Customized Portfolios in Wealth Management: Tailored Strategies for Financial Success

Want to know how customized portfolios in wealth management can help you achieve your financial goals? Customized portfolios are personalized investment strategies designed to fit your unique needs and risk tolerance. This article explores their benefits, how they are crafted, and why they are effective.

Key Takeaways

- Customized portfolios offer personalized investment strategies that directly align with individual financial goals, risk tolerance, and personal values.

- Wealth managers drive customized portfolios through structured portfolio management, continuous monitoring, and strategic adjustments.

- AI and big data enhance portfolio management with real-time monitoring, deep analysis, and data-driven decisions.

Understanding Customized Portfolios

Customized portfolios are not merely a collection of securities; they are a finely tuned financial instrument designed to address individual financial needs and goals. Unlike generic investment solutions, a customized portfolio takes a personalized approach, tailoring investments to reflect an individual’s unique circumstances, risk tolerance, and aspirations. This level of personalization ensures that each portfolio is closely aligned with the investor’s financial objectives and lifestyle, enhancing the overall effectiveness of the investment strategy.

Wealth managers often utilize separate accounts, which allow clients to own individual securities within their portfolio, providing more effective tax management. The journey to creating a customized portfolio begins with understanding the critical role played by wealth managers and the intricate portfolio management process. These professionals bring a wealth of expertise and insight, helping investors navigate the complexities of the financial markets while ensuring that their portfolios are optimized to meet specific financial goals.

The Role of Wealth Managers

Wealth managers design customized portfolios by aligning investment strategies with clients’ goals and risk tolerance. This alignment is crucial as it guides the investment journey, ensuring that strategies are appropriate and targeted.

Choosing a wealth manager requires evaluating their track record, qualifications, and experience. Ensuring that their investment philosophy matches your financial goals and risk tolerance is equally important. A wealth manager’s philosophy shapes decisions, requiring transparency for a successful partnership.

The Portfolio Management Process

Portfolio management ensures investments align with client goals through planning and adjustments. The use of separate accounts in this process allows for greater control over individual securities, enhancing tax efficiency and customization. This involves selecting appropriate asset classes that align with the client’s investment strategy and risk tolerance. Wealth managers collaborate with committees to optimize asset allocation for balanced investments.

Regularly monitoring portfolio performance maintains alignment with client goals and market conditions. This continuous evaluation allows for timely adjustments, ensuring that the portfolio remains responsive to economic shifts and evolving financial objectives. A disciplined portfolio management process helps clients achieve their investment goals with greater precision and confidence.

Benefits of Customized Portfolios

Customized portfolios align investments with individual financial goals and aspirations. These tailored solutions address distinct financial circumstances, enabling investors to achieve their financial objectives more effectively. Customized portfolios enhance investment performance and provide a sense of ownership by reflecting personal values and goals.

Benefits include personalized strategies, tailored risk management, and tax efficiency, ensuring purposeful investments aligned with financial goals.

Personalized Investment Strategies

Creating a personalized investment strategy involves a deep understanding of an investor’s goals, preferences, and risk tolerance. A customized portfolio aligns investments with individual financial goals for desired outcomes. This approach boosts goal achievement while ensuring a resilient, adaptable strategy.

Effective client service is a cornerstone of successful wealth management. Wealth managers need strong communication, responsiveness, and proactivity to provide personalized attention and effective investment strategies.

Enhanced Risk Management

Customized portfolios enhance risk management by aligning investments with individual risk preferences and time horizons. Custom portfolios align with an investor’s risk tolerance for appropriate, manageable risk. This tailored approach to risk management helps investors navigate market volatility with greater confidence and security.

Diversification is another key element of effective risk management. Customized portfolios mitigate risks and maximize potential returns by spreading investments across different asset classes and sectors. Tailored portfolios and diversification support long-term success and risk management.

Tax Efficiency

Customized portfolios offer significant tax efficiency by providing greater control over tax implications than pooled investments. Separate accounts enable direct security ownership, allowing strategic tax management and tax-loss harvesting to optimize after-tax returns.

This proactive approach aligns portfolios with financial goals, tax strategies, and risk tolerance, improving overall investment effectiveness.

The Power of AI in Building a Customized Portfolio

An Accenture study suggests AI could boost profitability by 38% by 2035. Wealth managers using AI-driven portfolio construction and personalized strategies can achieve better performance, client satisfaction, and efficiency.

AI enables customized portfolios tailored to financial goals, timelines, and objectives, ensuring flexibility to adapt to market shifts. By combining long-term planning with adaptability, investors can build resilient strategies.

AI optimizes asset allocation and personalization by analyzing real-time data and adjusting investments to align with goals and market trends. This integration streamlines management, boosting efficiency and optimizing outcomes.

Asset Allocation Techniques

Asset allocation is key to customized portfolios, balancing risk and return through strategic investment distribution. Advisors consider liquidity, income needs, time horizon, taxes, returns, and risk tolerance. This comprehensive approach ensures that the portfolio is well-suited to the investor’s unique financial situation.

Tactical and dynamic asset allocation adjust portfolios based on market conditions. Tactical allows short-term shifts to seize opportunities, while dynamic involves continuous adjustments to market changes, enhancing portfolio flexibility.

Selecting Asset Classes

Choosing asset classes is key to a customized portfolio, guided by investment goals and market conditions, whether for growth, income, or capital preservation. This alignment ensures that the investment strategy is tailored to meet the specific needs and expectations of the investor.

Market conditions play a crucial role in determining which asset classes are selected for a portfolio. By considering the current economic landscape and potential future trends, investors can make informed decisions about the composition of their portfolios and their purchasing power. This strategic selection of asset classes enhances the overall effectiveness and resilience of the investment strategy.

Leveraging Technology

The integration of advanced technologies, such as artificial intelligence (AI) and big data analytics, has revolutionized the way investment portfolios are customized and managed. These technologies enable wealth managers to create hyper-personalized strategies that align with client preferences and market conditions. Leveraging technology allows wealth managers to optimize asset allocation, enhance risk management, and keep investment strategies aligned with clients’ evolving financial goals.

Utilizing technology in portfolio management provides significant benefits, including real-time monitoring, detailed analysis, and the ability to make data-driven decisions. These capabilities enhance the overall efficiency and effectiveness of the portfolio management process, ensuring that investors can achieve their financial objectives with greater precision and confidence.

Monitoring and Adjusting Portfolios

Ongoing portfolio monitoring ensures alignment with financial goals and market shifts. Timely adjustments enhance resilience, while digital tools provide real-time insights for efficient management.

Modern investment platforms, equipped with sophisticated algorithms, enable wealth managers and asset managers to optimize portfolio management and customization efficiently. Evaluating and adjusting portfolios regularly helps investors stay aligned with financial goals and maximize outcomes.

Regular Performance Reviews

Regular performance reviews are essential for verifying that investment returns meet client expectations and align with their risk profiles. Frequent evaluations keep investors engaged and ensure portfolios stay on track with financial goals. Wealth managers play a crucial role in analyzing economic indicators and market fluctuations, making necessary adjustments to optimize investment outcomes.

Regular reviews help wealth managers adapt to market changes, ensuring investment strategies stay effective and aligned with investor goals. This proactive approach enhances the overall performance and resilience of the portfolio.

Adapting to Market Trends

Adapting to market trends is key to investment success. AI and big data help advisors create real-time, responsive portfolios that align with market shifts and investor needs.

Staying informed about geopolitical events, economic data, and market indicators is crucial for making timely portfolio adjustments. Incorporating sustainable investing and ESG factors aligns investment choices with the investor’s ethical concerns and long-term objectives. This approach strengthens portfolio resilience and keeps it aligned with investor values.

Rebalancing Strategies

Implementing effective rebalancing strategies is essential for maintaining the intended asset allocation and ensuring that portfolios remain efficient over time. Rebalancing involves realigning the proportions of assets in a portfolio to maintain the desired risk level and investment strategy. This process helps investors stay on track with their financial goals and adapt to changing market conditions.

Various rebalancing techniques, such as calendar-based and threshold-driven methods, help maintain the desired asset allocation and enhance overall portfolio effectiveness. Regularly adjusting asset allocations based on market performance keeps investment strategies optimized and aligned with the investor’s objectives.

Choosing the Right Wealth Manager

Choosing the right wealth manager is a critical decision that can significantly impact the success of your investment strategy. Evaluating a wealth manager’s expertise and experience is essential to ensure they are knowledgeable and capable of managing personalized portfolios tailored to your financial goals. Understanding their investment philosophy is also crucial, as it ensures alignment with your values and long-term objectives.

Assessing the client service capabilities of wealth managers helps determine the level of personalized care and responsiveness you can expect. By selecting a wealth manager who demonstrates strong communication skills, a personal connection, and effective use of technology, you can establish a productive and supportive relationship that enhances your investment experience.

Evaluating Expertise and Experience

Integrity, technical competence, and relevant experience are crucial criteria for evaluating potential wealth managers. A wealth manager’s educational background and professional licenses are indicators of their technical competence, providing assurance that they possess the necessary knowledge and skills to manage your investments effectively. Thorough evaluations of wealth managers’ expertise and experience can enhance the likelihood of achieving favorable investment outcomes.

By assessing the track record and qualifications of wealth managers, you can ensure that they have successfully handled complex financial situations and are capable of meeting your unique financial objectives. This rigorous evaluation process helps you select a wealth manager who is well-equipped to guide you on your investment journey.

Understanding Their Investment Philosophy

Aligning with a wealth manager’s investment philosophy is crucial in creating a successful tailored portfolio.

Asset allocation committees improve portfolio recommendations through collaboration. Understanding a wealth manager’s risk approach ensures alignment with your goals and tolerance, fostering a productive relationship. Choosing a manager whose philosophy matches your values enhances investment success.

Assessing Client Service Capabilities

Effective communication, personal connection, and technological support are key criteria for assessing the client service capabilities of wealth managers. A good wealth manager should demonstrate the ability to build a strong rapport with clients, understanding their unique needs and providing personalized attention. This personal connection is crucial for establishing trust and ensuring that the wealth manager can effectively address your financial concerns.

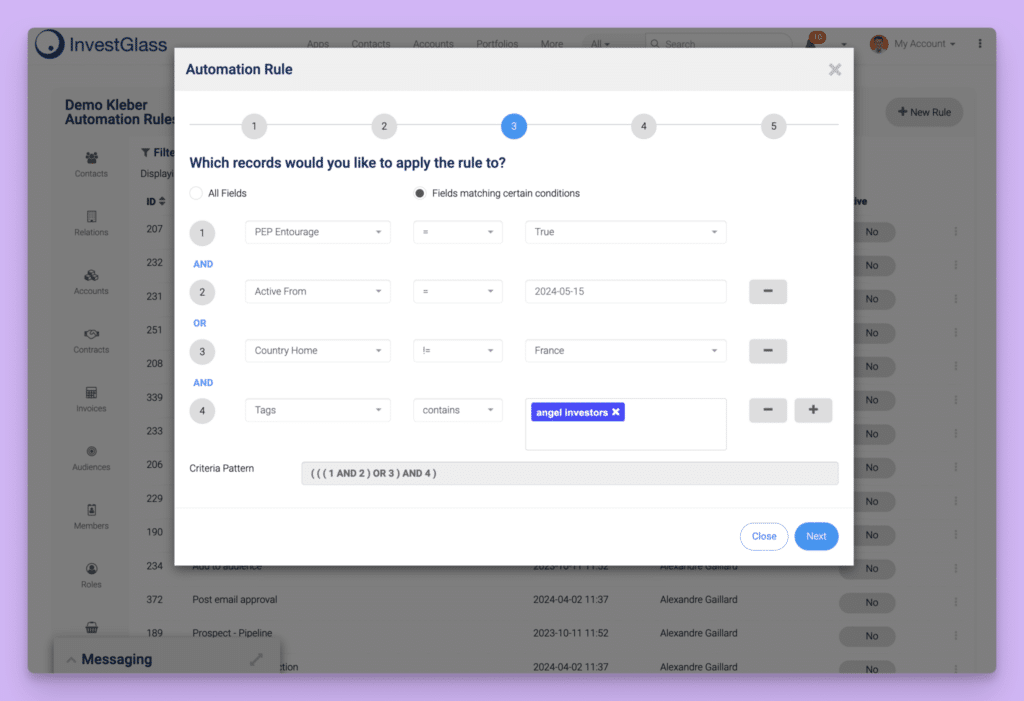

CRM tools improve client interactions and personalization, ensuring proactive investment management. Evaluating these helps you choose a wealth manager who offers tailored care and support.

How can InvestGlass personalize your portfolio?

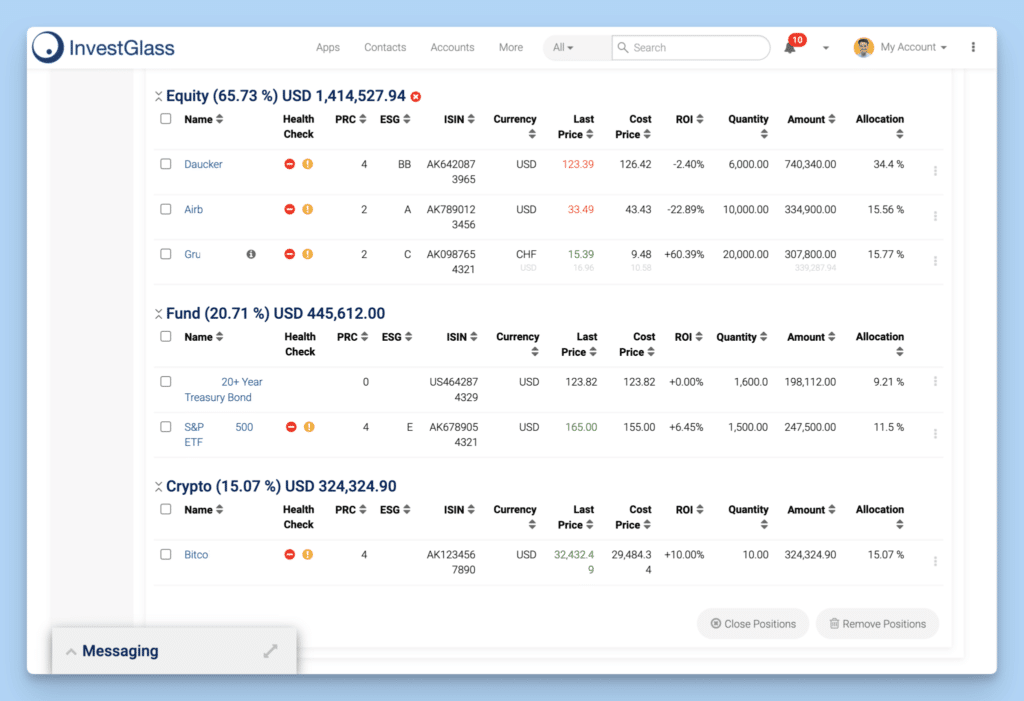

InvestGlass offers a comprehensive portfolio management system designed to help businesses build customized portfolios tailored to individual investment goals. The platform provides real-time monitoring and detailed portfolio analysis, allowing for precise and informed decision-making. With automated capabilities for investment tasks and stock screening, InvestGlass streamlines the portfolio management process, enhancing efficiency and effectiveness.

InvestGlass also integrates ESG factors into its portfolio management, enabling clients to align their investments with personal values and sustainability goals. The system supports compliance checks and provides real-time data tracking, ensuring that investment strategies adhere to regulatory standards and remain aligned with clients’ evolving financial objectives.

By offering customized portfolio reports, InvestGlass enhances transparency and understanding of portfolio performance, providing clients with a clear and comprehensive view of their investments.

Summary

Customized portfolios offer a multitude of benefits, from personalized investment strategies and enhanced risk management to tax efficiency and alignment with personal values. By understanding the role of wealth managers, the portfolio management process, and the importance of continuous monitoring and adjustments, investors can build robust and resilient portfolios that stand the test of time.

Choosing the right wealth manager is crucial for achieving financial success, and evaluating their expertise, investment philosophy, and client service capabilities can enhance the overall investment experience. InvestGlass provides a powerful tool for building and managing customized portfolios, offering real-time analysis, ESG integration, and compliance support. By leveraging these insights and tools, investors can navigate the complexities of the financial landscape with confidence and precision, achieving their financial goals with greater ease and success.

Frequently Asked Questions

What are customized portfolios?

Customized portfolios are specifically designed investment mixes that align with an individual’s unique financial needs, goals, and risk tolerance. This tailored approach ensures that the portfolio reflects personal aspirations and circumstances.

How do wealth managers create customized portfolios?

Wealth managers create customized portfolios by carefully assessing a client’s financial goals, risk tolerance, and investment preferences, utilizing a structured approach to ensure alignment with the client’s overall financial strategy. This tailored method fosters a personal connection and helps in achieving specific financial objectives.

What are the benefits of customized portfolios?

Customized portfolios provide tailored investment strategies that enhance risk management, improve tax efficiency, and align with individual values, thereby increasing the likelihood of achieving specific financial goals.

How does AI enhance portfolio management?

Technology enhances portfolio management by utilizing advanced tools such as AI and big data analytics, which facilitate the creation of tailored investment strategies and optimal asset allocation. This ensures investment approaches remain aligned with clients’ dynamic financial objectives.

How can InvestGlass help in building a personalized portfolio?

InvestGlass facilitates the creation of personalized portfolios by providing a robust portfolio management system that includes real-time monitoring, comprehensive analysis, and customizable reports, ensuring tailored solutions for businesses.