The SAAS Fintech Banking Platform

A SaaS Fintech Banking Platform is a cloud-based service that enables businesses to integrate banking functionalities—such as payment processing, account management, and compliance—into their operations without the need to develop these systems internally. This approach enhances operational efficiency and ensures data security.

The global SaaS market has experienced significant growth, with projections indicating it will reach $307.3 billion by 2026, reflecting a compound annual growth rate (CAGR) of 11.7% from 2019 to 2026.

If you’re looking for one of these systems, here are five features that you should look out for:

1) Easy integration with other applications 2) Secure data storage 3) Customizable workflows 4) Completely mobile 5) Fully customizable reports

1 – Go digital it’s never too late

The COVID-19 pandemic has significantly accelerated digital adoption across various sectors, including wealth management. A survey revealed that 79% of wealth management decision-makers acknowledged that digital technologies have enhanced their customer engagement strategies. Additionally, 52% reported an increased use of digital channels for client interactions since the onset of the pandemic. Furthermore, 85% of professionals in the industry feel they are now providing clients with the necessary digital capabilities. This shift underscores a broader trend towards digital advisory services, as firms adapt to reduced face-to-face interactions and evolving client expectations.

The global pandemic disrupted the means of communicating and satisfying clients. Besides, it also modified clients’ demands and approaches. The economic crisis and the ongoing uncertainty have led to increasing demand for financial advisory. InvestGlass provides the means for wealth managers to offer digital advising, be it via their workforce or artificial intelligence, and, thus, to develop a clear competitive advantage over laggards. With this pandemic – private banking – previously the most reluctant to move is running to catch up.

2 – Nurture all customer segments we mean ALL

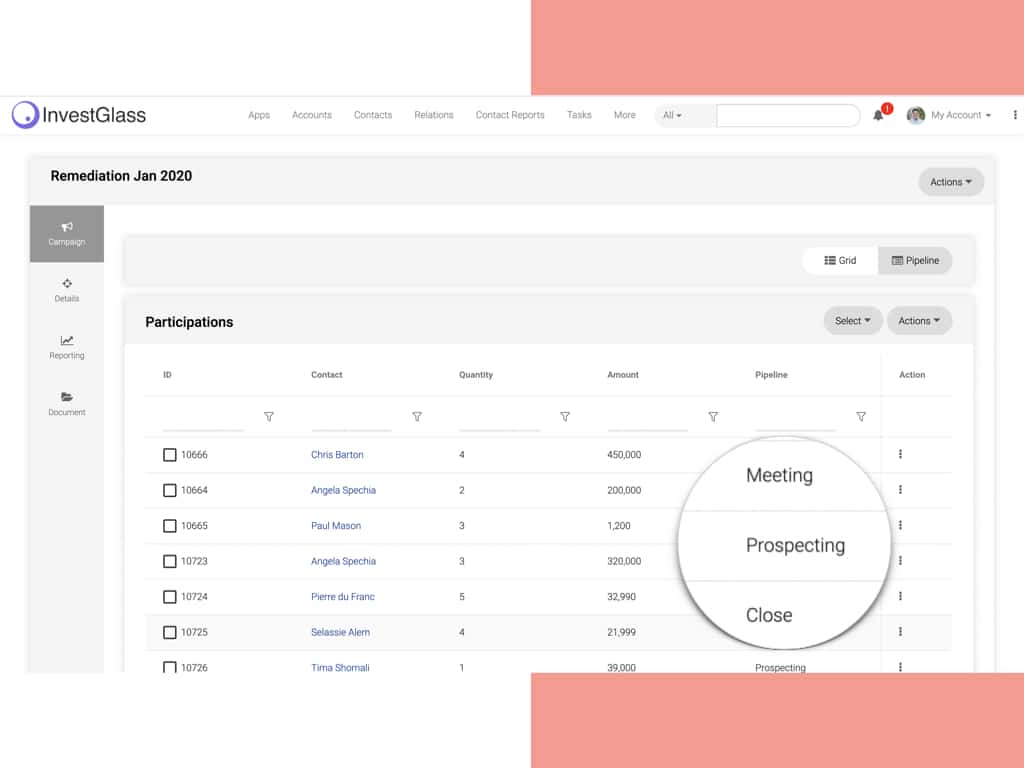

Over the past years, the role of wealth managers, as well as their client targeting, has changed. From a pure wealth focus, wealth managers are now considering other customer segments. Pricing structures of wealth managers are shifting to include lower balance prospects. Indeed, in order to succeed and be able to provide their service to all market segments by reducing costs or improving efficiency, wealth managers need to partner with Artificial Intelligence advisory providers or similar fintech solutions and SAAS solutions.

Correspondingly, these previously underserved markets are surging as key interests for the future. Women’s and mass affluents’ presence in the financial markets is getting important and the trend can be assumed to grow. The increasing interest in underserved markets enhances the wealth managers’ need to reformulate their pricing strategies to convince these customer segments and partner with InvestGlass. We provide an all-in-one CRM as the cheapest solution on the market and enable offering your service to other segments.

3 – Trust me I am your banker!

Studying the client’s expectations and behaviour, only 27% of Swiss individuals have worked with a financial advisor and over 50% manage their finances internally. This trend of behaviour is a worrying aspect for wealth managers with the rise of new, more efficient, advisors such as Artificial Intelligence and Fin-tech companies.

The Swiss financial environment clearly showcases a duality: most use a bank but choose other means to manage their wealth. This opens a large array of opportunities to convince sceptics, yet, it also conveys long-term risks.

The challenge for wealth managers is that every decision of any individual is now demanding some kind of advice, ranging from buying a house to which insurance a client is selecting. This is where wealth managers need to evolve in the future, in order to gain market shares and fulfil clients’ expectations more thoroughly.

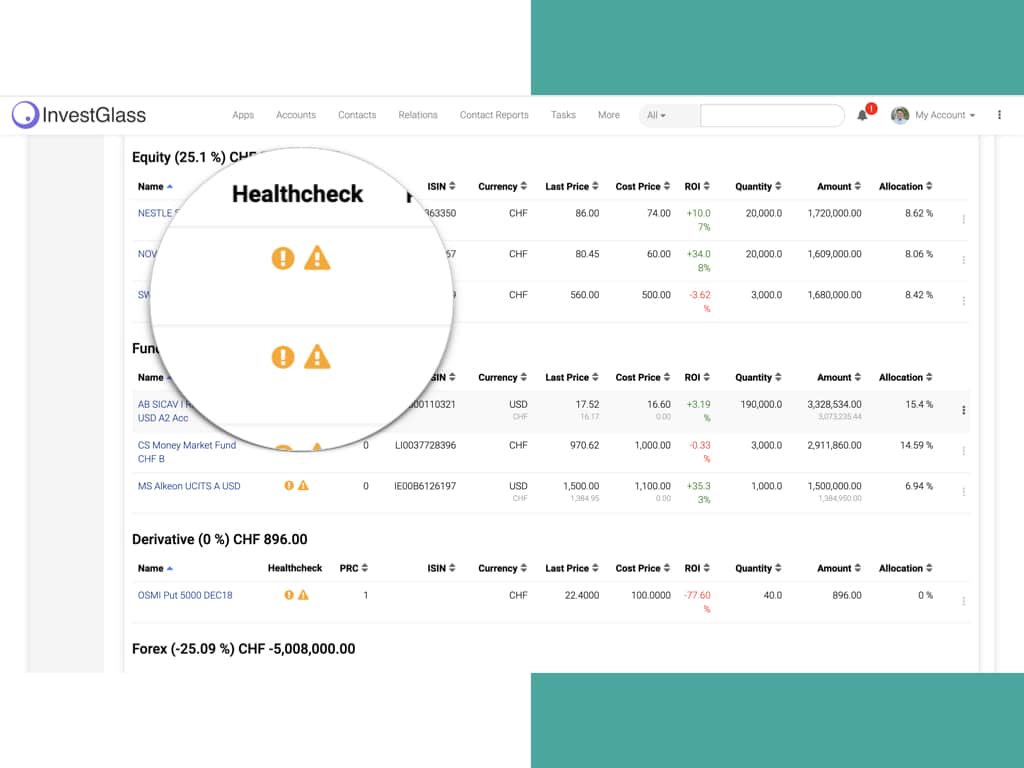

InvestGlass’s platform enables compliance with the need of the market by providing the means to make fast and efficient investment decisions. Satisfy your clients’ expectations starting today!

4 – Marketing hyper-personalization and All-in-one solution

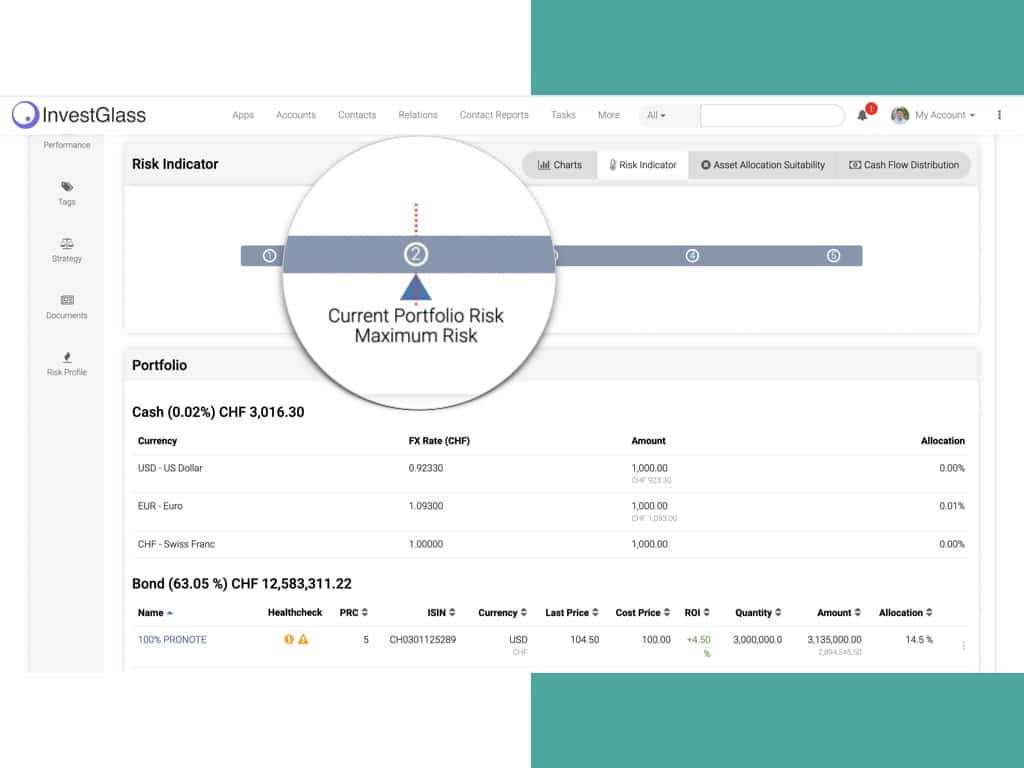

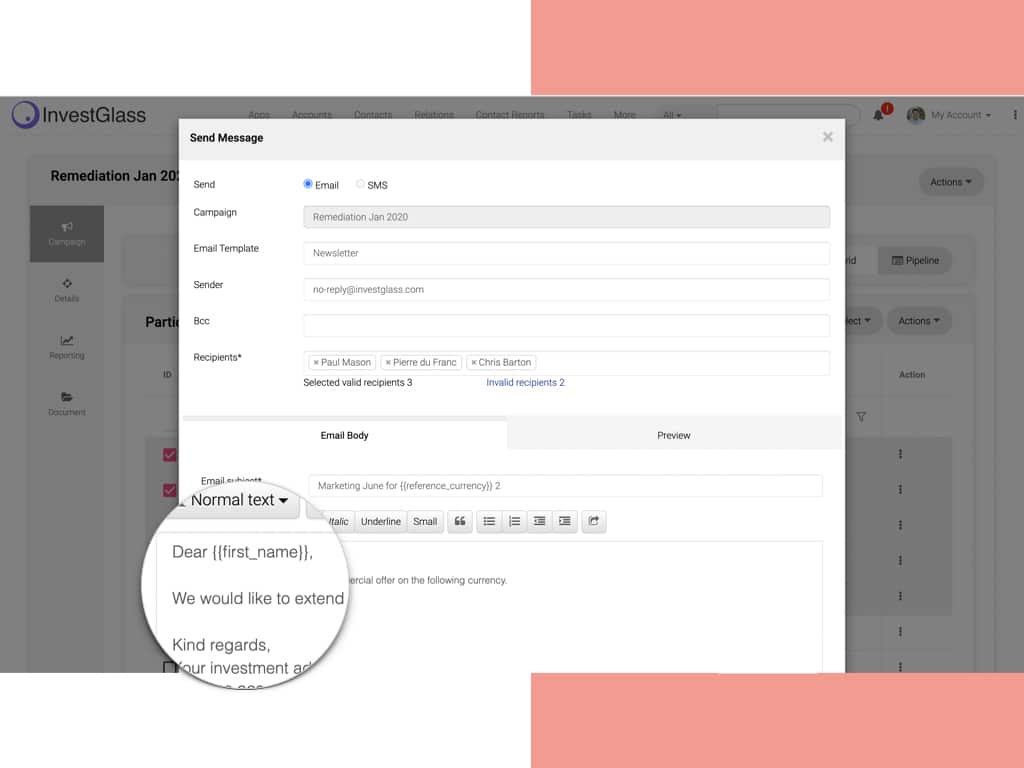

Our customer-focused society has long supported mass customization. This trend is slowly but surely impacting financial services and wealth managers and has been exacerbated by the pandemic as the health crisis creates and enhances a plurality of needs within customer segments. Wealth managers are thus expected to connect with Artificial Intelligence and digital advisory fintech to tailor their offering to each customer. The two main focuses are going to be risk-assessing firms, whose technology can interpret a client’s risk profile, and predictive analytics firms, which are expected to have extreme growth potential within the wealth management industry. Use InvestGlass CRM and tailor your offering to each customer with our customizable client portal.

Additionally, customers’ expectations have been changing and shifting towards all-in-one solutions. Indeed, clients and prospects aim for the most inclusive offer on the market. Therefore, wealth managers and financial companies, in general, need to include supplementary services or products in order to compete against inclusive competitors. Wealth managers, who can recognize this trend and act on it, will experience higher client satisfaction and retention. InvestGlass’s all-in-one solution, fin-tech ecosystem and open API embrace the trend.

5 – Get out with trendy thematics – even if you don’t share them. It’s the client first!

Over the last decades, before the pandemic became the main topic of discussion, sustainability and sustainable investment trend were gaining ground. Global warming, child labour, and, more generally, ethical and environmental issues were increasingly important for investors. The pandemic accelerated the trend and wealth managers’ clients consider ESG criteria more closely than in the past. The focus is thus to understand clearly the values and needs of your clients.

Consequently, wealth managers are expected to strengthen their sustainability offerings and showcase priority in sustainable compliant products. InvestGlass provides the means and ends to integrate ESG criteria in your offering as well as an AI advisor to match your investment strategy.

6 – Next-Gen Reporting when less is more – or maybe not

For any business, the tech age our society is in has redefined competition. Firms, companies, stores, and individuals are fighting for awareness and attention. In order to foster engagement and attention from clients, processes have to be easy to use, interactive, and customer friendly. Therefore, technologies and innovations try to enhance clients’ attention by providing visualizable data, graphs, and images to engage and interact with them. Similar account aggregation makes a more friendly and comprehensive view of the client’s assets.

Consequently, wealth managers can, via the InvestGlass module, deal with clients’ expectations to implement wealth tech which encompasses gamification in forecasting strategies and interaction in client wealth reporting.

7 – Instant Data is not flying cars

Data is the most important source of information for any sales manager. For wealth managers, it is imperative to know your customer and to base your advice and product propositions on data. The more data is gathered, the better tailored your service or product will be to the client. As the way to gather such data is limited, advisors and wealth managers are now aiming for an alternative source of information such as behavioural data or localization data. Additionally, machine learning is an important asset when pursuing predictive analytics and alternative data collection. E.g., Artificial Intelligence can scan the web and extract complex data on sentiments and social network critical trends.

Hence, it is clear that wealth managers will have to develop competencies and capabilities to deal with alternative data and to support machine learning processes, capabilities inherent to the InvestGlass solution.

7 Benefits Of Digital Banking In 2023 > Key Takeaways

Digitalization: we have seen an acceleration of Digital transformation since the pandemic started. It becomes a crucial point for wealth managers and the financial industry, in general, to innovate and embrace the revolution.

Nurture all segments: the range of potential customers for wealth managers is rapidly growing. The industry must understand this trend and change its offering to include lower-balance prospects

Financial Trust: Individuals are lacking trust and interest in financial advisory. This leaves room for opportunities and threats within the industry.

Hyper-personalization is an all-in-one solution: the mass-customization trend is also affecting customers’ expectations in the retail banking industry. Products should be customizable and integrate all relevant services via an ecosystem and integration.

Values and Sustainable investment: Competition and matching clients’ needs is a key focus during uncertain times. Recognizing the ESG trend and values within customer segments is the next focal point.

Next-Gen reporting: Interact with your clients. Clients are demanding gamification of performance reporting in order to increase their engagement with your product.