Top Future Trends in CRM for Banking Driving Innovation and Efficiency

Introduction to CRM

In the world of financial services, customer trust and loyalty are the lifeblood of growth. Banks and financial institutions thrive when they maintain strong, lasting relationships with their clients. Customer relationship management (CRM) systems have become indispensable tools in achieving this. They are not merely pieces of software but strategic enablers of transformation, shaping how banks connect with their customers, manage data, and deliver services.

A modern CRM platform provides a unified space where customer data, interactions, and service histories converge. By consolidating this information, banking CRM software reduces duplication, eliminates inefficiencies, and empowers sales and marketing teams to engage more effectively. What once required manual intervention and endless paperwork can now be streamlined, automated, and optimised.

The future of CRM in banking lies not only in automating basic processes but also in creating intelligent ecosystems that anticipate customer needs. To enhance efficiency and future-proof customer relationship management, it is essential for banks to use CRM systems to automate processes at scale. With artificial intelligence, advanced analytics, and mobile technology at the forefront, banks can use CRM systems to deliver personalised services, strengthen customer loyalty, and reduce costs. As digital transformation accelerates, the question for banks is not whether to adopt CRM solutions, but how to adapt to evolving CRM trends and align them with strategic goals.

The Importance of Customer Data

At the heart of every successful CRM strategy lies data. Banks handle vast amounts of client data every day, from transaction histories and credit scores to personal preferences and service requests. Harnessing this data effectively is essential for understanding consumer preferences and behaviour.

CRM systems provide a framework for collecting, storing, and analysing client data. They transform raw information into actionable insights that guide decision making. For example, sales teams can analyse client data to identify cross-selling opportunities, while marketing teams can design targeted marketing campaigns tailored to specific customer segments. This ability to offer personalised content and services gives banks a competitive edge in a crowded marketplace.

Advanced analytics and artificial intelligence are increasingly helping banks to predict customer needs. For instance, by examining patterns in savings behaviour, a CRM platform can suggest personalised investment products. By monitoring spending habits, banks can anticipate when a customer might need a loan or financial advice. This predictive capability does not just improve customer satisfaction but also ensures higher value interactions, leading to stronger loyalty and retention.

Customer data is also crucial for regulatory compliance. With strict rules around transparency and accountability, CRM solutions help banks document customer interactions and ensure that decisions are based on data-driven insights rather than assumptions. This increases trust and positions banks as responsible stewards of customer information.

CRM System Implementation

While the benefits of CRM systems are widely recognised, implementation remains a challenge for many banks. Legacy systems, siloed data, and complex organisational structures can delay adoption. However, when executed properly, CRM implementation delivers significant returns in operational efficiency, cost savings, and customer satisfaction.

Phased implementation is considered best practice. Banks often start by digitising core customer information, then gradually add features such as CRM automation, integration with multiple channels, and advanced reporting tools. This approach allows teams to adapt gradually and avoids overwhelming staff with sudden changes.

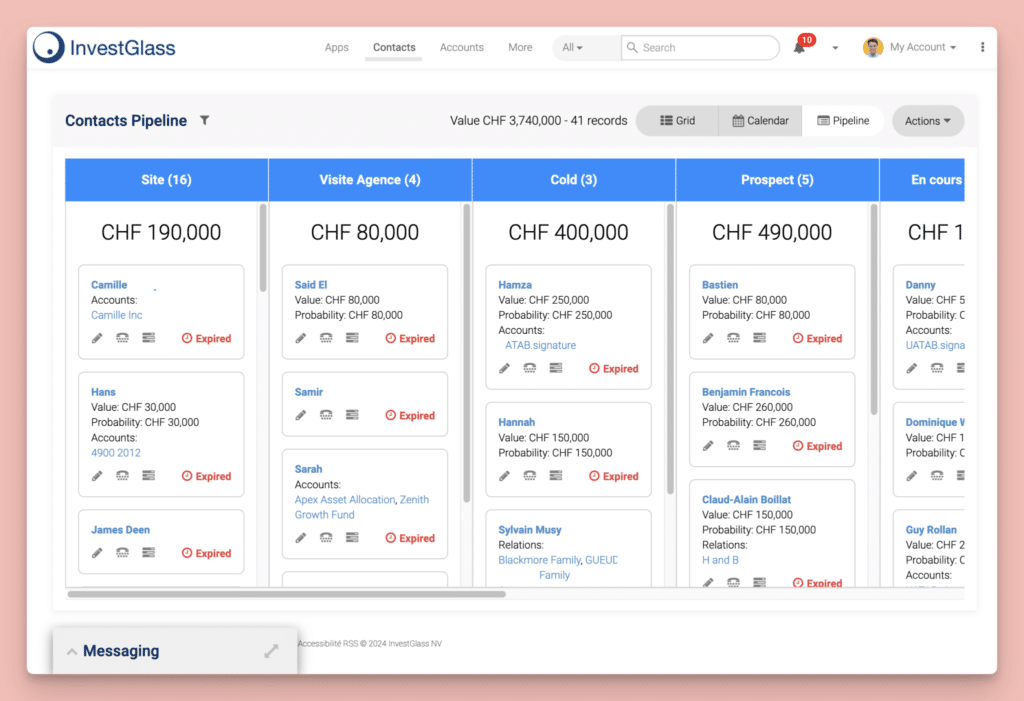

CRM automation plays a vital role in reducing manual data entry and repetitive processes. By automating routine tasks such as updating customer records, sending reminders, or managing sales pipelines, sales reps and service teams can focus on building relationships rather than completing paperwork. Mobile CRM adds another layer of convenience, enabling sales teams to access customer information on the move and make data-driven decisions in real time.

The integration of historical data with real-time analytics provides a powerful tool for banks. Sales reps can combine past customer interactions with current market dynamics to identify the right products for specific clients. This not only increases productivity but also ensures personalised experiences that strengthen long-term relationships.

Benefits of CRM Systems

The tangible benefits of CRM systems in banking extend across multiple dimensions. Firstly, they improve customer satisfaction by providing faster, more personalised service. A customer query that once took days to resolve can now be addressed instantly through integrated platforms and real-time assistance.

Secondly, CRM solutions increase productivity by streamlining operations. Banking staff spend less time switching between systems or searching for customer information and more time focusing on strategic tasks. The reduction in manual effort also lowers the risk of human error.

Thirdly, CRM systems lead to cost savings. Acquiring new customers is expensive, but retaining existing ones is more cost-effective. By offering tailored services and personalised experiences, banks can increase customer loyalty, thereby reducing spending on acquisition. CRM software also enables banks to reduce spending by supporting more targeted marketing efforts and preventing wasteful expenses in customer acquisition processes. This translates into higher profitability and a more sustainable business model.

Finally, CRM platforms provide banks with agility in a fast-changing market. By enabling quick adjustments to sales processes, targeted marketing campaigns, and customer engagement strategies, they help financial institutions stay ahead of competitors and adapt to shifting consumer behaviour.

CRM Software Solutions

CRM software has evolved significantly, moving from simple contact management tools to sophisticated platforms tailored to industry needs. For banking institutions, CRM software solutions must address specific challenges such as regulatory compliance, risk management, and multi-channel engagement.

Cloud-based CRM solutions are becoming the preferred choice for many banks. They provide flexibility, scalability, and cost efficiency while ensuring secure management of customer data. Banks no longer need to invest heavily in infrastructure; instead, they can scale resources up or down depending on demand.

Artificial intelligence and machine learning enhance CRM software by delivering predictive insights. These technologies analyse vast amounts of customer information to identify trends, predict future behaviour, and suggest the most effective course of action. For example, AI can highlight customers likely to close accounts, enabling proactive retention strategies.

Integration is another critical factor. There is a growing trend toward more integrations in CRM systems, as increasing the number of integrations enhances functionality, data access, and overall efficiency for banks. Modern CRM platforms connect seamlessly with mobile apps, core banking systems, and third-party tools, ensuring smooth customer interactions across channels. Whether through a branch visit, mobile app, or call centre, customers experience consistency and continuity.

Channel Integration and Automation

In today’s digital banking landscape, customers expect seamless experiences across multiple channels. Whether they engage via mobile apps, social media, phone calls, or in person, the interaction should feel integrated and personalised. This is where channel integration becomes essential.

CRM systems enable banks to consolidate interactions from various channels into a single platform. This unified view of customer interactions ensures that no query or request is missed, and the customer receives consistent service regardless of the touchpoint.

Automation enhances this integration by reducing delays and improving accuracy. Tasks such as routing customer queries, sending personalised notifications, or generating reports can all be automated. This not only saves time but also reduces the risk of human error. Furthermore, real-time assistance through automated chatbots ensures that customers get instant responses, even outside regular business hours.

For banks, the result is a streamlined value chain where sales teams, marketing teams, and service reps work with synchronised data. This efficiency translates into improved customer satisfaction and lower operational costs.

AI and Analytics

Artificial intelligence and advanced analytics are among the most influential trends shaping the future of CRM in banking. By applying machine learning algorithms to customer data, banks can uncover hidden patterns and gain valuable insights into behaviour, preferences, and needs.

For example, predictive analytics can forecast when customers are most likely to seek a mortgage, switch accounts, or invest in new financial products. This enables sales and marketing teams to create personalised offers at exactly the right time, leading to higher conversion rates.

AI-powered virtual assistants and chatbots are also transforming customer service. These tools provide real-time assistance, resolving common queries quickly while freeing human agents to focus on complex issues. Beyond service, AI enhances decision making by providing sales reps with data-driven recommendations during interactions.

The shift towards data-driven insights marks a turning point in the banking landscape. No longer dependent solely on intuition, banks can use more data to make informed decisions, improving both efficiency and customer experience.

Mobile and Cloud-Based Solutions

Mobile technology and cloud-based CRM are redefining how banks manage customer relationships. Mobile CRM allows sales teams to access pipelines, update records, and manage customer information while in the field. This flexibility is invaluable in a sector where responsiveness is key.

Cloud-based CRM provides secure, scalable, and cost-effective solutions that align with the digital transformation goals of most financial institutions. These systems ensure data is accessible anytime and anywhere while offering built-in resilience against downtime or technical issues.

The combination of mobile apps and cloud platforms enables seamless customer interactions. Customers can start a query on a mobile app and continue it in a branch without repeating information. This level of integration improves efficiency and creates a frictionless experience that customers increasingly expect.

Self-Service and IoT Integration

A growing trend in the banking sector is the shift towards self-service. Customers increasingly prefer to manage their accounts independently through digital portals and mobile apps. CRM systems support this by offering self-service options that reduce reliance on branch visits and call centres.

IoT integration adds another dimension by enabling banks to deliver personalised experiences based on customer behaviour. For example, wearable devices could provide insights into lifestyle choices that influence financial planning. Smart devices could also trigger personalised offers in real time.

Self-service portals combined with IoT integration represent a step towards greater empowerment of customers. They also allow banks to save time, cut costs, and focus human resources on higher value activities.

Departmental Alignment

Departmental alignment is your secret weapon for crushing CRM success in the banking sector, ensuring that your sales and marketing teams work in perfect harmony to deliver experiences that delight every single customer. Your robust CRM system becomes the ultimate command center for customer data, giving both teams instant access to the same game-changing information about customer behavior, preferences, and interactions. This unified approach eliminates those costly data silos and empowers your sales and marketing teams to collaborate like never before on shared goals—from nurturing potential customers to skyrocketing customer satisfaction.

By leveraging advanced analytics within your CRM software, your marketing teams can dive deep into client data to design targeted campaigns that don’t just reach customers—they resonate with them on a personal level. These powerful insights enable your marketing teams to anticipate customer needs like mind-readers and deliver personalized content across multiple channels, dramatically increasing the effectiveness of every single outreach. Meanwhile, your sales teams can harness the same data to refine their sales processes, prioritize those high-value leads that matter, and respond to customer queries with lightning speed and pinpoint accuracy. This alignment doesn’t just improve operational efficiency—it ensures that every customer interaction is powered by comprehensive understanding of their unique journey.

In today’s dynamic banking landscape, where customer expectations evolve at breakneck speed, departmental alignment allows your business to adapt with incredible agility to changing market dynamics. With your CRM system facilitating real-time collaboration, your sales and marketing teams can spot emerging trends, adjust strategies on the fly, and launch new initiatives with unmatched speed and precision. Automating processes such as data entry, lead assignment, and follow-up communications slashes costs and frees up your valuable resources for higher-impact activities—like building those lasting customer relationships that drive serious revenue growth.

Mobile CRM solutions play a game-changing role in supporting departmental alignment, enabling your sales reps to access customer information, manage sales pipelines, and provide real-time assistance from absolutely anywhere. This mobility ensures that your teams remain ultra-responsive to customer needs, whether they’re working remotely or conquering deals on the go. Cloud-based CRM platforms supercharge this flexibility, offering secure, scalable access to customer data and sales tools that boosts productivity through the roof and supports informed decision-making across all your departments.

Effective departmental alignment also delivers massive cost savings by reducing redundant efforts and streamlining operations like a well-oiled machine. Instead of focusing solely on acquiring new customers, your aligned teams can nurture existing relationships, identify lucrative upsell and cross-sell opportunities, and deliver personalized experiences that foster unbreakable customer loyalty. By analyzing customer data and behavior, your bank can create targeted marketing campaigns that drive higher engagement and revenue, while simultaneously reducing spending on those less effective acquisition strategies that drain your budget.

Ultimately, prioritizing departmental alignment through cutting-edge CRM solutions enables your bank to deliver a cohesive, personalized customer experience across all touchpoints that sets you apart from the competition. By harnessing the power of advanced analytics, artificial intelligence, and mobile technology, your bank can unlock valuable insights, improve operational efficiency, and stay miles ahead of the competition. In an increasingly digital and customer-centric business environment, departmental alignment isn’t just a best practice—it’s your strategic imperative for explosive long-term growth and success.

New Markets and Growth

CRM systems are vital for identifying and capitalising on new markets. By analysing client data, banks can detect emerging customer needs, regional trends, and untapped opportunities. This supports expansion into new territories or the creation of tailored financial products.

Personalised services and targeted marketing campaigns help attract new customers while strengthening loyalty among existing ones. In addition, integration with multiple channels and streamlined operations enables banks to scale efficiently, ensuring sustainable growth.

With global competition intensifying, the ability to adapt CRM strategies to local market dynamics is key. Future trends suggest that banks will increasingly rely on CRM users and data-driven decisions to identify opportunities and drive expansion.

Best Practices for Implementation

To maximise the impact of CRM systems, banks should follow best practices during implementation. These include setting clear objectives, defining measurable goals, and involving stakeholders from the outset. Phased deployment, combined with continuous training, ensures smooth adoption.

Regular monitoring and evaluation help track progress, identify bottlenecks, and make necessary adjustments. Support for sales teams, marketing teams, and customer service representatives is essential to maintain engagement and build confidence.

By focusing on processes and people as much as technology, banks can ensure that CRM implementation leads to real transformation rather than simply replacing one system with another.

Security and Sustainability

Security is paramount in the banking sector, and CRM solutions must adhere to the highest standards. Encryption, access controls, and audit trails are fundamental for protecting customer information. Cloud-based CRM providers often offer additional layers of protection, making them attractive choices for banks seeking both security and scalability.

Sustainability is another growing concern. CRM platforms designed with energy efficiency in mind reduce environmental impact while supporting corporate social responsibility goals. Cloud solutions also minimise the need for physical infrastructure, further contributing to sustainability.

By combining security and sustainability, banks build trust with customers while aligning with broader business and social priorities.

Industry-Specific Solutions

While CRM platforms share core functions, banking institutions require solutions tailored to their unique needs. Industry-specific CRM software incorporates features such as regulatory compliance monitoring, risk assessment, and integration with financial transaction systems.

These solutions enable banks to offer personalised services to specific clients while ensuring operational efficiency. Integration with multiple channels ensures consistent service, while automation reduces costs and response times. For customers, this translates into reliable, secure, and tailored banking experiences.

Social CRM and Customer Experience

The rise of social media has introduced new dimensions to customer relationship management. Social CRM allows banks to monitor and engage with customers across platforms such as Twitter, LinkedIn, or Facebook. This form of engagement is crucial for maintaining relevance in a digitally connected world.

Social CRM enhances customer experience by providing real-time assistance, addressing queries quickly, and responding to feedback in a public forum. For banks, it also provides an opportunity to humanise their brand and build stronger relationships.

Personalised experiences, driven by social insights, ensure that customers feel valued and understood. This helps attract new customers while reinforcing loyalty among existing ones.

Future of CRM in Banking

Looking ahead, the future of CRM in banking will be defined by personalisation, intelligence, and integration. Artificial intelligence and machine learning will play increasingly central roles in delivering actionable insights, predicting customer needs, and enabling proactive engagement.

CRM trends point towards greater reliance on mobile technology, cloud-based solutions, and automation to streamline processes. Integration with multiple channels will ensure consistent customer interactions, while advanced analytics will support data-driven decisions.

In essence, CRM systems will become the backbone of digital transformation in the banking landscape. By staying ahead of CRM trends and investing in platforms that deliver higher value, banks can drive innovation, achieve operational efficiency, and enhance customer experience.

Conclusion

CRM is no longer a peripheral tool in banking—it is a strategic necessity. By leveraging customer data, CRM systems enable banks to deliver personalised services, reduce costs, and improve operational efficiency. With AI, analytics, mobile CRM, and cloud-based solutions shaping future trends, the role of CRM in banking will only grow in significance.

For banking institutions, the challenge is to embrace digital transformation fully, align CRM strategies with market dynamics, and focus on customer-centric innovation. Those who succeed will not only enhance customer satisfaction but also secure long-term growth in an increasingly competitive environment.

Frequently Asked Questions (FAQ)

1. What is CRM automation in banking?

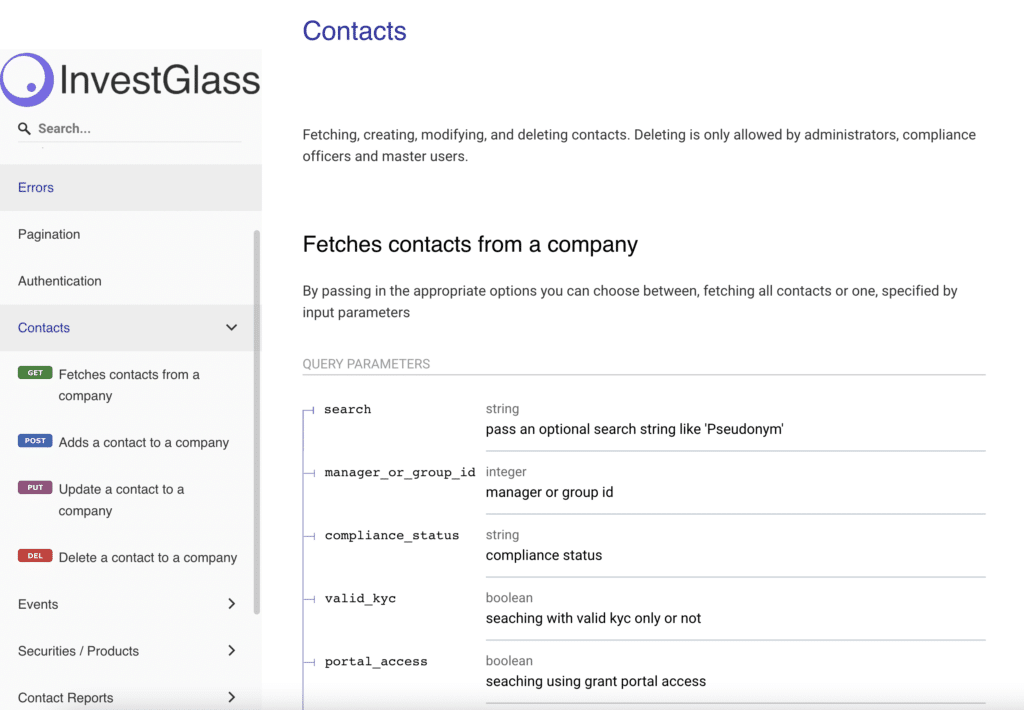

CRM automation in banking means using technology to remove repetitive manual tasks such as updating records, sending alerts, and routing customer queries. With InvestGlass, banks can automate onboarding, compliance checks, and client reporting. This ensures teams spend less time on administration and more time strengthening customer relationships.

2. How does CRM automation improve efficiency for banks?

Efficiency comes from speed and accuracy. InvestGlass CRM helps banks automate workflows such as KYC, AML checks, and document collection. By streamlining these processes, InvestGlass reduces human error, accelerates decision-making, and frees sales reps to focus on high-value interactions with customers.

3. What role does AI play in CRM systems?

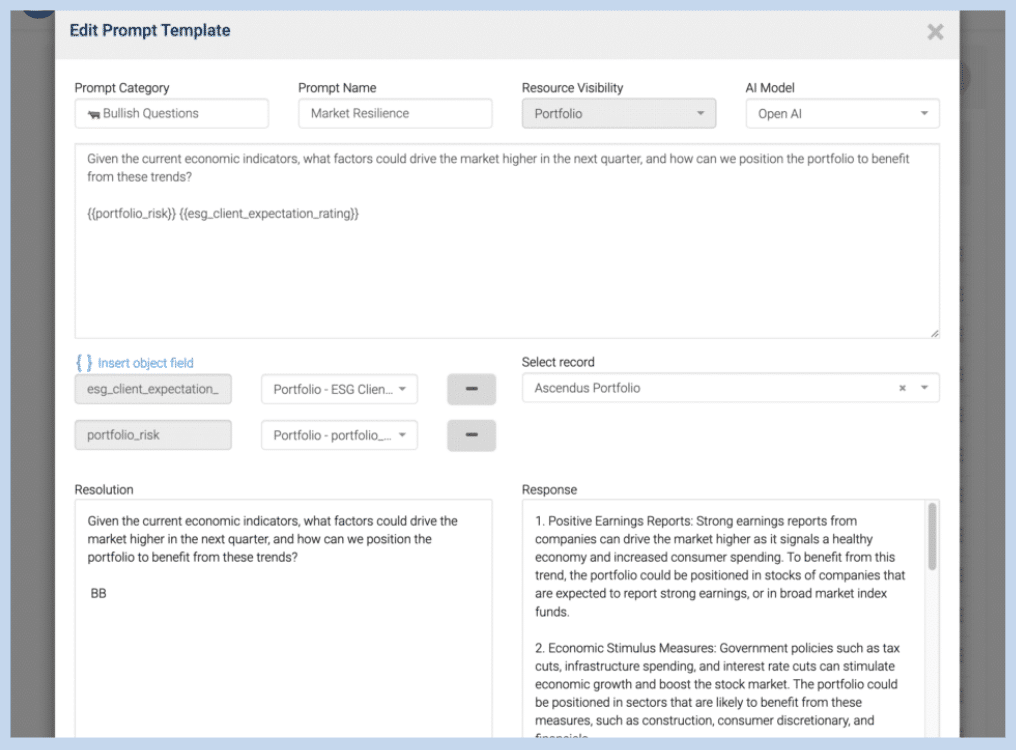

AI transforms CRM from a record-keeping tool into a predictive engine. InvestGlass integrates AI-driven analytics to help banks understand customer behaviour, identify patterns, and suggest next best actions. Whether it’s predicting when a client may need a mortgage or sending timely investment updates, InvestGlass empowers teams with actionable insights.

4. How does CRM contribute to data sovereignty in banking?

Data sovereignty is crucial in finance, where regulations often require customer data to remain within national borders. InvestGlass offers sovereign hosting options, allowing banks to run their CRM entirely on private or local servers. This ensures compliance with regional laws while protecting sensitive customer data.

5. Why is data sovereignty important in CRM adoption?

Banks cannot risk storing or processing data in jurisdictions with weaker privacy laws. InvestGlass enables financial institutions to adopt a CRM solution that respects local regulations and sovereignty. This builds customer trust by ensuring their information is safe, compliant, and not exposed to unnecessary cross-border transfers.

6. How can AI improve customer satisfaction in banking?

AI-driven features in InvestGlass, such as automated reminders, predictive product recommendations, and smart chatbots, help banks engage with clients at the right time with the right message. Customers receive personalised offers, faster responses, and proactive support, improving satisfaction and loyalty.

7. Can CRM automation reduce costs for banks?

Yes. InvestGlass automation reduces the time spent on manual tasks like form filling, compliance updates, and follow-up scheduling. By lowering operational costs and increasing productivity, banks using InvestGlass see higher efficiency without compromising customer service.

8. How secure are AI-driven CRM platforms?

Security is a top priority. InvestGlass combines data sovereignty with strong security protocols, including encryption, access controls, and audit trails. This ensures that AI-driven automation remains compliant with financial regulations while keeping customer information fully protected.

9. How does CRM automation support sales and marketing teams?

InvestGlass empowers sales and marketing teams by automating lead nurturing, segmenting customers, and launching targeted marketing campaigns. By analysing client data, InvestGlass helps teams deliver personalised content and offers at scale, leading to stronger customer engagement and more effective sales processes.

10. What future trends should banks watch in CRM automation and AI?

Banks should watch for greater use of AI, sovereign cloud solutions, and mobile CRM. InvestGlass is already aligning with these future trends by offering AI-driven insights, flexible sovereign hosting, and mobile-ready CRM. This ensures banks can adapt quickly to market dynamics and stay ahead of competition.