人工智能投资组合管理:2025 年投资战略转型

人工智能 投资组合管理 uses sophisticated algorithms to optimize investments, providing personalized advice, swift decisions, and robust risk assessments. By analyzing vast amounts of data in real-time, AI identifies market trends, automates trades, and enhances financial advising, transforming traditional investing into a more precise and efficient process. This article explores these advancements and their impact on investment strategies.

主要收获

AI significantly enhances portfolio management by automating processes, personalizing investment advice, and improving decision-making through real-time data analysis.

The integration of AI in investment management and investment strategies offers benefits across various management styles, including active, passive, and quantitative approaches, leading to improved operational efficiency and performance.

Successful implementation of AI in portfolio management is driven by clear investment goals, high-quality data, and regular model validation, ensuring tailored insights and reduced risks.

What is AI Portfolio Management?

AI portfolio management refers to the use of 人工智能 (AI) and machine learning algorithms to optimize investment strategies and manage portfolios. This innovative approach leverages advanced data analytics and predictive modeling to enhance investment decisions, reduce risk, and improve returns. By analyzing vast amounts of financial data, AI can identify patterns and trends that might be missed by traditional methods. This allows for more informed and timely investment decisions, ultimately leading to better portfolio performance. AI portfolio management can be applied to various investment strategies, including active, passive, quantitative, and factor-based investing, making it a versatile tool for modern investors.

Understanding AI in Portfolio Management

AI’s ascent in the realm of portfolio management is driven by advancements such as heightened computational capabilities, the proliferation of Big Data, and improved data storage. These developments have sparked excitement among investors about AI’s potential to revolutionize their field. It’s anticipated that over the coming ten years, AI will play a significant role in augmenting global economic output with an expected $7 trillion from productivity improvements.

One standout aspect of AI is its capacity for customizing investment guidance. By scrutinizing individual financial ambitions and risk tolerance levels against shifting market dynamics, AI models offer bespoke investment strategies. Platforms equipped with sophisticated analytics mine extensive datasets—which include news sources—to deliver pertinent insights on market trends that refine these tailored strategies even further.

Financial advisors can leverage these AI-driven insights to provide more personalized and efficient 为客户提供服务, enhancing the overall advisory process.

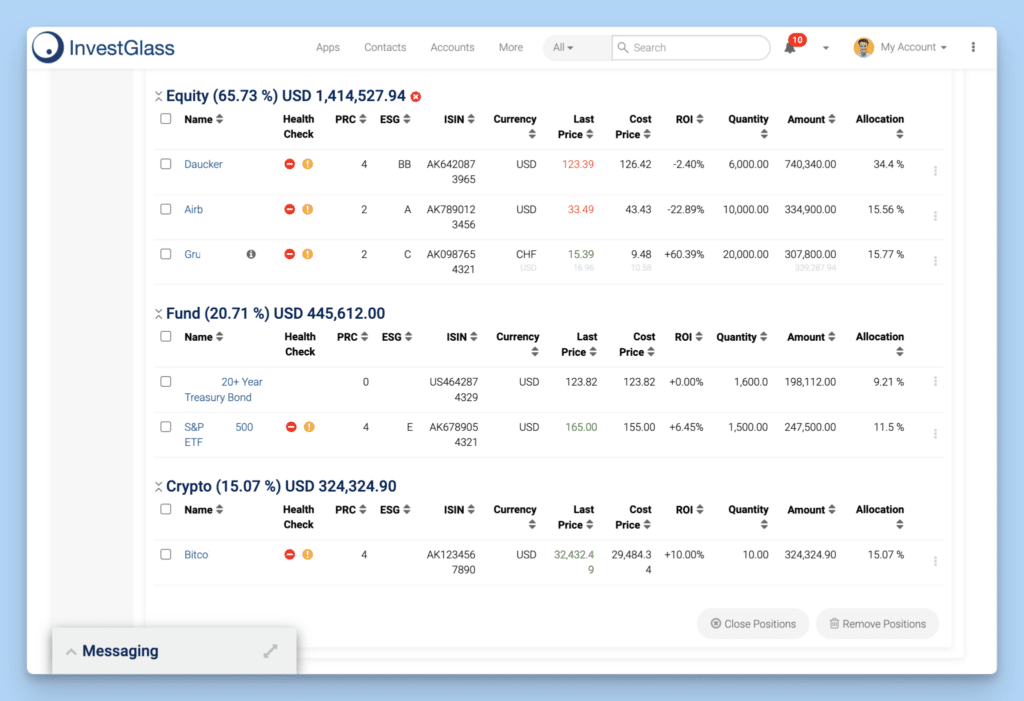

Rather than supplanting existing tools within the industry, AI blends effortlessly into traditional methods, enhancing cooperation across platforms used for wealth management tasks like examining asset distributions or rendering strategic recommendations—thus optimizing processes involved in investments while conservatively allocating investor time.

Such advances are mirrored in forecasts predicting growth in Global Assets under Management (AuM), bolstered by increased adoption of Ai-driven decision-making across various stages of investing—from strategy development to elevating operational efficacy—and ultimately fostering better engagement between clients and financial services providers.

How AI Works in Portfolio Management

AI works in portfolio management by analyzing vast amounts of data, identifying patterns, and making predictions about market trends and asset performance. Machine learning algorithms are trained on historical data to develop predictive models that can forecast future market movements. These models are then used to optimize asset allocation, ensuring that investments are strategically distributed to maximize returns and minimize risks. AI can also automate tasks such as data analysis, risk assessment, and portfolio rebalancing, freeing up portfolio managers to focus on high-level strategic decisions. By continuously monitoring market conditions and adjusting portfolios in real-time, AI ensures that investment strategies remain aligned with the investor’s goals and the ever-changing financial landscape.

Key Differences: Traditional vs. AI-Driven Portfolio Management

Artificial intelligence has revolutionized the field of portfolio management by transitioning from conventional methods driven by human analysis to a cutting-edge approach centered on data analytics. Whereas traditional investment strategies have historically relied on human discernment and past data, which can lead to slower responses and inherent biases, AI-enhanced portfolio management leverages sophisticated algorithms alongside real-time data analysis for more rapid decision-making processes.

These AI-driven models are exceptional at sifting through vast quantities of data and identifying trends that might be missed using conventional techniques. They enable automated trade execution with minimal delay in response to market fluctuations—a stark contrast to the more sluggish manual interventions traditionally employed.

When it comes to rebalancing portfolios, artificial intelligence streamlines the process of modifying asset allocation. This ensures greater efficiency in keeping investment portfolios properly attuned to predefined investment objectives.

The Role of AI Across Various Portfolio Management Styles

The function of AI in portfolio management is diverse, offering improvements to different investment strategies by employing advanced algorithms and analyzing data in real time. It delivers specific advantages suited to each approach, be it active, passive or quantitative management of portfolios.

Active Portfolio Management

In the realm of active portfolio management, the role of AI is crucial for quickly conducting trades that align with market sentiment and gleaned insights from data. Financial advisors can utilize AI to quickly conduct trades and provide timely advice, significantly influencing the success of their portfolios. The swift and precise nature of these executions allows managers to take advantage of evolving market trends swiftly, which in turn can significantly influence the success of their portfolios. By continuously processing vast quantities of market data, AI-powered analytics support rapid trading activities and decision-making processes, a particularly advantageous feature during times when markets are unstable.

Hedge funds powered by AI have the capability to sift through copious amounts of information at an accelerated pace while simultaneously circumventing human cognitive biases. Such advanced tools bolster equity research efficiency by automating routine data gathering tasks. This enables analysts to devote their attention to more significant analytical findings.

The enhanced operational proficiency brought about by these tools gives active credit managers a superior edge in dealing with large-scale shifts in financial information. They assist them effectively pinpoint potential investment avenues amidst a sea of ever-changing economic indicators.

Passive Portfolio Management

AI enhances passive portfolio management by automating the process of aligning asset allocation with benchmark indices. This ensures that portfolios consistently adhere to investment objectives, diminishing the frequency of manual interventions and cutting down on transaction costs. AI-driven investment management techniques ensure that portfolios consistently adhere to investment objectives, reducing the need for manual interventions. Through AI, passive portfolio managers can effectively oversee substantial volumes of investments while keeping portfolios in equilibrium and in line with market standards.

For both institutional and individual investors, the effectiveness offered by AI-driven methods is invaluable in managing passive strategies. It permits portfolio managers to delegate mundane tasks to technology, thereby concentrating their efforts on strategic planning geared towards long-term investment ambitions.

The incorporation of AI into these strategies elevates overall portfolio performance and offers a more uniformed and reliable method for investing.

Quantitative Portfolio Management

Within the realm of quantitative portfolio management, AI significantly bolsters trading tactics by sifting through voluminous data to enhance predictions regarding performance. This technology enables managers specializing in quant strategies to craft more potent investment plans by employing historical data for backtesting and re-creating past financial market environments. These advancements in AI-driven investment management enable more potent investment plans by employing historical data for backtesting and scenario analysis. By running a gamut of scenarios during backtesting, AI delivers richer insights into how these strategies might perform, thereby honing them further.

Employing AI for such rigorous backtesting paves the way for crafting sophisticated quantitative trading methodologies that translate into improved investment results. By emulating previous market conditions, it aids quantitative experts in uncovering trends and patterns that could elude conventional analysis techniques.

This cutting-edge method elevates portfolio management to new heights. Ensuring that all formulated investment strategies are thoroughly grounded in data. Consequently, they stand equipped to outperform across diverse financial markets with a higher caliber of resilience and efficacy.

Benefits of Implementing AI in Portfolio Management

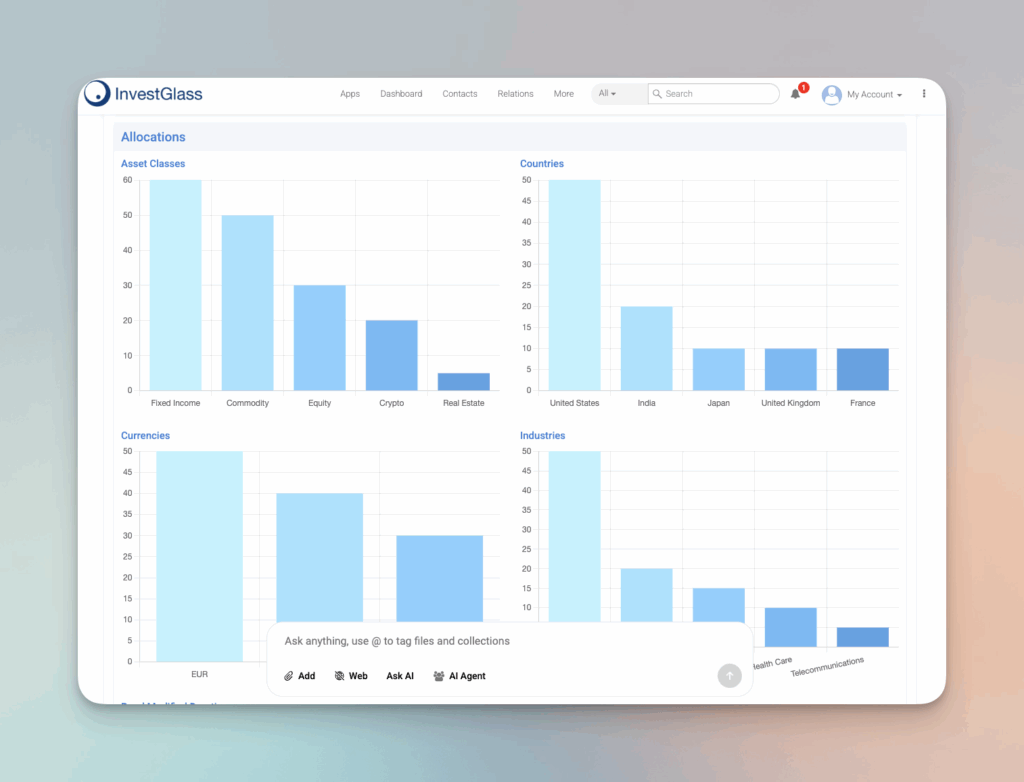

Incorporating AI into portfolio management significantly improves the process of managing investments by boosting both efficiency and personalization. Investors benefit from AI tools as they adeptly navigate extensive market data, resulting in enhanced precision and swiftness in investment decisions. By utilizing automated strategies, AI augments risk evaluations and hones asset distribution, culminating in more favorable investment returns.

Advanced AI models are instrumental for traders seeking to reduce transaction costs via streamlined trade executions. These models conduct thorough stress analyses on portfolios to determine their durability under a variety of economic conditions, ensuring that investor goals remain congruent with evolving market dynamics. Such perpetual oversight and adaptation is vital for sustaining robust portfolio performance amidst fluctuating markets.

AI also excels at scaling compared to traditional methods of portfolio management – it capably manages vast numbers of investments with greater efficacy. Integrating AI facilitates swift examination of substantial data sets, considerably improving decision-making processes within the realm of portfolio management. The heightened capacity for analyzing financial information coupled with real-time decision-making firmly establishes AI as an essential tool for contemporary portfolio managers looking to optimize outcomes.

AI and Investment Goals

AI can help investors achieve their investment goals by providing personalized investment advice and optimizing portfolio performance. AI-powered portfolio management systems analyze an investor’s risk tolerance, investment horizon, and financial goals to create a customized investment strategy. These systems continuously monitor the portfolio and make adjustments as needed to ensure it remains aligned with the investor’s objectives. By leveraging AI, investors can benefit from tailored advice that takes into account their unique financial situation, leading to more effective and efficient investment strategies. This personalized approach not only enhances portfolio performance but also provides peace of mind, knowing that investments are being managed in accordance with individual goals and risk tolerance.

Selecting the Right AI Models for Your Investment Strategy

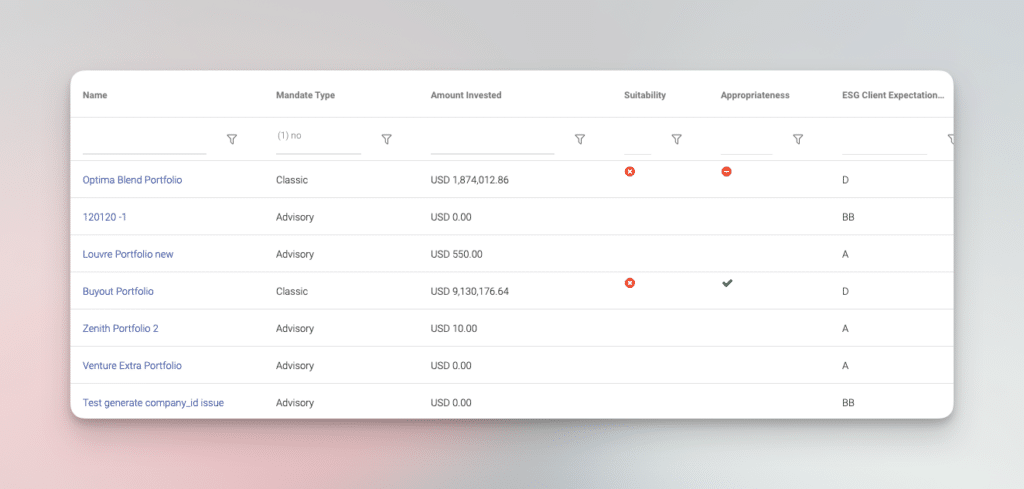

Establishing precise investment objectives is crucial as it steers the selection of appropriate AI models to align with your chosen investment strategy, dictating both the requisite features and data inputs. Prioritizing clarity in goals before incorporating AI ensures that the integration process not only runs smoothly, but also resonates with investor preferences.

To construct resilient AI models capable of providing sound investment recommendations, access to high-quality and varied data sources is indispensable. These models must reflect market complexities accurately. Continuous reliability checks through backtesting against historical performance can highlight potential areas for model enhancement.

Leveraging AI-driven analytics becomes instrumental in pinpointing potential risks while suggesting modifications tailored to an investor’s strategies—ones that are compatible with their financial aspirations. Customized guidance derived from analyzing previous investments empowers these intelligent systems to refine and improve overall investment decision-making processes and outcomes.

Integrating AI Tools into Existing Investment Frameworks

Incorporating AI tools into existing investment strategies demands meticulous consideration for data protection and accuracy to reduce risks. Establishing uninterrupted links between AI models and present systems prevents the formation of isolated data pools, guaranteeing a consistent flow of information. It’s crucial to approach the incorporation of AI as an evolving procedure that can be fine-tuned based on outcomes and feedback.

AI significantly improves the research process by swiftly navigating through vast quantities of data to extract meaningful insights. The adoption of AI instruments enables investment managers to apply sophisticated analytics for better decision-making processes, refining asset allocation, and boosting portfolio performance.

Such integration heightens operational efficiency while ensuring that investment approaches are grounded in solid data analysis and tailored to meet investor goals.

Automating Portfolio Rebalancing with AI Systems

AI technologies keep a constant vigil on the performance of assets, identifying when it’s necessary to make tweaks to preserve an ideal balance in the portfolio. This AI-led automation in trading substantially diminishes hands-on tasks, which cuts down both transaction fees and operational expenses for investors as well as investment firms. Thanks to sophisticated algorithms, AI has the capability to rapidly sift through vast amounts of market data and make adjustments to investment portfolios in real time.

By employing AI for automating the rebalancing process, it ensures that portfolios stay attuned not only with set investment objectives but also adapt fluidly with changing market scenarios. Such a proactive stance elevates efficiency and precision within portfolio management practices while delivering tailored advice on investments and perfecting asset allocation strategies. The intervention by AI minimizes reliance on manual modifications thus empowering portfolio managers with more time for concentrating on higher-level strategic planning focused towards achieving enduring investment ambitions.

Enhancing Risk Management with AI-Driven Analytics

AI bolsters risk management by perpetually analyzing the fluctuations of market trends and offering timely strategic updates to safeguard investments. Unlike traditional risk management practices that depend on fixed models, AI constantly evolves in response to shifts in market conditions, which reduces reliance on human judgment and elevates precision. Through vigilant oversight of these conditions and refining asset allocation correspondingly, AI tools aid in reducing potential hazards and fortifying portfolio endurance.

Utilizing machine learning algorithms, AI systems are adept at forecasting financial troubles by sifting through historical data from past economic slumps. AI enriches diversification efforts by calibrating the spread of assets across diverse industries thereby diluting volatility-related risks and amplifying portfolio outcomes. Advanced analytics powered by AI deliver profound insights into prevailing market inclinations as well as exposure to risks. This arms investment managers with critical information that enhances decision-making capabilities for more robust risk management approaches.

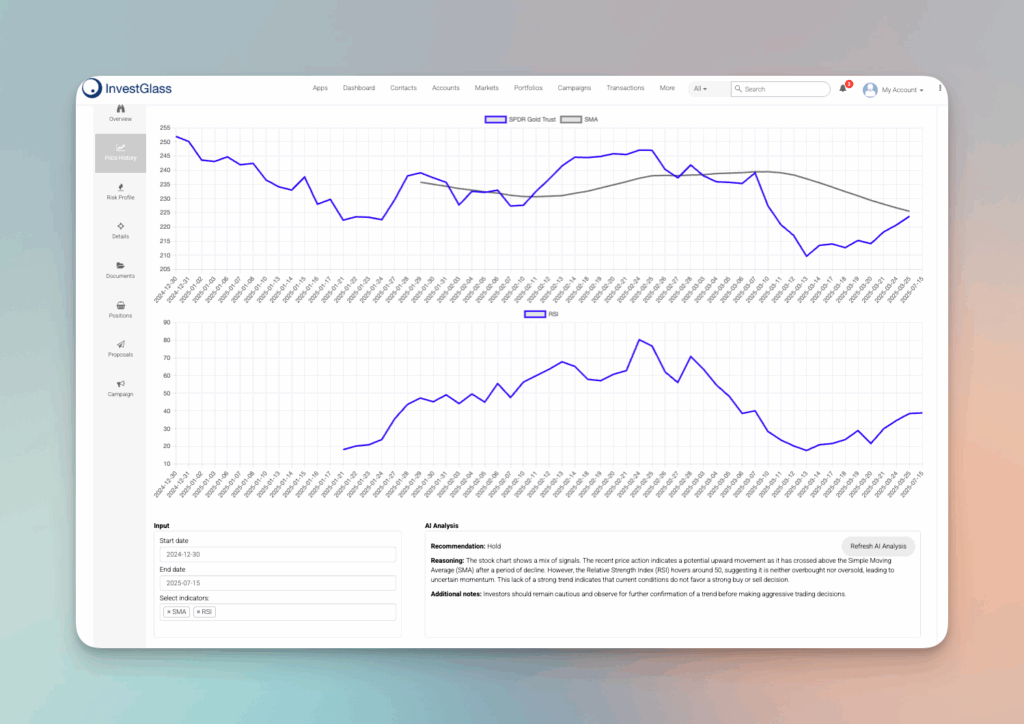

Leveraging AI for Predictive Market Analysis

Machine learning and natural language processing are integral in dissecting financial information to anticipate market shifts. Predictive models harness past data, utilizing statistical techniques and machine learning algorithms for precise forecasting. Natural language processing scrutinizes unstructured sources such as social media discourse and consumer feedback, deriving valuable knowledge that bolsters predictive analytics.

Through enhancing the preprocessing of data, NLP elevates the caliber of input resulting in improved predictions by predictive models. Tools based on natural language processing capture mood indicators from business communications that shed light on possible market movements. These insights assist investment managers in maintaining a lead over impending market changes.

Employing AI for foresightful analysis of markets yields a strategic edge while offering profound understanding crucial to shaping investment strategies and advancing portfolio outcomes.

Institutional Investors and AI

Institutional investors, such as pension funds and endowments, can benefit significantly from AI-powered portfolio management by improving their investment processes and reducing costs. AI can help institutional investors optimize their asset allocation, identify potential risks, and make informed investment decisions. By leveraging advanced data analytics and predictive modeling, AI provides institutional investors with the tools needed to navigate complex financial markets effectively. AI-powered portfolio management systems also offer real-time monitoring and reporting capabilities, enabling institutional investors to make data-driven decisions quickly and efficiently. This not only enhances the overall performance of their investment portfolios but also ensures that they remain aligned with their long-term financial objectives.

Investment Managers and AI

Investment managers can leverage AI to enhance their investment strategies and improve portfolio performance. AI-powered portfolio management systems provide investment managers with predictive analytics, risk assessment, and portfolio optimization tools. These advanced tools enable managers to make more informed and timely investment decisions, ultimately leading to better outcomes for their clients. AI can also automate tasks such as data analysis and portfolio rebalancing, freeing up investment managers to focus on high-level strategic decisions. Additionally, AI helps investment managers provide personalized investment advice to their clients, improving the overall investment experience. By integrating AI into their practices, investment managers can stay ahead of market trends and deliver superior results, ensuring that their clients’ financial goals are met.

Case Studies: Success Stories of AI in Portfolio Management

A prominent financial institution has incorporated artificial intelligence into its analytics to advance their portfolio management, achieving a remarkable 30% uptick in investment returns. The application of AI technology enabled the firm to sharpen its investment strategies, bolster forecasting accuracy, and expedite decision-making processes that exceeded market expectations.

In another instance of successful implementation, an international asset management enterprise introduced AI systems for streamlining risk evaluation procedures. This move significantly amplified operational efficiency and curtailed errors attributable to human oversight within their portfolio determinations.

Looking ahead, the integration of AI in portfolio management is set to break down existing hurdles for investors by offering widespread access to complex investment strategies. These examples underscore the profound influence of AI on managing portfolios — from elevating return rates on investments and enhancing procedural efficiencies to delivering tailored guidance for individual investor needs.

摘要

To summarize, AI is transforming the realm of portfolio management by advancing investment tactics, refining asset distribution, and fortifying risk management practices. Conventional techniques are giving way to methodologies informed by data that bring heightened efficacy, precision, and expandability. The capacity of AI for tailoring investment guidance, streamlining procedural tasks, and delivering profound insights into market fluctuations renders it an essential instrument for contemporary portfolio managers.

Looking forward to what lies ahead in the field of portfolio management underscores the vast promise held by AI technology. Investment managers who incorporate these technologies will likely remain at the forefront of their industry through judicious decision-making that bolsters both the robustness and outcomes of portfolios. Integrating AI within investment frameworks not only broadens access to advanced analytical tools, but also instills a higher level of trust and exactitude among investors pursuing their economic objectives.

常见问题

What are the main benefits of using AI in portfolio management?

The main benefits of using AI in portfolio management include improved investment accuracy, increased efficiency, and enhanced customization, resulting in better outcomes and reduced transaction costs.

Embracing AI can significantly elevate your investment strategy.

How does AI differ from traditional portfolio management methods?

AI differs from traditional portfolio management by leveraging advanced algorithms and real-time analytics for quicker decision-making while minimizing human biases.

This results in a more efficient and objective investment strategy.

Can AI be integrated into existing investment frameworks?

AI can indeed be integrated into existing investment frameworks, significantly improving research processes and enhancing data security and quality.

This integration can provide a competitive edge in investment strategies.

How does AI improve risk management in portfolio management?

By continuously assessing market fluctuations and modifying asset distributions, AI substantially improves risk management within portfolio management. This minimizes the potential for human error and promotes better diversification.

Such a forward-looking strategy enables more accurate forecasting of possible financial challenges.

What are some real-world success stories of AI in portfolio management?

AI has notably enhanced investment returns and operational efficiency in portfolio management for major financial firms and asset management companies through advanced analytics and risk assessment systems.

This demonstrates the powerful impact of AI technology on financial decision-making.