How to Start a Credit Union: A Comprehensive Guide for Financial Innovators

Introduction

Credit unions represent a distinctive and vital segment of the financial services landscape — member-owned, not-for-profit cooperatives that prioritize people over profit. Unlike commercial banks driven by shareholder returns, credit unions differ by focusing on the financial well-being of their members and the communities they serve. Whether it’s a small community institution or a federally chartered credit union, their mission remains the same: to provide fair access to credit, promote savings, and foster financial inclusion.

Launching a credit union is one of the most important steps for community and financial innovators seeking to empower local economies. It requires proper planning, regulatory compliance, and a clear understanding of day-to-day operations. Founders must secure a federal charter or state charter, identify a common bond among potential members, develop strong marketing plans, and file a comprehensive charter application with the appropriate regulatory body, such as the National Credit Union Administration (NCUA) in the United States. This process of obtaining official approval or licensing to start a credit union is known as chartering.

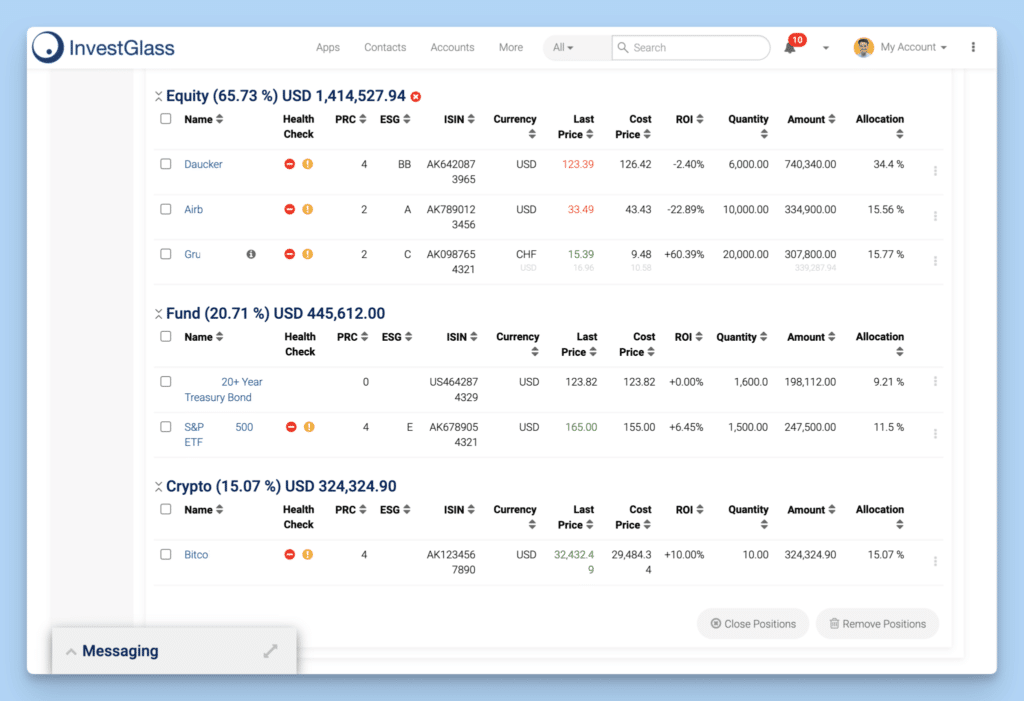

InvestGlass, a Swiss-based CRM and automation platform, provides tools that can assist credit unions in every stage — from managing member relationships to automating compliance. Whether you are forming a federal credit union or exploring other types of cooperative models, this guide will help you understand the structure, steps, and systems needed to create a sustainable, trusted institution.

What You’ll Learn

- The fundamental differences between credit unions and traditional banks.

- How federally chartered credit unions and basic credit unions operate.

- Key regulatory requirements and the National Credit Union Administration’s role.

- Important steps and procedures in the charter application process.

- How to develop marketing plans, assess income, and attract enough members.

- How InvestGlass supports compliance, automation, and day-to-day operations.

Understanding Credit Unions: Definition and Market Overview

At their core, credit unions are member-owned financial cooperatives that promote thrift and provide affordable financial services. They operate under the principle of “people helping people.” A federal credit union functions similarly but is regulated directly by the National Credit Union Administration (NCUA) under the Federal Credit Union Act. These institutions offer full-service banking capabilities — including savings accounts, checking, business loans, mortgages, and more — but they differ from banks in structure and purpose.

The first step in forming a credit union is to determine the common bond that connects your potential members. This could be based on geography, employment, association, or other shared interests. Once you define your membership base, you must demonstrate that you have enough members to sustain operations and financial viability. The NCUA or your local regulator will provide guidance on these criteria and review your charter application.

Example: A group of healthcare workers forming a federally chartered credit union might define their common bond as “employees within the regional health network.” Once approved, the credit union can begin offering full-service credit union products tailored to healthcare professionals.

|

Feature |

Credit Union |

Traditional Bank |

|---|---|---|

|

Ownership |

Member-owned |

Shareholder-owned |

|

Profit Motive |

Not-for-profit |

For-profit |

|

Governance |

One member, one vote |

Share-based voting |

|

Mission |

Member well-being |

Shareholder returns |

|

Rates |

Lower loan rates, higher savings |

Market-driven |

|

Fees |

Fewer and lower |

Often higher |

|

Focus |

Community and relationships |

Broad market focus |

This model not only improves financial access but also ensures that income and profits are returned to members rather than external investors.

Global and U.S. Regulatory Landscape

The regulatory framework for credit unions varies across countries, but in the United States, the National Credit Union Administration (NCUA) governs federally chartered credit unions. It issues the federal charter, supervises compliance, and ensures safety and soundness. Other regions have their own supervisory bodies, such as BaFin in Germany, FINMA in Switzerland, or the Monetary Authority of Singapore.

To launch a credit union, applicants must submit a charter application detailing governance structure, marketing plans, capital, and community purpose. All required forms and documents must be completed before submission to the NCUA for review. The NCUA will review this application to ensure the group’s readiness to manage day-to-day operations responsibly.

Note: If you are pursuing a federal charter, the NCUA’s website provides additional information, sample documents, and contact forms for interested parties. Early engagement with the agency is one of the first steps you should take.

InvestGlass complements these compliance efforts by offering integrated tools for regulatory reporting, data protection, and workflow automation — essential for maintaining oversight once operations begin.

Choosing a Legal Structure

Selecting the right legal structure is your game-changing foundation for launching a successful credit union! The National Credit Union Administration (NCUA) delivers powerful guidance on your available options—federally chartered credit unions and state-chartered credit unions that can transform your vision into reality. This decision will revolutionize how your credit union operates day-to-day, from regulatory oversight to the comprehensive range of services you can deliver to your members. Unlike traditional financial institutions, credit unions are member-owned and democratically governed—which means your chosen structure must support member control and address the unique needs that make your community thrive. Smart planning at this stage is absolutely essential—you need to consider your community’s specific requirements, the ambitious scale of your vision, and the regulatory landscape that shapes your success. Consulting with experienced professionals and leveraging NCUA resources gives you the expert guidance you need to ensure your credit union is positioned for long-term success and growth. Remember, the legal structure you choose will drive everything—from compliance obligations to how effectively you serve your members and achieve your transformative mission.

Business Plan Development

Developing a robust business plan is your ultimate game-changer when launching a credit union that truly delivers. Your business plan becomes the powerful foundation that clearly defines your credit union’s mission, pinpoints your target market, and addresses the specific needs of the community you’re ready to serve. It details your strategic marketing approach for attracting potential members, outlines your management structure, and provides realistic financial projections that demonstrate true sustainability. This plan isn’t just a roadmap for your team—it’s your critical advantage with interested parties, such as regulators, potential members, and investors, who will review it to assess the viability of your credit union. Regularly reviewing and updating your business plan ensures your strategies stay aligned with your goals and the evolving needs of your members. By addressing these game-changing steps early, you lay a rock-solid foundation for future growth, effective management, and the ongoing success of your credit union that delivers exceptional value to your community.

Step-by-Step Guide to Starting a Credit Union

1. Conduct a Feasibility Study

The first step involves determining the financial and community need for your credit union. Identify the common bond of your potential members, assess local financial gaps, and estimate income projections. The National Credit Union Administration can provide guidance and templates for your feasibility study.

2. Form an Organizing Committee

Gather a group of interested parties with expertise in finance, law, and business. This committee will oversee marketing plans, fundraising, and the charter application process. Each member must be committed to cooperative values.

3. Submit a Charter Application

Prepare your federal charter application with details on governance, capital, and day-to-day operations. Include your business plan, proposed products such as business loans, and your member engagement strategy.

The NCUA will review and approve or request revisions to ensure compliance.

4. Secure Capital and Funding

New credit unions often rely on member deposits, grants, or assistance from community development funds. Demonstrating sustainable income sources and capital adequacy is key to being approved.

5. Establish Governance and Operations

Once approved, the organizing committee transitions into an elected Board of Directors. The board oversees day-to-day operations, sets policies, and ensures compliance. Implement risk management, accounting, and audit systems.

6. Build Your Technology Infrastructure

Credit unions must adopt reliable digital systems for efficiency. InvestGlass provides tools for CRM, automation, and compliance — streamlining onboarding, reporting, and business loan processing.

7. Marketing and Member Acquisition

Develop marketing plans to reach potential members. Use digital campaigns, educational content, and community outreach to build trust. Your website should clearly explain membership benefits, eligibility, and contact information.

8. Launch and Maintain Operations

Once your charter is approved, begin operations and continuously monitor performance. Keep communication open with the NCUA or your local regulator for guidance and compliance updates.

Creating a Credit Unions Community

Building a vibrant and engaged community is the ultimate game-changer for every successful credit union. Because credit unions are member-owned powerhouses typically united by a common bond—whether it’s a shared workplace, neighborhood, or association—fostering that sense of belonging becomes absolutely essential. To create this dynamic community, focus on engaging members through strategic communication, educational initiatives that deliver real value, and events that bring people together in meaningful ways. Consider partnering with local organizations to expand your reach exponentially and offer additional services that truly benefit your members. Providing tailored financial products—such as savings accounts, loans, and comprehensive financial education—helps meet the unique needs of your community while reinforcing the incredible value of membership. By prioritizing trust, transparency, and personalized service, your credit union can create lasting relationships that drive unwavering loyalty and long-term success. Ultimately, a strong community not only supports your members’ financial well-being but also ensures the continued growth and relevance of your credit union in today’s competitive landscape.

Technology and Operations Infrastructure

Modern credit unions depend on advanced technology for success. Core banking systems, CRM platforms, and automation tools help manage day-to-day operations, from business loans to digital banking.

InvestGlass enhances this with:

- Automated workflows for loan approvals and compliance checks

- Data security aligned with Swiss privacy laws

- Analytics to monitor member engagement and operational efficiency

- Integrations with banking systems for seamless data management

These tools enable federally chartered credit unions and basic credit unions alike to deliver superior service while maintaining regulatory integrity.

Why InvestGlass: Swiss Data Sovereignty and Trust

Switzerland’s data sovereignty laws ensure maximum privacy for financial institutions. InvestGlass operates entirely under Swiss jurisdiction, meaning data remains protected from foreign access — an advantage for credit unions that handle sensitive member data.

Whether deployed on-premise or in a Swiss cloud, InvestGlass offers:

- GDPR and FADP compliance

- End-to-end encryption

- Multi-factor authentication

- Regular audits and secure access controls

This ensures that credit unions differ from other financial institutions not only in their purpose but also in their technological integrity.

Capital and Funding Strategies

Every credit union — from small community-based to federally chartered credit unions — needs sufficient capital for stability. Common sources include:

- Member deposits and share capital

- Government grants and cooperative assistance

- Secondary capital or retained earnings

Proper planning and realistic income projections ensure regulators see financial viability during the charter application process.

Compliance and Risk Management

Compliance is one of the most important steps in credit union management. Regulations from the National Credit Union Administration and the federal government require adherence to AML, data protection, and fair lending standards.

InvestGlass automates:

- Regulatory reporting

- Member due diligence

- Audit trail creation

This automation allows management to focus on member engagement and business loan growth instead of paperwork.

Growth and Scaling Strategies

After launch, focus on sustainable expansion:

- Broaden your common bond and reach new potential members.

- Introduce other types of products like investment and insurance.

- Merge or collaborate with other cooperatives for scale.

- Use technology and data analytics to drive decisions.

Continuous education, transparency, and community outreach will ensure lasting trust.

Conclusion

Starting a credit union — especially a federally chartered credit union under the National Credit Union Administration — requires dedication, compliance, and strategic foresight. Each phase, from the first step of research to the charter application, demands precision and collaboration.

With proper planning, guidance, and the right technological support from platforms like InvestGlass, credit unions can confidently manage day-to-day operations, meet regulatory standards, and serve their members with excellence.

As a result, these institutions not only build financial stability but also strengthen communities — fulfilling the cooperative mission that remains the heart of every credit union.even more practical and complete.

Frequently Asked Questions About Starting and Managing a Credit Union

1. Is owning a credit union profitable?

While credit unions are not-for-profit institutions, owning or managing a successful credit union can still be highly rewarding. Profits are reinvested into operations, used to reduce expenses and costs, and returned to members as better rates and lower fees. With InvestGlass, credit unions can obtain clearer financial insights, automate reporting, and manage resources more efficiently — maximizing community impact and long-term sustainability.

2. What is a weakness of a credit union?

A common challenge for community-based credit unions is limited access to capital and technology compared to larger banks. However, this weakness can be turned into a strength with the right tools. InvestGlass helps reduce operational costs, enhance efficiency, and strengthen member relationships through automation, making smaller institutions competitive in a fast-changing industry.

3. Who typically owns a credit union?

Credit unions are owned by their members, not shareholders. Each member has an equal vote, ensuring democratic governance and transparency. The owners are the customers — everyday people in the community who share a common bond. InvestGlass supports these owners with CRM tools that personalize communication, streamline services, and strengthen loyalty.

4. What are the requirements for a credit union?

Starting a credit union involves several key requirements: having enough members with a shared common bond, securing initial money and funding, preparing a detailed business plan, and filing a charter application with regulators such as the National Credit Union Administration (NCUA). To obtain approval, you must demonstrate financial stability and a plan for ongoing compliance. InvestGlass assists new credit unions by managing member data, compliance documentation, and regulatory workflows efficiently.

5. How much money does it take to start a credit union?

The costs and expenses of starting a credit union vary depending on location, size, and services offered. In most cases, founders must demonstrate sufficient capital to cover operating expenses, technology, and reserves. InvestGlass helps reduce long-term costs by automating repetitive tasks, minimizing manual errors, and providing scalable tools for both small and large credit unions.

6. What makes a credit union successful?

A successful credit union focuses on its members, financial education, and efficient management. It balances growth with community values. By integrating InvestGlass, credit unions can track performance, automate compliance, and improve customer engagement — all essential factors for long-term success in the financial industry.

7. How do community-based credit unions attract new members?

Community-based credit unions attract members through trust, accessibility, and personalized service. With InvestGlass CRM, they can create targeted marketing plans, automate outreach campaigns, and tailor messages that resonate with potential customers — helping them grow without overspending on advertising.

8. What can new credit union owners expect in the first year?

During the first year of a credit union starting, owners can expect challenges like managing expenses, meeting compliance standards, and building brand awareness. InvestGlass simplifies this by automating onboarding, tracking finances, and ensuring regulatory consistency — giving founders more time to focus on their members and mission.

9. How does technology influence the future of credit unions?

The future of credit unions is digital. Institutions that embrace automation, data analytics, and secure cloud solutions will thrive. InvestGlass empowers credit unions with Swiss-hosted data sovereignty, advanced security, and powerful workflow tools — helping them adapt to the evolving financial industry while protecting member privacy.

10. Can credit unions offer business loans and other advanced services?

Yes, full-service credit unions can offer business loans, mortgages, and investment services, depending on their charter and size. InvestGlass provides customizable automation for loan processing, document management, and compliance reporting, enabling credit unions to obtain approvals faster and serve customers more efficiently while controlling operational costs.