How Does ChatGPT Affects Banking?

In the era of artificial intelligence, the implementation of sophisticated language models like ChatGPT is having an extensive influence on various industries, including banking. The banking industry has always been a pioneer in leveraging technology to serve customers better and streamline operations. The introduction of AI and machine learning technologies have created opportunities to process vast amounts of data and enhance customer engagement.

Analyze Customer Data

Financial institutions are awash in customer data. This vast repository of information includes transaction data, customer behavior, and account balances, which can be effectively analyzed to identify patterns, understand consumer preferences, and make informed decisions. This data analysis capability is where ChatGPT’s artificial intelligence and massive database come in, driving efficiency and precision in understanding customers’ needs.

Moreover, the introduction of ChatGPT in banking aids in identifying potential risk factors, such as suspicious transactions that could signify potential fraud. AI can also help to identify potential compliance violations, assisting banks to avoid costly fines and data breaches.

Personalized Financial Advice

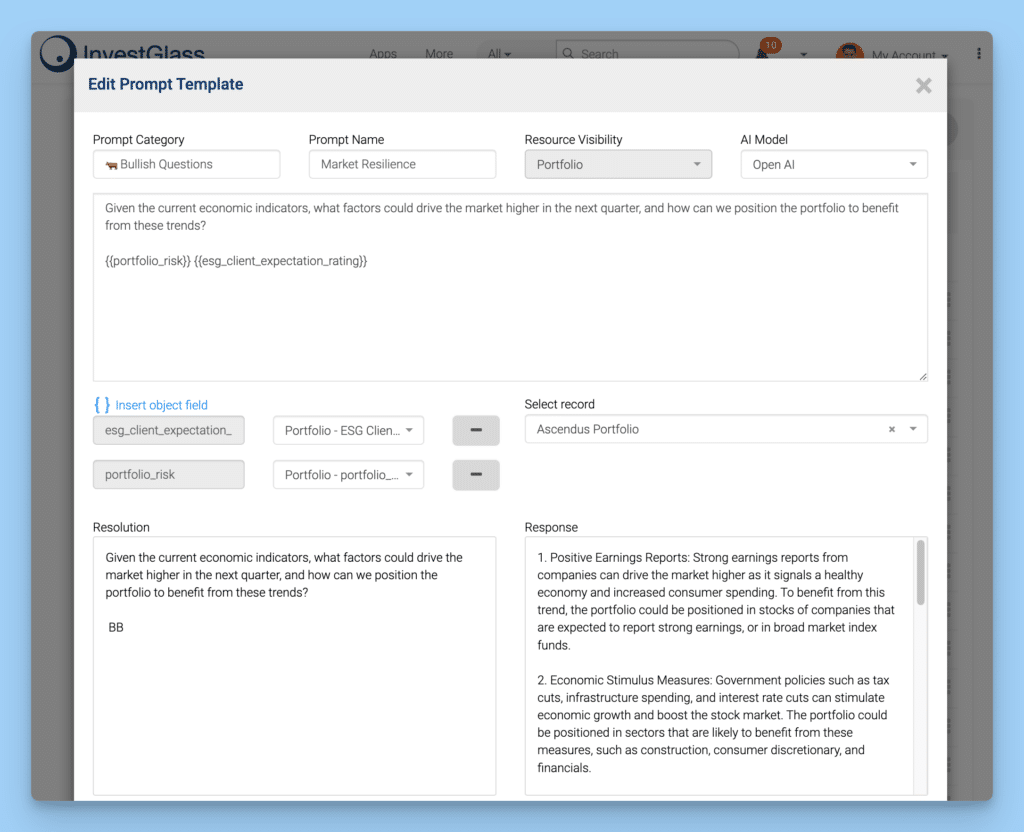

One remarkable attribute of ChatGPT is its capacity to provide personalized financial advice. Utilizing a combination of natural language processing and machine learning, it’s able to interpret customer queries, generate human-like responses, and offer tailored advice based on the customer’s risk tolerance and specific financial situation.

ChatGPT enables the development of personalized financial products and services, altering the existing business models in the banking industry. These AI-driven, personalized wealth management services can match and often exceed the quality of advice provided by human analysts, helping customers to make better-informed decisions.

Through the application of ChatGPT, banks can now provide personalized customer service on a large scale, while simultaneously managing potential risks.

Efficient Customer Service

In a world where the demand for instant, quality customer service is escalating, ChatGPT can be a game-changer. It allows financial institutions to offer streamlined customer processes and enhance customer satisfaction.

Chatbots and virtual assistants, powered by AI like ChatGPT, are equipped to handle routine tasks such as customer service inquiries and account balance inquiries. This relieves the workload on customer service representatives, allowing them to focus on more complex issues.

The use of these virtual assistants also helps to maintain ongoing operational costs and manage the increasing volume of customer inquiries, providing an efficient customer service system that not only enhances the customer experience but also optimizes operational processes within the banking industry.

Risk Management

Risk management is an integral part of the banking industry. ChatGPT aids in improving risk management by analyzing customer data to detect signs of potential risks and fraudulent activity. By monitoring bank transactions and identifying suspicious patterns, it contributes significantly to fraud detection, making it easier for human analysts to detect fraud.

This is particularly relevant in investment banking, where understanding market trends and managing potential risks are critical.

Final Thoughts

In essence, ChatGPT’s role in the banking industry is transformative. By leveraging generative language tools, it provides efficient customer service, personalized financial advice, and effective risk management. This allows banks not only to streamline operations but also to stay up-to-date in an increasingly competitive financial services industry.

However, like all technologies, AI comes with its potential pitfalls. To mitigate the potential for discriminatory or inaccurate outcomes, it’s crucial to continue refining these AI models, ensuring they are fair, accountable, and transparent. This way, the fintech and banking industry can maximize the benefits of ChatGPT while managing potential risks effectively.

For more information on how AI is shaping the banking industry, check out our comprehensive tools for sales, automation, marketing, and portfolio management.