Build Neobank for the Diaspora: Unlocking Growth Potential in 2023

The world is witnessing an exciting shift in the financial landscape as digital banking transforms the way people manage their finances. In particular, the African diaspora, a rapidly growing economic force, demands innovative solutions that cater to their unique needs. Traditional banks have long struggled to provide adequate services to these communities, creating a lucrative opportunity for neobanks to thrive. In this blog post, we explore the potential of building a neobank for the diaspora, focusing on key components, strategies, and case studies of successful neobanks that have already made a significant impact. Moreover, we delve into how to build neobank for the diaspora, ensuring that these digital banking solutions cater specifically to their financial needs and preferences.

Key Takeaways

- Neobanks have the potential to reduce remittance costs and facilitate financial inclusion for African diaspora communities, who present a lucrative market opportunity.

- InvestGlass provides comprehensive tools that empower neobanks to cater to the needs of diaspora communities, unlocking growth potential and promoting financial inclusion in emerging markets.

- Neobanks can successfully enter emerging markets by focusing on customer engagement, building strong brand strategies, embracing digital solutions, differentiating their services and balancing profitability with growth.

The Diaspora Demand: Tapping into a Lucrative Market

The African diaspora, with yearly remittances of $360 billion into Africa, is a testament to the growing demand for digital financial services in emerging markets. Traditional banks have long struggled to meet the unique needs of this market, often charging exorbitant fees for money transfers and failing to provide adequate access to financial services. Neobanking presents a promising alternative, offering the potential to reduce remittance costs and facilitate financial inclusion in Africa and beyond, particularly for those with limited economic resources.

Neobanks, aspiring to exploit this potential, should focus on mitigating the traditional banking challenges encountered by diaspora communities. These challenges include high fees, limited access, and lack of tailored services. Overcoming these challenges not only unlocks substantial growth potential but also sets these neobanks apart from conventional European banks, often criticized for their inability to cater to this market’s distinctive needs.

The African Diaspora: A Growing Economic Force

The African diaspora refers to the global population of communities descended from Native Africans or people from Africa, primarily in the Americas, but also in Europe, the Middle East, and Southeast Asia. As a significant part of the world’s population, a majority of the African population remains unbanked and underbanked, leading to a substantial demand for financial services. Their influence on global economics cannot be understated, with billions of dollars in remittances sent yearly and a vibrant mobile money movement facilitated by solutions such as M-PESA.

This burgeoning economic force signifies an opportunity for neobanks to offer digital financial services specifically designed for the African diaspora. Neobanks, by providing services aligned with local currencies, affordable remittances, and accessible financial services, can penetrate a market traditionally overlooked by conventional banks.

Challenges Faced by Diaspora Communities in Traditional Banking

Diaspora communities often face numerous challenges when trying to access traditional banking services. Some common obstacles include:

- High fees

- Restricted access

- Lack of tailored services, such as offline access to banking services

- Complexity and delay when accessing financial products and services due to a lack of knowledge and understanding of the banking system

- Language barriers

- Cultural differences

These challenges underscore the necessity of offering digital financial services tailored to the diaspora communities’ distinct needs. Neobanks stand a chance to fill the void created by traditional banks by delivering accessible, affordable, and personalized financial solutions. This not only empowers individuals and communities but also fosters financial inclusion and economic growth.

Building a Neobank for the Diaspora: Key Components

Creating a successful neobank for the diaspora requires considering three key components:

- Digital financial services: These form the core offerings of neobanks, enabling customers to manage their accounts, transfer funds, and make payments electronically.

- Cross-border payments: These are vital for facilitating money transfers between different countries, catering to the needs of migrant communities who often send funds to their home countries.

- Customized solutions: These allow neobanks to tailor their services to the unique financial requirements of diaspora communities, ensuring a personalized and seamless banking experience.

Concentrating on these key components allows neobanks to effectively tackle the traditional banking challenges that diaspora communities face, thus unlocking substantial growth potential. This not only sets them apart from conventional banks but also helps them emerge as leading providers of financial services for the African diaspora and other emerging markets.

Digital Financial Services: Core Offerings

Digital financial services form the backbone of neobanks, providing a wide range of services that cater to the needs of modern customers. These services include account creation, transaction processing, card issuance, payment processing, and digital payment solutions. Companies like LemFi simplify onboarding of users. The process is completed in a matter of minutes. This enables users to access a multi-currency ecosystem giving them options to send, receive, hold, convert, and save money in multiple currencies..

Digital financial services enable neobanks to provide convenience and accessibility to diaspora communities, especially those with limited access to traditional banking services. Providing solutions tailored to their unique needs can help neobanks realize growth potential and emerge as leading providers of financial services for the African diaspora and other burgeoning markets.

Cross-Border Payments and Remittances: Reducing Costs and Enhancing Convenience

Cross-border payments and remittances are a crucial service for migrant communities, who often send money to their home countries to support their families and contribute to economic growth. Neobanks can leverage secure, cost-effective, and efficient platforms to facilitate cost savings and improved convenience for cross-border payments and remittances.

For instance, LemFi offers a multi-currency ecosystem that enables users to:

- Send money internationally

- Receive money from abroad

- Hold multiple currencies

- Convert currencies

- Save in the currencies of both their home country and host country

By utilizing these features, users can easily manage their international transfers and make the most of their financial resources, including bill payments.

Neobanks, by lowering costs and improving convenience for cross-border payments and remittances, can mitigate the challenges diaspora communities experience in traditional banking and unlock substantial growth potential. This consequently promotes financial inclusion and aids economic development in emerging markets.

Catering to Diverse Needs: Customized Solutions for Migrant Communities

Migrant communities frequently encounter exclusive financial difficulties owing to their absence of access to conventional banking services. To cater to their diverse needs, neobanks must offer customized solutions that attend to the precise requirements of these communities. This can include access to local currencies, cost-effective remittances, and access to financial services in their home country.

Offering customized solutions enables neobanks to effectively cater to the unique needs of diaspora communities, unlocking substantial growth potential. This consequently promotes financial inclusion and aids economic development in emerging markets.

InvestGlass: Empowering Neobanks for the Diaspora

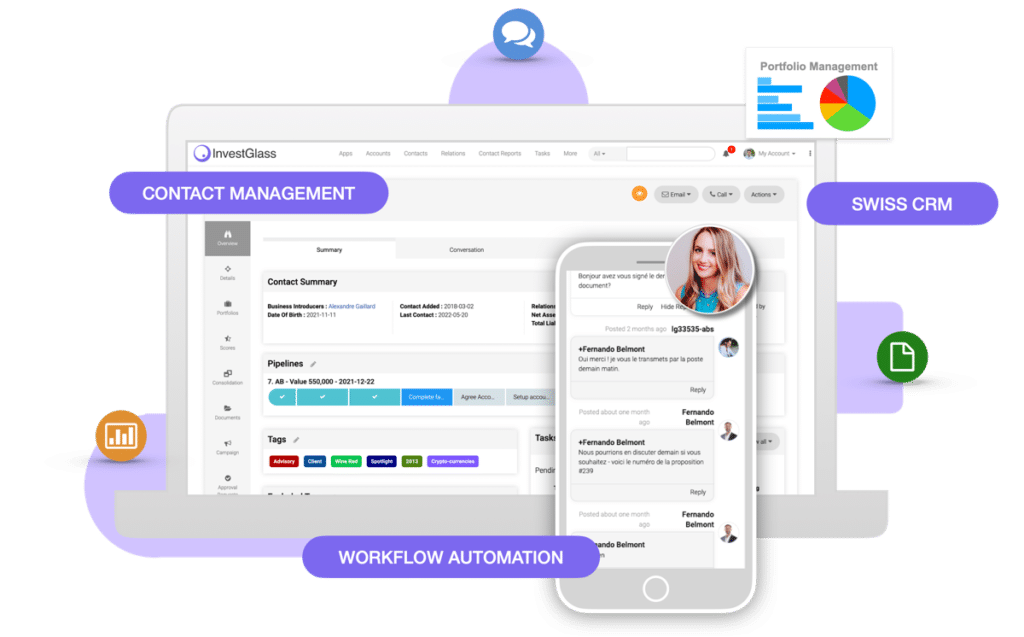

InvestGlass, a Swiss-based platform, recently completed a successful funding round led by prominent investors. The platform provides a comprehensive suite of tools for professionals in the finance industry, including a CRM, PMS, client portal, and digital onboarding tools. These tools empower neobanks to attract and retain new customers, streamline operations, and ensure compliance and security, all while catering to the unique needs of the diaspora market.

Leveraging InvestGlass’s robust suite of tools enables neobanks to efficiently tackle the challenges diaspora communities face in traditional banking, thereby unlocking substantial growth potential. This consequently promotes financial inclusion and aids economic development in emerging markets.

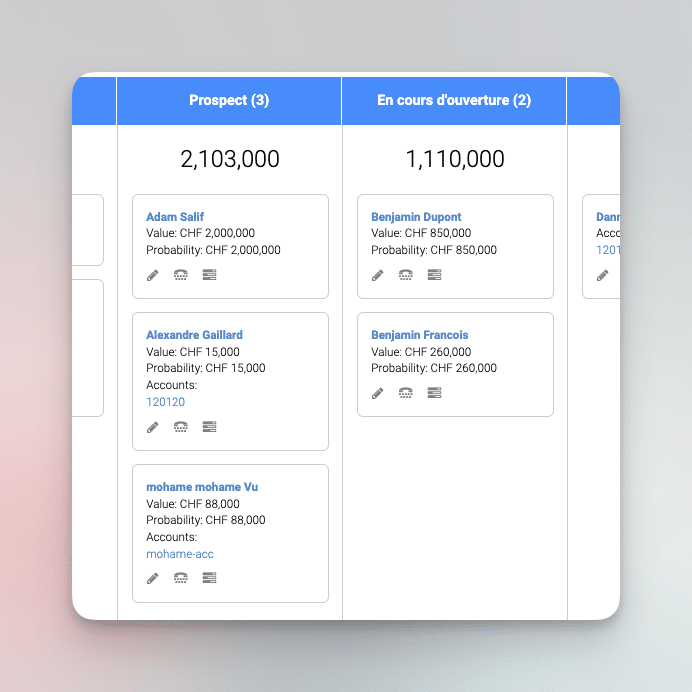

CRM and Marketing Tools: Attracting and Retaining New Customers

Customer relationship management (CRM) and marketing tools are critical components of a successful neobank, as they help attract and retain new customers in the diaspora market. InvestGlass provides a range of CRM and marketing tools, including customer segmentation and targeting, automated campaigns, and analytics to measure the effectiveness of marketing efforts. These tools can help neobanks build strong relationships with customers, identify their ideal target audience, and evaluate the productivity of their marketing strategies.

Utilizing InvestGlass’s CRM and marketing tools enables neobanks to:

- effectively attract and retain customers in the diaspora market, thereby driving growth and financial inclusion

- reduce expenses and increase effectiveness by automating marketing campaigns

- provide analytics to track customer engagement

These tools can greatly benefit neobanks in their efforts to grow and succeed in the market.

Automation and Data Management: Streamlining Operations and Enhancing Decision-Making

Automation and data management are essential components of a successful neobank, as they help streamline operations and enhance decision-making capabilities. InvestGlass offers a range of automation and data management solutions, including automating manual processes such as customer onboarding, compliance checks, and customer service, thereby reducing operational costs and increasing efficiency. Furthermore, InvestGlass provides real-time insights into customer data, enabling neobanks to make informed decisions and optimize their operations.

Leveraging InvestGlass’s automation and data management solutions enables neobanks to efficiently tackle the challenges diaspora communities face in traditional banking, thereby unlocking substantial growth potential. This consequently promotes financial inclusion and aids economic development in emerging markets.

Compliance and Security: Navigating Regulatory Challenges

For neobanks, ensuring compliance and security is paramount to safeguard customer data and meet regulatory standards. InvestGlass provides comprehensive compliance and security solutions to assist neobanks in navigating regulatory challenges, such as automated AML/KYC checks, data encryption, and fraud detection.

Neobanks like Kuda Bank and Chipper Cash are prime examples of successful institutions that have leveraged InvestGlass’s solutions to successfully navigate regulatory challenges and drive growth in the diaspora market. Ensuring compliance and security helps neobanks earn their customers’ trust and positions them as reliable providers of financial services for the African diaspora and other emerging markets.

Case Studies: Successful Neobanks Serving the Diaspora

The success stories of neobanks like Kuda Bank and Chipper Cash serve as inspiring examples for those looking to tap into the potential of the diaspora market. These case studies demonstrate the immense growth potential and innovation that can be achieved by addressing the unique financial needs of diaspora communities and leveraging cutting-edge technology.

The success of these neobanks provides valuable insights into the strategies and elements necessary for creating a successful neobank for the diaspora, ultimately promoting financial inclusion and contributing to the economic development of emerging markets.

Kuda Bank: Revolutionizing Banking in Nigeria

Kuda Bank, a digital-only bank in Nigeria, offers a comprehensive suite of services, such as bank account options, debit cards, and money transfers. Kuda Bank has achieved tremendous success, boasting over 1 million customers and expanding its reach to other African countries. By providing digital financial services tailored to the needs of the diaspora, Kuda Bank has revolutionized banking in Nigeria and unlocked significant growth potential.

Kuda Bank’s success validates the potential of neobanks to cater to the unique financial needs of diaspora communities. With its innovative solutions and advanced technology, Kuda Bank has distinguished itself as a leader in the digital banking sector, promoting financial inclusion and contributing to Nigeria’s economic development.

Chipper Cash: Facilitating Cross-Border Transactions in Africa and Beyond

Chipper Cash, a mobile payments platform, facilitates cross-border transactions within Africa, providing a valuable service for diaspora communities. With over 5 million users and a presence in 8 African nations, Chipper Cash has become a dependable and trustworthy source for cross-border payments and remittances. By offering competitive cross-border rates and simplifying the process of sending and receiving money, Chipper Cash has unlocked significant growth potential and contributed to financial inclusion in Africa.

Chipper Cash’s success underscores the enormous potential of neobanks to cater to the unique financial needs of diaspora communities. With its innovative solutions and advanced technology, Chipper Cash has distinguished itself as a leader in the mobile payments sector, promoting financial inclusion and contributing to the economic development in Africa and beyond.

Overcoming Obstacles: Strategies for Neobank Success in Emerging Markets

To achieve success in emerging markets, neobanks must overcome several obstacles, such as building trust with customers, navigating regulatory hurdles, and leveraging local partnerships. By prioritizing customer engagement, developing a strong brand strategy, embracing a digital-first approach, focusing on differentiation, and balancing profitability with growth, neobanks can unlock significant growth potential and establish themselves as a leading provider of financial services for the African diaspora and other emerging markets.

The success of Kuda Bank and Chipper Cash showcases the enormous potential of neobanks to cater to the distinctive financial needs of diaspora communities. Adopting these strategies and utilizing advanced technology can help neobanks foster financial inclusion and contribute to the economic development of emerging markets.

Building Trust: Gaining Customer Confidence in Digital Banking

Earning trust is crucial to gain customer confidence in digital banking, particularly in markets where traditional banking has fallen short of meeting the diaspora’s needs. By prioritizing customer engagement and providing services tailored to the unique needs of diaspora communities, neobanks can foster trust and loyalty among their customers. This consequently promotes financial inclusion and aids economic development in emerging markets.

Establishing trust is particularly important in the African diaspora market, where many individuals have limited access to traditional banking services and may be skeptical of digital alternatives. Offering innovative solutions and utilizing advanced technology can help neobanks earn their customers’ trust and emerge as reliable providers of financial services for the African diaspora and other emerging markets.

Navigating Regulatory Hurdles: Ensuring Compliance and Security

In the rapidly evolving neobank landscape, successfully navigating regulatory hurdles is imperative for ensuring compliance and security. Neobanks must:

- Stay abreast of relevant regulations and adapt swiftly to new ones

- Ensure that their systems are secure and customer data is safeguarded By leveraging tools like InvestGlass, neobanks can:

- Automate compliance checks

- Manage customer data securely This helps them navigate regulatory challenges and build trust with their customers.

The success of Kuda Bank and Chipper Cash underscores the significance of navigating regulatory hurdles and ensuring compliance and security in the neobank sector. Adopting these strategies and utilizing advanced technology can help neobanks foster financial inclusion and contribute to the economic development of emerging markets.

Leveraging Local Partnerships: Expanding Reach and Enhancing Services

Forming local partnerships can assist neobanks in expanding their reach and improving services, tailored to the unique needs of diaspora communities. By forming partnerships with local organizations and businesses, neobanks can take advantage of the partner’s local knowledge and resources, as well as benefit from their existing customer base. This can enable neobanks to develop innovative solutions and services tailored to the specific needs of diaspora communities.

The success of Kuda Bank and Chipper Cash underscores the significance of forming local partnerships for the success of neobanks in emerging markets. Adopting these strategies and utilizing advanced technology can help neobanks foster financial inclusion and contribute to the economic development of emerging markets.

Summary

In conclusion, the growing economic power of the African diaspora presents a lucrative market for neobanks looking to tap into this potential. By focusing on key components such as digital financial services, cross-border payments, and customized solutions, neobanks can address the unique needs of diaspora communities and unlock significant growth potential. The success stories of Kuda Bank and Chipper Cash serve as inspiring examples of what can be achieved when neobanks adopt strategies that prioritize customer trust, ensure regulatory compliance, and leverage local partnerships. By doing so, they can drive financial inclusion and contribute to economic development in emerging markets.

Frequently Asked Questions

How to build Neo bank?

To build a Neobank from scratch, it’s important to define your vision and mission, understand regulatory compliance, assemble a great team, prioritize user experience and marketing, prioritize compliance and security, develop relevant business processes, and choose the right software engineering approach.

What is a global Neobank?

A Neobank is a digital bank which provides online-only banking services via desktop or mobile apps, without the need for traditional banking technology or costly physical branches.

What is the difference between Neobank and Fintech?

Neobanks are digital-first financial companies that provide banking services such as checking accounts and debit cards but lack physical locations. They focus on traditional banking activities like deposits and loans, while fintechs provide more innovative products such as peer-to-peer payment systems or cryptocurrency investments.

What are the neobanks in Africa?

Neobanks in Africa, such as Kuda Bank (Nigeria), Tyme Bank (South Africa), FairMoney (Nigeria), Kopo Kopo (Kenya), Xeno (Uganda), Carbon (Nigeria) and 7aweshly (Egypt) are providing people with greater access to a range of financial services at lower costs than traditional banks.

What are the unique financial needs of diaspora communities?

Diaspora communities have unique financial needs, such as high fees, limited banking access, and tailored services that cater to their needs. These challenges must be met in order for them to achieve financial stability.