Introducing AI-Powered CRM and Portfolio Management

InvestGlass Unveils a Groundbreaking Solution for Sales

nvestGlass’s latest innovation leverages AI-driven technology to empower sales teams and financial professionals. By integrating automation and data analytics, this solution optimizes sales workflows, enhances customer engagement, and improves decision-making processes. Notably, 74% of businesses implementing generative AI have recovered their investment within the first year, with 86% reporting revenue growth post-AI adoption (MarketTimes).

Furthermore, companies using CRM systems have seen a 17% increase in lead conversion rates, a 16% boost in customer retention, and a 21% improvement in agent productivity (MarTech). With seamless CRM integration and real-time data accessibility, InvestGlass enables businesses to harness predictive analytics for unparalleled growth and efficiency.

Open Immersive Reader

Exciting news for InvestGlass enthusiasts and sales professionals worldwide! InvestGlass has just launched an innovative solution that’s set to revolutionize the way businesses interact with data. Known for its robust client relationship management software and portfolio management system, InvestGlass is now taking a giant leap forward.

Watch how we built it or try it today!

Transforming Financial Data into Conversational Knowledge

Revolutionizing Financial Services with InvestGlass’s AI: A Paradigm Shift Towards Enhanced Customer and Operational Excellence

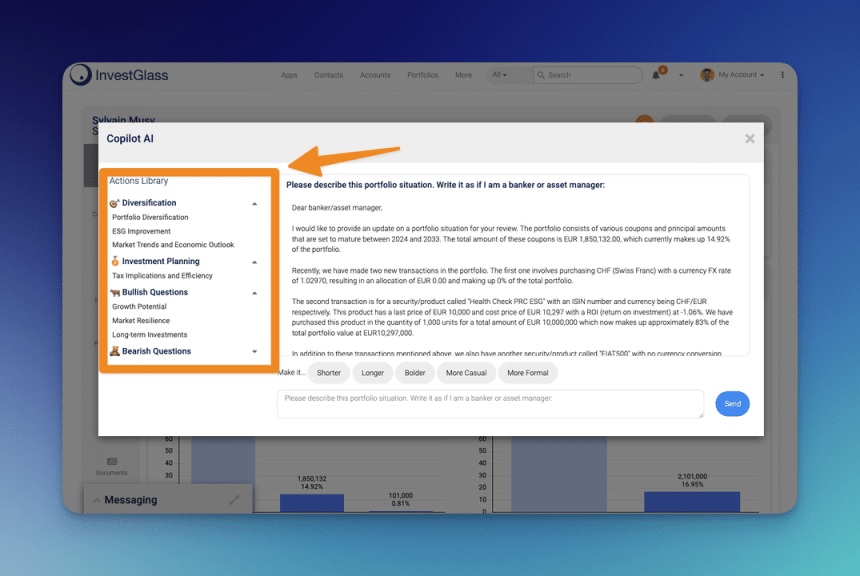

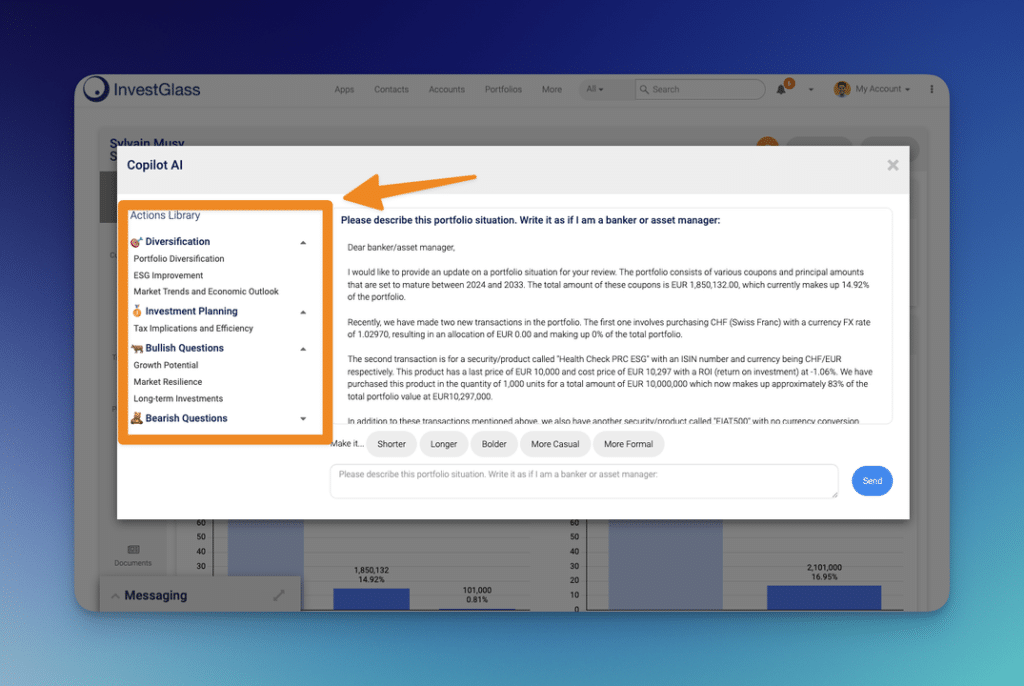

InvestGlass is pioneering the future of the financial industry with its groundbreaking AI solutions, Copilot and Mistral, engineered to convert unstructured financial data into invaluable, conversational knowledge and actionable insights.

These tools are at the forefront of integrating advanced artificial intelligence, including ChatGPT, specifically tailored for bankers and financial institutions, thereby redefining customer engagement in the banking sector. They are instrumental in delivering personalized financial advice, automating routine tasks, and facilitating informed decisions for banking operations, from account management to loan processing.

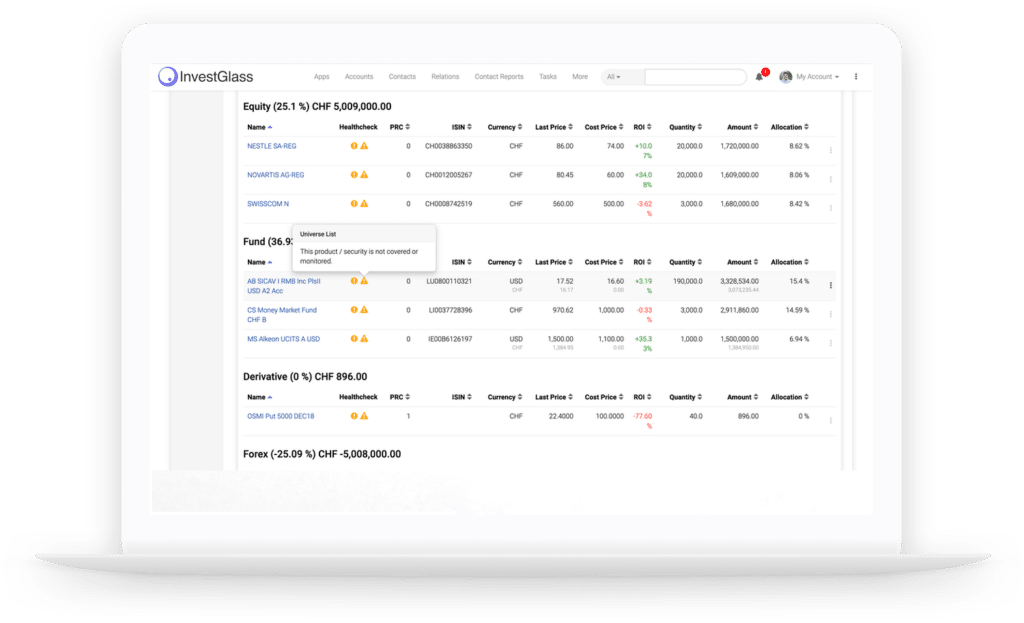

In the realm of risk management, Copilot and Mistral offer unparalleled capabilities in identifying and mitigating potential risks through sophisticated data analysis. These solutions assist banks in fraud detection by meticulously analyzing transaction data to pinpoint suspicious transactions, safeguarding account balances and financial statements against unauthorized activities.

Furthermore, they empower financial institutions with tools for comprehensive financial analysis, enabling a proactive approach in risk assessment, market analysis, and financial planning to cater to individual risk tolerance and financial objectives.

InvestGlass embeds compliance into chatgpt for banker

InvestGlass’s AI technologies significantly boost operational efficiency, streamlining operations and automating regulatory compliance tasks. This not only ensures adherence to regulatory requirements but also optimizes the approval process, from credit scores evaluation to loan approvals. By leveraging machine learning and natural language processing, these solutions offer multilingual support and are capable of generating AI-driven content, thus enhancing financial education, customer satisfaction, and ultimately fostering customer loyalty.

The integration of these advanced AI and generative AI technologies into banking services extends beyond operational tasks to encompass financial advisors’ roles. By providing tailored financial advice, automating customer queries, and offering insights into investment strategies and retirement planning, InvestGlass ensures that all financial planning needs are met with precision and personalization. The virtual assistants, powered by an advanced AI language model, are equipped to handle a wide range of customer inquiries, from debt management to financial literacy, ensuring a personalized banking experience that retains customers and builds trust.

InvestGlass invites all stakeholders in the finance industry, from emerging technologies enthusiasts to financial institutions aiming to elevate their banking operations and customer experiences, to explore the transformative potential of Copilot and Mistral. Through detailed webinars or direct trials, discover how these solutions can revolutionize your approach to customer engagement, operational efficiency, and financial services innovation, making InvestGlass a key partner in achieving excellence in the rapidly evolving financial landscape.

Experience the Future of Customer Experience in Sales Today

InvestGlass is inviting all its users and potential clients to explore the capabilities of its new AI-powered solutions. Whether you’re eager to test it out today or prefer to watch a detailed webinar, InvestGlass is ready to show you how these innovations can benefit your business. The prompt template offered by InvestGlass helps to streamline operations.

WATCH WEBINAR

How It Works: A Simple Three-Step Process

- CRM Field & Value Set Setup: Begin by customizing your CRM with Copilot AI. Tailor fields specifically for your industry needs, ensuring a seamless fit for your business operations.

- AI Template with Data Variable: Next, design pre-formatted questions to guide your teams in making more effective queries to ChatGPT. This step ensures that your interactions are both efficient and insightful.

- Actionable Insights: Finally, select from template questions, fine-tune them, and seek assistance from GPT. GPT delves into contact and portfolio pages to provide your team with exceptional insights, making every decision informed and strategic

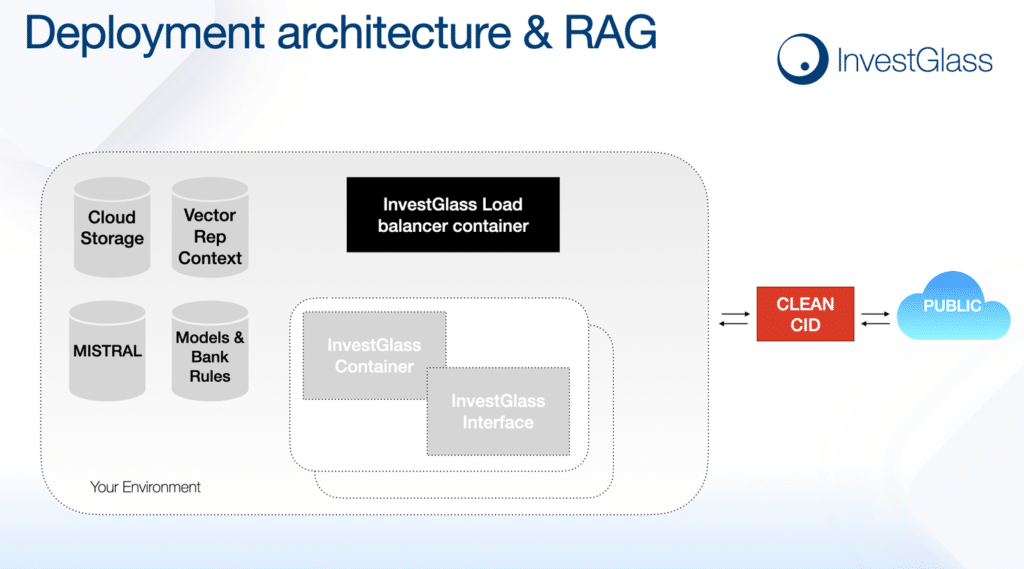

The Importance of Running ChatGPT in Banking on a Swiss Secured Environment

In today’s digital age, data security is paramount. Protecting customer data in the banking sector is crucial, and InvestGlass’s decision to offer the option of running ChatGPT on a Swiss secured environment underscores its commitment to ensuring the highest standards of data protection for its users.

Switzerland’s stringent data privacy laws and secure digital infrastructure make it an ideal location for managing sensitive information, offering peace of mind to businesses concerned about the security of their data and the importance of utilizing customer data for personalized services, risk analysis, and data-driven insights.

By integrating these cutting-edge AI innovations into its suite, InvestGlass is doing much more than merely enhancing its CRM and portfolio management capabilities. It is equipping businesses, especially within the banking industry, with the advanced tools necessary to adeptly navigate the complexities and dynamic market trends of today’s sales landscapes.

This evolution is not just about operational improvement; it’s a strategic enhancement aimed at streamlining operations, refining customer interactions through sentiment analysis, and fostering a deeper understanding of customer responses.

Financial institutions can cross PMS and CRM customer data on their servers

Leveraging the power of ChatGPT for bankers and risk management ChatGPT, InvestGlass enables banks to analyze data more effectively, including historical data and training data, to identify past risks and trends that warrant further investigation. This proactive approach in utilizing AI-generated content and sentiment analysis ensures a more personalized banking experience. By employing a virtual assistant, banks can now automate routine tasks like transferring funds, allowing them to focus on more complex issues that require a human touch.

Furthermore, this technological leap through InvestGlass aids in retaining customers by providing insights that help understand and predict customer needs and preferences. The ability to rapidly analyze and act on this information means banks can not only meet but exceed customer expectations, thereby solidifying customer loyalty. This approach, powered by advanced AI, enables banks to stay ahead in the game by adapting to emerging market trends and customer needs with agility and precision.

Don’t let this chance slip through your fingers. Redefine your sales and client relationship management strategies by embracing InvestGlass’s new AI solutions. Discover the transformative potential these tools offer for enhancing your business operations.

From enabling banks to conduct sentiment analysis for a more nuanced understanding of customer interactions to using AI for risk management and to streamline complex processes, InvestGlass is your partner in navigating the future of the banking industry. Explore these solutions today to see how they can revolutionize your approach to business, ensuring you remain competitive and responsive to the ever-changing financial landscape.