CRM for Traders and Trading Companies : What should you expect?

In the fast-paced world of trading and brokerage, having the right tools can be the difference between missed opportunities and success. To stay ahead of the curve, brokers and traders need more than just intuition—they need a friendly and powerful solution that integrates CRM, PMS, and cutting-edge trading tools all in one place. Enter InvestGlass, the sovereign Swiss CRM that blends seamlessly with portfolio management systems (PMS) and top trading platforms, providing an all-in-one suite designed to truly empower financial professionals. Whether you’re a trader managing your own portfolio or a broker supporting multiple clients, InvestGlass is here to help. It delivers the essential features you need to streamline operations, build stronger client relationships, and make informed decisions with confidence.

In this post, we’ll dive into how InvestGlass, combined with trading tools, is making life easier for brokers and traders, providing a secure, intuitive, and comprehensive environment that’s designed to meet your every need and help you thrive.

How the CRM and AI will automate your KYC?

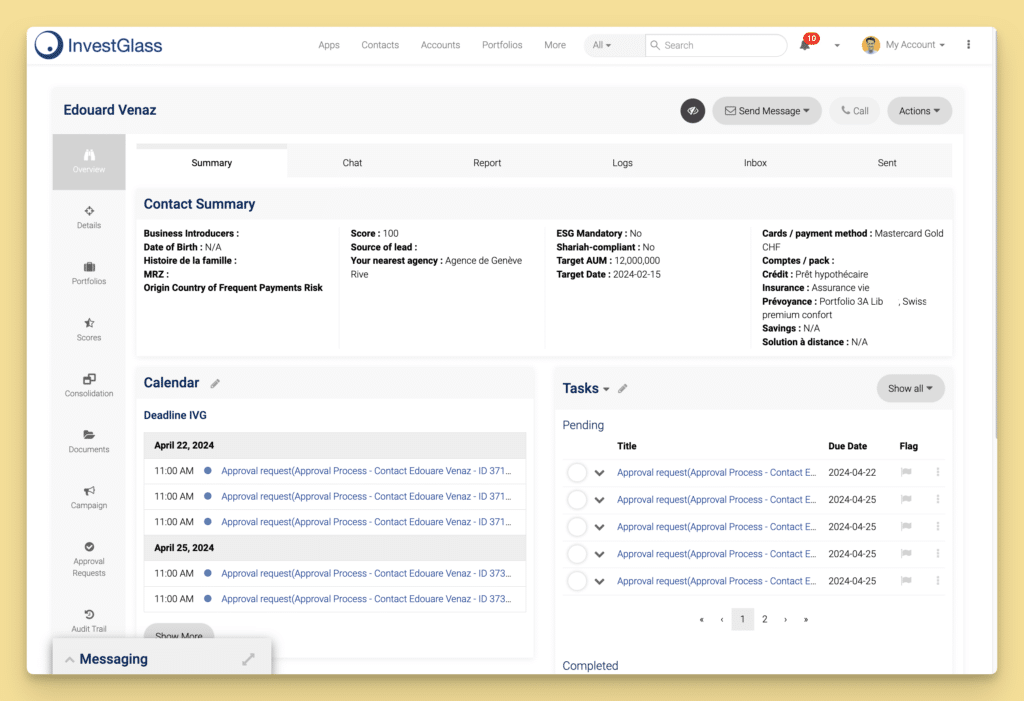

InvestGlass offers a powerful solution for KYC control and seamless account opening through its robust CRM tools. By integrating an advanced approval process, InvestGlass ensures compliance and efficiency in managing client onboarding. Automation capabilities streamline repetitive tasks, such as document verification and data entry, reducing errors and saving valuable time. Additionally, the incorporation of GPT-based Large Language Models (LLMs) enhances decision-making by providing AI-driven insights and responses, enabling faster and more accurate customer interactions. This combination of automation, AI, and compliance-focused tools positions InvestGlass as an essential platform for financial institutions aiming to optimize their KYC processes while adhering to regulatory standards.

How the CRM Reporting Module Benefits Traders and Trading Companies

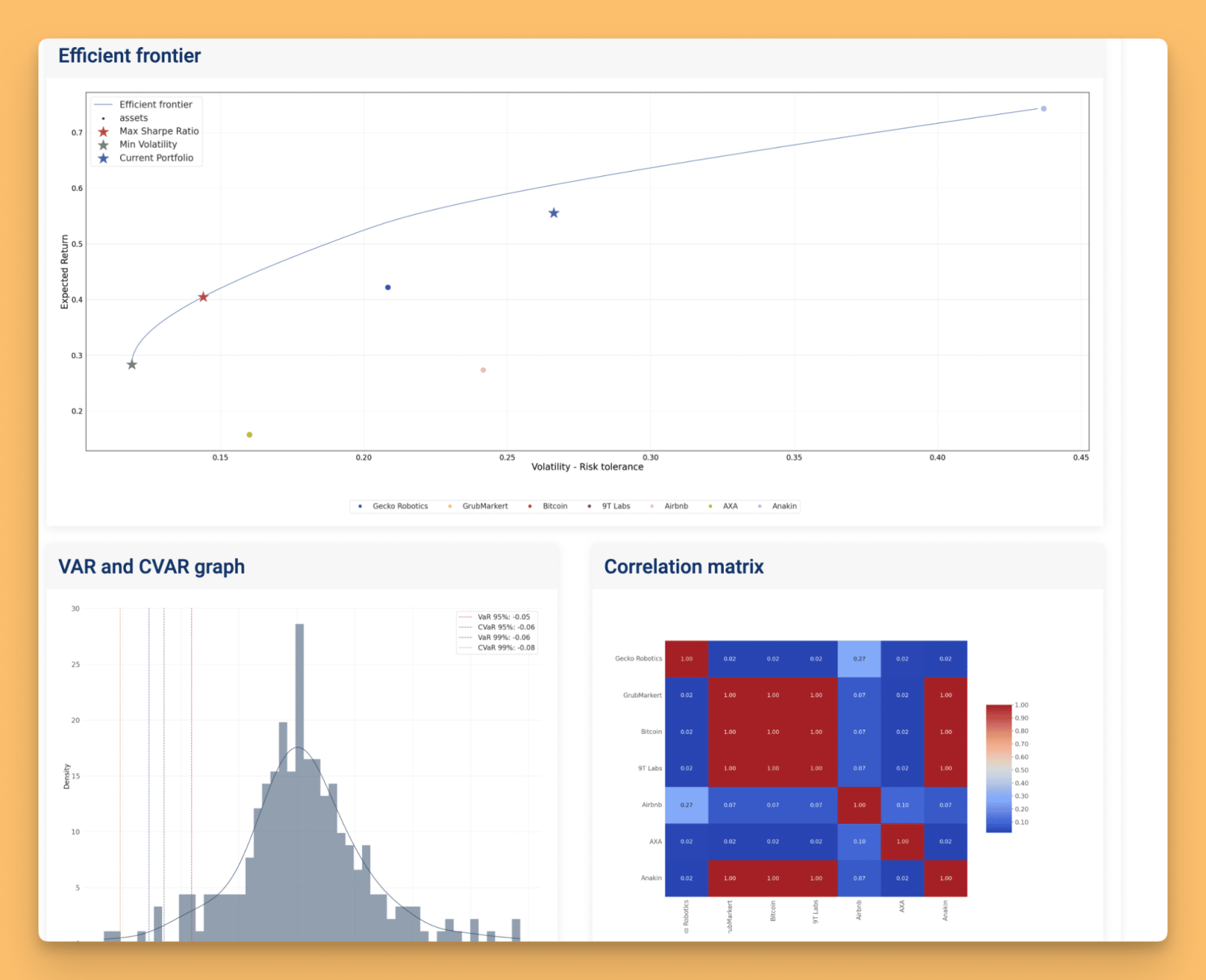

The CRM reporting module provides significant advantages to traders and trading companies by transforming complex data into comprehensible insights. Traders are accustomed to analyzing graphs and identifying trends, and the CRM’s reporting capabilities align perfectly with these needs. Here’s how it benefits them:

- Trend Identification and Analysis

Traders thrive on identifying market trends quickly. The CRM’s reporting module offers dynamic graphing tools that simplify this process, allowing traders to swiftly spot developing trends and make informed decisions. - Customizable Data Fields

One of the standout features of a CRM is its ability to create custom fields at various levels, such as contact, task, and deal. This customisation enables traders to tailor reports to their specific needs, pulling in virtually any data point to construct meaningful analyses. - Enhanced Decision-Making

By providing access to detailed and customisable reports, traders can make more informed decisions. The ability to visualize data in a tailored format ensures that traders are equipped with the right information to strategies effectively. - Efficient Data Management

The CRM reporting module helps streamline data management processes. Traders can organize and access vast amounts of data with ease, reducing the time spent on data entry and allowing more focus on trading activities.

These features collectively enhance the efficiency and accuracy of trading operations, making the CRM reporting module an invaluable tool for traders and trading companies alike.

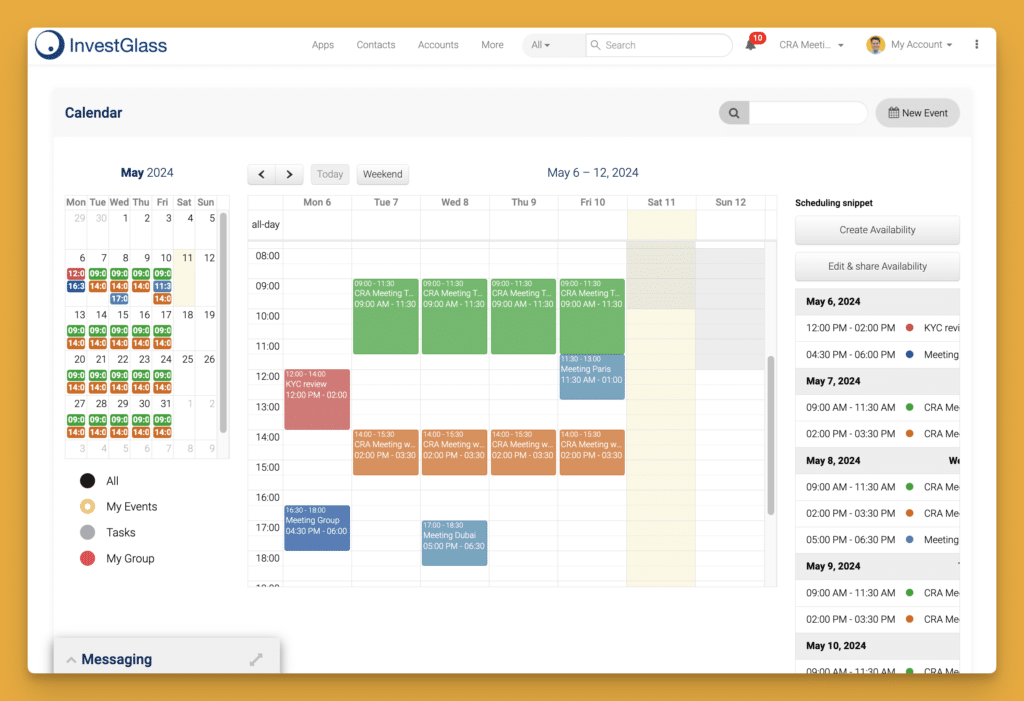

Benefits of Syncing Your CRM with Calendar Tools for Traders

Syncing your CRM with calendar tools like Outlook or Google Calendar can revolutionise how you manage your trading activities. Here’s why:

- Streamlined Scheduling: Integrating your calendar with your CRM lets you seamlessly plan meetings, calls, and trading sessions. Whether you’re coordinating with team members or setting personal reminders, everything is in one place, reducing the risk of double-booking or missed opportunities.

- Effortless Coordination: You can send invites, update schedules, or cancel appointments with just a few clicks. The ability to manage events both singularly and in bulk saves valuable time, ensuring you’re always on top of your schedule.

- Real-Time Updates: With two-way synchronization, any changes made on your calendar or within your CRM are updated across both platforms. This ensures that any adjustments to your trading timetable are instantly accessible, whether you’re in the office or on the go.

- Comprehensive View: By combining calendar data with your CRM, you gain a holistic view of your trading activities alongside client interactions. This consolidation aids in planning your day more effectively, balancing administrative tasks with actual market engagement.

- Flexibility and Adaptability: Having the ability to update your schedule from anywhere facilitates a more responsive approach to time management, keeping your trading operations flexible and adaptable to market changes.

How Can a CRM Be Used for Contact Management in Trading?

Efficient contact management is crucial for professionals in the trading industry. Utilizing a Customer Relationship Management (CRM) system can revolutionise how you organize and interact with your contacts.

Here’s how:

1. Unified Communication Channels

Navigating through various messengers, chats, emails, and texts can be daunting. A robust CRM integrates all these communication platforms, ensuring all your interactions are synchronized and easily accessible from a single interface. This consolidation enhances efficiency and reduces the time spent switching between apps.

2. Enriching Contact Profiles

Advanced CRM systems have the capability to automatically gather information from diverse online sources. This feature allows you to build comprehensive profiles of clients and colleagues. By collecting and integrating data from emails, social media, and third-party applications, the CRM fills in contact details, ensuring you have a full picture of the person even before the first direct communication.

3. Seamless Integration with Trading Tools

Many CRMs can be integrated with existing trading tools and platforms. This integration allows for a streamlined workflow where contact management is effortlessly linked with trading activities. Trading professionals can keep track of all interactions with clients while simultaneously monitoring market activities and executing trades.

4. Advanced Search and Filter Options

Searching for specific contacts or segments becomes a breeze with comprehensive search and filter features. You can easily locate contacts based on various criteria such as past interactions, trading history, or bespoke tags, making personalized communication and follow-up a seamless process.

5. Automation and Task Management

CRMs come equipped with task management and automation capabilities. Traders can set reminders for follow-ups, automate routine communications, and manage their schedules efficiently. This ensures no important meetings or communications fall through the cracks.

In summary, a CRM tailored for trading not only streamlines contact management by unifying communication channels and enriching contact details but also boosts productivity through integration, advanced search capabilities, and automation features.

How the CRM Reporting Module Benefits Traders and Trading Companies

The CRM reporting module provides significant advantages to traders and trading companies by transforming complex data into comprehensible insights. Traders are accustomed to analyzing graphs and identifying trends, and the CRM’s reporting capabilities align perfectly with these needs. Here’s how it benefits them:

- Trend Identification and Analysis

Traders thrive on identifying market trends quickly. The CRM’s reporting module offers dynamic graphing tools that simplify this process, allowing traders to swiftly spot developing trends and make informed decisions. - Customizable Data Fields

One of the standout features of a CRM is its ability to create custom fields at various levels, such as contact, task, and deal. This customization enables traders to tailor reports to their specific needs, pulling in virtually any data point to construct meaningful analyses. - Enhanced Decision-Making

By providing access to detailed and customizable reports, traders can make more informed decisions. The ability to visualize data in a tailored format ensures that traders are equipped with the right information to strategize effectively. - Efficient Data Management

The CRM reporting module helps streamline data management processes. Traders can organize and access vast amounts of data with ease, reducing the time spent on data entry and allowing more focus on trading activities.

These features collectively enhance the efficiency and accuracy of trading operations, making the CRM reporting module an invaluable tool for traders and trading companies alike.

Benefits of Syncing Your CRM with Calendar Tools for Traders

Syncing your CRM with calendar tools like Outlook or Google Calendar can revolutionize how you manage your trading activities. Here’s why:

- Streamlined Scheduling: Integrating your calendar with your CRM lets you seamlessly plan meetings, calls, and trading sessions. Whether you’re coordinating with team members or setting personal reminders, everything is in one place, reducing the risk of double-booking or missed opportunities.

- Effortless Coordination: You can send invites, update schedules, or cancel appointments with just a few clicks. The ability to manage events both singularly and in bulk saves valuable time, ensuring you’re always on top of your schedule.

- Real-Time Updates: With two-way synchronization, any changes made on your calendar or within your CRM are updated across both platforms. This ensures that any adjustments to your trading timetable are instantly accessible, whether you’re in the office or on the go.

- Comprehensive View: By combining calendar data with your CRM, you gain a holistic view of your trading activities alongside client interactions. This consolidation aids in planning your day more effectively, balancing administrative tasks with actual market engagement.

- Flexibility and Adaptability: Having the ability to update your schedule from anywhere facilitates a more responsive approach to time management, keeping your trading operations flexible and adaptable to market changes.

Incorporating this level of synchronization into your routine not only enhances efficiency but also provides a competitive edge, allowing you to focus more on trading and less on logistics.

Thrive or Decline: The Role of Continuous Education for Traders

In the fast-paced world of trading, staying informed isn’t just beneficial—it’s essential. The ever-evolving financial landscape demands that traders constantly update their knowledge if they wish to remain relevant and successful. But why, exactly, is continuous education so crucial?

The Necessity of Constant Learning

Successful traders understand that trading isn’t just about numbers on a screen. It requires a deep understanding of global trends, industry movements, and the ripple effects of geopolitical events. Knowledge of new trading tools, financial regulations, and market insights can mean the difference between profit and loss. Therefore, learning must be perpetual.

Transform Knowledge into Profit

Every piece of information you acquire adds to your arsenal. The more you understand the intricacies of the market, the better equipped you are to make informed decisions that could translate into substantial gains. Continuous education ensures you’re always prepared to capitalize on opportunities as they arise.

Organize Your Learning with a CRM

Balancing a trading career with ongoing learning can be challenging. This is where Customer Relationship Management (CRM) systems shine. A robust CRM helps you streamline your schedule, ensuring that important educational sessions and updates are seamlessly integrated into your daily workflow.

- Schedule Management: Tools like Salesforce or Zoho CRM can help keep your calendar organized, making sure you never miss important training.

- Structured Learning Plans: With features to set goals and track progress, CRMs ensure your educational pursuits are consistent and measurable.

- Resource Organization: Store and categorize learning materials efficiently, allowing for quick access to information exactly when you need it.

In today’s fast-paced markets, traders who fail to evolve risk falling by the wayside. Embrace the power of continuous learning and leverage technology like CRM systems to keep your educational journey on track. In doing so, you secure your place among the trading elite, rather than fade into obsolescence.

How Can Traders Keep Their Dreams and Major Life Objectives in Focus Using a CRM?

In the fast-paced world of trading, especially for scalpers and day traders, every second counts. But how can you ensure your broader life goals don’t get lost amidst the hustle? Here’s how a CRM can help you prioritize your dreams and major life objectives:

- Schedule Time for Growth

Make use of your CRM’s calendar feature to allocate dedicated slots for activities that fuel personal growth. Be it education, hobbies, or family time, these are the moments that contribute to your overarching life goals. Treat them as vital appointments that shouldn’t be canceled. - Set Life Goals as Tasks

Use your CRM to create tasks for your life goals, just like you would for client meetings or trading deadlines. By marking these goals in your system, they become part of your everyday to-do list, ensuring they don’t fall by the wayside. - Integrate Personal Development

Sync your CRM with other productivity tools like Google Calendar or Microsoft Teams. This allows you to streamline your activities and ensure your life goals are integrated into your daily workflow, avoiding overlaps that could push them aside. - Regular Reminders

Leverage automated reminders within your CRM to keep you on track. Whether it’s a prompt to spend time on a hobby or a nudge to attend a family event, these reminders can help you maintain focus on what truly matters. - Analyze and Reflect

Use the reporting features in your CRM to evaluate how much time you’re spending on trading versus personal objectives. Regular reflection can help you adjust priorities and strategies to better align with your long-term goals. - Visualize Your Progress

Many CRMs offer visual dashboards that help track progress. Use these to your advantage not only for your trading achievements but also for your personal milestones, giving you a holistic view of your success.

By strategically using a CRM, you create a structured environment that values personal development as much as trading success, ensuring your dreams and major life objectives remain in focus.

Access to breaking news is crucial for traders because market dynamics can shift in an instant; even subtle events can result in significant financial changes. For example, a single unexpected comment by a major figure can send stock prices spiraling.

Why Breaking News Matters

Traders operate in a fast-paced environment where real-time information is key. Market sentiment and asset values can change in seconds, influenced by news on economic indicators, political developments, or sudden corporate announcements.

- React Quickly: Immediate access to news allows traders to make informed decisions, seize opportunities, and mitigate potential losses quickly.

- Stay Ahead: Having the latest updates keeps traders one step ahead of market trends, enabling them to strategize effectively.

- Risk Management: Understanding the news landscape helps traders identify potential risks and adjust their portfolios to protect their investments.

The tools can be connected with Factset, Bloomberg News, Morningstar and more… We usually see customers adding live TV inside the welcome page. We call it the App page.

Trusted Sources for Traders

To stay informed, traders rely on credible and timely news channels. Here are some of the most respected sources:

- Bloomberg: Known for comprehensive financial analysis and reports.

- Investing.com: Provides a wide array of market data and insights.

- Investopedia: Offers educational content alongside current market trends.

- The Wall Street Journal: A staple for in-depth financial news.

- The Financial Times: Offers a global perspective on market movements.

- CNBC: Known for its live updates and expert opinions.

- Reuters: Renowned for its accuracy and speed in reporting.

Staying plugged into these sources can equip traders with the knowledge and insights needed to navigate the complexities of the financial markets effectively.

What Are Some Popular Charting Software Options for Traders?

When it comes to charting software, traders have a wealth of options to choose from, each providing unique features to meet diverse needs. Here are a few noteworthy charting tools widely used in the trading community:

- Stock Rover: Praised for its comprehensive data analysis capabilities.

- StockCharts: Known for its user-friendly interface ideal for both beginners and experienced traders.

- CNN Money: Offers a variety of charting and financial tools to help traders stay informed.

- Robinhood: Provides free charts as part of its trading platform, making it accessible for entry-level traders.

- Reuters: Delivers advanced charting features coupled with reliable news updates, valuable for informed trading.

Each of these platforms offers various features that cater to specific trading styles and preferences, ensuring that traders can find the right tool to suit their needs.

What is Stock Scanning Software?

Stock scanning software, also known as stock screeners or stock scanners, is a vital tool for traders and investors. It helps sift through thousands of stocks on exchanges like the New York Stock Exchange (NYSE) and NASDAQ. This software aids in identifying stocks that meet specific criteria, whether you’re a novice or a seasoned trader. By analyzing vast amounts of market data, stock scanners provide insights to help determine which stocks could be promising investments.

Recommended Stock Scanning Tools

When it comes to choosing the right stock scanning software, there are several reputable options known for their reliability and powerful features. Here are some noteworthy tools:

- Trade Ideas: Known for its AI-driven insights, this tool is popular for its advanced scanning capabilities.

- TC2000: Offers robust technical analysis and a user-friendly interface, ideal for charting and screening.

- Benzinga Pro: Provides real-time news and alerts, making it a favored choice for active traders.

- Yahoo Finance: A comprehensive platform that includes market data, news, and stock screeners.

- Teletrader: Offers a wide range of analytics and tools for in-depth market research.

- TradingView: Renowned for its charting features and a vast library of user-generated screeners.

- Finviz Elite: Known for its impressive visualizations and comprehensive screening functionalities.

Choosing the right stock scanning software can make a significant difference in your trading strategy by efficiently narrowing down potential investment opportunities. InvestGlass API can be connected to any other APIs. Contact us if you need to make sure that it’s working fine with your favourite tools.

Conclusion – because time is money !

In a world where every second counts, InvestGlass is the partner that brokers and traders can rely on to succeed. By combining CRM, PMS, and direct integration with trading tools, InvestGlass takes the stress out of managing your workflow so you can focus on what truly matters—growing your business and nurturing client relationships. It’s about making your workday smoother, uncovering new growth opportunities, and empowering you to make informed, profitable decisions. With InvestGlass, you’re not just managing portfolios; you’re creating a future where financial services are more personal, efficient, and rewarding.

.