Is direct indexing better than ETF?: Implementing Personalized, Tax-Efficient Portfolios at Scale

When it comes to investing, there are a lot of options to choose from. One popular option is exchange-traded funds (ETFs). ETFs offer investors a way to gain exposure to a basket of assets, and they can be traded just like stocks. But is direct indexing better than ETFs? Here’s what you need to know and connect to InvestGlass tools built for portfolio managers and financial advisors.

- What is direct indexing?

- Seeking tax efficiency in a separately managed account

- How to deliver personalization for your investors

- What types of investors may be a fit for a direct indexing strategy

What is direct indexing versus mutual fund?

Direct indexing is an investment strategy that involves buying and holding individual stocks rather than buying into ETFs. This can be a more tax-efficient way to invest, as it allows investors to avoid paying capital gains taxes on the ETFs themselves. Additionally, direct indexing can provide investors with more personalization and control over their portfolios.

An ETF, or exchange-traded fund, is a type of investment fund that holds assets like stocks, commodities, or bonds and can be traded on stock exchanges. ETFs offer investors a way to gain exposure to a basket of assets, and they can be bought and sold just like stocks. ETF is usually preferred to traditional index funds because ETFs often have lower costs and tax advantages. This is different from fractional shares, which involve setting up multiple accounts and investing in fractions of shares.

An ETF can include a variety of assets, including stocks, commodities, and bonds. This can provide investors with exposure to a range of markets and can be a convenient way to invest. Additionally, ETFs can be traded on stock exchanges, making them easy to buy and sell. ETF can include sophisticated strategies which have an impact on tax loss harvesting. It is also possible to offset capital gains if they are correctly used. The taxable account can vary in each country so make sure that you’re asking for your financial advisor first. Of course, if you’re using a robot advisor then the tax professional job is usually included within the robo advisor solution.

As InvestGlass, we suggest our customers be a teacher and boarding with potential tax savings inside the portfolio management proposal.

Seeking tax efficiency in a separately managed account with direct indexing strategies

Tax efficiency is a critical consideration for investors. By using a direct indexing strategy, investors can avoid paying capital gains taxes on the ETFs themselves. This can be a more tax-efficient way to invest, as it allows investors to keep more of their profits. Additionally, direct indexing can provide investors with more personalization and control over their portfolios.

Portfolio managers are used to creating portfolio mandates which to Matic investing or active strategies will include tax efficiency securities. You’ll also be able to sell stocks that have declined and use the loss to offset gains as a way of lowering your tax bill, or avoiding taxes altogether.

How to deliver personalization for your investors

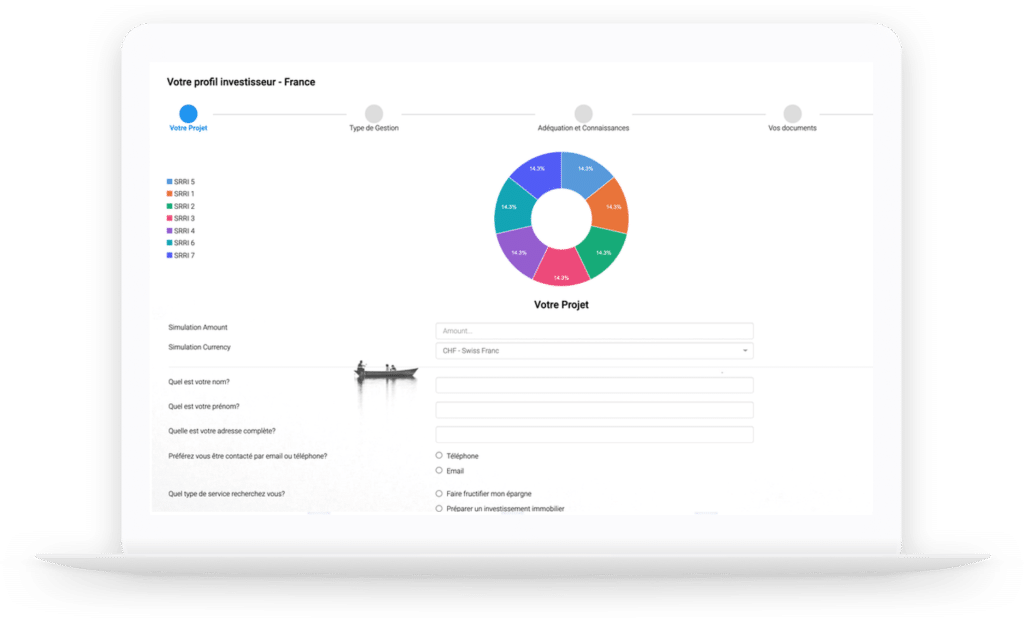

InvestGlass created a digital onboarding solution for fund managers and advisory firms looking to build robo advisory solutions. These templates are built with no coding knowledge and will facilitate the selection of most investment strategies.

These onboarding tools are suited for institutional investors or retail investors. Only the format will vary as you might not show retail investors information such as :

- tracking error

- full transparent underlying securities

- declining trading costs

- fund tax management

- index’s performance and benchmark inde

- detailed investment description

- factor exposure

- investment minimums

- certain risks and market conditions with backtesting

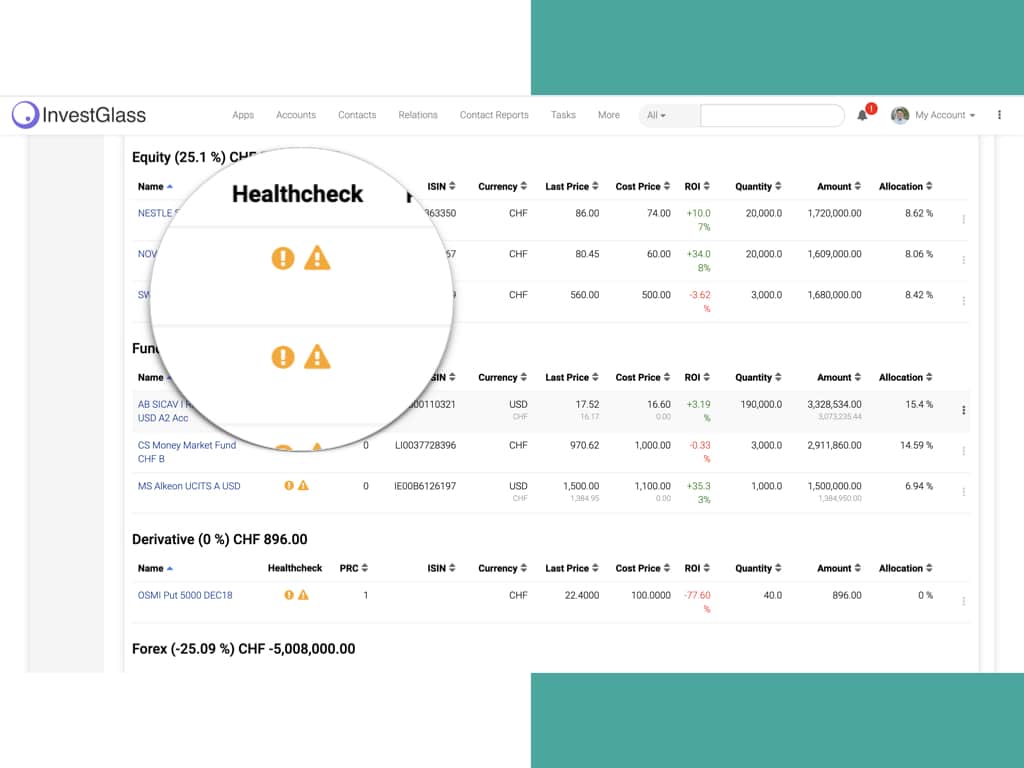

The robo advisor is connected to the InvestGlass portfolio management tool which enables efficient separately managed accounts management. The layout and background can be adapted based on the thematic investing you would offer.

What types of investors may be a fit for a direct indexing strategy and exchange-traded funds

Individual investors will appreciate the direct indexing strategy because it allows them to avoid paying capital gains taxes on the ETFs themselves. This can be a more tax-efficient way to invest, as it allows investors to keep more of their profits. Additionally, direct indexing can provide investors with more personalization and control over their portfolios.

Tax-sensitive investors, such as high-net-worth investors and pension plans, may also find direct indexing attractive. Direct indexing allows these investors to better manage their taxes by offsetting gains with losses. High-net-worth individuals can also benefit from the customization of portfolios that a direct indexing strategy provides. The same client type can be regarding transaction costs and after-tax returns. You shall then provide tax documents for each specific investment.

Direct indexing is a more tax-efficient way to invest, as it allows investors to keep more of their profits. Additionally, direct indexing can provide investors with more personalization and control over their portfolios. Tax-sensitive investors, such as high-net-worth individuals and pension plans, may also find direct indexing attractive. Direct indexing allows these investors to better manage their taxes by offsetting gains with losses. High-net-worth individuals can also benefit from the customization of portfolios that a direct indexing strategy provides.

Direct indexing coupled with InvestGlass Digital onboarding + Portfolio management is a fantastic way to respond to each investor’s personal values, investment objectives, and hyper-individualized advisory services.