How to Choose the Best Onboarding Software (Step-by-Step + RFP Template)

Welcome to this InvestGlass presentation about digital onboarding. I’m Alexander, the CEO of InvestGlass, and during this presentation we’ll show you how to onboard prospects, proceed with KYC remediation, and off board your customers. We will add 50 questions you should be using to answer your next request for proposal!

InvestGlass is a sales automation platform — the number one Swiss solution with no US footprint. It can be deployed on your own servers or hosted on Swiss servers. InvestGlass is a family-owned Swiss company offering all the tools you need for automation.

We currently serve over 120 customers worldwide, across finance, insurance, governments, associations, clubs, and companies of all sizes. Clients choose us because they seek a sovereign Swiss solution with data residency in Switzerland, their own country, or on a private cloud.

Core Products and Onboarding Process

We automate the entire journey from prospection to distribution with eight core products: onboarding, CRM, automation, approval process, client portal, reporting, marketing, portfolio management, and incident management.

When building onboarding for your company, the first step is defining the experience you want to offer:

- Self-onboarding by customers

- Relationship managers pushing forms

- Hybrid models where managers prepare data before prospects complete forms

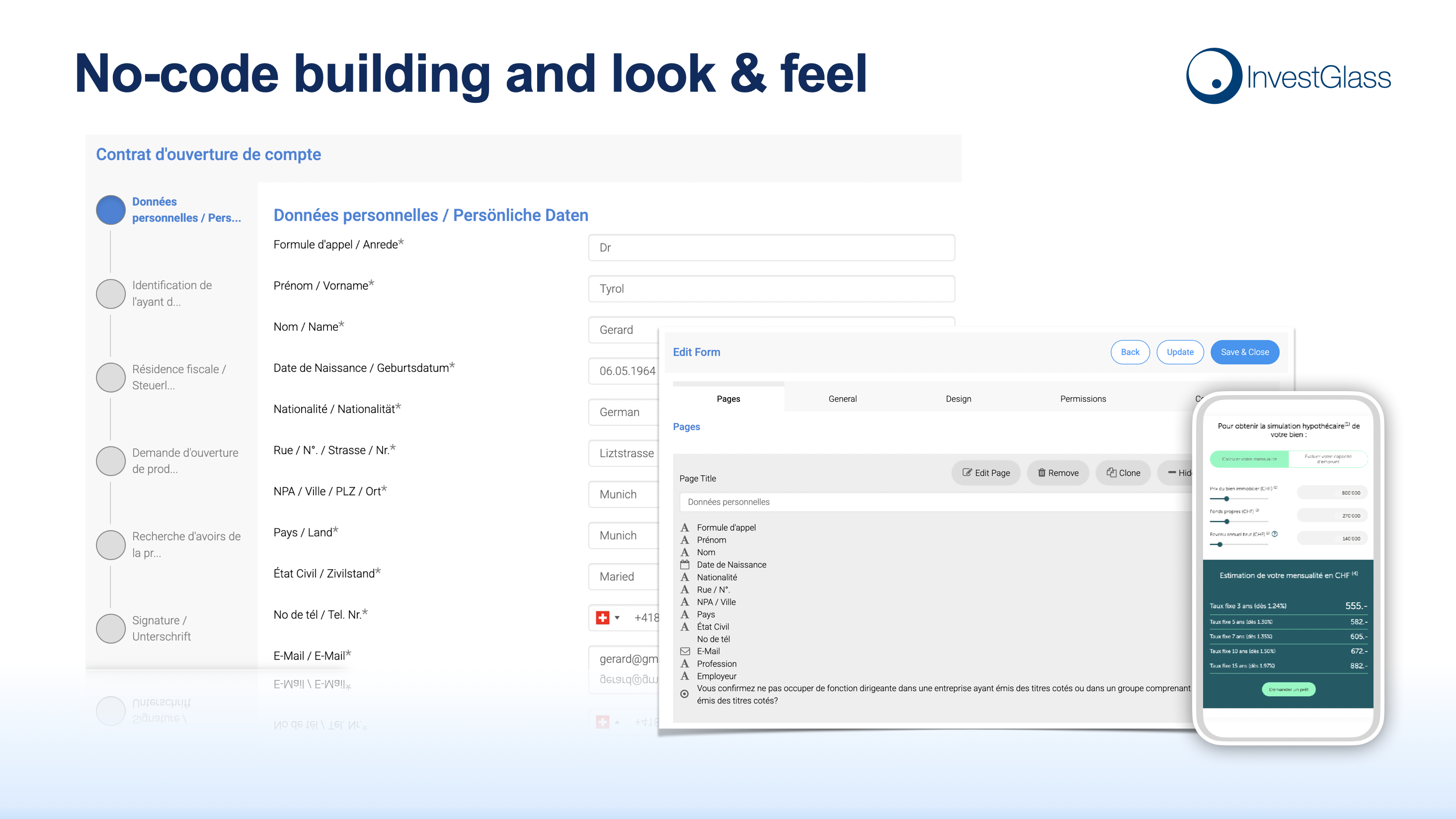

We then configure your branding (colors, layout, styles) and define the onboarding workflow. Typical setup takes 1–4 weeks, after which we test, go live, and continuously improve reporting.

Automation, AI, and Digital Forms

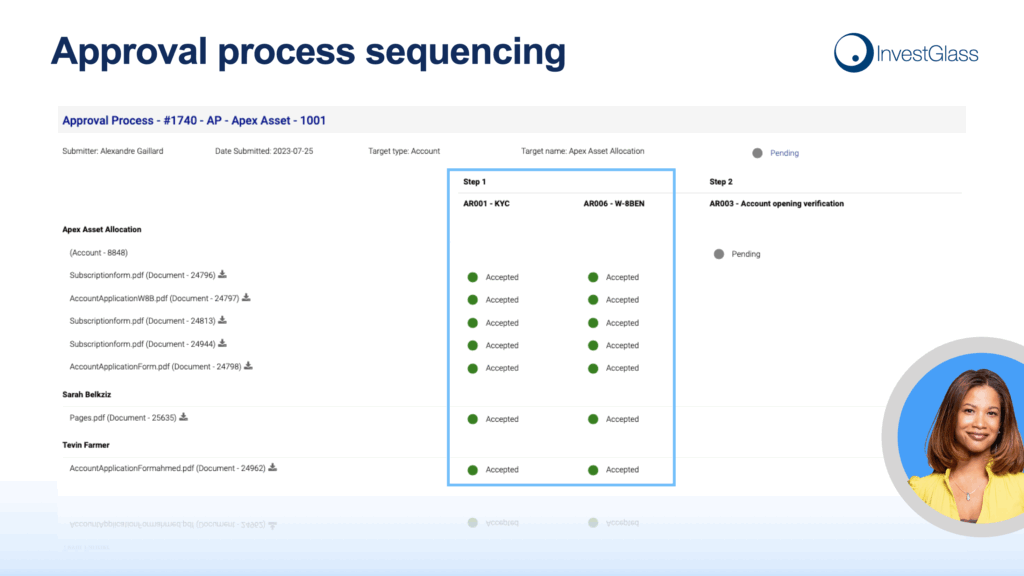

A key question is which parts of onboarding should be automated. Rule-based automation allows tasks like filtering forms, checking PEP status, or flagging country of origin, then triggering alerts or tasks. Approval processes can also be automated, requiring colleagues to vote on account openings, risk conditions, or tariff approvals.

AI further enhances onboarding by converting existing forms into structured CRM fields and JSON payloads. This saves hours of work, especially when merging multilingual forms (e.g., English, French, German, Chinese) into a unified digital format.

Our no-code form builder lets you design professional onboarding forms without coding. Information can be reused across forms with packages, reducing duplicate entries.

Security, Compliance, and Multi-Party Workflows

InvestGlass ensures security through audit trails, document management, mobile apps, two-factor authentication (2FA), and secure QR-code access. Forms can be pre-filled with data, ensuring only the right customer accesses them.

KYC/KYB/KYT checks are integrated with third-party providers via API. Our system supports complex relationships (companies, trusts, families) with multiple UBOs and LPOAs, defining permissions for portal access, signatures, and account viewing.

Digital signature workflows allow multiple parties to sign documents securely, with audit trails capturing IP addresses, timestamps, and 2FA validations. Multi-party onboarding can hide sensitive fields from unauthorized viewers, ensuring privacy.

Approvals, KYC Remediation, and Reporting

Our approval process is customizable with multi-step sequences and groups of approvers, covering account openings, W8/W9 reviews, KYC remediations, and offboarding.

KYC remediation may be triggered by:

- Subscription to a new service

- Periodic reviews (e.g., every 5–10 years)

- Incidents such as expired IDs or new PEP designations

All actions are tracked in live reporting dashboards, highlighting process efficiency, bottlenecks, and opportunities for automation. Clients can choose between full automation, full manual oversight, or hybrid approaches combining AI, rules, and human review.

InvestGlass digital onboarding streamlines client journeys, automates compliance, and enhances security while giving you full control over branding and workflows.

InvestGlass digital onboarding streamlines client journeys, automates compliance, and enhances security while giving you full control over branding and workflows.

Frequently Asked Questions to build you Request for Proposal

Are we missing any questions ? Let us know !

- Languages

How many files do you currently have? Will the account-opening process be multilingual, or will you have separate account-opening processes per language?

- Pro forma documents

How many PDFs must remain in pro forma format, for example W8NW9IMIBen, libre passage, or life insurance?

- Contact- vs account-based

Should your documents be contact-based or account-based?

Digital on-boarding with InvestGlass

- Formula documents (A, K, T)

Do your documents contain forms such as A, K, or T that must remain in pro forma?

- Account-opening packages

Have you defined packages for account opening? Can these be grouped by product families?

- Common law vs civil law

Have you established different packages depending on common law or civil law?

- Digital signature process with InvestGlass

Do you have a digital signature process in place? Would you expect to use the InvestGlass system with 2FA, IP/ID/time-stamp recording? Do you accept signature-pad signatures? Should the signature pad be hidden for each UBO/LPOA? Should certain fields be hidden from one UBO to another?

- Identity verification

When opening an account, do you accept cases without an initial meeting with a bank employee, or must an employee verify the identity document first?

- Prospect involvement

How do you expect the account-opening process to be undertaken by the prospect?

- Supporting documents

How many documents (ID, proof of wealth, tax slips, etc.) do you expect to collect for individual and company accounts? Have you standardised the required elements?

- Restricted countries

Will you block remote account opening for specific countries?

- Document packages

If multiple forms are filled in simultaneously, would you like them regrouped into packages for efficiency?

- Devices and channels

Are you expecting account opening to be done via mobile, tablet, desktop, or a hybrid paper-based process?

- Duration

How long should an account opening take?

- Third-party initiation

Will account openings be carried out by third parties such as external asset managers or business introducers?

- Mandatory questions

Have you defined minimum required answers for each form? Are all questions mandatory?

- Simulators

Do your forms include simulators? If so, which ones?

- Save and continue later

Do you allow forms to be saved and completed later? If so, do you have form versioning to ensure validity?

- Multiple UBOs

For multiple UBOs, do you allow sequential completion or must one UBO complete everything?

- Integration with InvestGlass CRM and other CRM

Once documents are completed, will updates feed into a third-party CRM? If so, do you have schema or JSON examples (client info, knowledge, experience, needs)?

- PDF formatting

Should generated PDFs match your existing format exactly, or can minor amendments be made?

- Approval workflow

When approving account openings, will approvers review individual fields or the full PDF/package? Could you provide your current workflow?

- KYC remediation

Do you conduct KYC remediation? If so, what process is in place?

- Notifications for expiry

Do you expect InvestGlass to notify if data or documents expire? If so, what process should be followed?

- Reputation and name checks

Do you use tools such as World-Check, North Data, or crypto-wallet reputation checks for AML, CFTC, and PEP lists? Should these be integrated into the account-opening process, and where should flags be displayed?

- Reporting

Do you expect reporting on account-opening efficiency, abandonment rates, completion times, form types, teams, employees, contracts, approvers, and approval processes?

- KYC tools

Which KYC tools are you currently using or planning to use (e.g. document verification, biometric checks, video identification)? Should these tools be integrated into the account-opening process, and how should the results be displayed?

- Hosting, sovereignty, and residency needs

Do you have specific hosting requirements regarding data sovereignty and residency (e.g. hosting within Switzerland, the EU, or other jurisdictions)? Are there any regulatory constraints we should be aware of for storing and processing client data?

- Connection to Active Directory

Do you require a connection to your members’ Active Directory for authentication and user management? Should access rights for bankers or employees be managed through this integration?

- User authentication methods

Which authentication methods do you require for clients and bankers (e.g. SSO, MFA, biometrics)?

- Session management

Should the system enforce session timeouts, re-authentication, or device restrictions?

- Initial funding

Should the account-opening process allow or require first deposit or transfer instructions?

- Payment integration

Do you need integration with payment systems (e.g. SWIFT, SEPA, internal rails) as part of the onboarding?

- Accessibility compliance

Do you require the onboarding process to comply with accessibility standards (e.g. WCAG, ADA)?

- Language fallback

If a document is not available in a client’s chosen language, should the system default to English or block the onboarding?

- Guided experience

Do you expect the onboarding process to include guided flows, tooltips, wizards, or live chat assistance?

- Data retention

How long should onboarding data be stored, and under which retention and archival policies?

- Audit trail

Do you require an immutable audit trail to record who made which changes and when, for regulatory purposes?

Record permission and Audit

- Custom reporting

Do you need dashboards or reports on abandonment rates, document errors, time-to-approve, or bottlenecks?

- Core banking integration

Should the system push completed onboarding data into your core banking platform, or only into InvestGlass CRM?

- Third-party APIs with InvestGlass API

Do you require integrations with third parties such as tax authorities, credit bureaus, or regulators?

- API availability

Do you need APIs exposed for partners or only for internal use?

InvestGlass API

- Jurisdiction-specific workflows

Should onboarding differ depending on the client’s domicile or jurisdiction (e.g. FATCA, CRS, MiFID II, FINMA)?

- Sanctions screening frequency

Should sanctions and PEP screening be performed only at onboarding or continuously afterwards?

- Consent management

Do you require electronic consent storage (e.g. for GDPR, privacy notices, terms & conditions)?

- Role-based access

Should employees have role-based permissions to access only their own clients, or broader team visibility?

- Delegation

Should a banker be able to transfer an onboarding case to another banker mid-process?

- Training environment

Do you need a sandbox mode for employees to practise the onboarding process without creating live data?

- Multi-entity onboarding

Do you require the ability to onboard several related entities at once (e.g. corporate accounts with subsidiaries or family groups)?

- Document version control

Should the system include document versioning to track updates, prevent outdated forms from being used, and ensure regulatory compliance?

Are we missing any questions ? Let us know !