PEP Sanction Screening: The Complete Compliance Guide for Financial Institutions in 2025

In the global fight against financial crime, few areas are as critical—or as complex—as the screening of Politically Exposed Persons (PEPs) and sanctioned individuals. For financial institutions, from global banks to boutique wealth management firms, the failure to identify and properly manage relationships with these high-risk individuals isn’t merely a compliance oversight. It’s a direct path to severe regulatory fines, reputational ruin, and potential complicity in the very illicit activities and financial crimes the global financial system is designed to prevent.

Consider the stakes: In 2023 alone, global financial institutions paid over £4.2 billion in AML-related fines, with a significant portion stemming from failures in PEP and sanctions screening. One major European bank faced a £1.1 billion penalty for processing transactions involving sanctioned entities—transactions that proper screening would have prevented. Non-compliance can also result in financial penalties and significant reputational risk, further underscoring the importance of robust compliance measures.

PEP and sanctions screening forms the cornerstone of any effective Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) compliance programme. It’s the systematic process by which financial institutions check their customers against various official lists of individuals and entities who are either subject to economic sanctions, including sanction screening and financial sanctions, or who hold prominent public positions that make them vulnerable to corruption.

From Our Experience: In our work with over 500 financial institutions across Europe and Switzerland, we’ve seen the compliance landscape transform dramatically. What was once a quarterly manual review process has evolved into real-time, AI-powered screening that happens seamlessly during customer onboarding. The increasing complexity of sanctions regulations and the introduction of new restrictive measures have been key drivers for this technological change. Institutions that embrace this evolution reduce their compliance costs by up to 60% whilst simultaneously improving their detection rates.

This comprehensive guide provides a deep dive into PEP and sanctions screening in 2025. We’ll define what constitutes a PEP, explore the myriad sanctions lists and sanction lists that institutions must navigate, and outline best practices for building a robust, risk-based screening programme. We’ll also examine the critical role of technology—from automated screening software to AI-powered risk assessment—in managing this complex compliance challenge.

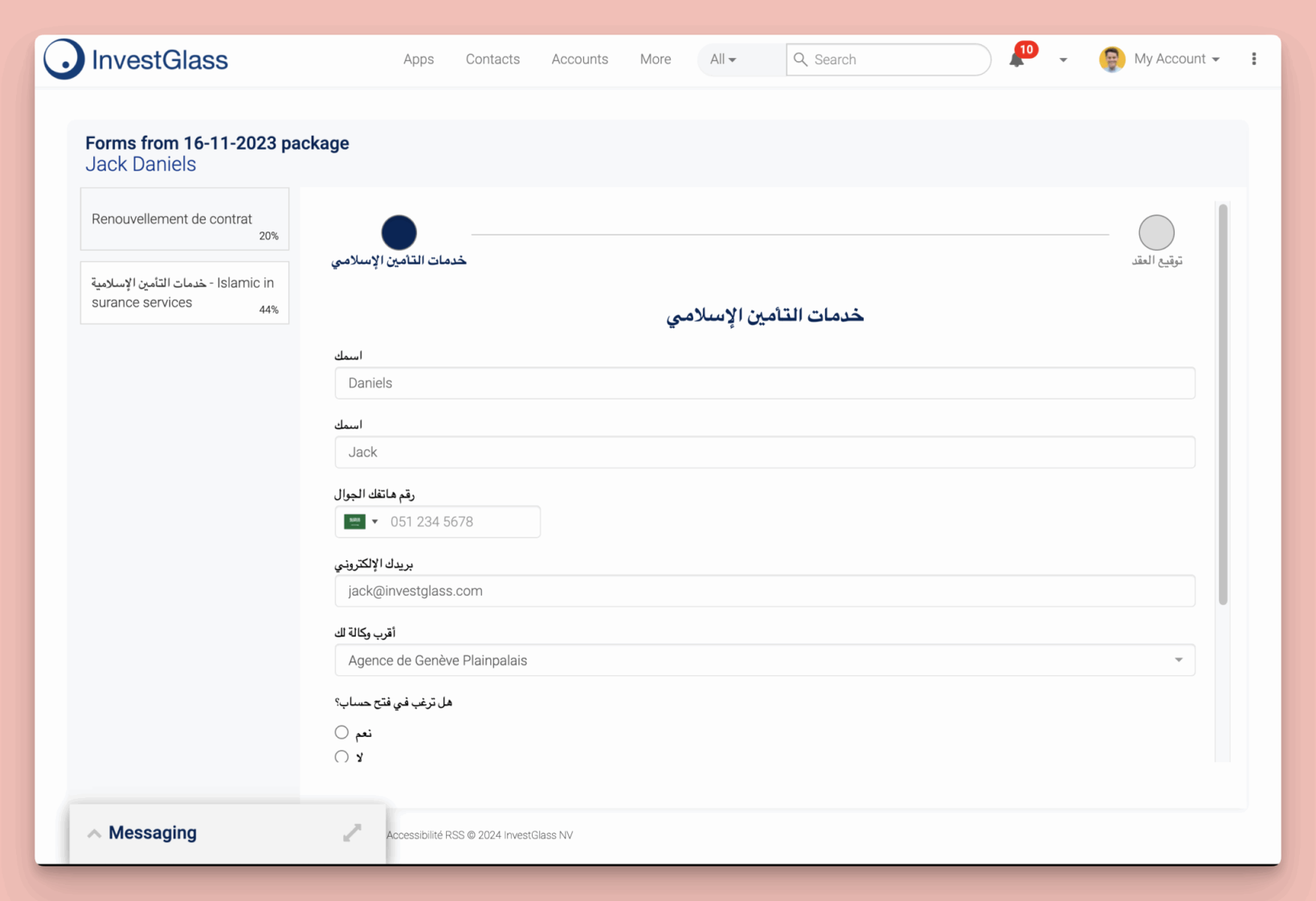

Finally, we’ll explore how integrated platforms like InvestGlass are revolutionising compliance by embedding seamless PEP and sanctions screening directly into the digital onboarding and client lifecycle management process.

Understanding the High-Stakes World of Screening

To appreciate the importance of PEP and sanctions screening (screening for both PEPs and sanctions), you must understand the two distinct but related categories of risk it’s designed to mitigate. Effective screening not only helps prevent financial crime and regulatory penalties, but also protects your business reputation by ensuring your institution remains trustworthy and compliant in the marketplace.

Sanctions Screening: Adhering to Economic Embargoes

Sanctions are political and economic measures taken by countries and international organisations to achieve specific foreign policy objectives. They can target entire countries (such as North Korea or Iran), known as sanctioned countries, or specific individuals, entities, and groups involved in activities like terrorism, nuclear proliferation, or human rights abuses. Identifying sanctioned countries is crucial for compliance and risk management.

When a person or entity appears on a sanctions list, financial institutions are generally prohibited from dealing with them. This isn’t a suggestion—it’s a legal obligation with severe consequences for non-compliance. To meet these obligations, institutions must perform sanction checks and sanctions checks during customer onboarding and ongoing monitoring to ensure they do not engage with sanctioned individuals, entities, or countries.

Key Sanctions Lists Financial Institutions Must Screen Against:

Sanctions List | Issuing Authority | Geographic Scope | Update Frequency | Penalties for Violations |

|---|---|---|---|---|

OFAC SDN List | US Treasury (Office of Foreign Assets Control) | Global (US persons & entities) | Daily | Up to $20M per violation or 2x transaction value |

UN Security Council | United Nations | Global (all member states) | As needed | Varies by jurisdiction |

EU Consolidated List | European Union | EU member states | Daily | Up to €5M or 10% of annual turnover |

UK HMT List | His Majesty’s Treasury | United Kingdom | Daily | Unlimited fines, up to 7 years imprisonment |

SECO List | Swiss State Secretariat for Economic Affairs | Switzerland | As needed | CHF 500,000 or imprisonment |

Trade restrictions are a common form of sanction and must be considered as part of compliance with these lists.

Critical Compliance Point: Sanctions screening is a strict liability obligation. There’s no room for error. A single transaction with a sanctioned individual—even if unintentional—can result in severe penalties and criminal prosecution. Sanctions screening is also essential for managing risk in any business relationship with customers or partners.

PEP Screening: Managing Corruption Risk

According to the Financial Action Task Force (FATF), the global standard-setter for AML/CFT, PEPs include:

•Heads of state or government

•Prime ministers

•High ranking government officials

•Senior politicians and government officials

•Senior judicial or military officials

•Senior executives of state-owned corporations

•Important political party officials

The definition also extends to their family members (spouses, partners, children, parents) and close associates (individuals known to have joint beneficial ownership or close business relationships). The risk is not limited to only the PEP; it also includes business associates and business partners, who may pose significant AML compliance risks.

Important Distinction: PEPs are not criminals, and it’s not illegal to have a PEP as a customer. However, their position and influence make them more susceptible to involvement in bribery and corruption. As a result, the FATF recommends that financial institutions apply Enhanced Due Diligence (EDD) to relationships with PEPs. Identifying PEPs is a critical part of compliance and due diligence processes.

There are increased risks when conducting business with PEPs and their associates, as these relationships can expose organizations to potential corruption, money laundering, and other financial crimes.

PEP Categories and Risk Levels

PEP Category | Definition | Risk Level | EDD Requirements |

|---|---|---|---|

Foreign PEP | Individual in prominent public function in foreign country | High | Mandatory EDD, senior management approval, source of wealth verification |

Domestic PEP | Individual in prominent public function in home country | Medium-High | Risk-based EDD, enhanced monitoring |

International Organisation PEP | Senior official in international organisation (UN, IMF, etc.) | Medium-High | Risk-based EDD |

Former PEP | Individual who held PEP status (minimum 12 months after leaving office) | Medium | Risk-based approach, consider influence and connections |

Family Member | Immediate family of PEP | High (same as PEP) | Same EDD as associated PEP |

Close Associate (RCA) | Known close business or personal relationship with PEP | Medium-High | Enhanced monitoring, source of funds verification |

Regulatory Insight:

“The 12-month rule for former PEPs is a minimum, not a maximum. In our regulatory examinations, we expect institutions to apply a risk-based approach. A former head of state may pose elevated risk for many years after leaving office, particularly if they maintain political influence or connections.”

— Former FCA Senior Examiner, now Compliance Advisor at InvestGlass

It is important to monitor for status changes in PEPs as part of ongoing customer screening. This ensures that any new risks or changes in risk status are identified promptly and the risk is reassessed appropriately throughout the customer lifecycle.

The Challenges of Modern Screening

In theory, screening customers against PEP and sanctions lists seems straightforward. In practice, it’s fraught with challenges that can overwhelm even well-resourced compliance teams. These screenings—encompassing PEP, sanctions, and KYB/KYC checks—are essential steps in the compliance process.

To address these challenges effectively, organizations must implement robust diligence checks and customer due diligence procedures. These measures are critical for verifying identities, identifying risks such as corruption or financial crime, and ensuring ongoing regulatory compliance.

Challenge 1: The Sheer Volume of Data

There are hundreds of sanctions and PEP lists worldwide, containing millions of names. As part of the screening process, it is also necessary to identify and verify beneficial owners to comply with regulatory requirements such as AML and KYC, including those set by FinCEN and the Corporate Transparency Act. These lists are constantly changing, with new names added and removed daily. The OFAC SDN list alone contains over 10,000 entries and is updated multiple times per week. Efficiently screening new customers during onboarding is a significant challenge for financial institutions aiming to meet compliance standards.

Challenge 2: Poor Quality Data

Data on sanctions and PEP lists can be incomplete or inaccurate, with:

•Variations in spelling and transliteration from different languages

•Use of aliases and multiple names

•Incomplete date of birth or identification information

•Outdated addresses or nationality information

These data quality issues can result in false negatives during screening, where individuals or connections that should be flagged are missed, increasing compliance risk.

Challenge 3: The False Positive Problem

One of the biggest operational challenges in screening is the high number of false positives—legitimate customers incorrectly matched to a name on a watchlist. Reducing false positives is crucial for improving compliance efficiency, as it allows teams to focus resources on genuine risks rather than unnecessary investigations.

Real-World Impact: A mid-size UK wealth management firm we worked with was generating over 1,200 screening alerts per month, of which 98.5% were false positives. Their compliance team was spending 80% of their time investigating alerts that posed no actual risk. After implementing InvestGlass’s AI-powered screening, false positives dropped to 2.3%, freeing the team to focus on genuine risks.

Common Causes of False Positives:

•Common names (e.g., “Mohammed Ali,” “John Smith”)

•Partial name matches

•Variations in spelling or transliteration

•Incomplete data in customer records

Challenge 4: Risk-Based Approach Implementation

Not all PEPs pose the same level of risk. A local councillor in a low-corruption country is fundamentally different from a government minister in a high-corruption-risk jurisdiction. Certain PEPs or jurisdictions present increased risk of financial crimes, such as money laundering and corruption, and therefore require more stringent controls. Yet implementing a truly risk-based approach—one that differentiates appropriately whilst remaining compliant—can be difficult without the right technology and frameworks.

Challenge 5: Real-Time and Ongoing Screening

Screening isn’t a one-time event at onboarding. It must be an ongoing process, with:

•Periodic rescreening of existing customers (typically quarterly or monthly)

•Real-time transaction screening to catch sanctioned parties attempting to use intermediaries

•Event-driven screening when lists are updated or customer information changes

Ongoing due diligence is essential to ensure compliance, especially when monitoring PEPs. Financial institutions should implement procedures to monitor PEPs and their associates for any changes in risk, as part of a robust compliance framework.

Best Practices for PEP and Sanctions Screening

To overcome these challenges and build a robust, effective screening programme, financial institutions should implement the following best practices. Customer due diligence and thorough diligence checks are essential components, helping to identify Politically Exposed Persons (PEPs) and mitigate risks such as corruption and financial crime.

1. Implement a Centralised, Automated Screening Solution

Manual screening is no longer viable. A centralised, automated screening solution is essential for managing the volume and complexity of modern screening requirements.

Your Solution Should:

•Provide comprehensive list coverage across global and local sanctions and PEP lists

•Automate the screening process and integrate with onboarding and transaction monitoring workflows

•Enable screening politically exposed persons (PEPs) and conduct PEPs checks as part of compliance with AML and KYC regulations

•Use sophisticated matching algorithms including fuzzy logic, phonetic matching, and AI-powered disambiguation to reduce false positives

•Update lists automatically in real-time as sanctions authorities publish changes

•Maintain a complete audit trail of all screening activities for regulatory examinations

2. Adopt a Risk-Based Approach

A risk-based approach allows you to focus compliance resources on areas of highest risk whilst maintaining regulatory compliance.

Implementation Framework:

Step 1: Develop a Clear PEP Policy Your policy should define:

•What constitutes a PEP in your business context

•Risk levels for different PEP categories

•EDD requirements for each risk level

•Approval authorities for establishing PEP relationships

Step 2: Conduct Thorough Risk Assessments Assess PEP and sanctions risk based on:

•Customer risk factors: PEP status, nationality, source of wealth, occupation

•Product risk factors: Cash-intensive products, international transfers, complex structures

•Geographic risk factors: Corruption Perception Index scores, sanctions regimes, political stability

When conducting risk assessments, it is essential to evaluate the potential for financial crimes and criminal activities, such as money laundering, fraud, and corruption, to ensure robust compliance and protect your institution.

Step 3: Apply Enhanced Due Diligence (EDD) to High-Risk Customers

EDD Measure | Purpose | Frequency |

|---|---|---|

Senior Management Approval | Ensure awareness and accountability | At onboarding and annually |

Source of Wealth Verification | Understand origin of customer’s total assets | At onboarding |

Source of Funds Verification | Understand origin of funds for specific transactions | Per transaction or relationship |

Enhanced Ongoing Monitoring | Detect unusual activity patterns | Continuous (automated) |

Periodic Review | Reassess risk profile | Annually or more frequently |

3. Integrate Screening with Your CRM and Onboarding Platform

Screening shouldn’t be a standalone process. It should be seamlessly integrated with your Customer Relationship Management (CRM) and digital onboarding platforms. Integrating screening into the onboarding process ensures compliance and customer due diligence from the very start.

Benefits of Integration:

•Single Source of Truth: All customer data, including risk profile and screening results, stored centrally

•Seamless Customer Experience: Screening conducted in the background during onboarding without creating friction

•Improved Efficiency: Compliance teams access all investigation information in one place

•Automated Workflows: Alerts automatically routed to appropriate compliance officers

•Real-Time Risk Scoring: Customer risk scores update automatically based on screening results

Technology Insight:

“The future of compliance is invisible compliance. Customers shouldn’t experience delays or friction because of necessary screening processes. With proper integration, screening happens in milliseconds during onboarding, and customers only experience a smooth, professional onboarding journey.”

— Dr. Elena Rodriguez, Chief Technology Officer at InvestGlass

4. Establish Clear Workflows for Alert Investigation and Management

When a potential match is identified, a clear and efficient workflow is essential for investigating and resolving the alert.

Effective Alert Workflow Should:

- Automatic Alert Generation with risk scoring and priority assignment

- Intelligent Alert Routing to appropriate compliance officer based on expertise and workload

- Investigation Dashboard providing all necessary information:

• Customer profile and documentation

• Details of potential match

• Historical screening results

• Related alerts or investigations

- Escalation Protocols for high-risk alerts requiring senior management review

- Disposition Options with clear audit trail, as required by regulatory bodies for documentation and oversight:

• True positive (confirmed match)

• False positive (no match)

• Possible match (requires further investigation)

- Regulatory Reporting Integration for confirmed sanctions matches

7.Case Management tracking investigation status and actions taken

5. Leverage AI and Machine Learning to Reduce False Positives

Modern screening solutions use AI and machine learning to dramatically reduce false positives whilst maintaining high detection rates.

AI-Powered Capabilities:

•Contextual Analysis: Evaluating additional data points (nationality, date of birth, address) to disambiguate matches

•Learning Algorithms: Learning from previous disposition decisions to improve future matching accuracy

•Network Analysis: Identifying hidden relationships between customers and sanctioned parties

•Adverse Media Screening: Automatically scanning news sources for negative information about customers

•Predictive Risk Scoring: Assigning risk scores based on multiple factors beyond simple name matching

InvestGlass employs advanced AI algorithms that learn from your compliance team’s decisions, continuously improving matching accuracy and reducing false positive rates by up to 95%.

6. Continuously Monitor and Review Your Screening Programme

The regulatory landscape and risk environment constantly evolve. Your screening programme must be continuously monitored and reviewed to ensure effectiveness.

Ongoing Programme Management:

•Stay Current with Regulatory Changes: Monitor FATF guidance, local regulations, and industry best practices

•Regular Risk Assessment Updates: Quarterly or when significant changes occur

•Ongoing Due Diligence and Status Changes Monitoring: Continuously perform ongoing due diligence and monitor for status changes in customer profiles to identify new risks or changes in risk status

•Effectiveness Testing: Annual independent testing of screening controls

•Quality Assurance: Sample-based review of alert dispositions

•Staff Training: Ongoing training on new risks, regulations, and system capabilities

•Technology Updates: Ensure screening software and list sources remain current

Regional Compliance Requirements: A Global Perspective

PEP and sanctions screening requirements vary by jurisdiction, though they’re increasingly harmonised through international standards. Financial sanctions implementation is typically managed by government agencies in each region, such as the UK’s Office for Financial Sanctions Implementation (OFSI), which compile and publish sanctions lists under various legal frameworks.

Compliance Requirements by Region

Region | Primary Regulations | PEP Definition Scope | Sanctions Lists | Key Requirements |

European Union | 5AMLD, 6AMLD | Foreign, domestic, international org PEPs | EU Consolidated List, UN, national lists | EDD for all PEPs, beneficial ownership transparency |

United Kingdom | Money Laundering Regulations 2017 (as amended) | Foreign PEPs (mandatory EDD), domestic PEPs (risk-based) | UK HMT, OFAC, UN, EU (retained) | 12-month minimum for former PEPs, risk-based for domestic |

United States | Bank Secrecy Act, PATRIOT Act, OFAC regulations | Foreign PEPs primarily | OFAC SDN, sectoral sanctions | Strict liability for sanctions, risk-based for PEPs |

Switzerland | Anti-Money Laundering Act (AMLA), FINMA regulations | Foreign and domestic PEPs | SECO sanctions, UN, EU (adopted) | Enhanced due diligence, senior management approval |

Singapore | MAS Notice 626 | Foreign PEPs (mandatory EDD), domestic PEPs (risk-based) | MAS sanctions, UN | Source of wealth and funds verification |

Hong Kong | Anti-Money Laundering and Counter-Terrorist Financing Ordinance | Foreign and domestic PEPs | HKMA sanctions, UN, OFAC | Enhanced ongoing monitoring |

The InvestGlass Solution: Seamless, Integrated, and Intelligent Screening

For financial institutions seeking to build a modern, effective, and efficient PEP and sanctions screening programme, an integrated and intelligent platform is essential. InvestGlass provides a comprehensive solution specifically designed for financial services, embedding seamless screening directly into compliance and client lifecycle management processes. The platform enables comprehensive screenings, including screening politically exposed persons, to help ensure regulatory compliance and mitigate risk.

A Unified Platform for Holistic Risk Management

InvestGlass provides a unified platform that brings together your CRM, KYC process, and compliance workflows into a single, integrated solution. This holistic approach to risk management provides a 360-degree view of each customer, enabling more accurate and nuanced risk assessment. By maintaining a comprehensive understanding of the business relationship throughout its lifecycle, you can better manage risk, conduct ongoing customer due diligence, and monitor for issues such as politically exposed persons (PEPs) and related parties.

Key Features of InvestGlass Screening:

- Comprehensive Global Coverage

•400+ sanctions and PEP lists from over 200 jurisdictions

•Real-time list updates (multiple times daily)

•Adverse media screening across 100,000+ news sources

•Comprehensive screenings including PEP, sanctions, and KYB/KYC checks

•Customisable list selection based on your risk appetite

- AI-Powered Matching and Disambiguation

•Advanced fuzzy logic and phonetic matching algorithms

•Machine learning that improves accuracy over time

•Contextual analysis using multiple data points

•False positive reduction of up to 95%

- Seamless Integration

•Embedded in digital onboarding workflow

•Integrated with CRM for complete customer view

•Automated periodic rescreening

•Real-time transaction screening

- Intelligent Alert Management

•Risk-based alert prioritisation

•Automated routing to appropriate compliance officers

•Complete investigation workspace with all relevant data

•Audit trail for regulatory examinations

- Swiss Data Sovereignty

•Hosted in Swiss data centres with bank-grade security

•Full GDPR and Swiss data protection compliance

•No data transfer to third countries

•Complete control over your sensitive compliance data

- Regulatory Reporting

•Automated SAR/STR generation for confirmed matches

•Regulatory reporting templates for multiple jurisdictions

•Complete audit trail and documentation

•Integration with regulatory reporting systems

Client Success Story:

“Before InvestGlass, our PEP screening was a manual quarterly process that took our team two weeks to complete. We were always operating with outdated information. Now, screening happens automatically during onboarding and continuously in the background. We’ve reduced our compliance costs by 65% whilst simultaneously improving our detection capabilities. The ROI was evident within the first quarter.”

— Chief Compliance Officer, Swiss Private Bank

Discover how InvestGlass can transform your compliance programme by visiting our Risk Management Swiss Sovereignty page or contact our compliance specialists.

Implementation Roadmap: Building Your Screening Programme

Implementing an effective PEP and sanctions screening programme requires careful planning and phased execution.

Phase 1: Assessment and Planning (Weeks 1-4)

Activities:

•Conduct gap analysis of current screening capabilities

•Define risk appetite and PEP policy

•Select screening technology platform

•Establish governance structure and approval authorities

•Design workflows and escalation procedures

Deliverables:

•PEP and sanctions screening policy

•Risk assessment framework

•Technology requirements specification

•Implementation project plan

Phase 2: Technology Implementation (Weeks 5-12)

Activities:

•Configure screening platform and list sources

•Integrate with CRM and onboarding systems

•Set up matching rules and thresholds

•Configure alert workflows and routing

•Develop reporting dashboards

Deliverables:

•Fully configured screening system

•Integration with existing systems

•User access and permissions

•Testing and validation results

Phase 3: Data Migration and Remediation (Weeks 13-16)

Activities:

•Screen existing customer base

•Investigate and resolve alerts

•Update customer risk ratings

•Implement EDD for identified PEPs

•Document remediation activities

Deliverables:

•Screened customer database

•Updated risk profiles

•EDD documentation

•Remediation report for management and regulators

Phase 4: Training and Go-Live (Weeks 17-20)

Activities:

•Train compliance team on new system

•Train front-line staff on PEP identification

•Conduct user acceptance testing

•Go-live with new screening process

•Monitor and support initial operations

Deliverables:

•Trained staff

•User guides and procedures

•Go-live checklist completed

•Initial performance metrics

Phase 5: Optimisation and Continuous Improvement (Ongoing)

Activities:

•Monitor false positive rates and adjust matching rules

•Review alert investigation times and streamline workflows

•Conduct quality assurance reviews

•Update risk assessments and policies

•Implement AI learning from disposition decisions

Deliverables:

•Monthly performance reports

•Quarterly effectiveness reviews

•Annual independent testing

•Continuous improvement initiatives

Common Pitfalls and How to Avoid Them

Even well-intentioned screening programmes can fall short. Here are common pitfalls and how to avoid them.

Pitfall 1: Over-Reliance on Technology Without Human Oversight

The Problem: Automated screening is essential, but technology alone isn’t sufficient. Algorithms can miss nuanced risks or generate alerts that require expert judgment.

The Solution: Maintain skilled compliance professionals who understand the context behind alerts and can make informed risk decisions. Use technology to enhance, not replace, human expertise.

Pitfall 2: Inadequate Documentation

The Problem: Failing to document screening decisions, risk assessments, and EDD measures leaves you vulnerable during regulatory examinations.

The Solution: Implement comprehensive documentation requirements for all screening activities. InvestGlass automatically maintains complete audit trails of all screening and investigation activities.

Pitfall 3: Static Risk Assessments

The Problem: Conducting risk assessments at onboarding but failing to update them as circumstances change (new sanctions, customer behaviour changes, geopolitical events).

The Solution: Implement continuous monitoring and periodic rescreening. Set triggers for risk reassessment based on specific events or time periods.

Pitfall 4: Inadequate Training

The Problem: Front-line staff who don’t understand PEP definitions or screening requirements can onboard high-risk customers without appropriate due diligence.

The Solution: Provide comprehensive, role-specific training on PEP and sanctions screening. Include real-world scenarios and case studies. Conduct annual refresher training.

Pitfall 5: Siloed Compliance Functions

The Problem: PEP screening conducted separately from transaction monitoring, KYC, and other compliance functions leads to incomplete risk assessment.

The Solution: Implement an integrated compliance platform like InvestGlass that provides a holistic view of customer risk across all compliance functions.

The Future of PEP and Sanctions Screening

As we look ahead, several trends are shaping the future of screening. Enhanced screening technologies will not only improve compliance but also play a crucial role in maintaining international security by enabling more effective enforcement of financial sanctions.

1. Increased Use of AI and Machine Learning

AI will continue to improve matching accuracy, reduce false positives, and identify hidden relationships between customers and high-risk individuals. Natural language processing will enhance adverse media screening, automatically categorising and prioritising news articles.

2. Real-Time Global Data Sharing

International cooperation on sanctions and PEP information will improve, with more standardised data formats and real-time sharing between jurisdictions. This will reduce the burden on individual institutions whilst improving global effectiveness.

3. Blockchain for Sanctions Compliance

Distributed ledger technology may enable real-time, transparent sanctions screening for cryptocurrency and digital asset transactions, addressing a current gap in many screening programmes.

4. Predictive Risk Analytics

Beyond identifying current PEPs and sanctioned individuals, future systems will predict which individuals or entities are likely to become high-risk based on behavioural patterns, network analysis, and geopolitical developments.

5. Regulatory Technology (RegTech) Standardisation

Industry-wide standards for screening data formats, risk scoring methodologies, and reporting will emerge, making it easier for institutions to demonstrate compliance and for regulators to conduct examinations.

Key Takeaways

PEP and sanctions screening is a critical component of any financial institution’s compliance programme. The stakes are high, but with the right approach and technology, you can build an effective programme that protects your institution whilst providing a seamless customer experience.

Remember:

•Understand the difference between sanctions screening (strict liability) and PEP screening (risk-based EDD)

•Implement comprehensive, automated screening across all customer touchpoints

•Adopt a risk-based approach that focuses resources on highest-risk relationships

•Integrate screening with your CRM and onboarding platforms for efficiency and effectiveness

•Leverage AI and machine learning to reduce false positives and improve detection

•Maintain robust documentation and audit trails for regulatory examinations

•Continuously monitor and improve your screening programme as risks evolve

By implementing these best practices and leveraging modern technology platforms like InvestGlass, you’ll transform screening from a compliance burden into a strategic advantage—protecting your institution whilst enabling efficient growth.

Ready to modernise your PEP and sanctions screening programme? Contact our compliance team to learn how InvestGlass can help you build a world-class screening capability tailored to your institution’s needs.

Frequently Asked Questions (FAQs)

1. What is the difference between a PEP and a sanctioned individual?

A PEP is someone who holds or has held a prominent public function, making them more vulnerable to corruption. Having a PEP as a customer is legal but requires Enhanced Due Diligence (EDD). A sanctioned individual is someone specifically designated by a government or international body as subject to economic restrictions. Dealing with sanctioned individuals is generally prohibited by law, and violations can result in severe penalties.

2. How long does someone remain classified as a PEP after leaving office?

According to FATF guidance and most regulations, an individual must be treated as a PEP for at least 12 months after leaving their prominent public function. However, this is a minimum requirement. Many institutions apply a risk-based approach and continue to treat former senior officials (such as former heads of state) as PEPs for much longer periods, sometimes indefinitely, depending on their continued influence and connections.

3. Are family members and close associates of PEPs also considered PEPs?

Yes. The FATF definition of PEPs includes family members (spouses, partners, children, parents) and close associates (individuals known to have joint beneficial ownership or close business relationships with the PEP). These individuals should be subject to the same EDD measures as the PEP themselves, as they may be used as conduits for corruption or bribery.

4. How often should we rescreen existing customers?

Best practice is to conduct periodic rescreening at least quarterly, with more frequent screening (monthly or even daily) for higher-risk customers. Additionally, you should implement event-driven screening that automatically rescreens customers when sanctions lists are updated or when customer information changes. InvestGlass automates this process, conducting continuous background screening without manual intervention.

5. What should we do if we identify a customer as a PEP after onboarding?

If you identify a customer as a PEP after the relationship has been established, you should immediately apply Enhanced Due Diligence measures. This includes obtaining senior management approval to continue the relationship, establishing source of wealth and source of funds, and implementing enhanced ongoing monitoring. Document the circumstances of the late identification and the remedial actions taken. InvestGlass’s continuous screening capabilities help prevent late identifications by automatically rescreening customers as new PEP data becomes available.

6. How do we reduce false positives in our screening programme?

False positives can be reduced through several strategies: (1) Use advanced matching algorithms that incorporate fuzzy logic, phonetic matching, and contextual analysis; (2) Collect complete customer data at onboarding, including full name, date of birth, nationality, and address; (3) Implement AI and machine learning that learns from your disposition decisions; (4) Use risk-based thresholds that adjust matching sensitivity based on customer risk profile; (5) Leverage platforms like InvestGlass that employ sophisticated AI to achieve false positive reduction rates of up to 95%.

7. What are the penalties for sanctions violations?

Sanctions violations can result in severe penalties, including: (1) Civil monetary penalties ranging from thousands to millions of pounds per violation; (2) Criminal penalties including imprisonment for individuals involved; (3) Loss of banking licences or regulatory permissions; (4) Reputational damage and loss of correspondent banking relationships. In the US, OFAC can impose penalties of up to $20 million or twice the transaction value per violation. In the EU, penalties can reach €5 million or 10% of annual turnover.

8. Do we need to screen for domestic PEPs or only foreign PEPs?

Requirements vary by jurisdiction. The FATF recommends mandatory EDD for foreign PEPs and risk-based EDD for domestic PEPs. However, many jurisdictions (including the EU under 5AMLD) now require EDD for both foreign and domestic PEPs. Even where not strictly required, best practice is to identify domestic PEPs and apply a risk-based approach to determine the appropriate level of due diligence. InvestGlass screens against both foreign and domestic PEP lists, allowing you to implement jurisdiction-specific policies.

9. How does GDPR affect PEP and sanctions screening in Europe?

GDPR requires that you have a lawful basis for processing personal data, including for screening purposes. For sanctions screening, your lawful basis is typically “legal obligation” (compliance with sanctions laws). For PEP screening, your lawful basis may be “legal obligation” (compliance with AML regulations) or “legitimate interests” (preventing financial crime). You must be transparent about your screening activities in privacy notices, allow individuals to access their data, and maintain appropriate security measures. InvestGlass is built with GDPR compliance at its core, including data minimisation, purpose limitation, and Swiss data sovereignty.

10. Can we outsource PEP and sanctions screening to a third party?

Yes, you can outsource the technology and data aspects of screening to a third-party provider. However, you cannot outsource the ultimate responsibility for compliance. You remain accountable for ensuring that screening is conducted effectively and that appropriate action is taken on alerts. When outsourcing, ensure that: (1) The provider has comprehensive list coverage; (2) The technology meets your accuracy and performance requirements; (3) You maintain access to audit trails and documentation; (4) You have clear SLAs for list updates and system availability; (5) The provider complies with data protection regulations. InvestGlass provides a fully managed screening solution whilst ensuring you maintain complete control and visibility over your compliance programme.

Related Resources:

•How to Automate the KYC Process

•InvestGlass KYC Software for Customer Onboarding: An In-Depth Review

•The Importance of KYC Remediation and Why You Should Be Doing It

•What Are the 5 Steps Involved in KYC?

•Artificial Intelligence: The Game Changer in Anti-Money Laundering