Navigating Digital Sovereignty in the UAE: Why a Swiss Sovereign Tool is the Premier Alternative to US Cloud Giants

As the United Arab Emirates (UAE) rapidly advances its ambitious agenda for digital transformation, the principle of digital sovereignty has emerged as a cornerstone of its national strategy. With goals to establish an AI-native government and diversify its economy, the UAE is keenly aware that its most valuable asset in the digital age is its data. This strategic focus has cast a spotlight on the underlying infrastructure that powers its digital ambitions, revealing the inherent risks of relying on US-based cloud giants like Salesforce and Microsoft. For organisations in the UAE, particularly in regulated sectors such as finance and government, the promise of local data hosting by these providers often masks a critical vulnerability: a lack of true data sovereignty. This article explores the UAE’s robust digital sovereignty landscape, exposes the limitations of US cloud platforms, and presents InvestGlass, a Swiss-made sovereign tool, as the definitive alternative for achieving genuine data control and security.

What You Will Learn:

•The strategic importance of digital sovereignty for the UAE’s national vision

•How the UAE’s legal framework, including the PDPL and free zone regulations, shapes data governance

•The critical difference between data residency and data sovereignty

•Why US cloud providers like Salesforce and Microsoft pose jurisdictional risks under the CLOUD Act

•How InvestGlass provides a truly sovereign alternative with flexible deployment options

•Practical considerations for choosing a sovereign CRM platform in the UAE

The UAE’s Unwavering Commitment to Digital Sovereignty

The UAE’s pursuit of digital sovereignty is not merely a matter of regulatory compliance; it is a strategic imperative woven into the fabric of its national vision. The UAE Digital Government Strategy 2025 and the ambition to create the world’s first AI-native government by 2027 are testaments to a leadership that views technological autonomy as essential for economic diversification and national security. This commitment is backed by a robust and multi-layered legal framework designed to assert control over the nation’s data assets.

The economic stakes are substantial. Artificial intelligence alone is projected to contribute approximately $96 billion to the UAE’s economy by 2030, representing 13.6% of its GDP. Maintaining sovereign control over the data that fuels these AI systems is therefore not an abstract policy goal but a concrete economic necessity. The nation’s strategic partnerships with technology companies, including its collaboration with G42 on projects like the Falcon open-source language model, demonstrate a clear intent to build indigenous technological capabilities rather than remain dependent on foreign providers.

The Federal Data Protection Law (PDPL)

At the federal level, the Federal Decree-Law No. 45 of 2021 on the Protection of Personal Data (PDPL) serves as the primary legislation. Inspired by global standards like GDPR, the PDPL governs the processing of personal data for individuals residing in the UAE, but its scope extends extraterritorially to any entity, anywhere in the world, that processes the data of UAE residents. This law establishes a clear legal basis for data protection, mandating that controllers and processors implement sufficient technical and organisational measures to protect personal data.

The PDPL introduces a comprehensive set of rights for individuals, including the right to access, rectify, correct, delete, and restrict the processing of their data. It also imposes strict security requirements, with the level of protection expected to scale with the risk of harm or likelihood of a breach. For businesses, this means that a robust data management platform is not optional but essential for compliance.

Free Economic Zones and Their Distinct Regulations

The UAE’s regulatory landscape is further nuanced by its influential free economic zones. Financial hubs like the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM) have instituted their own world-class data protection regulations. The DIFC Data Protection Law No. 5 of 2020 and the ADGM Data Protection Regulations 2021 are designed to combine best practices from a variety of current, world-class data protection laws, including GDPR. The Dubai Healthcare City (DHC) has also established its own DHA Health Data Protection Regulation for the healthcare sector.

This multi-jurisdictional approach creates a complex environment for organisations operating across different zones. The federal PDPL only applies if a free zone has not legislated any data protection, creating a patchwork of regulations that organisations must carefully map to ensure proper data handling and sovereignty compliance. For businesses operating across the UAE, navigating these different legal regimes requires a data management strategy that is both sophisticated and flexible, underscoring the need for a truly adaptable CRM platform.

National Infrastructure and Sovereign Cloud Initiatives

This legal scaffolding is reinforced by ambitious national projects. The Abu Dhabi government’s partnership with Microsoft and the local AI champion, Core42, to establish a sovereign cloud is a clear signal of intent. The goal is to build a world-class digital infrastructure that powers the nation’s digital transformation while ensuring that critical data remains under local control. The UAE Sovereign Launchpad, a collaboration between e& and AWS, is another example of this push to create compliant, in-country cloud solutions aligned with the UAE Cybersecurity Council’s requirements.

The UAE’s data centre market is growing rapidly, valued at approximately $1.26 billion in 2024, reflecting the massive investment in local digital infrastructure. Du’s capital investments in digital infrastructure reached AED 545 million in 2025, up from AED 442 million in 2024. These investments are designed to ensure that the UAE has the physical capacity to host its data locally. However, as we will explore, the physical location of data is only one piece of the sovereignty puzzle. Partnerships with US entities introduce complexities that challenge the very definition of sovereignty.

The Illusion of Sovereignty: Data Residency vs. True Data Sovereignty

In response to growing demands for data localisation, US cloud giants like Salesforce and Microsoft have established data centres within the UAE, offering local data residency through platforms like Hyperforce. While this move appears to address the requirements of the PDPL and other local regulations, it creates a dangerous illusion of sovereignty. It is crucial for organisations to understand the fundamental difference between data residency and data sovereignty.

Defining the Key Terms

Data Residency refers to the geographical location where data is physically stored. Storing data within the UAE satisfies residency requirements. Whether files live on servers in Dubai or Abu Dhabi is a residency question, concerned with geography rather than governing statutes. Organisations pursue residency to meet customer expectations, minimise latency, or satisfy industry mandates.

Data Sovereignty, however, dictates that data is subject to the laws and legal jurisdiction of the nation in which it is located. This is where the use of US-based providers becomes problematic. Data sovereignty determines which laws apply to your data based on legal jurisdiction—not physical location. If you capture customer details in Dubai and they are held by a US company, US regulations can still follow that record. Legal authority extends to every action: collection, access, processing, retention, and deletion.

The distinction matters because organisations can meet residency requirements while still violating sovereignty rules if legal control rests with a foreign provider.

The US CLOUD Act: A Non-Negotiable Risk

Despite being stored in a data centre in Dubai or Abu Dhabi, any data held by a US-headquartered company is subject to American laws with extraterritorial reach. The most significant of these is the Clarifying Lawful Overseas Use of Data (CLOUD) Act. The CLOUD Act empowers US authorities to compel American tech companies to provide requested data, regardless of where that data is stored globally. This means that even if your organisation’s data resides on a server in the UAE, it can be accessed by US law enforcement, creating a direct conflict with the data privacy and protection mandates of the UAE.

US legislation such as the CLOUD Act and FISA Section 702 allows American authorities to compel access to data from US-based companies, regardless of where that data is stored. This puts organisations in the UAE at odds with local data protection laws, which require strict protection of personal and operational data. The conflict is fundamentally about jurisdiction and control.

The Salesforce and Microsoft Dilemma

Because Salesforce is a multi-tenant cloud platform, sovereignty and residency concepts often collide in unexpected ways. You might select a UAE Hyperforce region to honour residency requirements, yet still face US law enforcement requests under the CLOUD Act if your company uses an American-owned platform. The multi-tenant architecture means your data shares infrastructure with other organisations, creating potential compliance gaps that single-tenant solutions do not face.

Technical enforcement becomes particularly challenging because automatic processes, such as backups, system logs, and metadata replication, can transfer data across jurisdictions without explicit user action or clear audit trails. Cross-border data movement creates the primary friction point where legal jurisdiction and cloud operations intersect. Limited out-of-the-box logging in platforms like Salesforce complicates compliance verification, as there is often a gap between standard event logs and the granularity regulators expect during audits.

Regulatory Precedent and Future Risk

This jurisdictional overreach is not a theoretical risk. The “Schrems II” ruling in Europe, which invalidated the EU-US Privacy Shield, was based on concerns about US surveillance laws. In 2023, Meta was fined €1.2 billion for unlawful transfers of EU user data to the US. The EU-US Data Privacy Framework (DPF) was designed to normalise data transfers across the Atlantic, yet its stability is already in question. The dismissal of key oversight officials in the US has reignited doubts about its credibility, and a potential “Schrems III” ruling could invalidate it altogether.

A similar legal challenge could easily disrupt the data transfer frameworks that US companies rely on to operate in the Middle East. For businesses in the UAE, this creates a precarious legal position, where they are caught between the conflicting demands of local data protection laws and the jurisdictional reach of a foreign government. Relying on a US provider for critical operations means accepting a level of risk that is incompatible with the principles of true digital sovereignty.

| Feature | Data Residency | Data Sovereignty |

| Definition | Physical location of data storage | Legal jurisdiction governing the data |

| Concern | Geography | Governing statutes and laws |

| US Provider in UAE | Satisfied (data is in UAE) | Not Satisfied (US law applies) |

| Key Risk | Latency, local compliance | Foreign government access (CLOUD Act) |

InvestGlass: The Swiss Sovereign Alternative for the UAE

In this high-stakes environment, choosing a CRM and automation platform is not just a technical decision; it is a strategic one. For organisations in the UAE that refuse to compromise on data sovereignty, the solution lies in a platform that is architecturally and jurisdictionally aligned with their needs. This is where InvestGlass, a 100% Swiss-owned and operated company, provides a compelling and superior alternative.

The Swiss Advantage: Neutrality and Privacy by Design

Unlike US-based providers, InvestGlass is immune to the reach of the US CLOUD Act. Headquartered in Geneva, Switzerland, InvestGlass operates under the robust legal framework of the Swiss Federal Act on Data Protection (FADP), which is recognised for its stringent privacy protections and its adequacy with GDPR. Switzerland’s long-standing tradition of political neutrality and legal stability provides a safe harbour for data, ensuring that it remains shielded from foreign government intrusion.

Switzerland’s data privacy laws are considered by many to be among the strongest in the world. The FADP enforces strict rules on cross-border data transfers, allowing them only to countries deemed to have “adequate” legal protections. This legal foundation, combined with the country’s political neutrality, stable legal framework, and commitment to sustainability, makes choosing a Swiss provider a smart move for companies that value control over their data. The advantages of Swiss-based data hosting are clear: stronger privacy, full compliance, and no foreign interference.

Flexible Deployment Options for Complete Control

InvestGlass offers a level of flexibility and control that is simply unattainable with US cloud giants. The platform can be deployed in a manner that best suits an organisation’s security and compliance posture:

On-Premise Deployment: For ultimate control, InvestGlass can be installed directly on an organisation’s own servers within the UAE. This ensures that data never leaves the client’s own infrastructure, providing the highest level of data sovereignty. You can choose your own physical location and install data with your own risk management procedure. Data access is restricted with unique SUDO, which means that you always have control over managing data.

Swiss Cloud Hosting: Alternatively, clients can opt for hosting in InvestGlass’s secure cloud environment in Switzerland, benefiting from the country’s formidable data protection laws. This independent Swiss cloud solution ensures data is stored and transmitted securely, in compliance with international data privacy regulations.

Local UAE Hosting: Recognising the specific needs of the region, InvestGlass also offers hosting within the UAE, providing a solution that meets local data residency requirements without the jurisdictional risks associated with US providers. InvestGlass CRM, hosted securely in Dubai, offers businesses a comprehensive platform tailored to their unique operational needs, built with scalability, security, and regional compliance in mind.

A Comprehensive Platform for Regulated Industries

This architectural flexibility is combined with a powerful suite of tools designed for financial professionals and regulated industries. The InvestGlass platform is the first Swiss CRM to manage digital onboarding, life cycle management, portfolio management, and marketing campaigns from start to finish.

Digital Onboarding: InvestGlass Digital onboarding is a flexible web form that speeds up your customer onboarding process. With these forms, you can easily request all the required information from your new customers and automatically import it into your CRM.

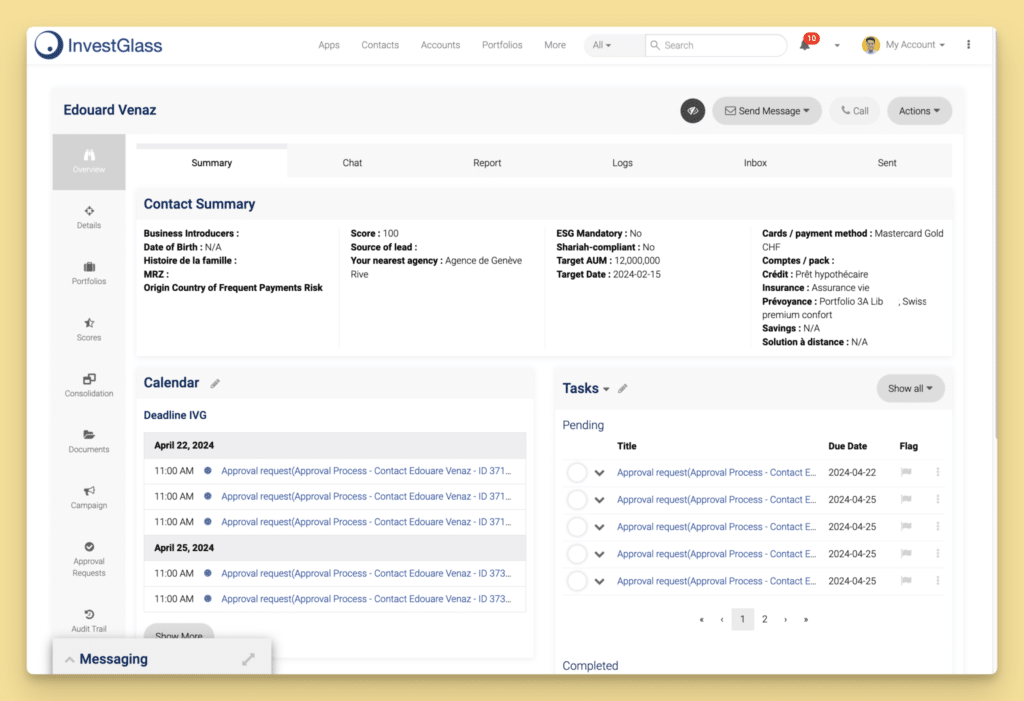

Customer Relationship Management (CRM): The CRM is built for financial professionals who want to manage their customer relationships, portfolios, and finances in one place. It has a simple and intuitive user interface, good customer support, and a wide range of features.

Portfolio Management System (PMS): The portfolio management tool is designed to manage portfolios and can connect to banks, crypto wallets, and smart contracts. The system is connected to multiple brokers and tools to ensure that operations are safely recorded.

Marketing Automation: InvestGlass marketing analytics helps track all digital marketing campaigns and measure their success. It includes a wide range of email templates, automatic lead scoring, and lead routing.

Client Portal: A secure portal for clients to access their information, enhancing transparency and engagement.

Artificial Intelligence: InvestGlass offers Swiss Safe Artificial Intelligence, enabling collaboration between departments and teams by unifying technology and workflows.

Proven Track Record in the Region

InvestGlass has a proven track record in the Middle East. After 30 months of joint efforts, Arab Bank Switzerland selected the InvestGlass solution for its digital onboarding, customer lifecycle management, and portfolio management. This partnership demonstrates that InvestGlass is not just a theoretical alternative but a battle-tested platform trusted by major financial institutions in the region. InvestGlass code is proprietary and Swiss, making it ideal for banks, brokers, or any industrial entities looking for a “non-US CRM”.

A Head-to-Head Comparison: InvestGlass vs. US Cloud Giants

To make the strategic choice clearer, the following table provides a direct comparison between InvestGlass and US-based platforms like Salesforce and Microsoft Dynamics 365 on the key dimensions that matter for digital sovereignty in the UAE.

| Criterion | InvestGlass | Salesforce / Microsoft |

| Headquarters | Geneva, Switzerland | San Francisco, USA / Redmond, USA |

| Governing Law | Swiss FADP (GDPR Adequate) | US Law (CLOUD Act, FISA 702) |

| CLOUD Act Exposure | None | Yes – Data can be compelled by US authorities |

| On-Premise Option | Yes – Full on-premise deployment available | Limited or unavailable for core products |

| UAE Local Hosting | Yes – Without US jurisdictional risk | Yes – But with US jurisdictional risk |

| Swiss Cloud Hosting | Yes – Native Swiss infrastructure | No |

| Target Industry | Financial Services, Government, Insurance | General Enterprise |

| Data Sovereignty | True Sovereignty | Data Residency Only |

Operational Resilience and Business Continuity

Beyond legal jurisdiction, the choice of a CRM platform has significant implications for operational resilience. Dependence on US vendors creates single points of failure. These companies can be forced to halt services or restrict access for political or legal reasons. US cloud services are subject to export controls, sanctions, and political mandates that can override customer agreements.

Recent years have seen cases where US technology companies restricted or suspended services to international organisations under government pressure. Such incidents highlight that a region’s digital continuity can be disrupted by decisions made far outside its jurisdiction. Meanwhile, outages on global platforms reveal how interlinked infrastructure has become. The AWS incident in October 2025 demonstrated that dependency on a small group of hyperscalers can affect entire supply chains, from government portals to e-commerce systems.

InvestGlass’s operational resilience is built into its architecture. The ability to deploy on-premise or on a dedicated cloud instance means that your operations are not dependent on the uptime or policy decisions of a US hyperscaler. InvestGlass SA offers operations throughout the world with six teams, providing services in different countries to satisfy high-level service level agreements. Cloud computing services and support span from early Eastern time to Central America’s time, ensuring global coverage.

The Growing Importance of Sovereign AI and Data Governance

The conversation around digital sovereignty is evolving rapidly, driven by the explosive growth of artificial intelligence. As organisations across the UAE adopt AI-powered tools for everything from customer service to risk management, the question of where AI models are trained and where data is processed becomes paramount. AI systems are only as good as the data they are trained on, and if that data is processed on foreign infrastructure, the sovereignty of the insights derived from it is compromised.

InvestGlass addresses this challenge with its Swiss Safe Artificial Intelligence capabilities. By keeping AI processing within a sovereign framework, organisations can leverage the power of automation and machine learning without ceding control of their data to foreign jurisdictions. This is particularly important for financial institutions in the UAE, where client data is highly sensitive and subject to strict confidentiality requirements.

The UAE’s own investments in AI, including the development of the Falcon large language model, signal a national commitment to building indigenous AI capabilities. For organisations in the private sector, aligning with a platform that shares this commitment to sovereignty is a natural strategic fit. InvestGlass provides the tools to automate workflows, enhance customer engagement, and drive efficiency, all while ensuring that the underlying data remains under the organisation’s complete control.

Conclusion: A Strategic Imperative for the UAE’s Digital Future

As the UAE continues its impressive journey to become a global leader in the digital economy, the choices it makes regarding its core infrastructure will have lasting consequences. The allure of familiar, big-name US cloud providers is understandable, but for a nation that has placed such a strong emphasis on sovereignty, the jurisdictional risks they carry are a fundamental flaw. Data residency is not data sovereignty, and the US CLOUD Act remains a non-negotiable reality for any US-based company.

For organisations in the UAE, the path to true digital sovereignty requires a shift in perspective—from simply meeting residency requirements to ensuring jurisdictional alignment. InvestGlass offers this alignment. As a Swiss-native platform, it is built on a foundation of privacy, security, and neutrality. By providing flexible deployment options, including on-premise and local UAE hosting, InvestGlass empowers businesses to take full control of their data, confident that it is shielded from foreign legal overreach.

In the pursuit of a secure and prosperous digital future, the tools we choose matter. For the UAE, embracing a sovereign-by-design solution like InvestGlass is not just a sound business decision; it is a strategic imperative that reinforces the very principles at the heart of its national vision.

Frequently Asked Questions (FAQs)

1. What is digital sovereignty and why is it important for the UAE?

Digital sovereignty is the principle that a nation’s data is subject to the laws and governance of the country where it is located. For the UAE, which is rapidly building a digital-first economy and an AI-native government, it is a critical component of national security, economic stability, and technological autonomy. It ensures that the nation’s most valuable digital assets are protected and controlled locally, free from foreign interference.

2. Doesn’t using a US cloud provider with data centres in the UAE solve the sovereignty issue?

No, it only solves for data residency (storing data locally). It does not solve for data sovereignty. US-based companies, regardless of where their data centres are located, are subject to US laws like the CLOUD Act. This means US authorities can legally compel them to hand over data, creating a direct conflict with UAE’s data protection principles and potentially exposing your organisation to compliance violations.

3. What is the US CLOUD Act and how does it affect my data in the UAE?

The Clarifying Lawful Overseas Use of Data (CLOUD) Act is a US federal law that allows US law enforcement to demand access to data controlled by US-based technology companies, no matter where the data is stored in the world. If you use a US cloud provider like Salesforce or Microsoft, your data in the UAE is not immune to such requests, regardless of local hosting.

4. How is InvestGlass different from Salesforce and Microsoft in terms of data sovereignty?

InvestGlass is a 100% Swiss-owned and operated company. It is not subject to US laws like the CLOUD Act. Its legal foundation is in Switzerland, a country with one of the world’s strongest data protection frameworks (the FADP) and a long-standing policy of neutrality. This provides a jurisdictional shield that US companies cannot offer, ensuring your data is governed solely by the laws you choose.

5. What deployment options does InvestGlass offer in the UAE?

InvestGlass offers unparalleled flexibility. You can deploy the platform on-premise on your own servers within the UAE for maximum control. Alternatively, you can use a secure cloud hosting option, either within the UAE to meet residency requirements or in Switzerland to benefit from its robust legal protections. This flexibility allows you to tailor your data strategy to your specific compliance needs.

6. Is InvestGlass compliant with the UAE’s PDPL and other local regulations?

Yes, the flexibility of InvestGlass’s platform allows it to be configured to meet the specific compliance requirements of the UAE’s Federal PDPL, as well as the distinct regulations of financial free zones like the DIFC and ADGM. The ability to host data on-premise or within the UAE ensures full compliance with data localisation mandates, while the Swiss legal framework provides an additional layer of protection.

7. What kind of industries is InvestGlass suitable for?

InvestGlass is designed for regulated and security-conscious industries. It is an ideal solution for financial services, including private banks, wealth management firms, and brokers, as well as government entities, insurance companies, and other sectors where data confidentiality and sovereignty are paramount. Its comprehensive feature set makes it suitable for any organisation that requires a robust CRM with strong compliance capabilities.

8. What are the core features of the InvestGlass platform?

InvestGlass is an all-in-one platform that includes a powerful CRM, a sophisticated portfolio management system (PMS), tools for digital onboarding and client lifecycle management, marketing automation, and a secure client portal. It also incorporates Swiss Safe Artificial Intelligence to automate workflows. It is designed to automate and streamline the entire client relationship journey from start to finish.

9. Can I migrate my existing data from Salesforce or another CRM to InvestGlass?

Yes, the InvestGlass team and its partners can assist with the migration of your data from existing CRM systems. The platform’s flexibility and open API architecture allow for the integration and mapping of data from various sources to ensure a smooth and secure transition to a sovereign platform.

10. Why choose a Swiss solution for the UAE market?

Switzerland and the UAE share a commitment to quality, security, and financial excellence. A Swiss solution like InvestGlass brings a legacy of trust, privacy, and neutrality that is highly valued in the UAE’s business environment. It offers a partnership based on shared principles, providing a secure foundation for digital growth without compromising on sovereignty. Choosing InvestGlass is a strategic decision to align with a jurisdiction that prioritises data protection above all else.