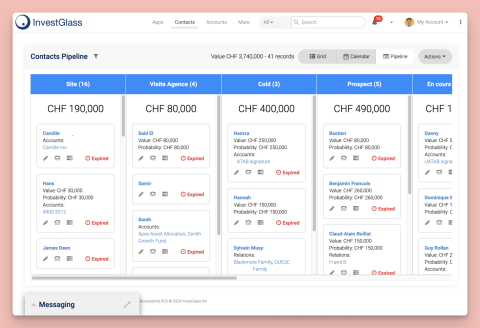

Sales pipeline and deals

InvestGlass venture capital software simplifies deal management with customisable smart lists and pipeline functionality. It tracks progress from beginning to end, identifies successful stages, and improves processes.

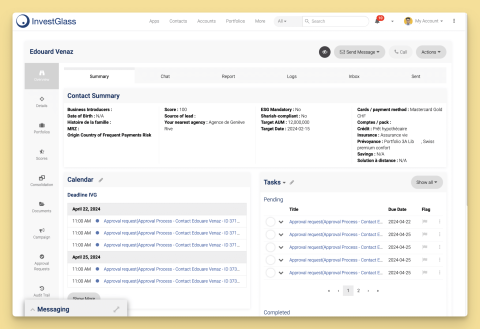

Flexible CRM

InvestGlass is a flexible venture capital CRM that’s easy to use, even without coding experience. Customise standard tabs, records, fields, and layouts to fit your business needs. Gain valuable insights with reports and dashboards to make informed investment decisions.

The Portfolio Management system for Venture Capitalist

Traditional CRM solutions fall short when managing portfolios, retaining client data, and measuring performance against peers. InvestGlass offers a complete portfolio management system (PMS) that can connect easily to your banks and brokers’ sources. With InvestGlass, venture capital professionals can efficiently manage their portfolios, analyse performance, and make informed investment decisions.