The 5 Major Trends Shaping Neobanks in 2024: A Comprehensive Guide

Build your neobank with InvestGlass

Are you contemplating opening a neobank account? If so, this guide is your one-stop source for understanding the trends transforming the financial world, particularly the neobanking sector, and how they may impact your business or personal finances. Let’s dive into the five major trends for 2024:

1. Convenience and Speed: Neobanks vs Traditional financial sector

Opening a bank account with a neobank is easier and faster than with traditional banks. With just a few clicks on your mobile banking app, you can become an account holder without ever stepping foot in a bank. Neobanks are taking customer convenience seriously. This trend has garnered so much attention that many banks are concerned about losing significant market share to these virtual banks.

2. Empowering Consumers Through Improved Financial Technology Knowledge

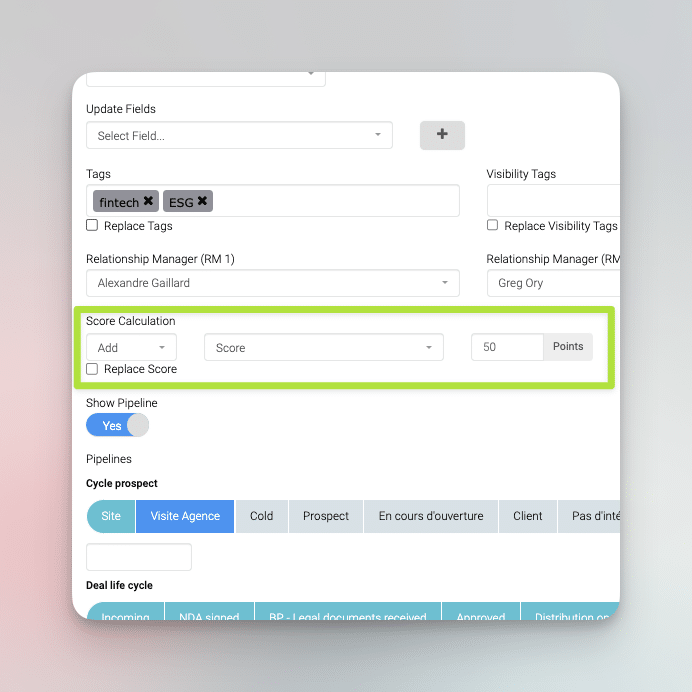

As the fintech industry evolves, consumers are becoming savvier about navigating digital platforms. Neobanks are at the forefront of this trend, offering educational tools that empower customers to understand complex financial data such as ESG and take charge of their savings accounts.

3. Transparent and Lower Fees: A Win for Customer Loyalty

Neobanks, offering services with unparalleled transparency, are setting a new standard in the financial sector. They clearly inform customers about any transaction fees, management fees, and extra charges — all in real-time through their mobile banking apps. This level of transparency, often associated with lower fees, is essential for building customer loyalty and customer retention.

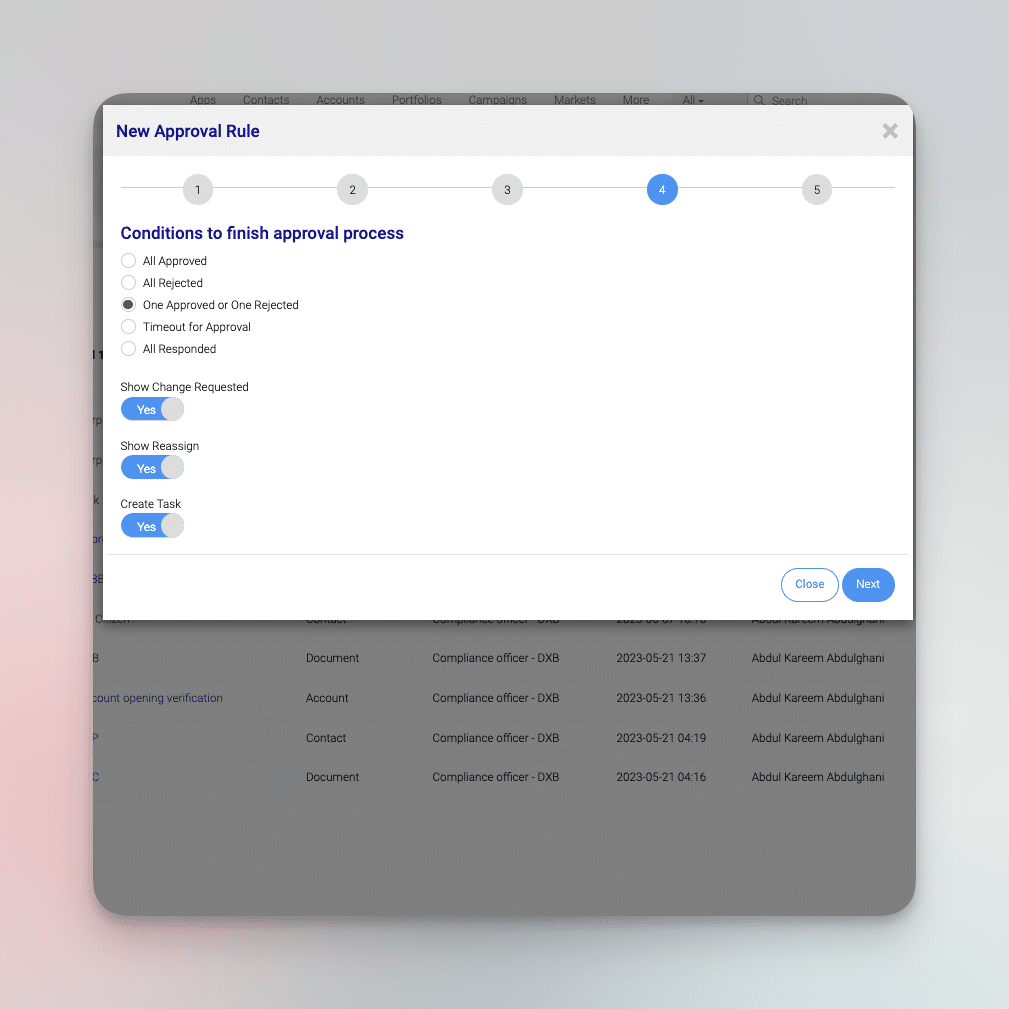

4. Cybersecurity and Data Security: A Non-negotiable Priority

In the fintech landscape, where digital assets are becoming commonplace, data security is critical. Neobanks are investing in advanced algorithms and cybersecurity measures, such as biometric verification and encryption technology, to safeguard customer’s banking data and ensure fraud detection.

5. Personalized Services and Insights Through AI and Analytics

Neobanks are leveraging advanced analytics and AI or chatgpt, such as virtual assistants, to deliver personalized customer experiences. These digital banks provide dashboard solutions that give users valuable insights into their spending habits, savings, and investment options, making financial planning more accessible than ever.

Additional Considerations in the Neobanking Landscape of 2024

- Regulatory Compliance and Open Banking: As the fintech revolution continues, regulatory compliance is a key concern. Open banking, which involves sharing financial data securely through APIs (Application Programming Interfaces) with third-party providers, is a transformative trend, highlighting the importance of compliance.

- Smart Contracts and Decentralized Finance (DeFi): In an era where blockchain is no longer a buzzword but a staple in financial systems, smart contracts are allowing for more secure and automated peer-to-peer payments and loans. Neobanks are well-positioned to capitalize on the DeFi movement.

- Contactless Payments and Digital Wallets: As online purchases become the norm, digital wallets and contactless payments, facilitated by neobanks, are essential for customer satisfaction.

- Innovative Customer Engagement Strategies: From leveraging gamification to offering cashback rewards and discount incentives, neobanks are getting creative to expand their customer base and foster brand loyalty.

- Global Money Transfers and Cross-Border Payments: Neobanks are increasingly facilitating cost-effective, quick, and secure international money transfers, challenging traditional financial institutions further.

- Expedited Loan Approval Process: With advanced risk assessment a

lgorithms, neobanks can provide faster loan approvals, saving customers both time and stress.

From the integration of smart contracts in financial systems to the convenience of virtual environments for managing bank accounts, it’s clear that neobanks are not only part of the fintech trends of 2024 — they are leading the charge. As these institutions continue to evolve, offering increasingly sophisticated and customer-centric services, they are setting new standards for what consumers can expect from their financial institutions.

How InvestGlass help you build a scalable neobank in 2024?

In today’s fast-evolving banking landscape, InvestGlass is positioning itself as a powerhouse platform that enables neobanks and fintech companies to scale effectively and efficiently. This platform’s robust banking technology is engineered to streamline digital payments, thereby offering seamless banking services that enhance the customer experience. For online banks striving to carve a niche in the crowded financial industry, InvestGlass offers a suite of fintech solutions, from wealth management tools to application programming interfaces (APIs) that allow integration with third-party developers. These APIs are particularly pivotal in enabling direct deposits, which is a significant convenience for account holders and a competitive edge for the digital bank. Furthermore, InvestGlass supports the journey of transforming a traditional bank setup into a modern, digital platform with minimal human intervention. This not only helps to save money on operational costs but also to dramatically reduce interchange fees. By staying ahead of top fintech trends, InvestGlass’ features are designed to simplify the complexities of providing financial services in an increasingly digital world, ensuring that neobanks can meet the needs of their customers today and scale for the challenges of tomorrow.

In conclusion, as the banking industry continues to be disrupted by these trends, traditional banks must adapt or risk being left behind in a world where digital banks are setting a new norm. It’s an exciting time to be a part of the fintech world, and customers stand to gain significantly from this competition and innovation.