Digital Sovereignty in Qatar: Why Swiss CRM Solutions Like InvestGlass Are the Future of Data Control

As the State of Qatar accelerates its ambitious journey towards becoming a global digital hub under the Qatar National Vision 2030, the concept of digital sovereignty has emerged as a critical strategic priority. This comprehensive guide explores Qatar’s determined push for data control, examines the inherent risks posed by dominant US cloud providers like Salesforce and Microsoft, and presents InvestGlass a Swiss sovereign CRM platform as the compelling alternative for Qatari enterprises seeking true data independence.

What You Will Learn

In this article, we will explore the following key topics:

•Qatar’s strategic vision for digital sovereignty and its foundational policy initiatives under the Digital Agenda 2030

•The regulatory landscape governing data protection in Qatar, including the Personal Data Privacy Protection Law

•The inherent data privacy risks associated with US-based cloud solutions due to the CLOUD Act

•How InvestGlass, a Swiss-based sovereign CRM, offers a genuinely independent alternative for Qatari businesses

•A detailed comparative analysis of InvestGlass versus Salesforce and Microsoft in the context of data sovereignty

•Practical implementation strategies for Qatari organisations seeking to enhance their data sovereignty posture

•Sector-specific considerations for financial services, healthcare, and government entities

Understanding Digital Sovereignty: A Foundation for Qatar’s Digital Future

Digital sovereignty represents far more than a technical consideration; it embodies a nation’s fundamental right to control its digital destiny. At its core, digital sovereignty encompasses the ability of a country to maintain autonomy over its digital infrastructure, data assets, and the legal frameworks that govern how information flows within and across its borders. For Qatar, this concept has become inextricably linked to national security, economic competitiveness, and the protection of citizen privacy.

The importance of digital sovereignty has grown exponentially in recent years as governments worldwide recognise that data has become the most valuable resource of the twenty-first century. According to the World Economic Forum, over 92% of all data globally is stored on servers owned by US-based companies, creating a significant concentration of control that has profound implications for nations seeking to maintain independence in the digital realm . This statistic alone underscores why countries like Qatar are investing heavily in strategies to reclaim control over their digital assets.

In the Gulf region, Qatar has distinguished itself by adopting what experts describe as a “sovereignty-first playbook” a deliberate, top-down strategy that prioritises national control over digital assets while still enabling the benefits of digital transformation . This approach stands in contrast to some neighbouring states that have adopted more permissive models favouring ease of business over strict data control.

Qatar’s Strategic Framework: The Digital Agenda 2030

The cornerstone of Qatar’s digital sovereignty strategy is the Digital Agenda 2030 (DA2030), launched by the Ministry of Communications and Information Technology (MCIT). This comprehensive framework represents a significant step towards comprehensive digital transformation, positioning Qatar as a regional leader in the digital economy whilst maintaining robust control over national data assets .

The Digital Agenda 2030 is structured around six strategic pillars, each designed to address a critical dimension of Qatar’s digital future:

Pillar One: Digital Infrastructure

Qatar aspires to ensure world-class, secure, and sustainable ICT infrastructure. This pillar recognises that true digital sovereignty begins with physical infrastructure the data centres, network connections, and computing resources that form the backbone of the digital economy. By investing in local infrastructure, Qatar reduces its dependence on foreign providers and creates the foundation for data localisation requirements.

Pillar Two: Digital Government

The second pillar aims to ensure transparency and improve digital government efficiency. Government services represent some of the most sensitive data processing activities in any nation, involving citizen records, national security information, and critical administrative functions. By digitising these services whilst maintaining sovereign control, Qatar can deliver better outcomes for citizens without compromising national security.

Pillar Three: Digital Technologies

Qatar plans to build strong foundations in data and emerging technologies, including artificial intelligence, blockchain, and advanced analytics. This pillar recognises that sovereignty extends beyond mere data storage to encompass the technologies used to process and derive value from that data. By developing indigenous capabilities in these areas, Qatar can reduce its dependence on foreign technology providers.

Pillar Four: Digital Innovation

The fourth pillar aims to develop an innovative and thriving digital sector powered by investments and applied research. This includes supporting local technology companies that can provide sovereign alternatives to foreign solutions, thereby creating a virtuous cycle of innovation and independence.

Pillar Five: Digital Economy

Qatar intends to drive digital adoption to accelerate economic growth. This pillar recognises that digital sovereignty is not about isolation but about participating in the global digital economy on Qatar’s own terms, with appropriate protections for national interests.

Pillar Six: Digital Society

The final pillar aims to build a digitally savvy population, nurturing talent and providing access to the best training programmes. A sovereign digital future requires citizens and professionals who understand both the opportunities and risks of digital technologies .

The Regulatory Landscape: Qatar’s Data Protection Framework

Qatar’s commitment to digital sovereignty is reinforced by a comprehensive legal framework that sets clear expectations for how data must be handled within the country. The centrepiece of this framework is the Personal Data Privacy Protection Law (QPDPPL, Law No. 13 of 2016), which establishes GDPR-style protections for personal data .

Key Features of Qatar’s Data Protection Law

The QPDPPL establishes several fundamental principles that organisations operating in Qatar must observe:

Consent and Purpose Limitation: Organisations must obtain explicit consent for data processing and may only use data for the purposes for which it was collected. This principle ensures that individuals maintain control over how their information is used.

Data Minimisation: Companies should collect only the data necessary for their stated purposes, reducing the risk of excessive data accumulation that could be exploited or compromised.

Security Requirements: The law mandates appropriate technical and organisational measures to protect personal data from unauthorised access, disclosure, or destruction.

Special Categories of Data: The QPDPPL defines “personal data of a special nature” to include health information, religious beliefs, ethnic origin, criminal records, and children’s data. Processing these categories requires additional safeguards and, in many cases, prior regulatory approval .

The Role of the National Data Privacy Office

The National Data Privacy Office serves as the primary regulatory authority for data protection in Qatar. While historically taking an education-first approach, the office has recently adopted a firmer enforcement stance, issuing binding decisions to correct material compliance gaps. This evolution signals Qatar’s increasing seriousness about ensuring that data protection requirements are not merely aspirational but actively enforced .

Sector-Specific Regulations

Beyond the general data protection framework, specific sectors face additional requirements:

Financial Services: The Qatar Central Bank (QCB) imposes stringent data localisation requirements for retail banks and insurers. Customer data must generally remain within Qatar, and material cloud outsourcing requires prior QCB approval. These requirements reflect the sensitivity of financial data and the potential systemic risks of relying on foreign infrastructure .

Healthcare: Patient health information is subject to the most stringent controls, mandating explicit consent and regulatory pre-approval for processing. Healthcare providers must ensure that patient data remains protected from foreign access.

Telecommunications: Operators must obtain explicit, opt-in consent for direct marketing and must implement special protections for children’s data.

The Challenge: US Cloud Providers and the CLOUD Act

While Qatar has established a robust framework for data protection, the practical reality of achieving digital sovereignty is complicated by the dominance of US-based cloud providers in the global technology market. Companies like Microsoft, Salesforce, and Amazon Web Services offer powerful platforms that many organisations depend upon for their daily operations. However, these providers are subject to US law, which creates fundamental conflicts with Qatar’s sovereignty objectives.

Understanding the CLOUD Act

The Clarifying Lawful Overseas Use of Data (CLOUD) Act, enacted by the United States in 2018, represents the most significant legal obstacle to achieving true digital sovereignty when using US-based services. This law grants US law enforcement agencies the authority to compel US-based technology companies to provide requested data, regardless of where that data is physically stored .

The implications of this law are profound and far-reaching:

Extraterritorial Reach: The CLOUD Act explicitly allows the US government to access data located overseas. Even if your data is stored in a data centre in Qatar, the UAE, or Switzerland, if the service provider is a US company, that data remains subject to US jurisdiction .

Bypassing Local Laws: The CLOUD Act does not require US authorities to work through local legal channels or mutual legal assistance treaties (MLATs). This means that data can be accessed without the knowledge or consent of local authorities, potentially violating local data protection laws .

No Adequate Remedies: Unlike domestic legal processes, the CLOUD Act provides limited avenues for foreign individuals or companies to challenge data requests, leaving affected parties with few options for protecting their information.

The Conflict with GDPR and Qatari Law

The CLOUD Act creates a direct conflict with data protection regulations like the European Union’s General Data Protection Regulation (GDPR) and Qatar’s own QPDPPL. Under these frameworks, data transfers outside the jurisdiction require a legal basis, and court orders from third countries are only valid if based on international agreements such as MLATs .

This puts companies in an impossible legal dilemma:

•If they comply with a US warrant, they risk breaching GDPR and Qatari data protection law, potentially facing significant fines and reputational damage.

•If they refuse, they may face legal penalties in the United States, including contempt charges and substantial fines.

The European Data Protection Board has made clear that service providers subject to EU law cannot legally base data transfers to the US solely on CLOUD Act requests . Similar logic applies to Qatar’s legal framework.

The Illusion of “Sovereign Cloud” Offerings

In response to growing concerns about data sovereignty, major US cloud providers have introduced offerings marketed as “sovereign” or “local data residency” solutions. Microsoft, for example, offers Hyperforce deployments in the UAE and has announced plans for data centres in Saudi Arabia . Salesforce similarly promotes local data residency options.

However, these offerings provide what critics describe as an “illusion of control” rather than true sovereignty. The fundamental problem remains: if the provider is headquartered in the United States, the CLOUD Act still applies, regardless of where the data is physically stored .

“While Microsoft offers local data centers in countries like Switzerland, the company remains a U.S. entity, and that’s a problem. Under the U.S. Cloud Act, Microsoft is obligated to hand over data to U.S. authorities upon request, regardless of where that data is physically stored.”

This reality has significant implications for Qatari organisations, particularly those in regulated sectors. Using US cloud providers, even with local data residency, does not provide protection from US government access and may not satisfy Qatar’s regulatory requirements for data sovereignty.

InvestGlass: A Truly Sovereign Alternative

In this challenging landscape, a new category of technology provider has emerged companies built from the ground up on principles of true data sovereignty. InvestGlass, a 100% Swiss-owned and operated company headquartered in Geneva, represents the leading example of this approach in the CRM and business automation space.

Why Switzerland Matters

Switzerland’s unique position in the global legal landscape makes it an ideal jurisdiction for sovereign technology solutions:

Legal Independence: Switzerland is not a member of the European Union and is not subject to US jurisdiction. Swiss companies cannot be compelled by US authorities to hand over data under the CLOUD Act.

Strong Privacy Laws: The Swiss Federal Act on Data Protection provides robust protections for personal data, with recent updates bringing it into alignment with GDPR standards whilst maintaining Swiss independence.

Political Neutrality: Switzerland’s long-standing tradition of political neutrality provides additional assurance that data will not be caught up in geopolitical conflicts.

Financial Sector Expertise: Switzerland’s centuries-long tradition of banking secrecy and financial services excellence has created deep expertise in handling sensitive data expertise that is embedded in platforms like InvestGlass.

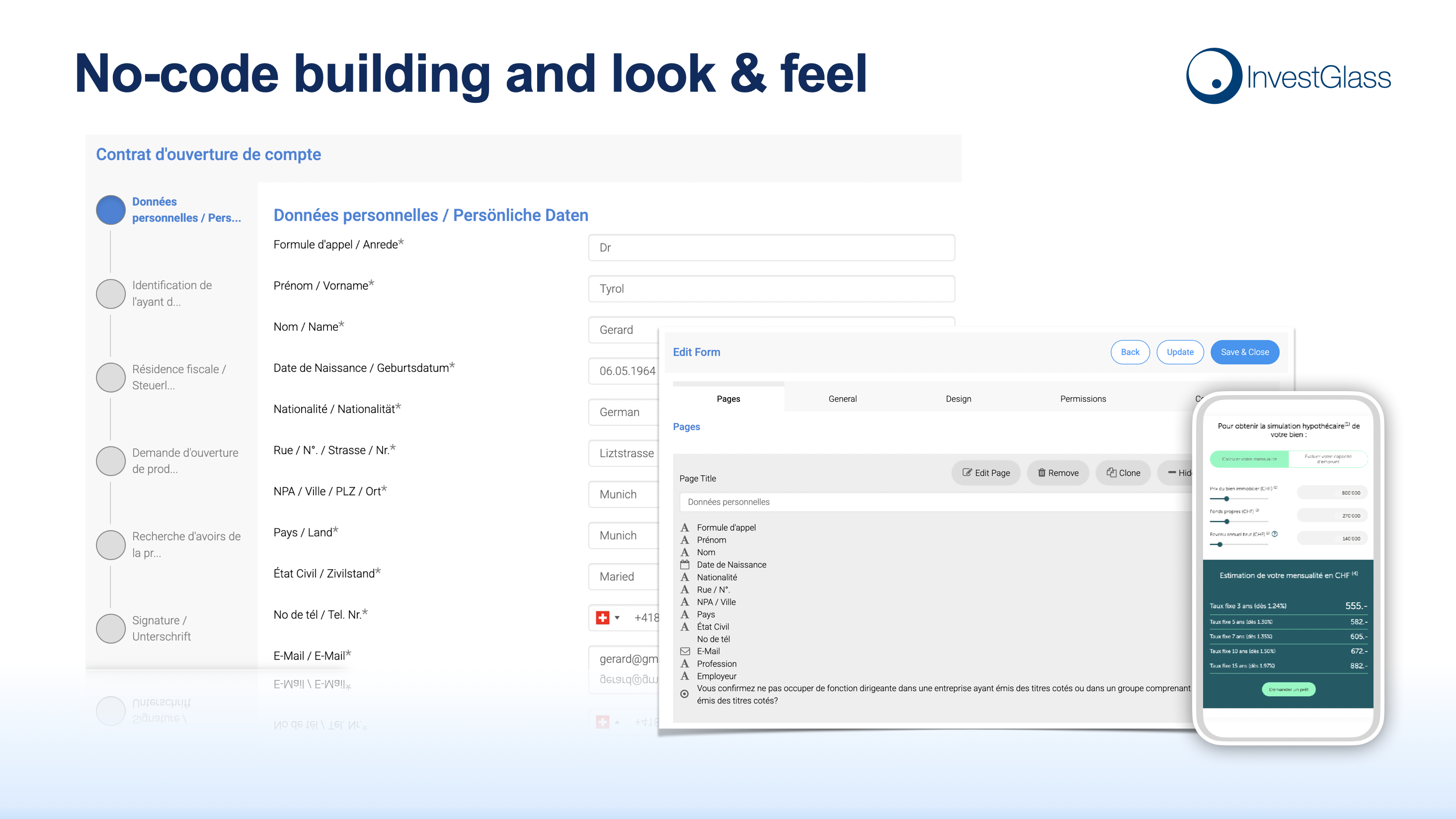

The InvestGlass Platform

InvestGlass offers a comprehensive suite of tools designed specifically for regulated industries that cannot compromise on data privacy and control. The platform combines the functionality expected of modern enterprise software with the sovereignty guarantees that Qatari organisations require .

Customer Relationship Management (CRM)

At its core, InvestGlass provides a powerful CRM for financial services that enables organisations to manage client relationships, track investment opportunities, and maintain comprehensive records of all client interactions. The CRM is designed with the specific needs of regulated industries in mind, including built-in compliance workflows and audit trails .

Digital Onboarding and KYC

One of the most critical functions for financial institutions is client onboarding, which must balance customer experience with rigorous compliance requirements. InvestGlass offers comprehensive KYC (Know Your Customer) solutions that automate identity verification, document collection, and risk assessment whilst maintaining full compliance with regulatory requirements .

The platform integrates with leading regulatory technology (regtech) partners, including Sumsub, to provide seamless identity verification and ongoing monitoring capabilities. This integration ensures that organisations can meet their compliance obligations without sacrificing efficiency or customer experience.

Portfolio Management System (PMS)

For wealth managers and investment advisors, InvestGlass provides a full-featured portfolio management system that can connect to existing banking and brokerage data sources. This enables advisors to provide comprehensive portfolio oversight whilst maintaining all data within sovereign infrastructure .

Marketing Automation

The platform includes sophisticated marketing automation capabilities that enable organisations to execute targeted campaigns whilst respecting client data privacy. Unlike US-based marketing platforms, InvestGlass ensures that marketing data remains within sovereign control.

Client Portal

InvestGlass provides a secure, branded client portal that enables organisations to communicate with clients and share documents in a controlled environment. This portal can be customised to match organisational branding and can be deployed on sovereign infrastructure.

Flexible Deployment Options

One of the key advantages of InvestGlass is its flexibility in deployment:

Swiss Cloud Hosting: Organisations can choose to have their data hosted in secure Swiss data centres, benefiting from Switzerland’s strong legal protections and world-class infrastructure.

On-Premise Deployment: For organisations requiring maximum control, InvestGlass can be deployed entirely on-premise within the organisation’s own data centres in Qatar. This option provides complete control over data residency and eliminates any dependence on external infrastructure .

This flexibility enables organisations to choose the deployment model that best fits their specific regulatory requirements and risk tolerance.

Comparative Analysis: InvestGlass vs. US Cloud Providers

To understand the practical implications of choosing a sovereign solution like InvestGlass over US-based alternatives, it is helpful to examine the key differences across several dimensions:

| Dimension | US Providers (Salesforce, Microsoft) | InvestGlass (Swiss Sovereign) |

| Legal Jurisdiction | Subject to US CLOUD Act | Subject to Swiss Federal Act on Data Protection |

| Government Access | Can be compelled by US authorities without local court order | Protected by Swiss law; no foreign government access |

| Data Residency | Local data centres available, but jurisdiction remains US | True data residency in Switzerland or on-premise |

| Regulatory Compliance | Potential conflict with GDPR and Qatari law | Fully compliant with GDPR and Swiss regulations |

| Sovereignty Guarantee | Marketing claims only; no legal protection | Legal and technical sovereignty guarantees |

| Financial Sector Expertise | General-purpose platforms | Purpose-built for regulated financial services |

| Deployment Flexibility | Cloud-only for most features | Cloud or on-premise deployment |

| Vendor Lock-in Risk | High; proprietary ecosystems | Lower; open architecture and data portability |

The True Cost of Sovereignty Risk

When evaluating CRM and business automation platforms, organisations often focus primarily on feature comparisons and licensing costs. However, the sovereignty dimension introduces risks that can have far-reaching financial and operational implications:

Regulatory Penalties: Organisations that fail to comply with data protection requirements may face significant fines. Under GDPR, penalties can reach up to 4% of global annual turnover. Qatar’s regulatory framework similarly provides for substantial penalties.

Reputational Damage: Data breaches or unauthorised access incidents can cause lasting damage to an organisation’s reputation, particularly in trust-dependent sectors like financial services.

Operational Disruption: In extreme scenarios, regulatory action could require organisations to cease using non-compliant systems, causing significant operational disruption.

Competitive Disadvantage: As clients become more aware of data sovereignty issues, organisations that cannot demonstrate sovereign data handling may lose business to competitors who can.

When these risks are factored into the total cost of ownership calculation, sovereign solutions like InvestGlass often prove more economical than superficially cheaper US alternatives.

Implementation Strategies for Qatari Organisations

For Qatari organisations seeking to enhance their data sovereignty posture, the transition to sovereign solutions requires careful planning and execution. The following strategies can help ensure a successful implementation:

Conduct a Data Sovereignty Audit

The first step is to understand your current data landscape. This involves identifying all systems that process personal or sensitive data, mapping data flows within and outside the organisation, and assessing the sovereignty implications of each system. Pay particular attention to:

•Where data is physically stored

•Which jurisdictions have legal access to that data

•What contractual protections exist

•Whether current arrangements comply with Qatari regulatory requirements

Prioritise High-Risk Data Categories

Not all data carries the same sovereignty risk. Focus initial efforts on the most sensitive categories:

•Customer financial data

•Personal identification information

•Health records

•Government-related information

•Trade secrets and intellectual property

Develop a Migration Roadmap

Transitioning to sovereign solutions is typically a phased process rather than a single event. Develop a roadmap that:

•Identifies quick wins that can demonstrate value early

•Sequences migrations to minimise operational disruption

•Allows for learning and adjustment between phases

•Aligns with budget cycles and resource availability

Engage Stakeholders Early

Data sovereignty initiatives touch multiple parts of the organisation, including IT, legal, compliance, and business units. Engage these stakeholders early to ensure buy-in and to surface potential concerns before they become obstacles.

Partner with Experienced Providers

Choosing the right technology partner is critical. Look for providers like InvestGlass that have:

•Demonstrated expertise in regulated industries

•Clear legal and technical sovereignty guarantees

•Flexible deployment options

•Strong implementation support capabilities

•A track record of successful deployments in similar organisations

Sector-Specific Considerations

Different sectors face unique challenges and requirements when it comes to digital sovereignty. Understanding these sector-specific considerations can help organisations tailor their approach:

Financial Services

Financial institutions in Qatar face some of the most stringent data sovereignty requirements. The Qatar Central Bank mandates data localisation for customer data and requires prior approval for material cloud outsourcing. For these organisations, InvestGlass offers particular advantages:

•Purpose-built CRM and PMS functionality for wealth management and banking

•Comprehensive KYC and compliance automation

•On-premise deployment options that satisfy QCB requirements

•Integration capabilities with existing banking infrastructure

The selection of InvestGlass by institutions like Arab Bank demonstrates its suitability for demanding financial services environments .

Healthcare

Healthcare organisations handle some of the most sensitive personal data, including medical records, genetic information, and mental health data. Qatar’s regulations require explicit consent and regulatory pre-approval for processing this data. Sovereign solutions ensure that:

•Patient data remains protected from foreign government access

•Compliance with Qatar’s healthcare data regulations is maintained

•Integration with electronic health record systems is possible whilst maintaining sovereignty

Government and Public Sector

Government agencies handle data that is critical to national security and public administration. For these organisations, digital sovereignty is not merely a compliance issue but a matter of national interest. Sovereign solutions enable:

•Complete control over citizen data

•Protection from foreign intelligence access

•Compliance with government security standards

•Support for national digital transformation initiatives

The Future of Digital Sovereignty in Qatar

As Qatar continues to execute its Digital Agenda 2030, the importance of digital sovereignty will only grow. Several trends are likely to shape this evolution:

Increasing Regulatory Stringency

Regulators worldwide are tightening data protection requirements, and Qatar is no exception. Organisations that invest in sovereign solutions today will be better positioned to meet future regulatory requirements.

Growing Awareness Among Clients

As high-profile data breaches and sovereignty incidents continue to make headlines, clients are becoming more aware of data sovereignty issues. Organisations that can demonstrate sovereign data handling will enjoy a competitive advantage.

Technological Advancement

Advances in encryption, distributed computing, and privacy-enhancing technologies will create new options for achieving sovereignty whilst maintaining functionality. Providers like InvestGlass are at the forefront of incorporating these technologies into their platforms.

Regional Collaboration

Gulf Cooperation Council (GCC) countries may increasingly collaborate on data sovereignty initiatives, creating opportunities for regional solutions and shared infrastructure.

Frequently Asked Questions

1. What is digital sovereignty and why does it matter for Qatar?

Digital sovereignty refers to a nation’s ability to control its digital infrastructure, data assets, and the legal frameworks governing information flows. For Qatar, digital sovereignty is essential to achieving the goals of Qatar National Vision 2030, protecting national security, fostering economic competitiveness, and ensuring citizen privacy. As data becomes increasingly valuable, maintaining sovereign control over this resource is a strategic imperative.

2. What is the US CLOUD Act and how does it affect Qatari businesses?

The CLOUD Act (Clarifying Lawful Overseas Use of Data Act) is a US law enacted in 2018 that allows American authorities to compel US-based technology companies to provide data, regardless of where that data is stored globally. For Qatari businesses using US cloud providers like Salesforce or Microsoft, this means their data could be accessed by US law enforcement without going through Qatari legal channels, potentially violating Qatar’s data protection laws.

3. Can local data centres from US providers solve the sovereignty problem?

No. While US providers like Microsoft and Salesforce offer local data centres in the Middle East, the fundamental problem remains: as US companies, they are subject to the CLOUD Act regardless of where data is physically stored. Local data residency provides some benefits but does not constitute true data sovereignty.

4. What makes InvestGlass different from US-based CRM providers?

InvestGlass is a 100% Swiss-owned company headquartered in Geneva, Switzerland. As such, it is not subject to US jurisdiction or the CLOUD Act. Swiss law provides strong data protection guarantees, and InvestGlass offers flexible deployment options including on-premise installation, giving organisations complete control over their data.

5. Is InvestGlass suitable for financial services organisations in Qatar?

Yes. InvestGlass is specifically designed for regulated industries, including banking, wealth management, and insurance. It includes specialised tools for CRM, portfolio management, KYC compliance, and client onboarding. The platform has been selected by major financial institutions including Arab Bank, demonstrating its suitability for demanding financial services environments.

6. Can InvestGlass be deployed on-premise in Qatar?

Yes. InvestGlass offers flexible deployment options, including full on-premise deployment within an organisation’s own data centres in Qatar. This option provides maximum control over data residency and eliminates dependence on external cloud infrastructure.

7. How does InvestGlass help with KYC and regulatory compliance?

InvestGlass provides comprehensive KYC automation capabilities, including digital identity verification, document collection, risk assessment, and ongoing monitoring. The platform integrates with leading regtech providers and maintains full audit trails to support regulatory compliance requirements.

8. What are the main risks of continuing to use US cloud providers?

The main risks include potential regulatory penalties for non-compliance with Qatar’s data protection laws, reputational damage from data sovereignty incidents, operational disruption if regulatory action requires system changes, and competitive disadvantage as clients become more aware of sovereignty issues.

9. How long does it take to migrate from Salesforce or Microsoft to InvestGlass?

Migration timelines vary depending on the complexity of existing implementations and the scope of data to be migrated. InvestGlass provides implementation support to ensure smooth transitions. Many organisations adopt a phased approach, starting with new use cases whilst gradually migrating existing data.

10. How can my organisation get started with InvestGlass?

Organisations interested in InvestGlass can visit www.investglass.com to request a demonstration or start a free trial. The InvestGlass team can provide detailed assessments of how the platform can meet specific organisational requirements and support the transition to sovereign data management.

Conclusion

As Qatar advances its ambitious digital transformation agenda, the question of digital sovereignty has moved from a technical consideration to a strategic imperative. The dominance of US cloud providers and the extraterritorial reach of the CLOUD Act create fundamental challenges for organisations seeking to comply with Qatar’s data protection requirements whilst leveraging modern technology platforms.

InvestGlass offers a compelling answer to this challenge. By combining comprehensive CRM, portfolio management, and automation capabilities with the legal and technical guarantees of Swiss sovereignty, InvestGlass enables Qatari organisations to embrace digital transformation without compromising on data control. For financial institutions, government agencies, and other organisations handling sensitive data, the choice of a sovereign platform is not merely a technical decision but a strategic one that will shape their ability to operate effectively in Qatar’s evolving regulatory environment.

The path to digital sovereignty requires careful planning, stakeholder engagement, and partnership with providers who understand both the technical and legal dimensions of the challenge. For organisations ready to take this journey, InvestGlass provides the platform, expertise, and commitment to sovereignty that the moment demands.

References

[1] Swiss digital sovereignty. InvestGlass.

[2] Bahrain and Qatar take diverging paths on data sovereignty. Gulf Business, August 2025.

[3] Digital Agenda 2030. Ministry of Communications and Information Technology, Qatar.

[4] Microsoft 365 and Cloud Compliance: Rethinking Data Sovereignty. Securosys, August 2025.

[5] What the CLOUD Act Really Means for EU Data Sovereignty. Wire, July 2025.

[6] Salesforce Hyperforce: Public Cloud Infrastructure in UAE. ThinkBeyond Cloud, June 2025.

[7] Data sovereignty. InvestGlass.

[8] CRM for Financial Services. InvestGlass.

[9] KYC Solutions. InvestGlass.

[10] Portfolio Management Software. InvestGlass.

Additional Resources

For further reading on digital sovereignty and InvestGlass capabilities, explore these resources:

•Data Sovereignty and Cybersecurity: Essential Insights and Best Practices

•How to Automate the KYC Process

•Best Salesforce Alternatives for 2025