Best Practices When Integrating Advisor Technology

In today’s financial landscape, technology plays a critical role in enhancing advisor efficiency and client satisfaction. Yet, advisors often struggle with technological fragmentation—57% of financial firms report the lack of integration between different software solutions as a major productivity barrier To overcome these challenges, firms must prioritize technologies that easily integrate, streamline operations, and improve client experiences.

This article highlights best practices to help advisors choose the right technology solutions and maximize their effectiveness.

1. What is advisor technology and why do you need it

2. How to select an investment advisor technology

3. How to choose the right type of advisor technology for your business

4. Best practices when integrating advisor technology into your business

5. Final thoughts on advisor technology

1. What is advisor technology and why do you need it

Advisors need a CRM to keep track of their clients and their interactions. A tidy CRM will help advisors stay organized and ensure they are providing the best possible service to their clients. CRM are used for a lot of things like tracking emails, phone calls, meetings, and tasks.

There are many different types of advisor technology available on the market. Some of the most popular include CRM systems, portfolio management software, client communication tools, and financial planning software.

CRM are also the place to collect KYC data and particular data for suitability and appropriateness analysis.

2. How to select an investment advisor technology

There are many different types of investment advisor software available on the market. Some of the most popular include CRM systems, portfolio management software, client communication tools, and financial planning software. Each of these software solutions has its own unique set of features and benefits that can be a valuable addition to your business.

Choosing the right type of investment advisor software for your business can be a daunting task. There are many different options available, and each one has its own unique set of features and benefits. Here are some tips to help you choose the right software solution for your business:

1. Understand your needs

The first step in choosing the right software is to understand your needs. What are your business goals? What type of clients do you work with? What features does the software need to have? Once you have a better understanding of your needs, you can start to narrow down the options.

2. Compare different solutions for financial planning

Once you have a list of potential solutions, it’s important to compare them side-by-side. This will help you get a better understanding of the features each solution offers and how they compare to your needs. In each country, each sub-asset class could have their fintech specialist so you have to compare as soon as possible.

3. Ask for recommendations to other financial advisors

Another great way to find the right software solution is by asking for recommendations from other businesses in your industry. They may have had experience with different software solutions and can point you in the right direction.

4. Trial different wealth management solutions

Finally, don’t be afraid to trial different solutions before making a decision. Many solutions offer free trials or demo versions so you can test out the features before making a commitment.

InvestGlass team will be glad to discuss your business models, risk assessment requirements, performance reporting, artificial intelligence support…

3. When selected – what are the integration best practices?

Best practices when integrating investment advisor software into your business

Once you have chosen the right type of investment advisor software for your business, it’s important to follow some best practices when integrating it into your workflow:

1. Train your team

It’s important to train your team on how to use the new software correctly. This will help ensure that everyone is using it effectively and getting the most out of its features. We belive that it’s better to have a MVP – minimum viable product you can use quickly than a HUGE plan with tens of thousands of processes no one will follow.

2. Use it as intended to create value for investors

One common mistake businesses make is using new software for tasks that it wasn’t designed for. Make sure you are using the software as intended so you get the most value out of it. The platform should be flexible for any type of investment and should capture the behaviors you are expecting to discuss with your clients : crypto, private equity deals, real estate, DPM, spending habits, risk assessment, tax harvesting, portfolio optimization…

3.The API

The API are used to connect your robo advisor tool, client portfolios, bank, custodian feeds altogether. As a modern financial advisor, you should be receiving those modern API. InvestGlass team can connect to other CRM systems, or Portfolio management tools but bear in mind that each new connection is a potential point of failure.

4. Best practices when integrating advisor technology into your business

Well… InvestGlass of course… We built the perfect CRM system, to reduce human intervention thanks to pre-built artificial intelligence.

The artificial intelligence aims to reduce errors in the MIFID and FIDLEG LSIN works. In today’s world, you must use AI to really be competitive.

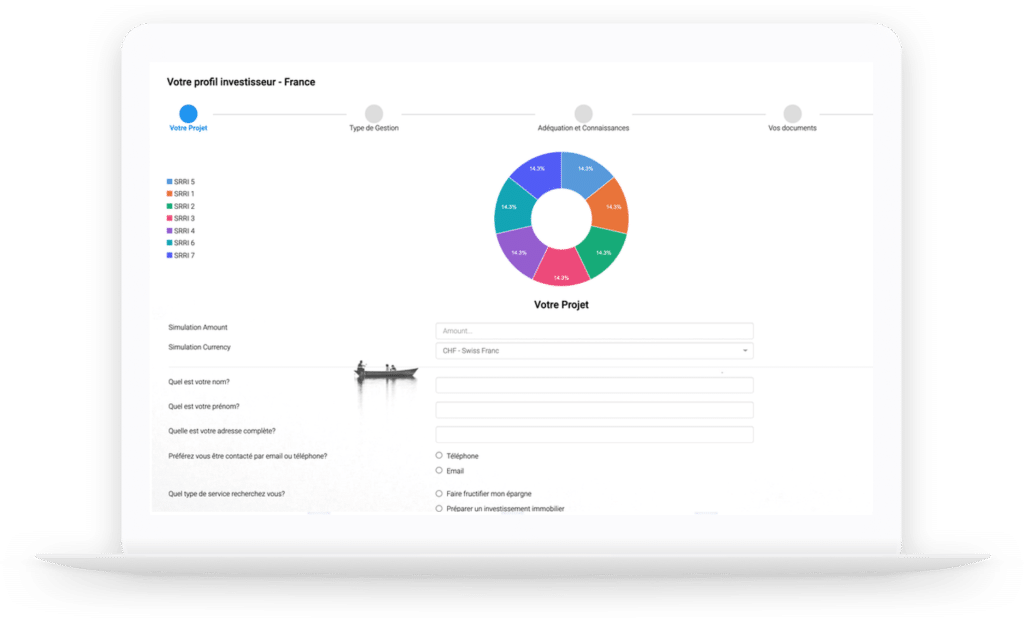

InvestGlass offers a client portal that aims to facilitate the distribution of content generated by financial advisors or share a robo advisors form you can build from InvestGlass. Here you will see a robo advisor built for self determination of portfolio mandate.

5. Final thoughts on advisor technology and automations

The lack of talents and inflations, and compliance costs are pushing the financial services industry to adapt faster with self-service robo advisors, digital advisory firms and modern financial technology.

As you can see, there are a number of things to consider when selecting investment advisor software for your business. By following these tips, you can make sure you find the right solution that meets your needs and helps you grow your business. At InvestGlass, we believe in using the latest technology to help financial advisors succeed. Our team has years of experience in the industry and is dedicated to providing the best possible service. We offer a variety of features that can help businesses of all sizes get the most out of their investment advisor software. Contact us today to learn more about how we can help you grow your business with our innovative solutions.

Stay focused on your growth! InvestGlass new technology is here to automate advisory firms!