How Fee-Only Firms Maximize Value?

In today’s complex financial landscape, choosing the right financial advisor is crucial. Fee-only advisors are compensated solely by their clients, typically through a percentage of assets under management, hourly fees, or flat fees, ensuring unbiased advice. In contrast, fee-based advisors earn income from client fees and third-party commissions on products they sell, which can lead to potential conflicts of interest. Understanding these distinctions is vital for informed financial decision-making.

They have become increasingly appealing to individuals who are seeking transparency, integrity, and advice that is free from conflicts of interest. In this blog, we will delve into the world of fee-only advisory firms and explore how they maximize value for their clients.

We’ll also introduce you to the InvestGlass invoice system, a cutting-edge tool designed specifically for client-centric, fee-only advisors. From clear fee structures to dedicated investment strategies and comprehensive financial planning, we will unpack the unique advantages that a fee-only advisor can offer and why they may be the perfect fit for your financial journey. Keep reading to learn more about how working with a fee-only advisor could be the game-changer in your path to financial security and success.

Fee Only Financial Advisors

Fee only financial advisors are bound by a fiduciary standard, which means they are legally bound to act in their clients’ best interests. They provide comprehensive financial planning services, including investment management, tax planning, retirement planning, and estate planning. According to the National Association of Personal Financial Advisors (NAPFA), its members, who are fee only financial advisors, must adhere to strict professional and ethical standards that prioritize the client’s best interest, above all else.

The fee only financial advisor operates under a compensation model distinct from the fee based financial advisor pay out. While fee based advisors might receive fees for advice and also earn commissions from product sales, a fee only advisor’s compensation is not tied to the sale of financial products, reducing potential conflicts of interest. This advisor works to create a comprehensive financial plan tailored to each client’s individual circumstances and goals. Whether the advisor is paid hourly, charges a flat fee, or uses an annual fee based on assets under management, clients can be assured of transparent, unbiased advice.

Comprehensive Advice and Plan Implementation

A fee only financial advisor provides comprehensive advice that encompasses all aspects of a client’s financial life and the advisor is responsible for plan implementation. This could include strategies for managing assets, constructing a balanced investment portfolio, and proactively adjusting the plan as life circumstances change.

Fee Only Financial Planner

A fee only financial planner, like a fee only financial advisor, is paid directly with money made by clients and does not accept commissions or other compensation based on the sale of financial products. The Garrett Planning Network, for example, is a national association of fee only financial planners committed to serving the best interest of clients through comprehensive, client-centered advice. Fee only financial planners often focus on more than just investment advice; they offer holistic services, such as tax and estate planning, which are crucial components of a solid financial plan.

Managing Assets and Investment Management

Fee only advisors are deeply involved in tax planning, managing assets and investment management, always seeking the best possible return for clients while being mindful of risks and costs. Because they are paid directly by clients and do not earn commissions on investment products, their advice is aligned with the clients’ interests, not with generating income through product sales.

Fiduciary Standard and Clients’ Interests

Fee only advisors operate under a fiduciary standard, meaning they as advisors are legally bound to act in the clients’ best interests. They prioritize clients’ interests, and unlike fee based advisors, they do not face the same level of conflicts when offering advice. This responsibility is central to their service, solidifying the trust between advisor and client.

The Fee Structure and Transparency

One of the defining features of fee only advisors is their transparent fee structure. Whether advisor recommends that they are paid an hourly rate, a flat fee for services, or a percentage of the client’s assets they manage, fees are clearly defined and agreed upon upfront. This contrasts with the often complex and opaque compensation structures found in fee based and commission models.

Regulation and Accountability

External asset managers, gérants indépendants, Registered investment advisors (RIAs) and brokerage firms operating on a fee only model are regulated by the Securities and Exchange Commission (SEC), AMF, FINMA, FCA… They are required to provide a high level of transparency and are held to the highest standard of client care, the fiduciary standard. The regulators will usually ask you in the business model how you will charge your customers. They will also ask you how you deal with inducements as well as referral fees.

InvestGlass Invoice System: A Client-Centric Solution for Advisors

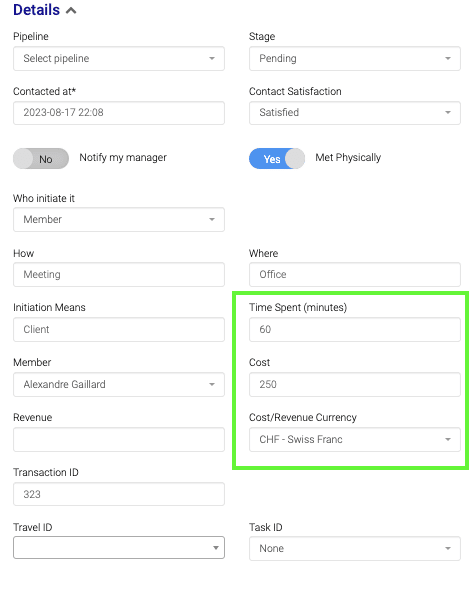

InvestGlass, known for its robust and intuitive platform, has crafted an invoice system that is ideally suited for fee only advisors who prioritize a client-centric approach. The system is designed to streamline billing, making the process transparent and efficient for both advisors and clients. As a fee only advisor, you can easily configure the system to align with your unique fee structure, whether that entails hourly rates, flat fees, or a percentage of assets under management. Unlike the experience with a fee based advisor, clients of fee only advisors using InvestGlass never have to worry about hidden charges or surprise commissions. The platform’s automated features also save time for fee only planners, allowing them to focus on providing value to their clients rather than on administrative tasks. With InvestGlass, fee only advisors can effortlessly maintain the high level of transparency and trust that is fundamental to their client-centric approach. In a profession where every fee counts and clarity is paramount, InvestGlass stands as a valuable partner for fee only advisors committed to prioritizing their clients’ best interests.

Conclusion

In a world where financial products and the fees associated with them can be complex and confusing, fee only advisors offer a transparent and client-focused alternative. By removing the conflicts of interest associated with commission and fee based models, and by adhering strictly to a fiduciary standard, fee only firms are positioned to offer advice and services that are in the best interest of their clients, maximizing the value they deliver at every step of the financial planning money management process.