What is identity verification and how does it work?

Identity verification, or “ID verification,” has become an essential process in today’s digital world. From financial institutions to online services, verifying users’ identities is crucial for maintaining security and preventing fraud. The global identity verification market was valued at USD 10.45 billion in 2023 and is projected to reach USD 39.82 billion by 2032, growing at a compound annual growth rate (CAGR) of 16.2% during this period.

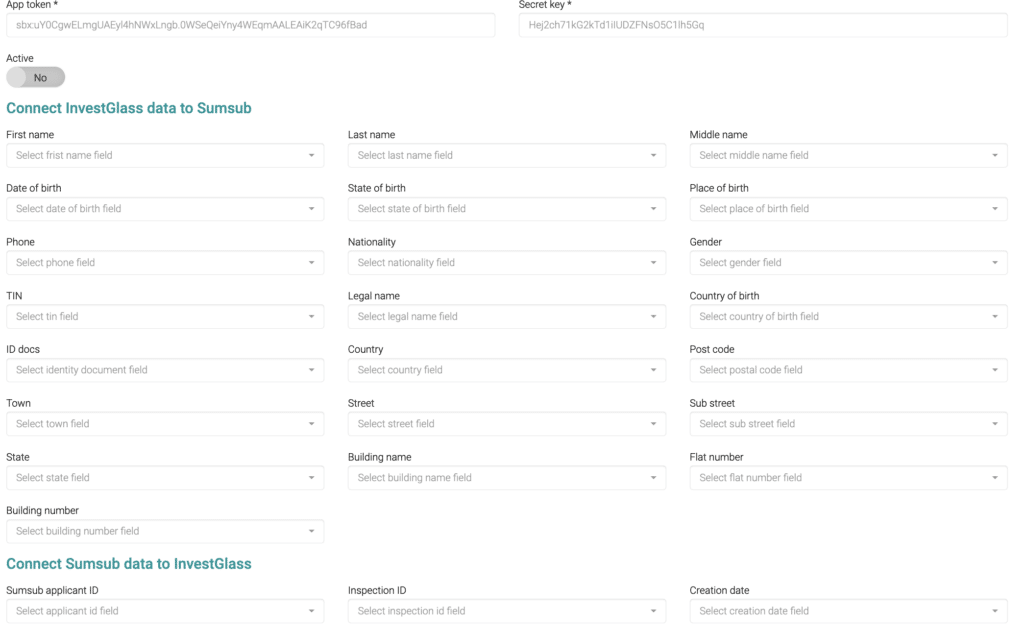

The connectivity between Sumsub and InvestGlass offers a unique approach to help financial institutions, insurance, and gaming company to identify individuals and identity theft. InvestGlass is #1 Swiss Sovereign CRM to offer this type of connectivity.

Why ID Verification and biometric verification processes

ID Verification is a security measure used to verify a person’s claimed identity, typically for account opening or for gaining access to specific services. This may involve asking for knowledge-based authentication, such as a single-use passcode sent to a phone number or verifying an electronic signature. It may also include biometric verification methods like facial recognition or liveness detection. With rising concerns about identity theft and identity fraud, ID verification has become an integral part of most online processes, from bank account opening to signing in to online banking.

As of my knowledge cut-off in September 2021, there was no specific “European Biometric Verification Regulation”. Biometric data processing, however, is covered under the General Data Protection Regulation (GDPR) in the European Union. The GDPR treats biometric data as a “special category of personal data” that has more stringent protections.

The use of biometric data is generally prohibited unless the individual has given explicit consent, or if it is necessary for reasons of substantial public interest, for preventive or occupational medicine, for the assessment of the working capacity of an employee, medical diagnosis, the provision of health or social care or treatment, or the management of health or social care systems and services, or under contract with a health professional.

For biometric data to be legally processed for these purposes, stringent criteria must be met, including employing the highest standards of security to prevent unauthorised access, ensuring data minimisation principles are adhered to, and that processing is transparent and fair.

If there have been any updates or new regulations post my last training data in September 2021, I recommend checking the latest resources or official EU websites for the most accurate and up-to-date information.

Identity Verification and digital onboarding

Identity verification goes a step further than simply checking an ID. It involves using a trusted identity network, verified data, and other means to verify an individual’s identity beyond doubt. This can involve checking the individual’s government ID, like a driver’s license, against a verified data set, or using knowledge-based authentication to confirm identity. Identity verification is especially critical in financial sectors where customer identification program (CIP).

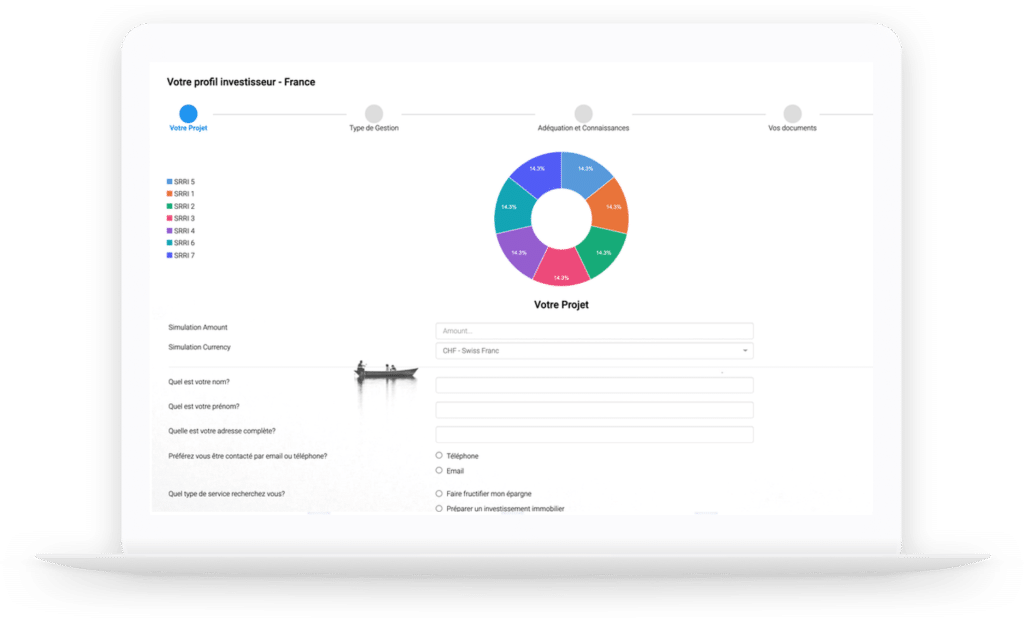

InvestGlass offer a no-code digital onboarding solution. The entire process is completed online, allowing customers to onboard and verify their identities from the comfort of their own homes or offices. InvestGlass’s platform ensures data security and privacy throughout the process, using encryption and other security measures to protect customer data.

Digital Identity Verification

Digital identity verification takes this process online, allowing individuals to verify their identity without physical contact or in-person visits. Using a blend of artificial intelligence and machine learning, digital identity verification solutions can quickly and accurately verify identity, offering a seamless customer experience while also providing robust security and fraud prevention.

Companies like InvestGlass and SumSub provide digital identity verification services that can quickly and accurately verify identity. These companies use advanced techniques like facial recognition and machine learning algorithms to verify a person’s identity online, adding another layer of security to the online process.

Identity Verification automation

The identity verification process often begins with a user creating a new account online or initiating a transaction that requires a verified identity. The user may be asked to provide an ID document for document verification, such as a passport or driver’s license, and possibly a selfie for biometric verification.

These identity documents are then checked for visible security features and matched against various databases for verification purposes. Additionally, the user may be required to pass knowledge-based authentication, for example, by answering personal questions or entering a one-time passcode sent to their phone.

InvestGlass offers digital forms which help you to verify your identity and get the identity document data to send to Sumsub. As InvestGlass can be hosted on your server – on-premise – InvestGlass can satisfy any financial institution’s security framework. This is effective to reduce money laundering thanks to liveness detection.

InvestGlass CRM is fully flexible and will adapt to your existing KYC process. To prevent fraud, you can leverage InvestGlass automation. Both artificial intelligence from InvestGlass and Sumsub are key tools to fight fraud.

Identity Documents and Identity Online Process

Identity documents, often required in the ID verification process, include government-issued IDs like passports, driver’s licenses, or social security cards. These documents come with built-in visible security features, which are verified during the ID document verification stage. In some cases, additional forms of ID document verification like biometric verification are used to further ensure the validity of these documents.

The use of InvestGlass and SumSub in the digital identity verification process enables financial institutions and other entities to conduct a more thorough and secure ID check. By incorporating technologies like machine learning, artificial intelligence, and facial recognition, these platforms can more accurately verify identities, detect and prevent fraud, streamline the onboarding process, and improve the customer experience.

This is particularly important in an era where data breaches, identity fraud, and financial crimes are increasingly common. By implementing robust digital identity verification solutions, businesses can enhance their security, reduce customer risk, and comply with regulations such as the anti-money laundering (AML) and Know Your Customer (KYC) process, all while delivering a streamlined, user-friendly experience for their customers.

In conclusion, digital identity verification, particularly when supported by sophisticated platforms like InvestGlass and SumSub, is a powerful tool in the fight against identity fraud. It enhances security, ensures compliance, and provides a seamless, secure online experience for users.