5 ways to improve your verification experience

If you’re like most people, you probably dread the idea of having to go through the verification process every time you want to make a purchase. It can be time-consuming and frustrating, especially if the verification service is slow or unresponsive.

But there are ways to make the verification process easier and faster, and we’re going to show you how. In this article, we’ll discuss three methods for improving your verification experience with InvestGlass CRM and ONFIDO.

InvestGlass is working with multiple identity verification software, but ONFIDO is definitely our preference for a large quantity of customer verification processes.

1. The importance of identity verification

One of the main reasons the verification process can be frustrating and time-consuming is that it’s often done manually. This means that someone has to review each document submitted by the customer and compare it to their records. Not only is this slow, but it’s also expensive, as it requires additional staff to manage the process.

InvestGlass digital onboarding offers flexible customer onboarding for any type of industry. When we don’t have the tool we connect to third-party API for the following

- Scan ID documents

- Identity fraud database

- Address verification

- MRZ verification

- Transaction verification, and specifically for crypto

- Money laundering database

- Facial recognition

Some companies we work with like to ask all the questions at the initial onboarding. We don’t think it’s a good idea! It’s like eCommerce retailers, if you would ask KYC process questions to buy shoes, no one would checkout, or even check in!

Customers expect to check quickly if the service you are offering is matching their expectations. Therefore KYC processes should be initiated in the right order. We would always suggest you to 1st create light onboarding process by asking a maximum of 3 to 5 questions then give access to Investglass’s client portal to submit additional compliance checks.

2. How to improve your verification experience with InvestGlass CRM and ONFIDO verification process

There are several ways that you can improve your verification experience with InvestGlass CRM and ONFIDO. Here are a few of them:

– Use automated verification: Automated verification is the fastest and most efficient way to verify identities. It uses technology to automatically compare documents against a database of records, which means that there is no need for manual review. This speeds up the process and reduces the costs associated with verification.

– Use a reliable identity verification service: InvestGlass CRM and ONFIDO are both reliable identity verification services that have been trusted by businesses around the world. They both offer fast, efficient, and reliable verification services that will make the process easier for you.

– Upload your documents quickly and accurately: Make sure that you upload your documents quickly and accurately so that there is no need for additional manual review. This will speed up the process and make it easier for you.

Last not least, ONFIDO offers a beautiful tool whose conversion rates are very high. This is the very nature of offering a nice technology, it will naturally win customer trust.

3. Benefits of using automated verification service for customer verification

The customer verification process is needed in order to ensure the safety and security of financial industries. By verifying the identities of customers, businesses can reduce the risk of fraud and money laundering. Additionally, by using a reliable identity verification service such as InvestGlass CRM or ONFIDO, businesses can speed up the verification process and make it easier for their customers.

Manual processes should be prevented as they will not offer good data protection, they will not prevent fraud and slow down online businesses. ID verification can be double check but the 2nd layer will be an API connection with a service like ONFIDO.

There are many reasons why businesses might choose to collect biometric data. Here are a few of them:

1. To improve security: Biometric data is a more reliable way to verify identities than traditional methods such as passwords or ID cards. By collecting and storing biometric data, businesses can improve the security of their systems and reduce the risk of fraud or identity theft.

2. To speed up the verification process: Collecting biometric data can speed up the verification process, making it easier for customers to access the services they need.

3. To build customer trust: By collecting biometric data, businesses can show their customers that they take their security seriously and are doing everything possible to protect them from fraud and identity theft. This builds trust and encourages customers to do business with them.

4. Final thoughts for a modern customer experience

Pick the right verification methods for your goals

New customers are coming from different countries, it’s the first step to check which country the customers are coming from and if they are restricted to share information such as biometric verification, passport or restricted CID – Customer Identification Data. CID is a hot topic in financial services and we can offer instant access to InvestGlass hosted on your server.

To improve your customer onboarding, you should make sure that you have the right tools.

Zero-friction customer verification

Make sure that your onboarding can be seen on any mobile device and match current regulatory requirements. It will match customers’ expectations anyhow. A complete verification should be explained in advance. If customers need to collect hard-to-find identity documents – company documents – you should warn them to raise customer expectations.

High-assurance verification in risky new markets

Make sure you are using high assurance checks such as document OCR checks and biometric verifications. This requires the customer to take a photo of their ID and their face. It’s slightly higher friction for your digital onboarding but creates a strong level of assurance in that person’s identity. ONFIDO does not cover the crypto yet so we can use other vendors like Scorechain for this purpose.

Workflow builder

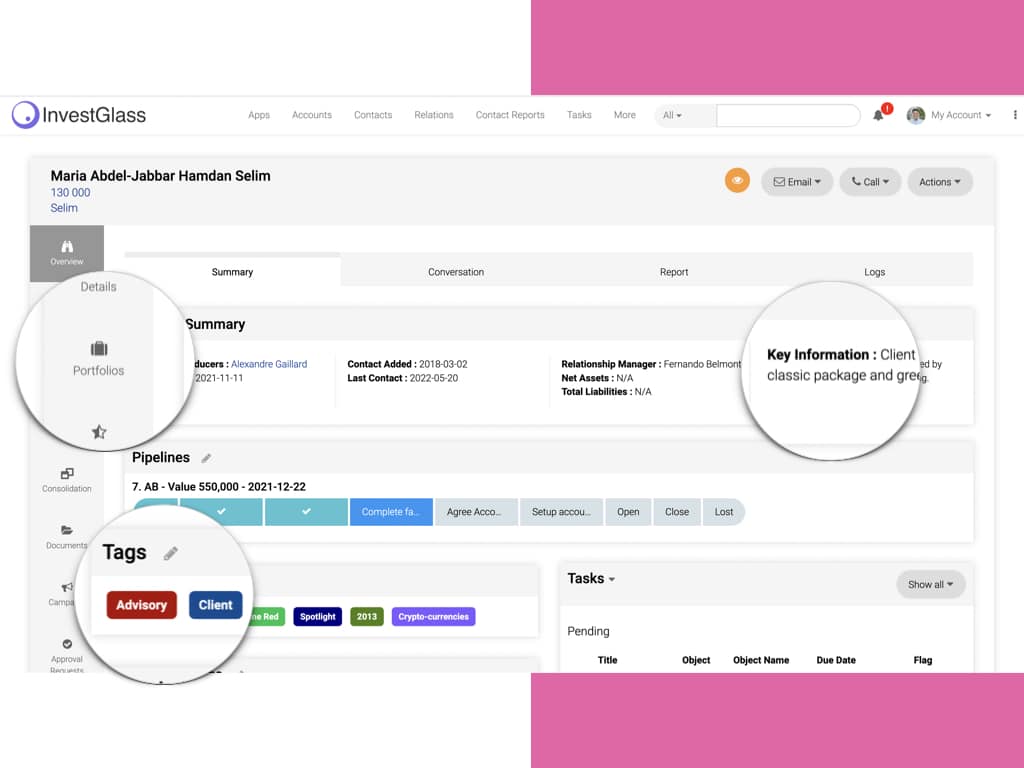

You can use InvestGlass Automation workflow builder and Onfido Studio to build to create different paths for higher-risk customers and low risk customers. You can offer different signup process based on the complexity.

Red, orange, green, customer onboarding experiences will be different based on the customer data. Customers with complex id verification or inexistent digital identity presence know that onboarding can be complex.

One of the main benefits of using InvestGlass automation is that it can speed up the verification process and make it easier for your customers. Additionally, by using a reliable identity verification service such as ONFIDO, businesses can reduce the risk of fraud and money laundering. It is crucial to used automation to prevent errors.

5. Modularity and flexibility of the ID verification and digital customer experience

InvestGlass digital onboarding is extremely flexible and can be used for a single form or multiple forms we call “package”. The package is a great way to collect multiple contracts to be signed and prevent cumbersome KYC checks. Indeed if you answer questions on one form, after submitting the form, all related answers will populate the next form. This is the best customer onboarding experience you can offer. You can add Onfido then one page – this is ONFIDO SDK.

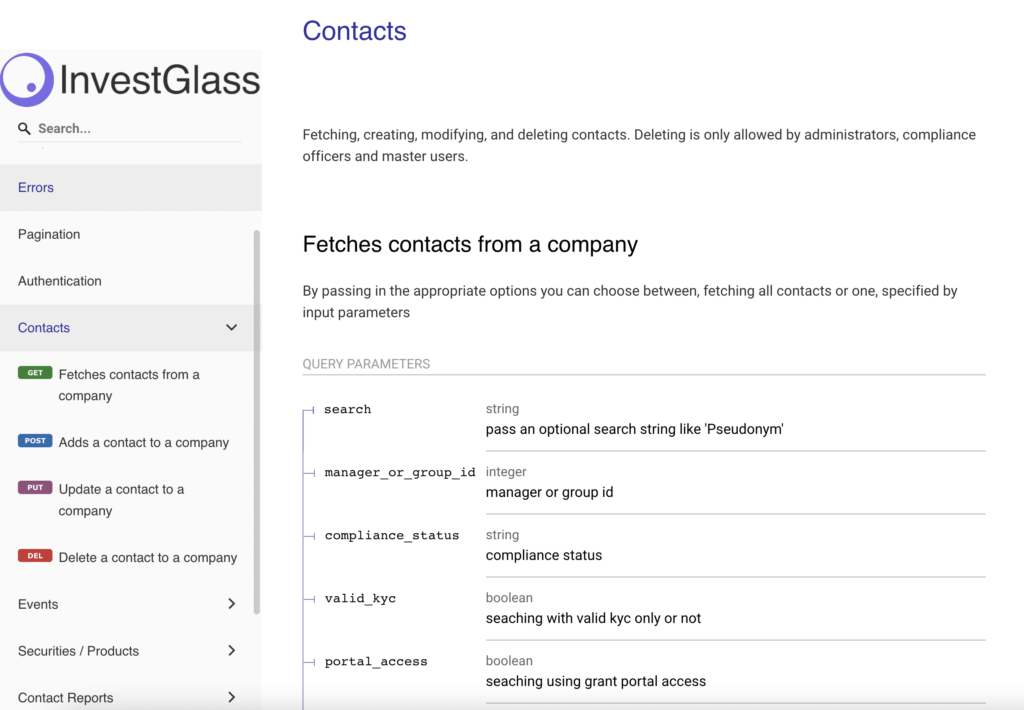

An SDK, or software development kit, is a set of tools that helps developers create applications. In the case of identity verification, an SDK would provide the developer with the necessary tools to integrate identity verification into their application. This would include things like APIs and libraries that make it easier to connect to the verification service.

API stands for “Application Programming Interface.” An API is a set of instructions that allows two applications to communicate with each other. In the case of identity verification, an API would allow an application to communicate with the identity verification service. This would include things like requesting verification checks, retrieving results, and managing account settings. API is a great way to offer real-time checks and it is a reliable technology.

InvestGlass connects to ONFIDO API in one click – no programming is needed to verify biometrics or identity.

When it comes to verifying the identities of your customers, there are a number of different methods you can use. In this article, we’ve looked at three ways that businesses can improve their verification experience: by using zero-friction verification, high-assurance verification, and workflow builder. Additionally, we’ve explored how InvestGlass automation can be used to speed up the process and make it easier for your customers.

By using a combination of these methods and tools, businesses can create a smooth and efficient customer onboarding process that is compliant with current regulations. Furthermore, by using a reliable identity verification service such as ONFIDO, businesses can reduce the risk of fraud and money laundering.