6 Best Bank Marketing Strategies in 2025

In today’s rapidly changing financial landscape, banks and credit unions are facing numerous challenges that significantly impact their marketing strategies. According to G2 Learning Hub, the AI-powered banking market is expected to expand the yearly rate of 28.58% through 2026. From the closure of branches to balancing digital advancements with human interaction, these institutions must adapt to thrive. InvestGlass, a leader in marketing automation and optimisation, leverages AI Language Learning Models (LLMs) to address these challenges head-on. This article explores the key marketing strategies for 2025 and how diverse banking marketing strategies, combined with InvestGlass’s innovative tools, can transform the way financial institutions engage with their customers.

Understanding Bank Marketing

Bank marketing refers to the various strategies and tactics employed by financial institutions to promote their services, attract new customers, and retain existing ones.

Effective bank marketing involves: understanding the needs and preferences of the target audience, creating a unique value proposition, and leveraging various marketing channels to reach and engage with customers. Bank marketing has evolved to include a range of digital marketing strategies, including search engine optimization, content marketing, paid advertising, and social media marketing.

- Understanding the needs and preferences of the target audience

- Creating a unique value proposition

- Leveraging various marketing channels to reach and engage with customers

Bank marketing has evolved to include a range of digital marketing strategies, including search engine optimization, content marketing, paid advertising, and social media marketing.

A well-rounded bank marketing strategy not only focuses on acquiring new customers but also on nurturing relationships with existing customers. By understanding customer behavior and preferences, banks can tailor their marketing efforts to provide personalized experiences that resonate with their audience. This approach not only enhances customer satisfaction but also fosters loyalty and long-term relationships.

Identifying Marketing Challenges

When crafting a marketing plan, understanding these challenges is crucial. Here’s a closer look at some of the significant hurdles:

| Challenges | Details |

| Underperformance of New Branches | Many struggle to gain local traction, weakening marketing efforts and customer retention. |

| Lack of a Sales Culture | Without proactive sales strategies, financial institutions find it hard to promote services and drive engagement. |

| Educational & Advocacy Gaps | Limited financial education initiatives can hinder trust and long-term customer relationships. |

| Reactive Customer Service | Addressing issues only as they arise reduces satisfaction and weakens brand loyalty. |

| Balancing Digital & Human Touch | While digital banking grows, maintaining personal connections remains a challenge. |

Addressing these obstacles is key to refining marketing strategies effectively. By understanding and mitigating these issues, financial institutions can improve their brand presence and better serve their customers’ needs. Developing comprehensive solutions tailored to these challenges can help banks and credit unions thrive in a competitive market.

What are the benefits of cultivating community partnerships for banks and credit unions?

The Benefits of Cultivating Community Partnerships for Banks and Credit Unions

Establishing community partnerships is a powerful strategy for banks and credit unions, benefiting both the institution and the local populace.

Fostering Customer Loyalty

Engaging with community organizations through partnerships helps banks and credit unions deepen their relationship with existing customers. By actively participating in local events or causes, such as supporting a neighborhood sports team or contributing to a local food bank, financial institutions can demonstrate their commitment to the community. This, in turn, bolsters customer loyalty as patrons see the bank or credit union as an integral part of their everyday lives.

Expanding Customer Base

Community partnerships are also an effective method for attracting new customers. By aligning with widely supported initiatives—such as assisting in building homes with Habitat for Humanity—banks and credit unions gain visibility among potential customers who value social responsibility. Such exposure often leads to new accounts and an expanded customer base.

Making a Tangible Impact

Financial institutions can make a meaningful difference by supporting impactful projects. Whether it’s hosting free financial literacy workshops at a local library or organizing fundraising for local animal shelters, these efforts enhance the institution’s reputation as a socially responsible entity. The positive influence on the community not only feels good but also reflects positively on the institution.

Facilitating Long-Term Success

These partnerships not only boost immediate public perception but also lay the groundwork for long-term institutional success. By embedding themselves in the fabric of the community, banks and credit unions not only thrive financially but also contribute to the overall well-being of the communities they serve.

In essence, community partnerships are invaluable for banks and credit unions looking to elevate their influence and business by fostering loyalty, attracting new customers, and making a positive community impact.

What are some key marketing strategies for banks and credit unions in 2025?

Key Marketing Strategies for Banks and Credit Unions in 2025

As we step into 2025, the marketing landscape for banks and credit unions continues to evolve. Here are some essential strategies to consider this year:

Transform Bank Tellers into Customer Advocates

With the increasing adoption of self-service technologies like ATMs, Interactive Teller Machines (ITMs), and mobile banking, the role of the traditional bank teller must change. Instead of focusing solely on transactions, tellers can be retrained to act as financial advocates. They should focus on understanding customer needs and providing tailored advice on financial products and services. Investment in training programs is crucial to this transition, emphasizing proactive communication and comprehensive product knowledge. This shift can enhance customer relationships and differentiate your institution in a competitive market.

Enhance In-Branch Marketing Efforts

Delivering an exceptional branch experience remains a powerful marketing tool. While interactions with staff are important, the time customers spend unattended in your branch is just as critical. To enhance their experience, consider integrating digital signage that highlights key services, offers tutorials, and provides local updates like weather or news. Additionally, interactive digital kiosks and tablets can serve as informative tools, providing customer-friendly insights into products such as mortgages, loans, and savings accounts. These tactics position your institution as modern and customer-focused, enhancing your overall brand perception.

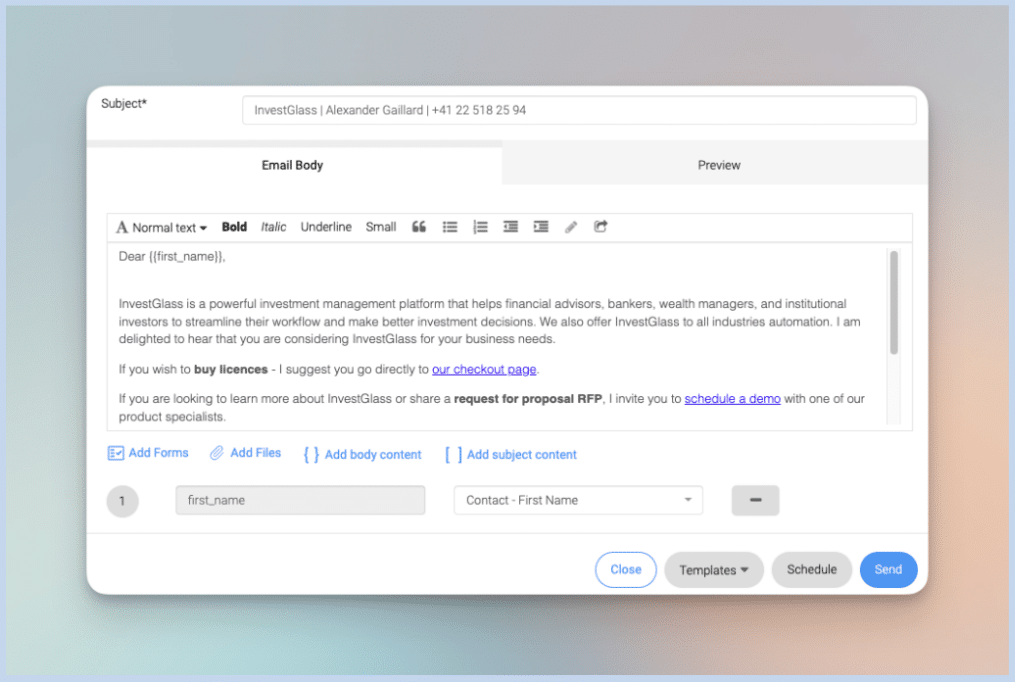

Expand Digital Marketing Capabilities and generate personalized service

In today’s digital world, a strong online presence is indispensable. Digital marketing campaigns are crucial for enhancing business metrics and driving customer engagement. With many banking customers using mobile apps, there is ample opportunity to connect through digital channels. Your strategy should encompass:

- Email Marketing: Regularly engage with customers through emails, sharing updates, promotions, and insightful blog content.

- Content Creation: Develop informative, SEO-optimized blog posts that educate consumers about your services and industry trends, driving organic traffic and enhancing your authority.

- Social Media Engagement: Maintain a robust social media presence with a blend of ads, informative content, and engaging contests to boost brand visibility.

- Targeted Advertising: Leverage platforms like Google Ads to reach local prospects and highlight new offerings.

Foster Community Relationships

Building community connections in the financial services industry is another effective way to bolster your institution’s local presence. Engaging in community partnerships not only boosts brand loyalty but also taps into new customer bases. Consider activities such as sponsoring local sports, organizing charity drives, participating in community-building projects, or hosting workshops on financial literacy at community centers or schools.

Deploy Effective Promotional Materials

Promotional marketing helps extend your reach beyond the branch. Consider providing branded apparel, practical kits for new mortgage clients, or personalized gifts like mugs and water bottles. These materials not only enhance brand awareness but also create a sense of belonging among customers and staff alike.

Harness Customer Data Analytics

Effective marketing strategies are crucial for optimizing marketing efforts, tailoring offerings, and maximizing returns. By analyzing data on customer behavior and preferences, banks can craft personalized marketing strategies that resonate with their audience. Personalized messaging and offers make customers feel valued and understood, fostering stronger relationships and encouraging loyalty.

In 2024 and 2025, embracing these strategies can help banks and credit unions connect more effectively with their audience, enhance customer satisfaction, and stay ahead in the market.

Understanding Your Audience

Identify Unique Needs and Preferences

Understanding your audience is crucial to developing an effective marketing strategy for your financial institution. To identify unique needs and preferences, start by gathering data on your target audience’s demographics, behaviors, and pain points. This can be achieved through surveys, focus groups, and online analytics tools.

Once you have collected this data, create detailed buyer personas that outline the characteristics, needs, and preferences of your ideal customers. These personas will help you tailor your marketing strategies to resonate with your audience and address their specific needs.

For instance, if your target audience consists of millennials, focus on digital channels such as social media marketing and online advertising. Millennials are tech-savvy and prefer engaging with brands through digital platforms. On the other hand, if your target audience includes baby boomers, consider more traditional marketing strategies such as print advertising and in-person events, as they may value face-to-face interactions and tangible materials.

By understanding your audience’s unique needs and preferences, you can develop marketing strategies that speak directly to them, increasing the likelihood of converting them into loyal customers.

What are effective branch marketing tactics for enhancing customer experience?

Effective Branch Marketing Tactics for Enhancing Customer Experience

Enhancing customer experience within a branch is vital for creating a favorable perception of your brand. Every customer visit offers a moment to impress, and leveraging this can significantly boost brand loyalty. Here’s how you can refine your branch marketing tactics:

1. Optimize Customer Interactions

While personal interactions are crucial, ensuring a customer’s time alone in the branch is also engaging is equally important.

2. Utilize Digital Signage

Implement engaging digital signage, such as eye-catching graphics and videos. This technology can highlight your top services, offer product tutorials, and deliver local updates like weather and news. By doing so, you keep customers informed and entertained, enriching their waiting experience.

3. Offer Interactive Digital Brochures

Equip your branch with digital kiosks, tablets, or displays. These interactive devices can serve as digital brochures, giving customers access to detailed information about services like mortgages, checking accounts, auto loans, and savings accounts. This interaction keeps them engaged and informed about offerings relevant to their needs.

By integrating these strategies, your business positions itself as a forward-thinking institution, providing valuable, engaging content to customers during their wait. This approach not only reinforces your brand image but also enhances the overall customer experience in the branch.

How can reimagining the role of bank tellers as customer advocates benefit banks and credit unions?

Enhancing Bank Experiences: Tellers as Customer Advocates

The transformation of bank tellers into customer advocates presents a multitude of benefits for both banks and credit unions. In an era where self-service alternatives like ATMs, Interactive Teller Machines (ITMs), and mobile banking apps are prevalent, the opportunity to redefine the teller’s role is ripe.

Building Strong Customer Relationships

By shifting their focus from mere transactional duties to deeper customer engagement, tellers can become key players in understanding and catering to their customers’ unique financial needs. This shift allows them to proactively offer personalized advice and solutions, strengthening customer relationships and loyalty.

Maximizing In-Person Interactions

With routine transactions handled efficiently through technology, tellers have more time to interact meaningfully with clients. These face-to-face interactions enable tellers to educate customers about financial products and services that can enhance their financial well-being.

Empowering Through Training Programs

To facilitate this transition, banks and credit unions can develop comprehensive training programs. These programs should equip tellers with advanced communication skills and knowledge of the institution’s offerings. A focus on proactive customer service, where tellers provide unprompted, yet valuable, suggestions can significantly elevate the customer experience.

Smart Cross-Selling Opportunities

As customer advocates, tellers are better positioned to identify relevant cross-selling opportunities. Understanding the full range of available products and when it’s suitable to introduce them can lead to increased sales and a more satisfied, well-informed customer base.

By embracing this innovative role, banks and credit unions not only enhance their service offerings but also foster a culture of customer-focused financial advocacy. This approach not only boosts customer satisfaction but can also drive long-term growth and success for financial institutions.

What role does customer data play in optimizing bank marketing strategies?

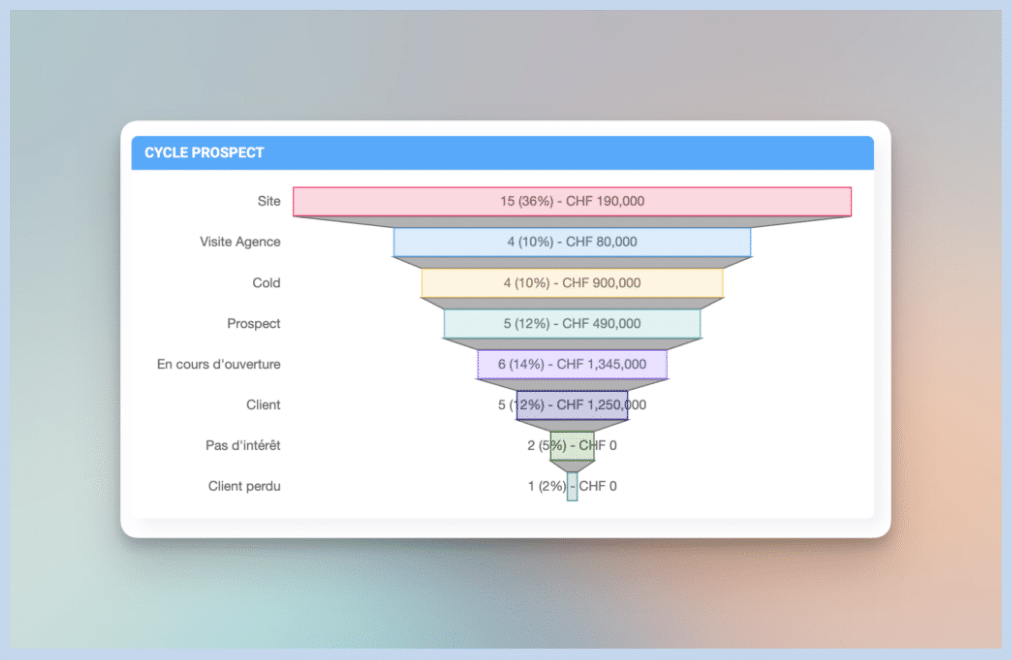

“First, ask customers more questions. If you cannot or don’t feel like asking the question – try the big data approach. With a simple automation algorithm, InvestGlass can recommend products to your existing customer base. All previous interactions are monitored. More data will give you more consumers’ preferences. Existing customer data is used to extrapolate potential customers’ expectations for financial services. Big data bundled to InvestGlass marketing reporting can teach you which marketing strategies work. You will not be guessing why a new account comes to your bank. It’s about target marketing. Customer loyalty is the last pillar of this strategy.

The Power of Data and AI in Bank Marketing

Understanding customer data is crucial for financial marketers and banks looking to optimize their marketing strategies. By collecting and analyzing data on spending patterns, credit card usage, and investment preferences, banks can tailor their services to better meet the needs of their customers. This approach not only streamlines operations but also maximizes returns by ensuring resources are used efficiently.

Personalization and Customer Satisfaction

Using data analytics goes beyond improving the bottom line; it also enhances customer satisfaction. Tailored and relevant messaging, informed by data, allows for a more personalized customer experience. By understanding behavior patterns, banks can offer deals that seamlessly integrate into customers’ lives, making them feel valued and connected.

Enhancing Customer Experience

Use data to improve customer experience, focus on complaints, and be more proactive about customer service. You will quickly see which channels are the preferred ones for communicating with your institution. The best thing you can do is focus on making digital interactions with customers as human as possible.

How can data analytics improve customer satisfaction for financial institutions?

Use data to improve customer experience, focus on complaints, and be more proactive about customer service. You will quickly see which channels are the preferred ones for communicating with your institution. The best thing you can do is focus on making digital interactions with customers as human as possible.

To enhance this approach, financial institutions can leverage data analytics to gain deeper insights into customer behavior and preferences. By analyzing data on spending patterns, credit card usage, and investment choices, banks can tailor their services to meet individual needs. This personalization not only optimizes resources but also streamlines operations, leading to maximum returns.

Moreover, data analytics enables the delivery of personalized, relevant, and timely messages. This can significantly boost customer satisfaction by ensuring that communications and offers are aligned with the customers’ daily lives. Understanding customer behavior through data allows for the offering of complementary deals and services, which reinforces a sense of connection and value.

Incorporating data-informed processes into your strategy ensures that customers feel valued, as they receive services that are not just available but truly beneficial. This proactive approach to using data fosters a deeper relationship between the institution and its customers, making digital interactions feel personal and engaging.

What is the role of data analytics in understanding customer behavior?

Data analytics plays a crucial role in decoding behavior patterns of customers and members. This understanding enables financial institutions to craft offers and services that are not only relevant but also complementary to customers’ lifestyles.

What are the benefits of personalized communication for customers?

Personalized communication, informed by customer data, makes customers feel valued and connected. It ensures that the services and offers they receive are directly aligned with their unique preferences and daily activities.

How can data analytics directly lead to increased customer satisfaction?

By utilizing data analytics, banks can send messages that are tailored to individual customer needs, making them more relevant and timely. This personalization enhances the overall customer experience, leading to higher satisfaction levels.

How do financial institutions use customer data to optimize their operations?

Financial institutions leverage customer data by analyzing patterns in spending, credit card usage, and investment choices. This data-driven approach allows them to allocate resources efficiently, streamline their processes, and enhance profitability.

How can promotional materials be used to enhance brand awareness and customer loyalty?

Creating marketing brochures and guidelines is the basis of marketing efforts for any financial institution. The digital marketing agency can help you to set the basic color, wording but you have to make sure that your colleagues effectively use them. New customers will look into their bankers’ profiles. Therefore you might also suggest and create contacts for your bankers to push on social media. This is what we call influencer marketing or micro-influencer marketing. Each colleague can be part of an effective marketing strategy.

To further elevate your marketing strategy, consider the power of promotional materials. These items are not just giveaways; they are strategic tools to enhance brand awareness and foster customer loyalty. Additionally, incorporating search engine optimization (SEO) into your digital marketing efforts can significantly improve your website’s visibility and usability for both search engines like Google and users. Here’s how you can use them effectively:

Apparel

- Popular items like outerwear and polo shirts can turn your staff and customers into walking billboards, spreading your brand’s image far and wide.

Personalized Collections

- Tailor promotional items to the services you provide. For instance, offering new home loan customers a branded kit with practical items like a tape measure or screwdriver set can create a lasting impression and a sense of care.

Customized Gifts

- Providing personalized mugs, T-shirts, water bottles, and other branded gifts not only delights customers but also makes them feel a part of your brand family, boosting loyalty and repeat business.

Employee Dress

- A cohesive dress code for employees distinguishes them from visitors and instills pride in your institution, reinforcing a professional and trustworthy brand image.

By weaving these elements into your marketing strategy, you ensure that your brand reaches beyond the confines of the office, showing customers and potential clients how much they matter. Balancing traditional marketing with innovative promotional strategies creates a holistic approach that resonates on multiple levels.

Optimize Your Website for Speed and Mobile Usability

In today’s digital age, having a website that is optimized for speed and mobile usability is crucial for financial institutions. A slow-loading website can lead to high bounce rates and a poor user experience, while a website that is not optimized for mobile devices can result in a loss of potential customers.

To optimize your website for speed, use tools such as Google PageSpeed Insights to identify areas for improvement. This can include compressing images, minifying code, and leveraging browser caching. These optimizations can significantly reduce load times, enhancing the overall user experience.

For mobile usability, ensure your website uses responsive design to adapt to different screen sizes and devices. Mobile-friendly templates and intuitive navigation are essential for providing a seamless experience on smaller screens. Make sure that buttons are easily clickable, text is readable without zooming, and forms are easy to fill out on mobile devices.

By optimizing your website for speed and mobile usability, you can improve user experience, increase engagement, and drive more conversions, ultimately enhancing your digital marketing strategy.

Use Local SEO to Reach Prospects

Local SEO is a crucial marketing strategy for financial institutions aiming to reach prospects in their local area. By optimizing your website and online presence for local search terms, you can increase your visibility in search engine results pages (SERPs) and drive more traffic to your website.

To use local SEO effectively, include location-based keywords in your website’s content, meta tags, and alt tags. This helps search engines understand your relevance to local searches. Additionally, create and optimize a Google My Business listing with accurate and up-to-date information, including your address, phone number, and business hours.

Furthermore, leverage online directories and citations to boost your online presence and build high-quality backlinks to your website. List your business in local business directories, chambers of commerce, and industry-specific listings to enhance your local SEO efforts.

By implementing local SEO strategies, you can increase your visibility in local search results, attract more traffic to your website, and draw more prospects to your financial institution, ultimately strengthening your local market presence.

InvestGlass — Your Ally in AI-Powered Marketing Campaign for Banks

In an era where artificial intelligence reshapes how financial services today are delivered, marketing strategies for banks must evolve to stay competitive. Whether you’re a local bank, a digital bank, or one of the big banks, the key to success lies in leveraging AI tools like InvestGlass to enhance every stage of the customer journey.

InvestGlass empowers local banks and traditional banks alike to create content that resonates with their local audience. From crafting effective social media ads to launching data-driven direct mail campaigns, it simplifies the complexities of modern marketing. The platform helps banks engage with prospective customers and retain current customers by tailoring personalized services that build loyalty and generate happy customers.

Whether you’re aiming to emulate the success of global leaders like Commonwealth Bank or carve out a niche in your market, InvestGlass is the ideal partner. With its ability to streamline operations and personalize online banking and online services, it equips banks with the tools needed to build brand awareness, adapt to customer demands, and thrive in a competitive market.

Start your journey toward smarter, AI-driven marketing with InvestGlass. Let’s redefine how banks create content, connect with many customers, and shape the future of financial services today.

Conclusion

As the banking industry evolves, staying ahead with innovative marketing strategies is essential for attracting and retaining customers. The six strategies outlined—ranging from personalized digital experiences to community engagement—can help banks build stronger relationships and enhance their competitive edge in 2025. By leveraging technology, data-driven insights, and customer-centric approaches, banks can create impactful campaigns that drive growth and trust. The key is to stay adaptable and continuously refine marketing efforts to meet changing customer expectations.