5 Dinge, die Sie wissen sollten, bevor Sie Ihren eigenen Robo-Advisor bauen

Robo-advisors have transformed financial planning by using machine learning and algorithms to automate investment management, offering a cost-effective alternative to human advisors. Platforms like Betterment provide personalized investment strategies with minimal human intervention (Betterment – Wikipedia). The rise of robo-advisors has democratized wealth management, making financial planning accessible to a wider audience (Robo-advisor – Wikipedia).

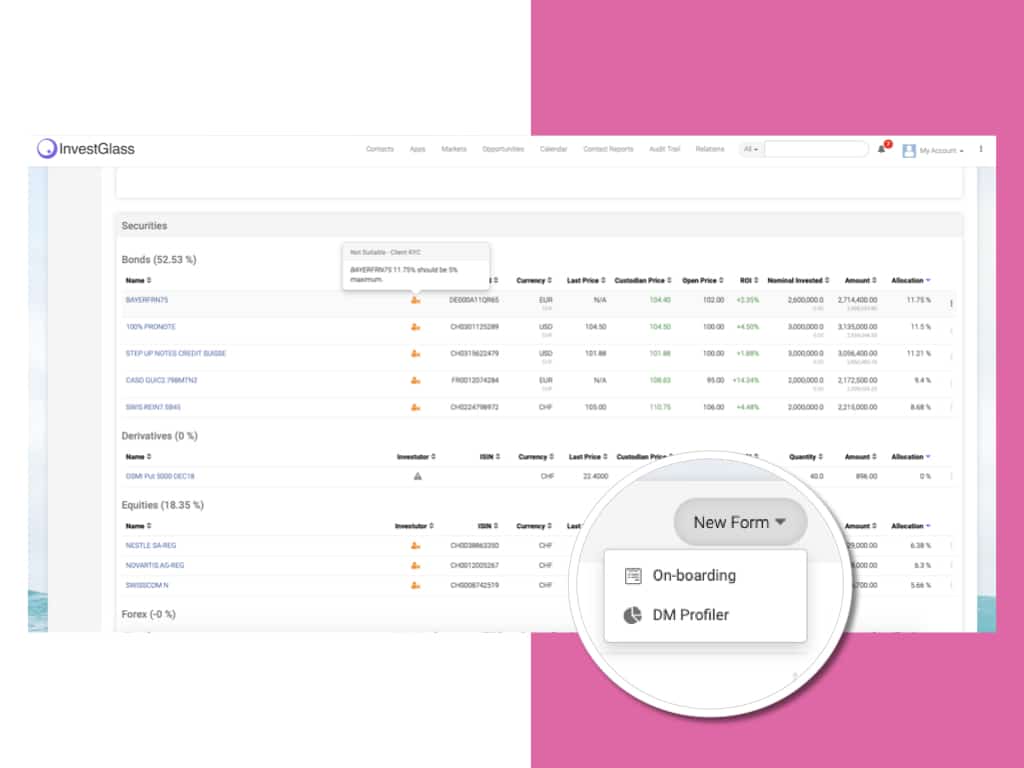

If you’re considering building your own robo-advisor, it’s essential to understand the various factors involved. In this guide, we’ll discuss the key aspects of creating a successful robo-advisor platform, from the technology and features to the advantages and potential challenges. InvestGlass includes risk metrics and ESG screening to respect clients and strategy suitability and appropriateness.

Robo-Advisors und ihre Bedeutung für die Finanzplanung verstehen:

Robo-advisors are digital platforms that use algorithms to manage and create investment portfolios for clients. They’ve gained popularity in recent years due to their lower fees compared to traditional financial advisors and their ability to provide access to investment management tools and financial planning tools that were once only available to wealthy investors. By automating the investment process, robo-advisors help clients develop and manage their investment strategies efficiently. These platforms assess a user’s risk tolerance through onboarding quizzes to tailor investment portfolios to individual client preferences, ensuring alignment with their financial goals. This makes robo-advisors a valuable addition to the financial planning landscape.

Merkmale einer Robo-Advisor Plattform:

Um Ihren eigenen Robo-Advisor zu erstellen, müssen Sie eine Reihe von Funktionen implementieren, die auf die Bedürfnisse Ihrer Kunden abgestimmt sind. Dazu können gehören:

Portfolio management: Robo-advisors should offer automated portfolio construction and management, focusing on asset allocation to maintain the desired risk profile and optimize financial strategies. This might involve the use of exchange-traded funds, mutual funds, or other investment vehicles, with algorithms tailoring the investment portfolio based on clients’ profiles and regularly rebalancing to align with target allocations.

Tools zur Finanzplanung: Diese Tools können Kunden dabei helfen, finanzielle Ziele zu setzen, für den Ruhestand zu planen oder ihre persönlichen Finanzen zu verwalten. Beispiele sind Zielplanung, Ruhestandskonten und die Verfolgung des Nettovermögens.

Ernte von Steuerverlusten: Diese Funktion kann Kunden helfen, ihre Steuerverbindlichkeiten zu minimieren, indem sie strategisch Anlagen verkaufen, die an Wert verloren haben, um Gewinne in anderen Vermögenswerten auszugleichen.

Diversifizierte Portfolio-Optionen: Eine robuste Robo-Advisor-Plattform sollte eine Vielzahl von Portfolio-Optionen anbieten, um den verschiedenen Kundenpräferenzen gerecht zu werden, einschließlich sozial verantwortlicher Investitionen, Private Equity und mehr.

Integration von menschlichen Finanzberatern: Einige Kunden wünschen sich vielleicht immer noch die persönliche Note eines menschlichen Beraters, andere sind mit der Nutzung künstlicher Intelligenz einverstanden. Die Möglichkeit, sich mit einem menschlichen Finanzberater in Verbindung zu setzen, kann helfen, die Kluft zwischen automatisierten und traditionellen Beratungsdienstleistungen zu überbrücken.

Mobiles Erlebnis: Eine benutzerfreundliche mobile App kann das Gesamterlebnis der Kunden verbessern, indem sie ihnen ermöglicht, ihre Investitionen zu überwachen und von unterwegs auf Finanzplanungstools zuzugreifen.

Die Rolle der menschlichen Finanzberater in einer Robo-Advisor-Plattform:

While robo-advisors offer many advantages, they don’t necessarily replace the need for human financial advisors. Robo-advisors manage investments through a robo advisor investment account, charging account management fees as a percentage of the invested amount. Instead, they can complement the services provided by human advisors, who can focus on offering personalized advice, addressing complex financial situations, and building long-term client relationships. By integrating human advisors into your robo-advisor platform, you can cater to clients who prefer a hybrid approach to financial planning.

Technical Requirements for Building a Robo Advisor:

Building a robo advisor requires a blend of technical expertise and financial acumen. The technical foundation of a successful robo advisor platform involves several key components:

First, you’ll need proficiency in programming languages such as Python, Java, or C++. These languages are essential for developing the core algorithms that drive automated investing and portfolio management. Additionally, robust data storage and management solutions, including SQL and NoSQL databases, are crucial for handling vast amounts of financial data.

Machine learning algorithms and libraries, such as TensorFlow or Scikit-Learn, play a pivotal role in creating intelligent investment strategies. These tools enable the robo advisor to analyze historical market data and make data-driven decisions. Cloud infrastructure, provided by services like Amazon Web Services (AWS) or Microsoft Azure, ensures scalability and reliability, allowing your platform to handle a growing number of users and transactions.

Security is paramount in the financial industry. Implementing encryption and firewalls protects sensitive customer data and financial transactions from cyber threats. Additionally, integrating external data sources, such as financial APIs and market data feeds, enriches the platform’s capabilities, providing real-time insights and updates.

A user-friendly interface is essential for customer interaction. Developing an intuitive and responsive interface ensures that clients can easily navigate the platform, monitor their investment portfolios, and access financial planning tools. Furthermore, implementing risk management and compliance features is critical to adhere to regulatory standards and protect both the platform and its users.

Given the complexity of these technical requirements, assembling a skilled technical team is indispensable. This team should possess expertise in software development, data analytics, machine learning, and cybersecurity to build a robust and reliable robo advisor platform.

Challenges of Building a Robo Advisor:

Building a robo advisor is a multifaceted endeavor that presents several significant challenges. One of the foremost challenges is developing a robust and accurate algorithm capable of providing personalized investment advice. This requires a deep understanding of financial markets, investment strategies, and the ability to analyze vast amounts of historical market data.

Ensuring the security and integrity of customer data and financial transactions is another critical challenge. With the increasing prevalence of cyber threats, implementing advanced security measures, such as encryption and firewalls, is essential to protect sensitive information and maintain customer trust.

Compliance with regulatory requirements and industry standards is a non-negotiable aspect of building a robo advisor. Navigating the complex regulatory landscape requires a thorough understanding of financial regulations and the ability to implement compliance features within the platform.

Scalability is another challenge that cannot be overlooked. The robo advisor must be capable of handling a large volume of customers and transactions without compromising performance. This necessitates a robust cloud infrastructure and efficient data management solutions.

Creating a user-friendly interface is crucial for customer satisfaction. The platform should be intuitive and easy to navigate, allowing clients to monitor their investment portfolios and access financial planning tools seamlessly.

Overcoming these challenges requires a skilled technical team with expertise in machine learning, data analytics, and software development. Additionally, a deep understanding of financial markets, investment strategies, and regulatory requirements is indispensable to build a successful robo advisor platform.

Vor- und Nachteile des Aufbaus Ihres eigenen Robo-Advisors:

Wenn Sie überlegen, ob Sie Ihren eigenen Robo-Advisor aufbauen wollen, müssen Sie die potenziellen Vor- und Nachteile abwägen:

Vorteile:

Lower fees: Robo-advisors typically charge a lower management fee compared to traditional financial advisors, making them more attractive to cost-conscious investors. Management fees are a key factor in evaluating the cost-effectiveness of robo-advisors, as they are usually calculated as a percentage of the investment amount.

Breiterer Zugang: Automatisierte Plattformen können ein breiteres Spektrum an Kunden bedienen, auch solche mit niedrigeren Mindestbeträgen oder weniger investierbarem Vermögen.

24/7 Zugänglichkeit: Kunden können jederzeit auf ihre Anlageportfolios und Finanzplanungstools zugreifen, was eine komfortable Erfahrung darstellt.

Nachteile:

Anfangsinvestition: Der Aufbau einer Robo-Advisor-Plattform erfordert erhebliche Vorlaufkosten für Technologie, Infrastruktur und die Einhaltung gesetzlicher Vorschriften.

Launch and Growth:

Launching a robo advisor requires a meticulously planned strategy and flawless execution. The launch plan should encompass marketing and promotion efforts to create awareness and attract potential clients. Effective customer acquisition strategies are essential to build a solid user base from the outset.

Starting with a minimum viable product (MVP) is a prudent approach. An MVP allows you to test the platform’s core functionalities and gather valuable feedback from early users. This feedback is instrumental in refining and enhancing the platform before a full-scale launch.

A well-defined growth strategy is crucial for the long-term success of your robo advisor. Expanding the customer base and increasing assets under management are primary objectives. Enhancing the user experience through continuous improvements and the development of new features, such as tax loss harvesting and retirement planning, can significantly boost client satisfaction and retention.

Continuous monitoring and evaluation of the platform’s performance are essential to ensure it meets its goals and objectives. Regular updates and enhancements based on user feedback and market trends will keep the platform competitive and relevant.

The launch and growth of a robo advisor require a deep understanding of the financial industry, effective marketing strategies, and efficient customer acquisition techniques. By focusing on these areas, you can successfully build and grow a robo advisor platform that meets the evolving needs of your clients and stands out in the competitive financial landscape.

Fazit

In conclusion, building your own robo-advisor is an ambitious and potentially rewarding endeavor that can help revolutionize your clients’ financial planning and wealth management. However, navigating the complexities of technology, feature integration, and compliance with various banking regulatory landscapes can be challenging. This is where InvestGlass comes in.

Als erfahrener und vertrauenswürdiger Partner in der Fintech-Branche kann InvestGlass Ihnen dabei helfen, eine maßgeschneiderte Robo-Advisor-Plattform aufzubauen, die auf Ihre spezifischen Bedürfnisse und Anforderungen zugeschnitten ist. Unser Expertenteam begleitet Sie durch jeden Schritt des Prozesses und stellt sicher, dass Ihre Plattform den Bankvorschriften entspricht, für die Benutzerfreundlichkeit optimiert ist und über die neuesten Tools für die Anlageverwaltung und Finanzplanung verfügt.

Durch eine Partnerschaft mit InvestGlass können Sie die Vorteile von Robo-Advisory nutzen, um Ihren Kunden eine effizientere, kostengünstigere und leichter zugängliche Lösung für ihre finanziellen Bedürfnisse zu bieten und gleichzeitig in der sich ständig weiterentwickelnden Finanzwelt wettbewerbsfähig zu bleiben. Mit unserer Expertise und Unterstützung können Sie erfolgreich einen Robo-Advisor aufbauen, der sich auf dem Markt abhebt und Ihr Unternehmen für langfristiges Wachstum und Erfolg positioniert.