Mitigating Compliance Risk in Banking: Best Practices for Success

Introduction to Compliance Risk

Compliance risk is a critical concern for financial institutions, as it can lead to significant financial penalties, significant fines, and reputational damage. InvestGlass provides a comprehensive platform designed to streamline regulatory compliance, ensuring strict adherence to applicable laws and legal obligations to mitigate compliance risk.

Effective compliance risk management involves identifying, assessing, and mitigating compliance risks to protect financial stability and the bank’s reputation. InvestGlass helps institutions ensure adherence to applicable laws and obligations, safeguarding reputation among regulators, stakeholders, and customers—this includes managing market risk, operational risk, and credit risk. Senior management plays a crucial role in overseeing compliance risk, establishing risk appetite, and ensuring adherence to regulatory standards.

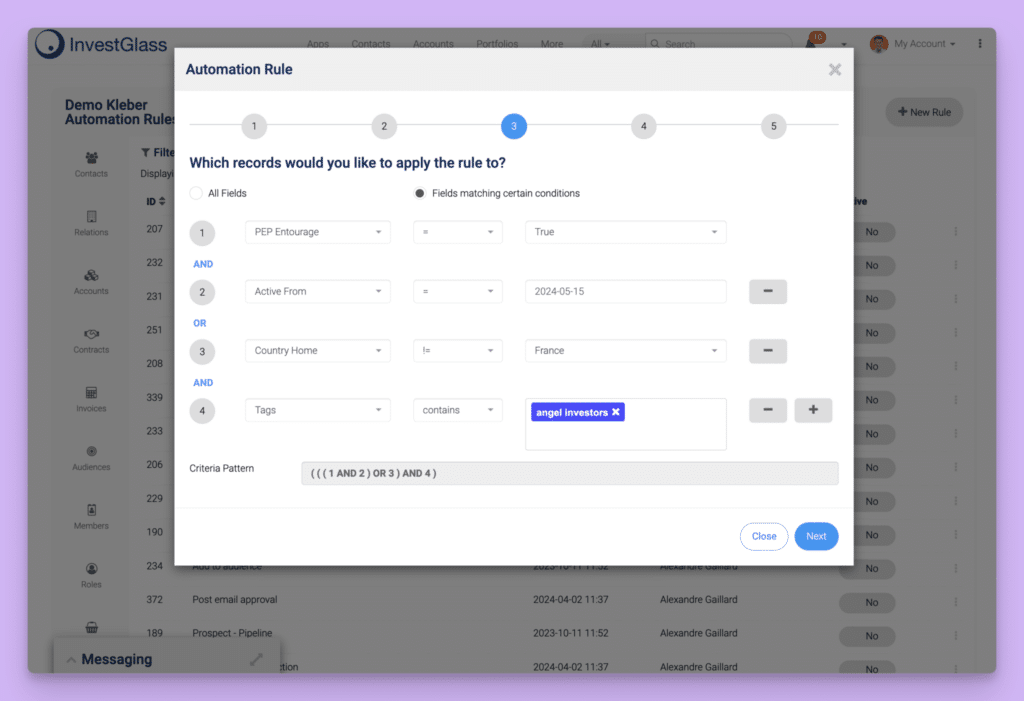

Compliance risk management strategies should be integrated into overall risk management processes to ensure a comprehensive approach to managing risks—this includes risk assessments and compliance programs supported by InvestGlass automation tools. Compliance efforts are further streamlined by InvestGlass, reducing manual work and supporting ongoing adherence to regulatory requirements.

Banking Compliance and Regulatory Requirements

Banking compliance involves adherence to regulatory requirements, compliance regulations, and relevant laws, as well as industry standards and internal policies to prevent financial crimes and maintain regulatory compliance—this includes compliance with anti-money laundering regulations supported by InvestGlass compliance modules. Accurate and timely financial reporting is also essential for meeting regulatory compliance, maintaining internal controls, and ensuring transparency in bank operations.

Regulatory compliance is crucial for financial institutions to avoid legal penalties and maintain trust with regulatory bodies and customers—this includes compliance with consumer protection regulations enhanced by InvestGlass dashboards. An integrated risk and compliance framework helps banks meet legal obligations, enhance compliance, and prevent financial crimes.

Compliance management involves implementing a systematic compliance process and a structured compliance program, along with effective compliance procedures, to manage compliance risks and ensure ongoing compliance—this includes risk monitoring and compliance strategies efficiently handled by InvestGlass automation. It is also important to consider external factors such as regulatory changes and industry trends, which can impact compliance requirements and necessitate proactive oversight.

Assessing Risk in Banking

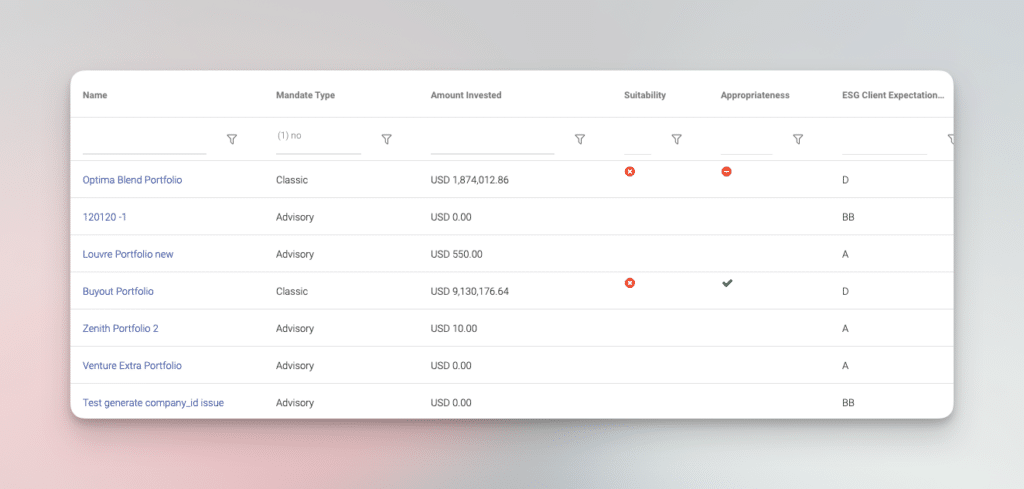

Banking risk assessment involves evaluating potential risks in a bank’s business activities, including compliance risks, operational risks, and credit risks—this includes assessing risks inherent in new products and services, as well as evaluating the bank’s risk profile through InvestGlass analytics. The bank’s risk profile is evaluated through inherent, residual, and composite risk levels to provide a comprehensive view of overall risk exposure.

Risk assessment is essential to help banking institutions identify, monitor, and control compliance risks, manage risks effectively, and implement effective risk management strategies—this includes risk identification, risk mitigation, and understanding and managing residual risk, all of which are simplified with InvestGlass risk tools. Understanding and managing risk exposure is a critical part of the risk assessment process to ensure the bank’s safety, soundness, and compliance.

Compliance risk assessments should be conducted regularly by banking institutions to ensure that banks are aware of potential compliance risks and can take proactive measures to mitigate them—this includes assessing compliance complexity and regulatory demands supported by InvestGlass reporting. Senior management oversight is crucial in ensuring effective risk management and compliance throughout the institution.

Common Compliance Risks and Challenges

In today’s fast-paced banking landscape, you’re facing a complex web of compliance risks that can make or break your institution’s success and reputation. The big players? Market risk, operational risk, credit risk, and liquidity risk—each one ready to challenge your bottom line in unique ways. Market risk hits you when interest rates shift and market conditions fluctuate, while credit risk strikes when your borrowers can’t deliver on their promises. Don’t forget liquidity risk—it can crush your ability to meet short-term commitments when you need cash flow most.

Here’s where things get real: operational risks are everywhere, lurking in human errors, system breakdowns, and those weak spots in your internal controls. These bad boys can trigger compliance disasters, data breaches, or serious financial crimes if you’re not on top of your game. That’s exactly why you need rock-solid compliance programs—they’re your secret weapon to spot, evaluate, and neutralize these threats before they explode into major problems.

Smart risk management strategies are your compliance game-changer. With comprehensive banking risk assessment in your toolkit, you can pinpoint every risk hiding in your business processes and deploy laser-focused controls to tackle them head-on. Staying compliant with regulatory requirements isn’t just about checking boxes—it’s a dynamic, always-on process that demands your constant attention and quick adaptation. When you prioritize bulletproof compliance processes and internal controls, you’re not just managing risks—you’re staying ahead of them, preventing financial crimes, and mastering regulatory compliance in this demanding, high-stakes environment.

Anti-Money Laundering and Financial Crimes Prevention

Anti-money laundering (AML) regulations are critical to prevent money laundering and terrorist financing—this includes implementing effective transaction monitoring and customer due diligence powered by InvestGlass AML solutions. AML compliance also safeguards the legitimate financial system from financial crimes. Banks manage risk by leveraging automation solutions to comply with AML and KYC requirements, enabling them to adapt to evolving regulatory standards and enhance operational security.

Financial institutions must implement robust AML controls to prevent financial crimes and maintain regulatory compliance—this includes compliance with know-your-customer (KYC) regulations, which require monitoring financial transactions to prevent illicit activities through InvestGlass KYC automation.

Mitigating Compliance Risk in Banking: Best Practices for Success

Introduction to Compliance Risk

Compliance risk is a critical concern for financial institutions, as it can lead to significant financial penalties, significant fines, and reputational damage. InvestGlass provides a comprehensive platform designed to streamline regulatory compliance, ensuring strict adherence to applicable laws and legal obligations to mitigate compliance risk.

Effective compliance risk management involves identifying, assessing, and mitigating compliance risks to protect financial stability and the bank’s reputation. InvestGlass helps institutions ensure adherence to applicable laws and obligations, safeguarding reputation among regulators, stakeholders, and customers—this includes managing market risk, operational risk, and credit risk. Senior management plays a crucial role in overseeing compliance risk, establishing risk appetite, and ensuring adherence to regulatory standards.

Compliance risk management strategies should be integrated into overall risk management processes to ensure a comprehensive approach to managing risks—this includes risk assessments and compliance programs supported by InvestGlass automation tools. Compliance efforts are further streamlined by InvestGlass, reducing manual work and supporting ongoing adherence to regulatory requirements.

Banking Compliance and Regulatory Requirements

Banking compliance involves adherence to regulatory requirements, compliance regulations, and relevant laws, as well as industry standards and internal policies to prevent financial crimes and maintain regulatory compliance—this includes compliance with anti-money laundering regulations supported by InvestGlass compliance modules. Accurate and timely financial reporting is also essential for meeting regulatory compliance, maintaining internal controls, and ensuring transparency in bank operations.

Regulatory compliance is crucial for financial institutions to avoid legal penalties and maintain trust with regulatory bodies and customers—this includes compliance with consumer protection regulations enhanced by InvestGlass dashboards. An integrated risk and compliance framework helps banks meet legal obligations, enhance compliance, and prevent financial crimes.

Compliance management involves implementing a systematic compliance process and a structured compliance program, along with effective compliance procedures, to manage compliance risks and ensure ongoing compliance—this includes risk monitoring and compliance strategies efficiently handled by InvestGlass automation. It is also important to consider external factors such as regulatory changes and industry trends, which can impact compliance requirements and necessitate proactive oversight.

Assessing Risk in Banking

Banking risk assessment involves evaluating potential risks in a bank’s business activities, including compliance risks, operational risks, and credit risks—this includes assessing risks inherent in new products and services, as well as evaluating the bank’s risk profile through InvestGlass analytics. The bank’s risk profile is evaluated through inherent, residual, and composite risk levels to provide a comprehensive view of overall risk exposure.

Risk assessment is essential to help banking institutions identify, monitor, and control compliance risks, manage risks effectively, and implement effective risk management strategies—this includes risk identification, risk mitigation, and understanding and managing residual risk, all of which are simplified with InvestGlass risk tools. Understanding and managing risk exposure is a critical part of the risk assessment process to ensure the bank’s safety, soundness, and compliance.

Compliance risk assessments should be conducted regularly by banking institutions to ensure that banks are aware of potential compliance risks and can take proactive measures to mitigate them—this includes assessing compliance complexity and regulatory demands supported by InvestGlass reporting. Senior management oversight is crucial in ensuring effective risk management and compliance throughout the institution.

Common Compliance Risks and Challenges

In today’s fast-paced banking landscape, you’re facing a complex web of compliance risks that can make or break your institution’s success and reputation. The big players? Market risk, operational risk, credit risk, and liquidity risk—each one ready to challenge your bottom line in unique ways. Market risk hits you when interest rates shift and market conditions fluctuate, while credit risk strikes when your borrowers can’t deliver on their promises. Don’t forget liquidity risk—it can crush your ability to meet short-term commitments when you need cash flow most.

Here’s where things get real: operational risks are everywhere, lurking in human errors, system breakdowns, and those weak spots in your internal controls. These bad boys can trigger compliance disasters, data breaches, or serious financial crimes if you’re not on top of your game. That’s exactly why you need rock-solid compliance programs—they’re your secret weapon to spot, evaluate, and neutralize these threats before they explode into major problems.

Smart risk management strategies are your compliance game-changer. With comprehensive banking risk assessment in your toolkit, you can pinpoint every risk hiding in your business processes and deploy laser-focused controls to tackle them head-on. Staying compliant with regulatory requirements isn’t just about checking boxes—it’s a dynamic, always-on process that demands your constant attention and quick adaptation. When you prioritize bulletproof compliance processes and internal controls, you’re not just managing risks—you’re staying ahead of them, preventing financial crimes, and mastering regulatory compliance in this demanding, high-stakes environment.

Anti-Money Laundering and Financial Crimes Prevention

Anti-money laundering (AML) regulations are critical to prevent money laundering and terrorist financing—this includes implementing effective transaction monitoring and customer due diligence powered by InvestGlass AML solutions. AML compliance also safeguards the legitimate financial system from financial crimes. Banks manage risk by leveraging automation solutions to comply with AML and KYC requirements, enabling them to adapt to evolving regulatory standards and enhance operational security.

Financial institutions must implement robust AML controls to prevent financial crimes and maintain regulatory compliance—this includes compliance with know-your-customer (KYC) regulations, which require monitoring financial transactions to prevent illicit activities through InvestGlass KYC automation.

Compliance programs should include AML and KYC procedures to prevent money laundering and terrorist financing—this includes implementing effective risk management strategies to manage compliance risks with InvestGlass compliance workflows.

Technology and Automation in Compliance

Technology and automation aren’t just nice-to-have tools—they’re your secret weapons for conquering compliance risk in today’s lightning-fast banking industry! Automated risk management systems empower you to streamline your compliance processes like never before, identify and assess compliance risks with laser-sharp accuracy, and deliver real-time monitoring and reporting that keeps you ahead of regulatory expectations every single day.

For you as a compliance manager, leveraging technology means more effective compliance management and the power to implement robust compliance programs with absolute ease. Your automated risk assessments and transaction monitoring systems don’t just help you detect potential compliance issues—they supercharge your anti money laundering efforts and slash consumer compliance risks before they become headaches. These tools put you in the driver’s seat, keeping you miles ahead of regulatory bodies’ expectations while demonstrating rock-solid adherence to applicable laws and industry standards.

But here’s where it gets even better—technology plays a game-changing role in managing those tricky risks lurking in your business processes, from interest rate fluctuations to foreign exchange exposures that keep you up at night. By integrating advanced compliance solutions, you’re not just reducing the likelihood of compliance failures—you’re enhancing your entire risk management strategy and protecting your institution’s reputation in the ultra-competitive banking sector where every advantage counts.

The bottom line? Embracing technology and automation allows you to manage risks more efficiently than ever before, respond to regulatory changes at lightning speed, and maintain a resilient compliance framework that supports your long-term success. You don’t just get compliance tools—you gain the competitive edge that transforms regulatory challenges into strategic advantages.

Consumer Protection and Compliance Management

Consumer protection and compliance management aren’t just essential pillars—they’re your ultimate competitive advantage in today’s banking landscape! Financial institutions that design smart compliance programs and streamlined business processes with InvestGlass don’t just safeguard consumers—they build unshakeable trust and create lasting relationships that drive real results. Compliance with the Community Reinvestment Act is also a critical standalone supervisory area, independently assessed and rated, highlighting its importance in the overall compliance framework.

Effective compliance risk management transforms your consumer protection strategy from reactive to proactive powerhouse! Banks that master this approach with InvestGlass don’t just identify and assess compliance risks—they turn regulatory challenges into opportunities.

Smart banks implement game-changing internal controls that make compliance risk management feel effortless! These aren’t just risk assessments—they’re your secret weapon for spotting potential issues before they become problems. Whether it’s perfecting disclosure practices or revolutionizing complaint handling processes, continuous monitoring and updating with InvestGlass automation doesn’t just ensure compliance—it future-proofs your operation.

Conclusion and Future Outlook

In conclusion, mitigating compliance risk in banking requires a comprehensive approach to risk management, including compliance risk management, operational risk management, and credit risk management—all of which are simplified and automated by InvestGlass.

Financial institutions must stay up-to-date with regulatory requirements and industry standards to ensure ongoing compliance—this includes compliance with anti-money laundering regulations and consumer protection regulations managed effectively within InvestGlass.

The future of banking compliance will likely involve increased use of technology and automation to manage compliance risks and improve compliance efficiency—InvestGlass stands at the forefront of this transformation, helping banks not just comply, but lead in the era of intelligent compliance.

Frequently Asked Questions (FAQ)

1. What is compliance risk in banking?

This risk may also stem from inadequate oversight of foreign exchange rates or insufficient data security measures.

2. How does InvestGlass help banks manage compliance risk?

InvestGlass automates compliance monitoring, reporting, and documentation—reducing manual errors and ensuring ongoing adherence to regulatory standards. It detects anomalies, including those related to foreign exchange rates and data security, helping to prevent regulatory sanctions.

3. What are the main types of compliance risks?

Typical compliance risks include anti-money laundering (AML) breaches, KYC deficiencies, failures in consumer protection, manipulation of foreign exchange rates, data security incidents, and other non-compliance issues that result in regulatory penalties.

4. How can automation improve compliance efficiency?

Automation tools such as InvestGlass streamline client onboarding, risk scoring, and transaction monitoring—saving time while ensuring precision and consistency. Automated alerts also track foreign exchange rate fluctuations and reinforce data security controls.

5. Why is AML compliance important for financial institutions?

AML compliance helps prevent criminal activities such as money laundering and terrorism financing, safeguarding both the bank’s integrity and the wider financial system. Non-compliance may expose institutions to sanctions and data security vulnerabilities.

6. How often should banks perform compliance risk assessments?

Banks should carry out compliance risk assessments at least annually—or more frequently when launching new products, services, or responding to regulatory changes. InvestGlass automates these reviews and continuously monitors foreign exchange and data security measures for ongoing compliance.

7. What role does technology play in modern compliance management?

Technology enables real-time risk detection, automated reporting, and secure data management. InvestGlass enhances data security through encryption and monitors foreign exchange data flows to help institutions avoid regulatory breaches.

8. Can InvestGlass integrate with existing banking systems?

Yes. InvestGlass integrates seamlessly with core banking platforms, CRMs, and document management systems, including modules that track foreign exchange rates and strengthen data security for all client records and transactions.

9. How does InvestGlass support KYC and AML processes?

InvestGlass automates KYC verification and transaction monitoring, identifying suspicious activity—including irregular foreign exchange movements—and ensuring full AML compliance. Its robust data security framework protects client information from misuse or breaches.

10. What are the benefits of using InvestGlass for compliance automation?

By centralising risk management, compliance workflows, and audit trails, InvestGlass reduces costs, improves accuracy, and helps banks stay ahead of evolving regulations. It safeguards data, monitors foreign exchange rates in real time, and mitigates the risk of regulatory sanctions.