How to Build the Perfect Customer Journey Mapping?

In today’s fiercely competitive banking landscape, customer experience has emerged as a key differentiator. Gone are the days when banks could solely compete on products, services, or rates. Instead, in the era of customer-centricity, understanding and optimizing the customer journey has become paramount. Every touchpoint, from opening an account online to visiting a local branch or using a mobile banking app, shapes a customer’s perception and overall satisfaction.

Why Customer-Centered Design Matters

By utilizing customer-centered or service design approaches, banks are able to give themselves a competitive edge. These evolving strategies ensure that services stay relevant and needed into the future. This means banks aren’t just reacting to changes in consumer behavior—they’re anticipating and shaping them.

The Role of Customer Journey Mapping

But how can banks ensure a seamless and delightful experience across this multifaceted journey? How can they understand the intricate web of interactions that customers have with their services? This is where customer journey mapping comes into play.

In the banking sector, a customer journey map is not merely a trend; it’s an essential tool. It’s a comprehensive visual representation that illustrates customers’ steps, experiences, and emotions while interacting with the bank, from the moment they consider opening an account to the ongoing management of their finances.

A Guide to Implementing Effective Strategies

This article is designed to serve as your complete guide to understanding and implementing customer journey mapping in the banking industry. We will delve into why this process is critical for banks in today’s customer-focused market and guide you through the steps to build a perfect, effective customer journey map. Through this map, you can identify pain points, areas for improvement, and opportunities to exceed customer expectations—ultimately cultivating loyalty and driving growth for your bank.

By aligning customer-centered design with strategic journey mapping, banks can not only meet but exceed customer expectations, ensuring long-term success and differentiation in a crowded marketplace.

Table of Contents

- What is a Customer Journey Map?

- Customer Journey Map Template

- Parts of a Journey Map

- Stages of the Customer Journey

- Advanced Customer Journey Mapping Tips

- Types of Journey Maps

- Customer Journey Mapping Example

1. What is a Customer Journey Map?

A customer journey map is a visual representation of the steps that a customer goes through when engaging with a company. This tool gives businesses a deeper understanding of a customer’s experience, from the initial contact to conversion, and beyond. The primary purpose is to get into the customer’s shoes, understand their needs, and meet or exceed their expectations throughout the entire customer journey.

2. Customer Journey Map Template

A customer journey map template serves as a starting point for businesses. Such templates generally outline various customer touchpoints, the customer’s perspective at each stage, their emotions, pain points, and customer needs. These templates are designed to accurately reflect the customer journey and can be customised based on customer data gathered by the customer service team.

InvestGlass team can help you build your template as we know customer pain points when implementing automation in the cells and compliance journeys. Customer pain points are specific to each industry and also specific to each product group you’re looking to sell. We often say that one customer can include multiple personas. It is important to let customers experience some slack as it is dangerous to accurately predict and “constrain” all journeys. Some customers like to be told what to do, other customers like to discover by themselves. Customer experiences can vary over time. Some customers can be busy others have time. Some customers can be annoyed by the sales process for the salesperson then customer interacting becomes perilous for the sales conversion.

3. Parts of a Journey Map

Creating an effective customer journey map requires several components:

- Customer Persona: A detailed profile of the average customer.

- Customer Actions: The steps the customer takes as they interact with the business.

- Touchpoints: Where the customer interacts with the company.

- Emotions and Pain Points: Identifying when customers feel frustrated or delighted.

- Opportunities: Areas for improving customer experience and satisfaction.

4. Stages of the Customer Journey

Typically, customer journeys are broken down into stages, such as:

- Awareness: The customer journey begins when customers become aware of a solution to their pain point.

- Consideration: Where customers evaluate different options.

- Purchase: The customer makes a decision and completes a purchase.

- Retention: Ensuring customer loyalty through positive customer experience.

- Advocacy: Satisfied customers refer others and promote the business.

5. Advanced Customer Journey Mapping Tips

To make your customer journey map more precise and useful:

- Use real customers’ feedback and surveys to inform the map.

- Iterate and update the map based on customer feedback.

- Align the map with business goals and objectives.

- Use customer journey mapping tools to facilitate the process.

6. Types of Journey Maps and buyer persona

There are several types of journey maps:

- Current State: Maps the existing customer journey based on current understanding.

- Future State: Envisions the desired customer journey, focusing on potential improvements.

- Service Blueprint: A more detailed map that includes interactions between customers, employees, and processes.

Creating an accurate customer journey map is a meticulous process that involves various essential steps. Start with customer personas and buyer personas, which represent the different target audiences that interact with your business. These personas, constructed through a research process involving customer surveys and data analysis, provide a vivid picture of who your customers are. Next, outline the customer’s journey, from the initial touchpoint where the customer interacts with your service or product, through the entire customer lifecycle. Utilize customer journey map templates or a service blueprint template as a starting point; these can guide your layout and help to ensure you’re considering all necessary elements. Examples of other customer journey maps, as well as specific customer journey mapping examples, can provide valuable insights and inspiration.

As you design your map, focus on customer interactions, emotions, and pain points at each stage of the buyer journey. Viewing the map from the customer perspective is key, enabling you to identify areas where the customer experience can be improved. Survey customers regularly to understand their emotions and gather real-time insights into their experiences. This information helps in creating a customer-focused journey map that accurately predicts and meets customer needs.

Collaboration with customer service teams, sales teams, and customer journey management professionals is crucial in this process. They can provide on-the-ground insights into customer emotions and challenges, further refining the map. Ultimately, your customer experience map should reflect the complete, nuanced journey of your customer, highlighting opportunities to delight them at every stage. This deep understanding allows your business to strategize effectively, ensuring that your services are not only meeting but exceeding the needs and expectations of your diverse customer base.

To achieve this, leverage service design approaches and tools like journey mapping and personas. These techniques enable you to gain an in-depth understanding of your customers, empowering you to adapt swiftly to changes in their experiences.

- Journey Mapping: This tool helps you visualize each interaction a customer has with your brand, identifying key moments where you can enhance their experience.

- Personas: By creating detailed profiles of your typical customers, you can tailor your services to address real needs and anticipate how novel circumstances might affect their behavior.

Incorporating these approaches allows your business to develop increasingly personalized interactions that maintain high levels of confidence and trust. As you adapt to the evolving landscape, focus on creating services that are not just reactive but proactively designed to delight and engage your customers at every touchpoint.

So what are the 5 types of buyer persona and how they will impact your customer journey design

- The Price-Sensitive Shopper

- Description: This persona is primarily concerned with price and is always hunting for the best deal. They are motivated by discounts, sales, and promotions, and often compare prices from various sources before making a purchase.

- Needs and Pain Points: Avoiding overspending, finding the lowest price, leveraging discounts, and avoiding buyer’s remorse.

- The Expert Researcher

- Description: This persona is characterized by their in-depth research before making a purchase. They read reviews, seek advice, compare options, and want to know the ins and outs of a product or service.

- Needs and Pain Points: Finding reliable and detailed information, avoiding bad purchases, and taking the time to make an informed decision.

- The Convenience Seeker

- Description: Convenience is the top priority for this persona. They value quick, easy, and hassle-free shopping experiences, whether that’s in-store or online.

- Needs and Pain Points: Saving time, avoiding complicated processes, and desiring fast shipping or immediate availability.

- The Brand Loyalist

- Description: This persona type sticks to brands that they know and love. They are less sensitive to price and are more interested in consistency and trust in a brand.

- Needs and Pain Points: Seeking quality, trustworthiness, and consistency in products/services; avoiding the risk of trying new brands.

- The Social Validator

- Description: This persona cares deeply about the opinions of others and is heavily influenced by what is trending on social media, or what friends and family are buying or using. They often read and rely on customer reviews and ratings.

- Needs and Pain Points: Social acceptance, keeping up with trends, avoiding the fear of missing out (FOMO), and seeking validation through purchases.

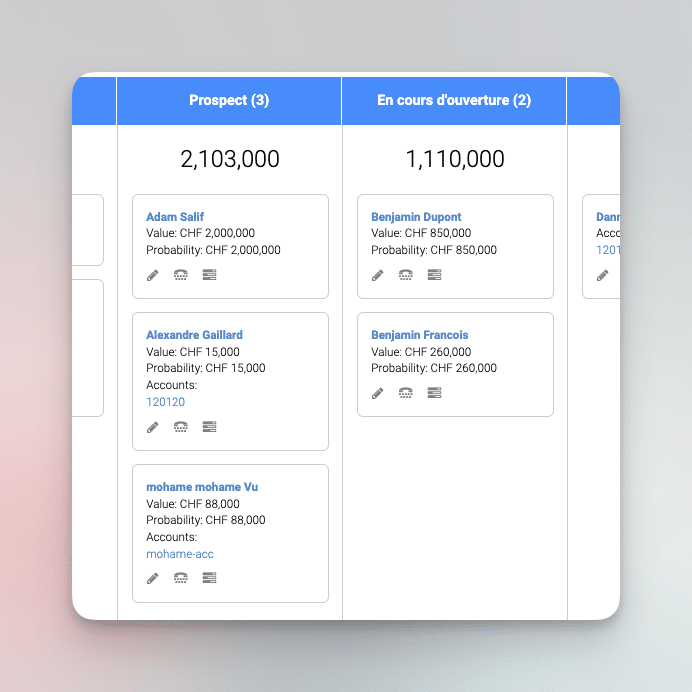

7. Customer Journey Mapping Example with InvestGlass Pipeline

For instance, consider a customer, Sarah, who needs a CRM solution. The map begins when Sarah identifies her need (pain point). It tracks her actions—from searching online (awareness), reading reviews and comparing options (consideration), engaging with a sales rep (purchase), using the product (retention), to finally writing a positive review due to excellent customer service (advocacy).

The customer journey mapping process is not a one-time task. It is a continuous process that needs constant revision based on customer feedback and changing business landscapes. It is essential to stay focused on the customer’s perspective and emotions to craft a strategy that enhances customer satisfaction and loyalty.

Remember, great customer journey maps are not created overnight. They are the result of careful research, iterative design, and a steadfast focus on the customer’s experience and needs.

Innovative Banking Services Transforming Customer Experience

In today’s landscape, traditional banks face the challenge of meeting evolving customer expectations driven by digital disruptors. To stay competitive, they must offer innovative solutions that attract new users while retaining existing ones.

1. Customized Banking Platforms

The integration of digital financial technologies is revolutionizing banking services. Software solutions are enabling banks to offer tailored, flexible platforms that simplify how customers access their funds. These solutions not only streamline the banking experience but also cater to individual user needs, enhancing satisfaction and loyalty.

2. Seamless International Transfers

The demand for international financial transactions is growing as the world becomes more interconnected. Innovative banking services now offer seamless foreign currency transfers. Through user-friendly apps, customers can transfer money across borders just as effortlessly as they would domestically, often at reduced costs. This enhancement is crucial for individuals and businesses engaging in global operations.

3. Peer-to-Peer (P2P) Lending

The complexity and costs associated with traditional loan processes have paved the way for peer-to-peer lending platforms. These services connect borrowers with lenders directly, cutting out the middleman and offering more competitive loan terms. With simplified procedures and often lower interest rates, P2P lending addresses customer frustrations with conventional bank loans, providing a more accessible option for obtaining credit.

By focusing on personalized service delivery and addressing specific customer pain points, these banking innovations are reshaping how individuals interact with their finances. As expectations for more connected and efficient financial solutions grow, these advancements set the standard for the future of banking.

How to implement your customer journey maps with InvestGlass

InvestGlass CRM and CLM solutions are designed to empower businesses to create a customer journey that not only meets but exceeds customer expectations. By utilizing these tools in conjunction with customer journey maps, companies can ensure that their service teams are well-equipped to provide a seamless and satisfying experience at every customer touchpoint.

In doing so, businesses are better positioned to achieve their goals, drive customer loyalty, and foster a culture that is genuinely customer-centric.