How to create a neobank from scratch in 2023?

Starting a bank from scratch requires significant capital, regulatory approvals, and a strong business strategy. In the U.S., the minimum capital requirement is typically $20-30 million, while in the UK, it’s at least €5 million (Bank of England). Securing a banking license involves strict compliance checks and risk assessments. Additionally, investing in robust technology and cybersecurity is crucial for ensuring operational efficiency and regulatory adherence (Deloitte).

In this article, we will share with you some key ideas to start your neobank services from scratch.

What is a neobank and why are they becoming so popular?

A neobank is a digital-only bank that offers enhanced customer experiences and increased security through the use of cutting-edge technology. Neobanks are becoming increasingly popular as more consumers move away from traditional banking institutions and towards digital-first platforms. The development of neobank apps has made it easier than ever for consumers to access their accounts and conduct financial transactions on the go. In addition, neo banks often offer a wider range of services than traditional banks, including foreign exchange, investments, and even insurance products. For many consumers, the convenience and flexibility of neobanks make them a more attractive option than traditional banks.

How do you create a neobank from scratch in 2022, and what challenges will you face along the way?

Today, there are a number of banking services available online. However, with the advent of neobanks, there is an opportunity to provide a more comprehensive suite of digital banking services. In order to create a neobank from scratch in 2022, it will be necessary to obtain a banking license and partner with various service providers. Obtaining a banking license can be a challenge in itself, as it requires meeting certain regulatory requirements. However, once obtained, it will allow the neobank to offer a full range of banking services. In terms of partnering with service providers, it is important to choose partners that are reliable and offer a good range of services. Furthermore, it is also important to consider the fees that service providers charge in order to ensure that the neobank is able to offer competitive prices. Ultimately, by taking these factors into consideration, it should be possible to create a successful neobank platform from scratch in 2022.

What features will your neobank have to differentiate it from the other banking services, and how will you make money off of it?

In order to differentiate our neobank from the competition, we will focus on providing customer-centric solutions that enhance the customer experience. We will also protect customer data and promote customer-centric solutions. Our enhanced customer experience neobanks will attract customers and customer acquisition will be a key driver of our growth. We believe that by providing a superior customer experience, we will be able to differentiate our neobank from the competition and drive significant growth.

To become a neobank platform you don’t be a fintech company. Financial solutions exist already, payment gateway are connected to software solutions with API. The service provider should receive a details RFP before you start. An RFP is a formal invitation to request suppliers to submit a proposal for a specific product or service. The RFP outlines the requirements that the product or service must meet and provides instructions on how to submit a proposal.

RFIs are used when an organization wants to gather information about a potential supplier, such as their experience, capabilities, and pricing. RFIs are typically used early in the vendor selection process, before a decision is made about whether to issue an RFP. Remember to ask them how they manage customer data and what they have ready for mobile phones. We call this a SDK a software development kit that has the ability to scale. Most have ready-made SDK for digital banks. conventional banks and traditional bank services.

RFQs are used when an organization wants to request quotes from potential suppliers for a specific product or service. RFQs are usually issued after an RFI has been issued and the organization has narrowed down the list of potential fintech companies. You should differentiate the must-have features from the nice to-have. You should ask them also for future app development.

Once you have selected a service provider, it is important to consider the fees that they charge. Many service providers charge a monthly fee, so it is important to consider whether this is something that your neobank can afford and get your online banking up and running fast!

How will you market your neobank to consumers and attract new customers?

In order to market my neobank to consumers and attract new customers, from traditional banks, I will need to obtain a license and offer traditional banking services. However, I will also need to differentiate my neobank from traditional banks by offering digital banking services that are not available at traditional banks. I will also need to provide an enhanced customer experience that is not available at traditional banks. In order to attract new customers, I will need to offer a neobank app that is superior to the traditional banking app offered by traditional banks.

What kind of financial transactions you will offer based on the banking license you are receiving?

The type of license you receive will determine the banking services you are able to offer. For example, a retail banking license will allow you to offer services such as current accounts, credit cards, and mortgages. In contrast, a wholesale banking license will allow you to offer services such as foreign exchange, investments, and loans. It is important to choose the right banking license in order to ensure that your neobank can offer a comprehensive suite of services.

Creating a neobank from scratch can be a daunting task. However, by starting small and focusing on the essentials, it is possible to create a successful neobank. An MVP (minimum viable product) is the best way to start, as it allows you to test your idea and get feedback from customers. The MVP should include the most essential features of your neo bank and should be easy to use. By focusing on the essentials, you can ensure that your neo bank is successful and meets the needs of your customers.

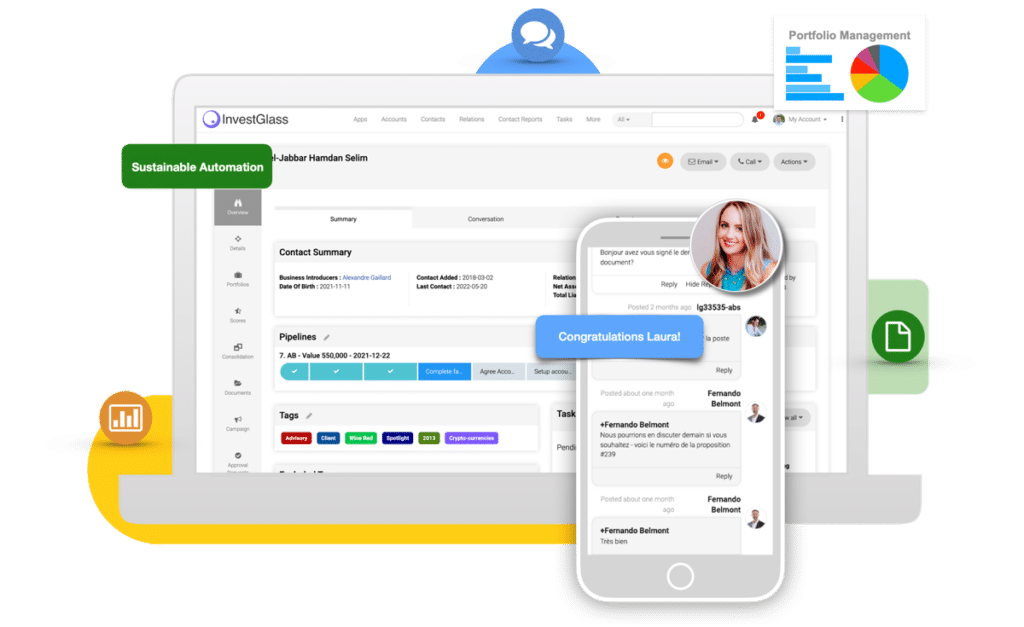

If you targeting a fast adoption you might be looking to have a mobile apps only approach. We build apps on FLUTTER. Flutter is a language that can run on both IOS and Android devices. This would save you time and money as you will not have to create two separate apps for each platform. The development team can easily play with existing templates. Challenger bank can add modules like mortgage, savings accounts, robo advisors, crypto services and offer different modules based when it’s needed. The user interface is important as it needs to be easy to use and sleek. The average user might not be used to using a mobile app for their banking needs and you will need to make sure that your target market can easily understand and use your app. Flutter is a perfect language that we connect to the InvestGlass core system. This prevents a FOMO (Fear Of Missing Out) because we can build new financial services in weeks instead of months. The back office tools are provided by InvestGlass and you decide the front end.

What are the risks involved in starting a neobank, and how can you mitigate them?’

There are a number of risks associated with starting a neobank, but these can be mitigated with careful planning and risk management. One of the biggest risks is money laundering, as neo banks are often used to facilitate money laundering activities. To mitigate this risk, neo banks should have robust anti-money laundering compliance programs in place. Another risk is offboarding, which occurs when clients close their accounts or stop using the neobank’s services. This can be mitigated by offering attractive rates and terms to encourage customers to stay with the neobank. Finally, reputation risk is a major concern for neo banks, as a single scandal could damage the bank’s reputation irreparably. To mitigate this risk, neobanks should focus on building a strong brand and developing positive relationships with their customers. The development process should be carefully offered to clients – remember you don’t remove kids’ gifts.

We will see in the coming month many companies that might not have a sufficient financial surface to cope with market turmoils. This will result in increased pressure on the banking sector to provide more credit facilities and products that can help companies weather the storm. This is where neobanks can play a role, by providing financing products that are not available at traditional banks.

What are the potential benefits of launching a neobank in 2022, and how can you ensure that your business is successful long-term versus traditional banks?

Launching a neobank in 2022 comes with a number of potential benefits. First and foremost, neobanks have the opportunity to tap into the growing trend of digital banking. More and more consumers are gravitating towards online and mobile banking solutions, and neobanks are well positioned to take advantage of this trend. In addition, neobanks can also benefit from the increased interest in sustainable finance. As consumers become more aware of the environmental impact of their financial decisions, they will be looking for banks that offer sustainable solutions. Neobanks that can provide these sorts of solutions will be well-positioned to attract and retain customers long-term. Finally, neobanks can also benefit from the current low interest rate environment. With traditional banks struggling to offer competitive rates, neobanks have an opportunity to attract customers by offering better rates on deposits and loans. However, it is important to note that launching a successful neobank requires more than just taking advantage of current trends. To ensure long-term success, neobanks need to focus on building a strong foundation that includes investing in the latest technology, attracting top talent, and establishing trusted relationships with regulators and partners. InvestGlass is the perfect solution for your business needs as it offers you the ability to monitor your portfolios in real time, get actionable insights about your investments via notifications, and much more! With InvestGlass, you can rest assured that your business will be well-positioned for success in the years to come.

It’s all about simple automation, and sustainable growth – try InvestGlass way

Many traditional banks, and physical branches are still reluctant to use automation. InvestGlass offers an automation suite that will help you to take advantage of the opportunities that digitalization provides. With InvestGlass, you can monitor your portfolios in real-time, get actionable insights about your investments via notifications, and much more!

The automation tool aims also to better serve niches and hyper-target audiences. For instance, if you are a Sustainable bank, the automation will help to monitor and give advice on the client’s investment. If the client is veery active in his/her social media, the automation can help to send frequent updates about the market conditions or new products that might be of interest.

InvestGlass is a cutting-edge investment management platform that offers a wide range of features and benefits to help businesses succeed in the financial markets. With InvestGlass, you can monitor your portfolios in real time, get actionable insights about your investments via notifications, and much more! In addition, InvestGlass offers a suite of automations tools that will help you take advantage of the opportunities that digitalization provides. With InvestGlass, you can rest assured that your business will be well-positioned for success in the years to come.

Neobanks are becoming increasingly popular due to their innovative features and customer-centric approach. If you’re thinking of starting a neobank in 2022, it’s important to plan ahead and anticipate the challenges that you will face along the way. By building a strong team of experts and focusing on customer satisfaction, you can set your neobank up for success.