What does AML do banking?

Written by InvestGlass on .

When it comes to banking, Anti Money Laundering (AML) is a set of compliance procedures that banks must follow in order to detect and prevent illegal activity. But what does AML actually do? In this blog post, we’ll take a closer look at the different aspects of AML and how they work together to protect both banks and their customers. So if you’ve ever wondered how exactly AML works or what it covers, read on!

AML in banks is short for anti-money laundering and bank secrecy act

The term AML is thrown around a lot these days, but it stands for something very important. Anti-money laundering is a practice put in place by governments and financial institutions all around the world to not only prevent illegal activities from taking place but to also deter criminals from engaging in those activities. In essence, it ensures that all economic transactions are legitimate, with both parties involved being known entities. AML has made great strides in curtailing criminal activity so that our economies and financial systems remain safe and secure for the years to come. AML in banks usually include :

- drug trafficking alerts

- combatting terrorist financing

- illegal funds

- criminal activities

- illegal funds

- finance terrorism

- politically exposed persons

- securities fraud

- transaction fraud

New prospects have to have legitimate income and any past criminal prosecution.

AML policy compliance in the U.S. For example, in the United States under the Bank Secrecy Act ( BSA ), banks must create an effective AML compliance program, as well as establish the appropriate customer due diligence systems and programs. Banks must also screen against Office of Foreign Assets Control ( OFAC ) economic and trade sanctions.

The Federal Council adopted the dispatch for the attention of Parliament at the end of June 2019. Parliament passed the revision in March 2021. The revised Anti-Money Laundering Act and its implementing provisions will enter into force on 1 January 2023.

Money laundering and terrorist financing are two of the major challenges in today’s global economy. To protect their customers and comply with international obligations, banks have to abide by a set of regulations that serve as a framework for proper record-keeping, customer due diligence, and reporting of suspicious transactions. While the regulations might seem like a nuisance for those working in finance, they ultimately play an important role in maintaining the integrity of financial markets and safeguarding against any unethical activities across different countries.

Include customer due diligence, reporting suspicious activity, and maintaining records

Banks have many responsibilities to uphold for the safety of their customers and their financial systems. One essential responsibility is customer due diligence, which includes verifying the identity of clients and understanding the nature of their businesses or operations. Banks also need to report any suspicious activity as soon as possible so that it can be looked into and prevented or addressed. Finally, it is mandatory for banks to maintain records of all transactions and activities so they can provide them if requested by governmental authorities. Without these checks, banks would not be able to oversee customers’ financial activities properly. Ultimately, the responsibility of these tasks lies with banks so they can ensure a safe environment for customers’ money.

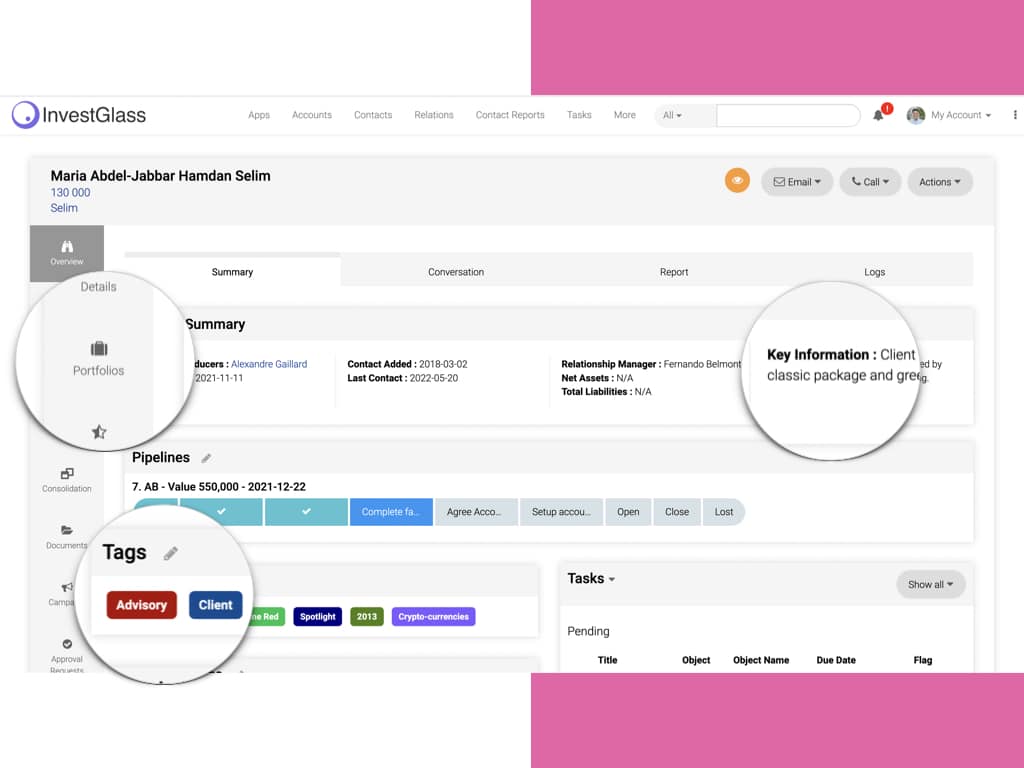

With InvestGlass AML tools, AML compliance officers can automate the process with a risk based approach. InvestGlass has developed automated AML tools which enable compliance officers to easily check customers’ identities and monitor their financial activities. The automated system uses a risk-based approach, which means it can quickly identify high-risk customers or transactions that may pose a threat of money laundering or terrorist financing.

With the InvestGlass form, you can collect information from multiple beneficial owners, and limited power of attorney KYC. This process with digital forms helps to protect bank against financial crimes. You can also ask the right questions in those digital forms to produce suspicious activity reports. Senior management will appreciate that AML in banks is a digital process.

These regulations help to keep the financial system safe and secure

Financial regulations exist to protect investors, prevent markets from becoming too volatile,and mitigate economic risk. They set the minimum requirements for operating financial firms and markets, including licenses and certifications as well as outsourcing arrangements. By helping to keep the financial system secure, these regulations create an environment conducive to sustainable growth and create safeguards against misconduct. Without them, it would be much more difficult for individuals to invest safely and easily. Not only do they act as a deterrent against practices that could harm the integrity of markets; they also help consumers by holding companies accountable through compensation funds that cover losses resulting from poor advice or bad investments. Ultimately, these regulations ensure that everyone plays by the same rules and creates an inclusive, safe space for investments in the economy.

Banks have to conduct ongoing customer due diligence, this is when you need a powerful CRM like InvestGlass. InvestGlass’s CRM – customer relationships software – provides real-time data to help banks monitor customer activity, including changes in their financial situation over time. It also helps them understand the source of funds and detect any patterns that might indicate money laundering or terrorist financing. The powerful technology behind InvestGlass enables banks to quickly identify suspicious activities and take appropriate action before it’s too late. With InvestGlass, banks can be sure that they are compliant with all financial regulations and have the necessary protection for their customers.

Overall, AML laws and regulations provide a framework to ensure that banks take appropriate measures to prevent money laundering or terrorist financing from taking place. By conducting customer due diligence, reporting suspicious activity, and monitoring customer activity, banks can be sure that they are compliant with all regulations and create a safe environment for customers’ finances. InvestGlass provides powerful tools to help banks comply with these laws while also helping them stay ahead of potential threats and protect their customers from financial harm. With InvestGlass, banks can ensure that their customers are secure and their operations are compliant.

If you’re financial institutions, you may notice some changes in how your bank operates, but overall it’s for the greater good!

For customers of any bank, it’s common to continually see changes and modifications in the way the bank operates. While this can be inconvenient at times, it is for the greater good and is necessary for banks to protect their customers’ funds, safety, and security. To conform to Evolving policies, banks must closely monitor potential risks, implement updated practices and re-evaluate how they provide services. All of these changes are necessary steps that banks take to ensure protection from potential threats. Despite potential frustrations from shifts in banking operations, these measures truly enable customers who trust their banking institutions with financial information to feel secure knowing that their assets are safe.

AML regulations can change as terrorism financing, and money laundering risk change over time. Transaction monitoring is key for financial institutions in order to stay compliant and keep their customers protected. InvestGlass helps financial institutions to monitor customer activity, detect suspicious activities and take appropriate action before it’s too late. Powerful software like InvestGlass enables banks to quickly identify suspicious activities and take the necessary measures to protect their customers from any potential harm.

AML is an important set of regulations that banks have to follow in order to prevent money laundering and terrorist financing. These regulations help to keep the financial system safe and secure. If you’re a bank customer, you may notice some changes in how your bank operates, but overall it’s for the greater good! Thanks for reading and I hope this article was helpful in explaining what AML is and why it’s so important.