Decoding Gender Differences in Investing: Bridging the Gap for Financial Equality

Written by InvestGlass on .

What drives the gender differences in investing, and how do these distinctions shape financial success? In a landscape where investment decisions can significantly influence long-term financial stability, this article unpacks the behaviors and results propelling men and women in unique directions. Explore the key findings and consider how these insights might impact your investment approach.

Key Takeaways

- Women investors, historically informed by lower pay and societal norms, are often more risk-averse and prefer diversified and stable investment strategies, which has led to generally better investment outcomes compared to men.

- The persistent gender pay gap significantly reduces women’s investment opportunities and contributes to a notable retirement savings gap, with women saving approximately 30% less for retirement than men.

- The rise of women in the stock market, with a notable increase in younger females investing, could see an additional $3.22 trillion in assets under management, influencing the shift towards sustainable investing.

Utilizing InvestGlass Digital Forms to Build a Robo Advisor for Diverse Investor Segments

InvestGlass provides a versatile digital form builder that can be leveraged to create a customized robo advisor, catering to various investor segments. By utilizing these forms, financial institutions can gather essential data about their clients’ investment preferences, risk tolerance, and financial goals. This information is crucial for the robo advisor to tailor investment strategies and recommendations.

To begin, firms can design a series of questions within the InvestGlass form to assess the investor’s financial situation and investment experience. These questions can range from basic demographic information to more complex inquiries about investment history and future financial aspirations. The forms can be customized to include conditional logic, which guides the investor through a personalized set of questions based on their previous answers, ensuring relevance and efficiency.

For novice investors, the form can focus on establishing a foundational understanding of their goals and risk comfort, while for more experienced investors, it can delve into specific asset classes and investment strategies they are interested in exploring. This allows the robo advisor to segment clients effectively and provide advice that aligns with each individual’s financial profile.

Once the data is collected, InvestGlass’s powerful analytics can process the responses to create a unique investor profile. This profile informs the robo advisor’s algorithms, which then generate personalized portfolio suggestions. These suggestions are made up of diversified investments, such as stocks, bonds, mutual funds, and ETFs, that align with the client’s risk profile and investment objectives.

Additionally, the platform can be set up to provide ongoing portfolio management, automatically rebalancing investments as market conditions change and as clients update their information through the digital forms. This dynamic approach ensures that each investor segment receives continuous, tailored financial guidance.

By harnessing the capabilities of InvestGlass digital forms, financial service providers can offer a scalable, efficient, and personalized robo advisory experience to a diverse range of investors, enhancing client engagement and satisfaction.

Exploring Gender Disparities in Investment Practices

Women have historically faced significant barriers to investing, a concern that undermines their ability to secure a prosperous future. Lower pay and societal misconceptions have contributed to a gender investing gap, putting women at a disadvantage in building long-term wealth. However, the perception of investing is changing. More women now believe that one can start investing with smaller amounts, fostering an inclusive view towards investing at any financial level.

Female investors tend to prioritize value for money with a focus on low fees. Unlike male investors, women are less likely to expect their portfolio to outperform the market. This suggests a more measured and realistic investment outlook, which could contribute to them being better investors than men in the long run, as more women invest with this approach.

Risk Appetite Amongst Genders

Men and women exhibit different risk appetites in investing. Men have a higher risk tolerance and are more likely to make riskier investment decisions compared to women. This is corroborated by a survey conducted by BNY Mellon, which revealed that nearly half of the women surveyed perceive investing in the stock market as too risky.

Women tend to be more risk-averse, often perceived as conservative investors due to societal roles such as being caretakers. This cautious approach to investing is reflected in their investment choices. Women hold less risky investments and were 50% less likely to experience a loss of 30% or more during a specific study period. Moreover, this conservative or moderate investment choice potentially contributes to their better investment returns.

InvestGlass CRM is a powerful tool designed to monitor and analyze an investor’s appetite for different investment opportunities. By tracking interactions, preferences, and historical financial data, the CRM can provide insights into an investor’s behavior and risk tolerance. This enables financial advisors to tailor their recommendations and strategies to align with the investor’s unique profile. With its advanced analytics and customizable features, InvestGlass CRM helps in identifying shifts in investment appetite, ensuring that recommendations remain relevant and timely, thus fostering a more proactive and personalized investment management approach.

Investment Strategy Variances

Women’s portfolios are generally more diversified than men’s, as a higher proportion of women spread their investments across funds. Such diversification provides women peace of mind and a sense of empowerment when managing their finances.

In contrast, overconfidence leads men to trade 45% more than women. Such aggressive trading habits can lead to underperformance. Women, on the contrary, trade less frequently, steering clear of ‘lottery style’ investing and speculative stocks. This approach contributes significantly to their investment performance.

Financial Planning Perspectives

Women display a more collaborative approach to investment decisions. They are more likely to acknowledge lower levels of financial knowledge and seek assistance. Their focus on financial planning and the larger financial picture could lead to more effective investment results over time.

Women’s financial planning is affected by unique factors such as longer lifespans and possible caregiving duties. These necessitate different asset management strategies, underscoring the need for a holistic and long-term approach to investment. Financial advisors can play a crucial role in addressing these challenges.

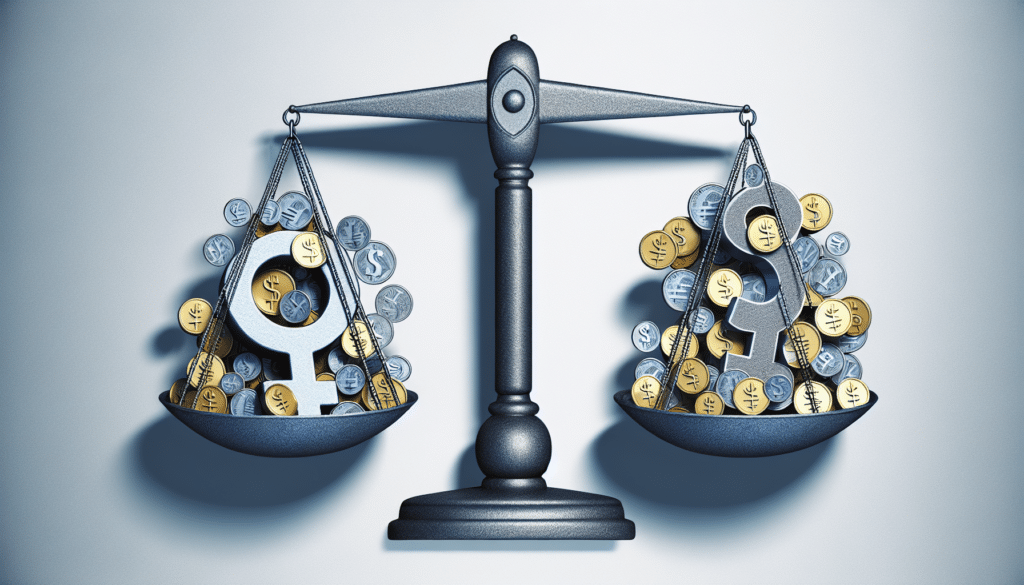

The Impact of the Gender Pay Gap on Investment Opportunities

Women’s investment opportunities are significantly affected by the gender pay gap. It limits the amount of money available for investment, thereby affecting earnings growth over time. Women are less likely to invest in employer-sponsored plans or brokerage accounts compared to men, which is compounded by their overall lower earnings capacity. This is why the gender investing gap matter is crucial to address.

The gender pay gap also contributes to a significant retirement savings gap. Women save about 30% less for retirement than men, partially due to earning 82 cents for every dollar paid to men. This retirement gender gap is further exacerbated by the ‘motherhood penalty’. Women often take time off work for child care, thereby losing income and retirement-related benefits.

Earnings and Investment Capacity

The gender pay gap results in a corresponding gender investing gap, also known as the gender investment gap. Women earn less money on average, which in turn impairs their investment rates. On average, women save a lower percentage of their salaries for retirement and report needing a significantly higher amount of disposable income before investing. This contributes to a sizeable disparity in retirement account balances between genders.

Furthermore, women prioritize financial goals like emergency funds, debt repayment, and child support over investing. They are less likely to invest in plans such as employer-sponsored or brokerage accounts. Access to employer-sponsored retirement plans is generally lower for women, especially for part-time workers, further constricting their investment opportunities.

Retirement Planning Discrepancies

With an estimated median retirement savings of EURO 43,000, women have less than half of the men’s median savings, which stands at EURO 91,000. A significant proportion of women feel financially uncomfortable about retiring on their target date. Nearly half of women aged 55 to 66 have no personal retirement savings.

The lack of paid maternity leave leads to reduced retirement savings. Only 32% of women have access to this benefit, and nearly half use their savings to finance parental leave. Therefore, it is crucial for married couples to consider building retirement savings for non-working spouses, especially when one partner steps back for child care.

Female Investors: Challenging Stereotypes and Outperforming Expectations

Defying common stereotypes, women investors often outperform their male counterparts, not just match them. Various studies, including a University of California, Berkeley study from the 1990s and a 2021 Fidelity analysis, revealed that women’s investments yield higher returns. A study by Warwick Business School also found that over three years, women’s investments outperformed the FTSE 100 by 1.94%, while men only outperformed it by 0.14%.

Women’s historical tendency to achieve stronger investment outcomes stems from their cautious approach, lesser trading, and focus on long-term investments. Indeed, single women outperformed single men by an average of 1.44% per annum in investment returns, according to the ‘Boys Will Be Boys’ study.

Survey Findings on Investment Performance

Beyond the mentioned studies, additional surveys have underscored the superior performance of women in investments. For instance, women’s investments outperformed the FTSE 100 by 1.94%, which is 1.80% higher than men’s performance over the same three-year period.

Additionally, 60% of women in the stock market demonstrate a steadfast approach by maintaining their investments during market downturns, compared to 43% of men.

Overcoming Excessive Trading Habits

It’s worth noting that one of the factors contributing to women’s superior investment performance is their tendency to trade less frequently. Men often exhibit overconfidence in investing, which leads to an increase in trading activity. This increased trading activity in men decreases their net returns by 2.65 percentage points per year, a more substantial reduction compared to women.

On the contrary, women, with a tendency to remain calm and wait out market fluctuations, trade 45% less frequently, leading to a smaller reduction in their yearly returns due to trading, by only 1.72%.

The Rise of Women Investors in the Stock Market

The investing landscape is witnessing a significant shift as more women are entering the stock market than ever before. Fidelity Investments reported a 48% increase in new women customers in 2023 compared to 2019. Moreover, there was a 21% year-over-year increase in women opening Roth IRA accounts in 2023 with Fidelity. If women invested at the same rate as men, it could potentially lead to an additional $3.22 trillion of assets under management from private individuals. This change could have significant implications for the financial industry..

Women are predicted to control more wealth in the U.S. in the next three to five years, funneling a substantial portion towards ESG and sustainable investments. This will significantly influence the future of sustainable investing.

Young Women and Investing Trends

Young women, notably millennials and Gen Z, are starting to invest at a conspicuously higher rate. In fact, UK women start investing at an average age of 32, younger than men by three years, with women in the 18-to-35 age group opening brokerage accounts at age 21 on average.

Investment popularity is high among younger women, with 71% of Generation Z and 63% of millennials actively investing in the stock market as of 2023. Young women investors are leveraging networking to gain market insights and are increasingly preferring to invest in companies aligned with their community and environmental values.

The Role of Women in Asset Management

The growing presence of women in the stock market correlates with their expanding role in asset management. The assets under management from private individuals could increase by an additional $3.22 trillion if women invested at the same rate as men. Women’s adoption of investment products is on the rise, exemplified by a 204% growth in Health Savings Account opens by women since 2019.

However, only about one in seven investment professionals are female, indicating a significant underrepresentation of women in finance. Yet, women exhibit less engagement in high-risk ‘lottery style’ investing and maintain composure during market volatility, adding value to asset management through potentially better long-term returns.

Strategies to Empower More Women Investors

Several key strategies, such as enhancing financial literacy, offering access to resources, and building investment confidence, are involved in empowering more women investors. Women’s economic participation enhances development, reduces inequalities, and positively influences the well-being of families and communities.

To maximize their economic impact, women need full access to a range of financial services, including credit and banking, that are essential to developing their assets.

Financial Literacy and Education

Improving financial literacy is key to empowering women to become more effective investors and bridging the investment gap. Greater financial literacy is linked to higher financial independence for women, enabling them to make critical financial choices independently, especially in unpredictable situations. In fact, improving financial literacy among women also benefits the next generation, as children learn from the example set by their financially aware mothers.

It’s important, however, to address the barriers that discourage women from investing. Many women feel they need a higher disposable income to start investing and often seek investment knowledge from personal connections, including partners.

Access to Investment Resources

Another factor critical to empowering women investors is access to investment resources. However, only about one in seven investment professionals are female, indicating a significant underrepresentation of women in finance.

Entrepreneurial training can lead to significant business improvements for women, including higher sales and profits. Enhancing connectivity among women through business networks can provide them with access to mentors, vital information, and potential investors.

Traditional lending institutions could offer more accessible credit to women by adapting loan requirements, such as accepting business performance and savings history instead of property as collateral.

Building Investment Confidence

Building women’s confidence in making investment decisions is vital to foster their independence and improve their financial well-being. Initiatives such as Ellevest provide tailored financial advice and resources, fostering a supportive community that can boost women’s investment confidence.

Educational resources on investment products and investment portfolios, including own investments like:

- Stocks

- Bonds

- Mutual funds

- Real estate investment trusts (REITs)

Equip women with the knowledge to make informed decisions and diversify their portfolios. Setting specific and achievable financial goals is crucial for women to take control of their investment journey, thereby increasing their focus and overall confidence.

Addressing the Needs of Diverse Women Investors

Catering to the needs of diverse women investors requires addressing racial disparities and socioeconomic influences impacting their investment choices. Unfortunately, significant disparities exist within the investing world.

Here are some statistics:

- 59% of Black women have not engaged in investing

- 48% of Latinas have not engaged in investing

- 34% of white women have not engaged in investing

- 23% of white men have not engaged in investing

These numbers highlight the need for targeted efforts to educate and empower women from all backgrounds to participate in investing.

Racial Disparities in Investing

The racial wealth gap remains substantial, with Black households holding just 15 percent of the wealth of white households. Some key points to note about the racial wealth gap are:

- Black households have significantly less wealth compared to white households.

- Even Black individuals with college degrees have less wealth than white individuals without degrees.

- Education level does not close the racial wealth gap.

Black women’s investment opportunities are significantly hampered by systemic racism and sexism linked to the historical devaluation of their labor. Further, the statistics show that:

- 59% of Black women do not have any cash in investments

- They face a disproportionate debt burden, usually carrying more student loan debt than their peers

- They typically have EURO 0 in home equity.

These factors contribute to the financial challenges that Black women face in building wealth and achieving financial security.

Socioeconomic Influences on Investment Choices

Socioeconomic factors also play a crucial role in women’s investment choices. Over one quarter of women surveyed by BNY Mellon described their financial health as poor or very poor, presenting a barrier to entering the financial markets due to the perceived need for high disposable income.

Women entrepreneurs report significant barriers to accessing capital, with almost 60% stating they do not have the same access to capital as their male counterparts. This significantly impacts their investment capabilities.

The Socially Responsible Investment Movement Among Women

Leading the socially responsible investment (SRI) movement, women prioritize sustainability and environmental impact in their investment decisions. ESG funds have seen a substantial increase, receiving EURO 51.1 billion of net new money from investors in 2020, largely contributed by women investors.

Women Leading the SRI Charge

Women are leading the charge in sustainable investing, demonstrating a preference for investments aligned with their personal values. Over fifty percent of women have expressed interest in impact investing, preferring investments that yield positive social or environmental outcomes.

The Influence of SRI on Financial Markets

As the influence of women in sustainable investing grows, it is reshaping the future of financial markets and fostering a more equitable, inclusive economy. Women investors have been instrumental in the substantial growth of sustainable investments.

Organizations that prioritize equity and inclusiveness are better equipped to empower women leaders who can navigate global markets towards a sustainable future.

InvestGlass and ESG Monitoring

InvestGlass introduces a comprehensive ESG (Environmental, Social, and Governance) tool designed to monitor and align with investors’ preferences for sustainable and responsible investments. This tool is integrated within the InvestGlass platform, providing a seamless experience for financial advisors and investors alike.

The ESG tool allows for the detailed tracking of an investor’s interest in sustainability topics, such as environmental impact, social responsibility, and ethical governance practices. By incorporating ESG criteria into the digital form builder, financial institutions can gather specific data about their clients’ values and investment goals related to ESG factors.

Once the data is collected, InvestGlass’s analytics can process the responses to create a unique ESG investor profile. This profile is then used to inform investment strategies, ensuring that portfolio recommendations are not only financially sound but also align with the client’s personal values and the global shift towards sustainable investing.

Furthermore, the ESG tool includes ongoing monitoring capabilities, allowing advisors to adjust investment strategies as new ESG data becomes available or as clients’ preferences evolve. This proactive approach ensures that investors can maintain a portfolio that reflects their commitment to ESG principles over time.

By leveraging InvestGlass’s ESG tool, financial service providers can cater to the growing demand for investments that consider the broader impact on society and the environment, offering a more ethical and personalized investment experience.

Summary

In conclusion, women are not just breaking barriers in the world of investing; they are reshaping it. From challenging outdated stereotypes to leading the socially responsible investment movement, women are proving to be savvy, successful investors. As we strive for a more equitable and inclusive economy, it is crucial that we continue to empower women investors, address the needs of diverse women investors, and celebrate their successes.

Frequently Asked Questions

What percentage of investors are by gender?

Approximately 48% of women and 66% of men have investments in the stock market, according to a survey by NerdWallet. This difference may be attributed to women not prioritizing investing financially.

How does gender really affect investment behavior?

Gender can significantly impact investment behavior as men tend to have higher financial literacy and risk tolerance compared to women, leading to superior investment behavior. This shows the importance of financial education for both genders.

What is the gender impact investment?

Gender impact investment, also known as Gender Lens Investing (GLI), considers gender-based factors in the investment process to promote gender equality and improve investment decisions.

Why invest in gender equality?

Investing in gender equality is crucial for promoting personal and economic growth, fulfillment, and empowerment among women. It also accelerates development, reduces inequalities, and improves overall well-being, making it both an economic imperative and a human rights issue.

Why is there a gender investing gap?

The gender investing gap exists due to lower pay, societal misconceptions, and differing investment outlooks among genders. These factors contribute to the imbalance in investing.