Save the World & Say No to Paper Onboarding!

Digital onboarding is increasingly replacing traditional paper-based processes in the banking industry, leading to significant cost reductions and enhanced efficiency. Implementing digital onboarding can reduce customer acquisition costs from $280 to $120, and in subsequent years, to $19 for retail banking; for corporate banking, costs can decrease from $4,000 to $1,200. Additionally, banks have experienced a 20% increase in customer acquisitions and a 15% reduction in associated costs after adopting fully digital onboarding processes.

This shift not only enhances operational efficiency but also improves customer satisfaction by enabling faster and more convenient access to banking services. Once customers are onboarded digitally, they can seamlessly transition into users of the bank’s Customer Relationship Management (CRM) system. This integration allows for the provision of personalized client portals, facilitates KYC remediation, and supports additional onboarding requirements such as uploading identification documents and proof of address.

Embracing digital onboarding not only modernizes the banking experience but also positions institutions to better meet evolving customer expectations and regulatory demands.

Using CRM software employees can customize the onboarding solution and influence the onboarding journey. Employee onboarding can also enhance the company’s capabilities by enabling flexibility of the human resources team with efficient talent management at hires.

Digital onboarding financial services with InvestGlass

At InvestGlass, we provide an all-in-one CRM solution that incorporates a complete onboarding process. Our clients have the choice between full digital onboarding, full paper onboarding, or a mix of both; even if remaining with paper increases the manual workload. We can divide digital onboarding into three main stages. First, the customer must fill in a form or multiple forms to correctly input their information into the system. Second, we launch approval processes and conduct ID verifications. Finally, we may have to pursue KYC remediation at a later stage.

Information gathering

We can present the invitation to collect data in various ways depending on the desired user experience. Banks must digitize their onboarding forms, which can then be sent to specific prospects. You can share these forms through email or embed simple signing forms into your website. If prospects have already been given a client portal, depending on the organization’s privacy policy, the forms may be shared directly via the portal. Prospects fill in the required information and files via the forms, and you receive a notification when they have completed the process.

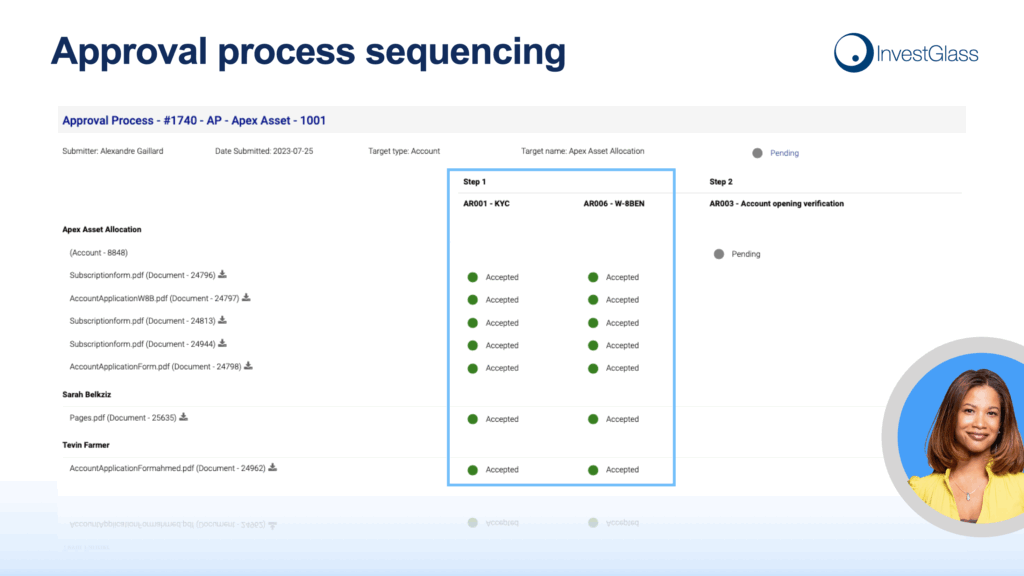

Approval and verification

Digital onboarding aims to simplify customers’ adoption by deciding whether to accept or reject said prospect. Businesses also want to verify the identity of prospects and check their names in AML and warning lists. In order to verify individuals and people filling the forms, you can use a variety of InvestGlass partners from AML checks to facial recognition ID verification. These checks can be automated or launched manually depending on your needs. Once a prospect is categorized, e.g. low risk, medium risk, or PEP individual, you can launch (again automatically or not) an approval process. The approval process allows accepting or rejecting prospects depending on their answers, risk level, and so forth. You set the rules of the game.

Know Your Customer – “KYC” remediation

After accepting a prospect, you can create access to a client portal, initiate communication, share documents, generate investment proposals, and utilize all the features and products of the solution to establish robust and enduring relationships. More importantly, you can create marketing automation and easily develop KYC remediation processes. E.g., you may want to set a KYC remediation check if a user changes his address, nationality, or marital status. KYC remediation represents checking customers’ information. It is usually made timely or on special events. Via InvestGlass, remediation can be notified on any device, and remediation forms can be shared via email or client portal. Obviously, traditional ways such as phone calls or in-person meetings are still doable but we want to turn digital!!

Do not forget the client is human!

Let’s focus on tricks and tips when onboarding prospects. Whether you are a challenger bank or an established one, they might trigger your interest.

- The organization is everything. When setting up your forms and onboarding process, make sure that the workflow and each step are clear and complete.

- Remain simple and fast. You should not ask a prospect to fill in a form for more than 10min.

- Spread onboarding. In order to maintain the engagement of your prospect, spread your process over several steps or stages.

- Set clear expectations and goals. This will help you to assess metrics and your onboarding quality. Thus, helping you maximize your customer acquisition.

- Get feedback regularly. Enable feedback from your prospects and clients in order to improve your workflows.

Save the World & Say No to Paper Onboarding!

Adopt digital onboarding and expect an 80% increase in your retention rates! Yet, monitor closely your process as 60% of customers abandoned digital onboarding last year for multiple reasons such as complexity, length, etc. So let’s get ready if you are a digital bank, broker, retail bank, or IFA it’s your turn to stop using paper!

Start your free trial of InvestGlass digital onboarding

Digital Onboarding with InvestGlass – Frequently Asked Questions

1. What is digital onboarding in banking?

Digital onboarding replaces traditional paper-based processes with online forms, ID checks, and approvals. With InvestGlass, banks can streamline customer onboarding while reducing costs and enhancing efficiency.

2. How much can banks save with digital onboarding?

Retail banks can cut customer acquisition costs from $280 to as low as $19 in subsequent years. Corporate banking costs can drop from $4,000 to $1,200. InvestGlass provides the tools to achieve these savings with automated workflows.

3. How does digital onboarding improve customer satisfaction?

It offers faster, more convenient access to services. With InvestGlass, prospects complete forms online, verify their identity securely, and gain instant access to personalised client portals.

4. What are the stages of InvestGlass digital onboarding?

The process includes three steps:

- Information gathering through forms.

- Approval and ID verification.

- Ongoing KYC remediation.

This creates a complete, compliant, and user-friendly journey.

5. How does InvestGlass handle identity verification?

InvestGlass integrates with trusted partners for AML checks, facial recognition, and ID verification. These checks can be automated or manual, helping institutions categorise prospects as low, medium, or high risk.

6. What is KYC remediation and how does InvestGlass manage it?

KYC remediation is the process of updating and re-checking customer data after changes like address or nationality updates. With InvestGlass, remediation can be triggered automatically and managed via forms, client portals, or notifications.

7. Can digital onboarding be customised?

Yes. Employees can use InvestGlass CRM to design tailored onboarding workflows, adapting forms, approval rules, and communication methods to meet organisational needs and customer expectations.

8. What are the best practices for effective onboarding?

InvestGlass recommends keeping forms short, spreading onboarding into clear steps, setting measurable goals, and collecting feedback. These practices reduce abandonment rates and improve customer acquisition.

9. Why should banks move away from paper-based onboarding?

Paper onboarding is slow, costly, and error-prone. Digital onboarding with InvestGlass reduces manual workload, lowers operational costs, and improves retention rates by up to 80%.

10. How can my organisation start using InvestGlass digital onboarding?

You can activate digital onboarding directly within InvestGlass CRM. Choose between fully digital, paper-based, or hybrid workflows, and start your free trial of InvestGlass today to modernise your onboarding process.