Invoice Automation: Why Accounts Payable Needs to Embrace the Future

Manual invoice processing is broken. It drains productivity, introduces errors, delays payments, and prevents businesses from scaling efficiently. For years, companies have relied on paper invoices, manual data entry, and inefficient processes. But as businesses grow, the flaws in traditional accounts payable processes become impossible to ignore.

The good news? With today’s automated invoice processing software—including solutions like InvestGlass Invoice Automation hosted on a sovereign, cloud-based platform—finance teams can finally take control of their accounts payable workflow, streamline the entire invoice payment process, and reduce costs while improving compliance.

This article explores the full picture: from the pain of manual processes to the additional benefits of invoice processing automation, and how workflow automation with InvestGlass can transform the way your accounting department operates.

The Problem with Manual Invoice Processing

Despite advances in accounting software and ERP systems, many organisations still rely on manual processes for processing invoices. Typically, the accounts payable clerk or AP department must:

- Collect incoming invoices (often as paper invoices or PDFs via email).

- Manually input invoice data into the accounting system.

- Match the invoice against the purchase order and delivery note.

- Route invoices for approval.

- Manage the invoice payment process.

Manual invoice processing workflows can result in lost invoices due to manual routing and handling, increasing the risk of delays and missed payments.

Manual invoice processing workflows create several issues:

- Time-consuming – Delays in the ability to approve invoices are common and can take days or weeks.

- High error rates – Typing errors in payment data or relevant data can result in duplicate or missed payments.

- Lack of visibility – Tracking the status of invoice payments becomes difficult.

- Increased costs – Manual data entry and corrections drain staff hours and increase operating costs.

- Inefficient processes – The lack of automation prevents scaling as the business grows.

The Case for Automated Invoice Processing

Automating invoice processing replaces manual handling with smart, integrated systems. When an invoice arrives, automation software extracts invoice data, matches it with the purchase order, and routes it to the right approver—without human intervention.

Key advantages of invoice processing automation include:

- Faster cycle times – Process invoices in hours rather than days.

- Improved accuracy – Reduce error rates by eliminating manual data entry.

- Lower costs – Minimise staffing overheads in the accounts payable function.

- Better cash management – Take advantage of early payment discounts and forecast more accurately.

- Enhanced compliance – Maintain an audit trail across the AP process.

The result? A finance team that can shift from manual processing to value-added tasks such as cash flow optimisation, vendor relationships, and key performance indicators analysis.

How Automated Invoice Processing Systems Work

Modern automated invoice processing systems integrate seamlessly into your accounting software, ERP system, or cloud-based platform.

Step 1: Capture Invoice Data

Invoices—whether paper invoices, PDFs, or e-invoices—are scanned and processed using optical character recognition (OCR) and machine learning. The system automatically extracts relevant data such as supplier name, invoice number, due date, and line items.

Step 2: Match with Purchase Orders

Automation software compares the invoice against the original purchase order and goods receipt. Any discrepancies trigger alerts, allowing the accounts payable department to intervene only when necessary.

Step 3: Route for Approval

Through workflow automation, the invoice is sent to the correct manager for approval. Businesses can create custom workflows to reflect their unique business processes—whether that means approval by project managers, department heads, or finance leads.

Step 4: Payment Processing

Once approved, the invoice is automatically scheduled for payment. The payment process is tracked in real-time, ensuring transparency and efficiency.

Step 5: Archiving and Reporting

Invoices are securely stored within the invoicing system, creating a digital archive for audits, compliance checks, and internal reviews. Accounting departments can generate reports instantly, tracking the health of the payable workflow.

Exception Management in Automated Invoice Processing

Exception management is the game-changing element that transforms automated invoice processing from good to extraordinary. When discrepancies strike or issues surface in your invoicing process, you need lightning-fast identification and resolution. Advanced automated invoice processing software with machine learning and optical character recognition works tirelessly to extract invoice data and perform three-way matching, but exceptions still happen—missing information, duplicate invoices, non-compliant documents. That’s where true automation excellence shines.

Here’s where your business wins big. Automated invoice processing systems tackle these challenges head-on by empowering you to create custom workflows that automatically route problem invoices to the right team members for instant review and resolution. This automation eliminates manual data entry completely, slashing error rates and supercharging your accounts payable process. Real-time visibility into exception management means your finance teams can track, analyze, and crush exceptions as they happen, keeping your payable process efficient and crystal clear.

The benefits go way beyond streamlined processing. When you automate exception management, you unlock powerful advantages that transform your bottom line. Capture early payment discounts that boost your cash position. Improve cash management with precision timing. Strengthen supplier relationships by ensuring every payment hits exactly when it should. Your automated invoice processing software adapts to your unique business needs, creating custom workflows that fit your accounts payable function like a glove.

Integration with your existing accounting systems and ERP platforms takes exception management to the next level. This seamless connection lets you automate the entire invoice-to-pay cycle while delivering real-time insights into cash flow and financial performance. Companies slash costs, minimize manual intervention, and redirect resources toward strategic initiatives that drive serious business growth. This is automation that actually moves the needle.

Bottom line: robust exception management within automated invoice processing systems is your secret weapon for reducing errors, boosting efficiency, and optimizing your accounts payable process. Leverage automation, custom workflows, and integrated accounting systems to transform your accounts payable function into a streamlined, cost-effective powerhouse that drives your business forward.

The Role of Accounts Payable Automation Solutions

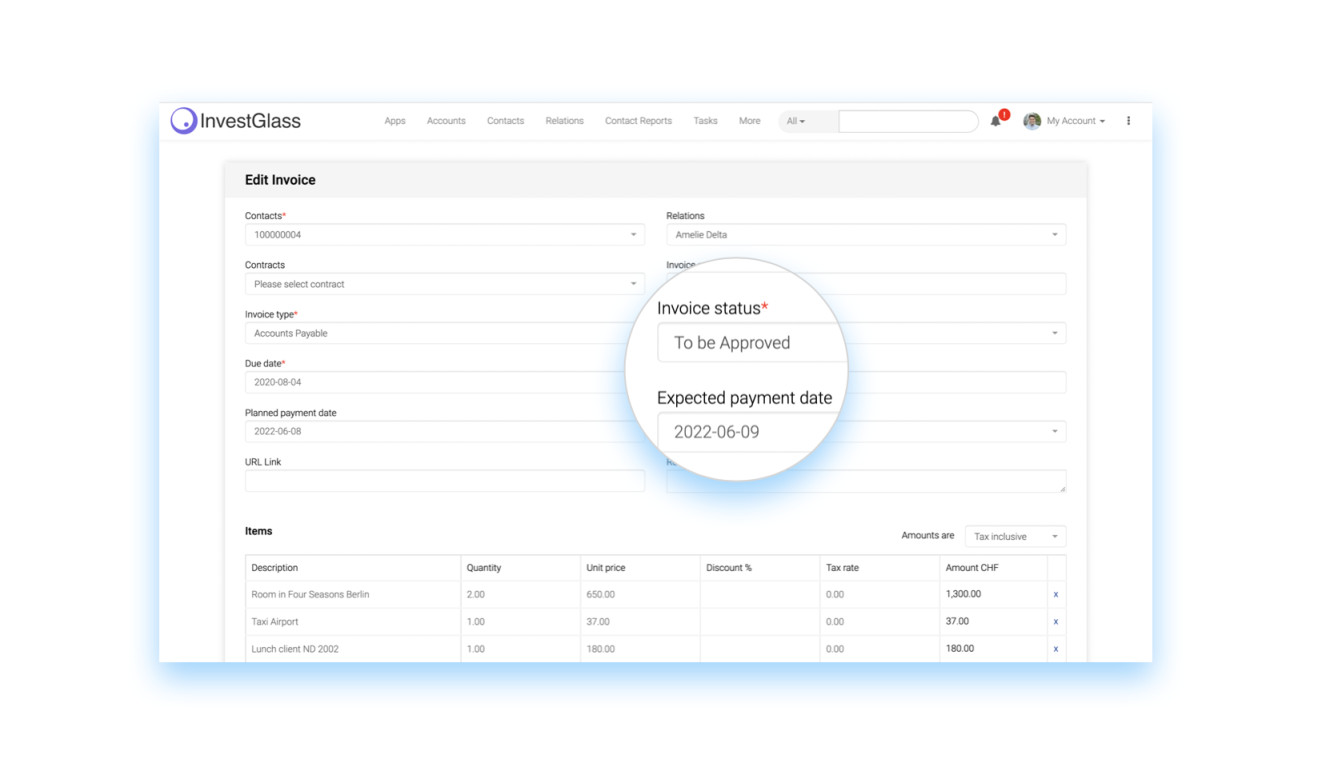

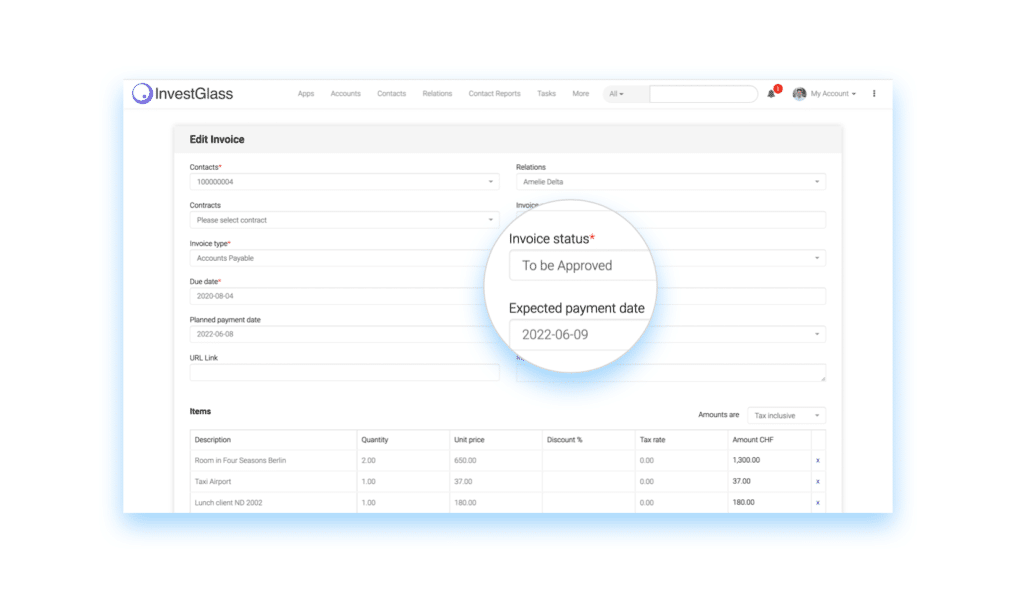

An accounts payable automation solution like InvestGlass revolutionises the accounts payable process. Rather than drowning in admin, the accounting team benefits from:

- Centralised invoice management – One unified platform for all invoices.

- End-to-end process automation – From invoice capture to payment.

- Custom workflows – Adaptable approval processes tailored to your business needs.

- Integration with existing systems – Seamless connection to ERP systems and tools such as Microsoft Dynamics.

This means AP automation is not just about efficiency—it’s about enabling the AP department to become a strategic driver of value in the organisation.

Manual vs Automated Invoice Processing

| Aspect | Manual Invoice Processing | Automated Invoice Processing |

|---|---|---|

| Data Entry | Manual data entry by staff | Automated OCR + AI |

| Speed | Slow, time-consuming | Fast, real-time |

| Error Rates | High error rates | Significantly reduced |

| Costs | Labour-intensive | Reduced costs through automation |

| Visibility | Poor tracking | Full transparency |

| Scalability | Limited as business grows | Scales effortlessly with volume |

How Automation Software Enhances Invoice Management

Invoice processing automation brings additional benefits far beyond efficiency. With automation software, accounting departments can:

- Analyse KPIs – Monitor key performance indicators for AP cycle times, error rates, and processing costs.

- Ensure compliance – Build digital audit trails for regulators.

- Improve vendor relationships – Pay suppliers on time, every time.

- Support growth – Adaptable systems scale as the business grows.

- Enhance collaboration – Finance teams work more closely with procurement, thanks to shared visibility over purchase orders and invoice payments.

Custom Workflows and Flexibility

One of the biggest advantages of workflow automation is the ability to create custom workflows.

Examples include:

- By supplier type – Large suppliers may require two signatures, small suppliers only one.

- By invoice amount – Low-value invoices auto-approved, high-value invoices escalated.

- By department – Different workflows for IT, HR, and operations.

This level of flexibility ensures that the processing workflow supports your business processes rather than forcing your team to adapt to rigid software.

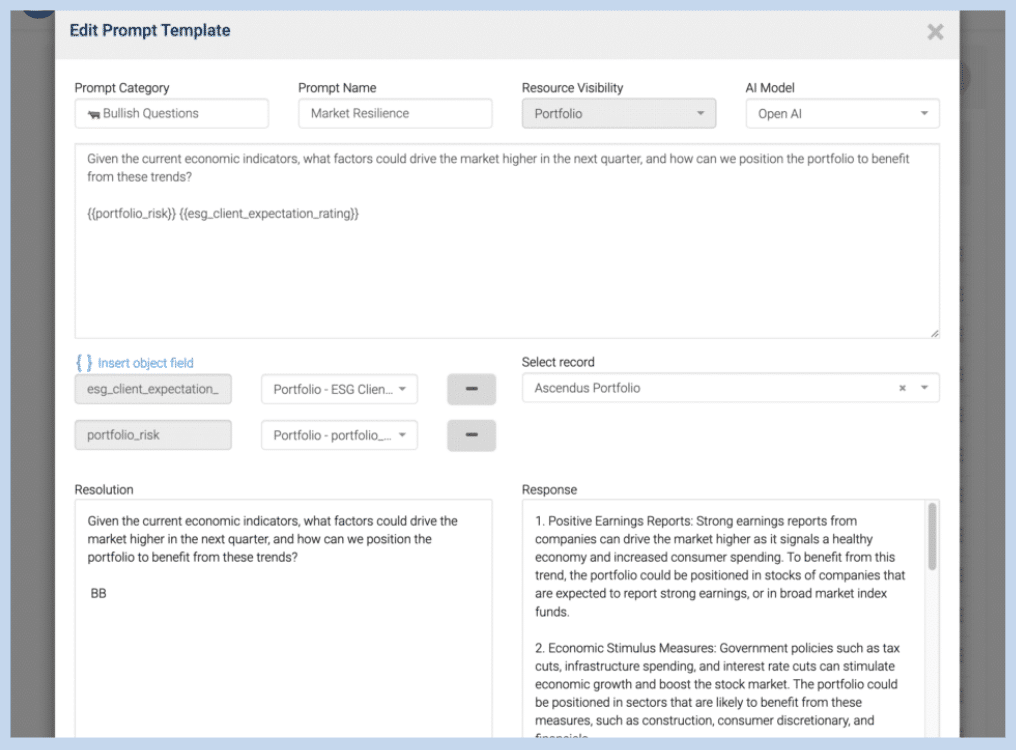

The Role of AI and Machine Learning

Artificial intelligence and machine learning are transforming how organisations process invoices.

- Optical character recognition (OCR) reduces the need for manual data entry.

- Predictive analytics help forecast cash flow and highlight anomalies.

- Automation software learns from historical invoice data to flag fraud or unusual patterns.

By embedding AI into the accounts payable function, companies can dramatically reduce risks while improving performance.

Why InvestGlass? A Sovereign Cloud-Based Platform

While many AP automation solutions are hosted on American cloud providers, InvestGlass is built on a sovereign, non-American cloud—ideal for European companies seeking compliance with GDPR, FINMA, and other local regulations.

With InvestGlass, you benefit from:

- Invoice processing automation within a single CRM and ERP-ready solution.

- A cloud-based platform ensuring secure, compliant data storage.

- Custom workflows that adapt to your business needs.

- AP process optimisation that reduces costs and errors.

- Integration with leading systems, including Microsoft Dynamics.

This makes InvestGlass the perfect payable automation solution for organisations that value efficiency, compliance, and sovereignty.

Conclusion: The Future of Accounts Payable

The days of relying on manual invoice processing are over. As business processes become more complex and as the accounting team faces increasing compliance demands, automated invoice processing systems are no longer a luxury—they are essential.

By adopting an accounts payable automation solution like InvestGlass, businesses can:

- Reduce costs by eliminating manual processing.

- Increase accuracy with automated invoice data capture.

- Improve cash management and take advantage of early payment discounts.

- Enhance productivity in the accounts payable department.

- Future-proof their accounting system with scalable, sovereign technology.

In short, if your organisation still relies on paper invoices and manual data entry, it’s time to automate invoice processing. The investment pays off quickly—transforming your accounts payable function from a cost centre into a driver of strategic value.

InvestGlass provides the tools, flexibility, and compliance you need to achieve it.

Frequently Asked Questions (FAQ)

1. What is automated invoice processing in InvestGlass?

Automated invoice processing in InvestGlass replaces manual tasks like data entry, approval routing, and payment scheduling with smart workflows. It uses forms, OCR (optical character recognition), and integrations to capture invoice data, approve invoices, and trigger payments automatically.

2. How does InvestGlass reduce errors in invoice management?

By eliminating manual data entry, InvestGlass significantly reduces error rates. Invoice data is extracted digitally and matched against purchase orders, ensuring fewer duplicate invoices, missing details, or incorrect payment data.

3. Can InvestGlass handle both paper invoices and digital invoices?

Yes. Whether your invoice arrives as a paper document, a PDF, or directly through an integration, InvestGlass’s automation software captures, processes, and stores it securely in the invoicing system.

4. Does InvestGlass integrate with accounting software and ERP systems?

Absolutely. InvestGlass connects seamlessly with popular accounting systems and ERP solutions such as Microsoft Dynamics. You can also build custom workflows through the InvestGlass API to adapt to specific business needs.

5. How does automation help the accounts payable department?

Automation transforms the accounts payable function by reducing manual processing, lowering costs, and improving cash management. It allows AP clerks to focus on higher-value tasks such as monitoring KPIs, vendor relationships, and strategic decision-making.

6. Can InvestGlass support recurring invoices?

Yes. InvestGlass enables businesses to set up recurring invoices for long-term clients on a monthly, quarterly, or custom basis. This saves time, ensures accuracy, and supports consistent cash flow forecasting.

7. How secure is InvestGlass’s invoice automation solution?

InvestGlass is hosted on a sovereign, non-American cloud, ensuring compliance with GDPR, FINMA, and other European regulations. Sensitive invoice and payment data is protected by robust security protocols and audit trails.

8. Can InvestGlass automate reminders for unpaid invoices?

Yes. You can set automated reminders for late payments and create tasks for your team to follow up with clients. This keeps the invoice payment process on track and helps protect your business from cash flow issues.

9. What are the main benefits of using InvestGlass invoice automation?

The key benefits include:

- Reduced costs from manual processes

- Faster approval of invoices

- Lower error rates in invoice data

- Better cash management and forecasting

- A scalable system as your business grows

10. How flexible are InvestGlass’s workflows for invoice processing?

InvestGlass allows businesses to create custom workflows that adapt to their internal approval processes. For example, invoices above a certain value may require multiple approvals, while smaller invoices can be auto-approved. This flexibility ensures the system fits your business processes, not the other way round.