InvestGlass: Elevating Operational Risk Management

Empowering Risk Intelligence, Ensuring Resilience

Simplify Your Workflow

From Start to End

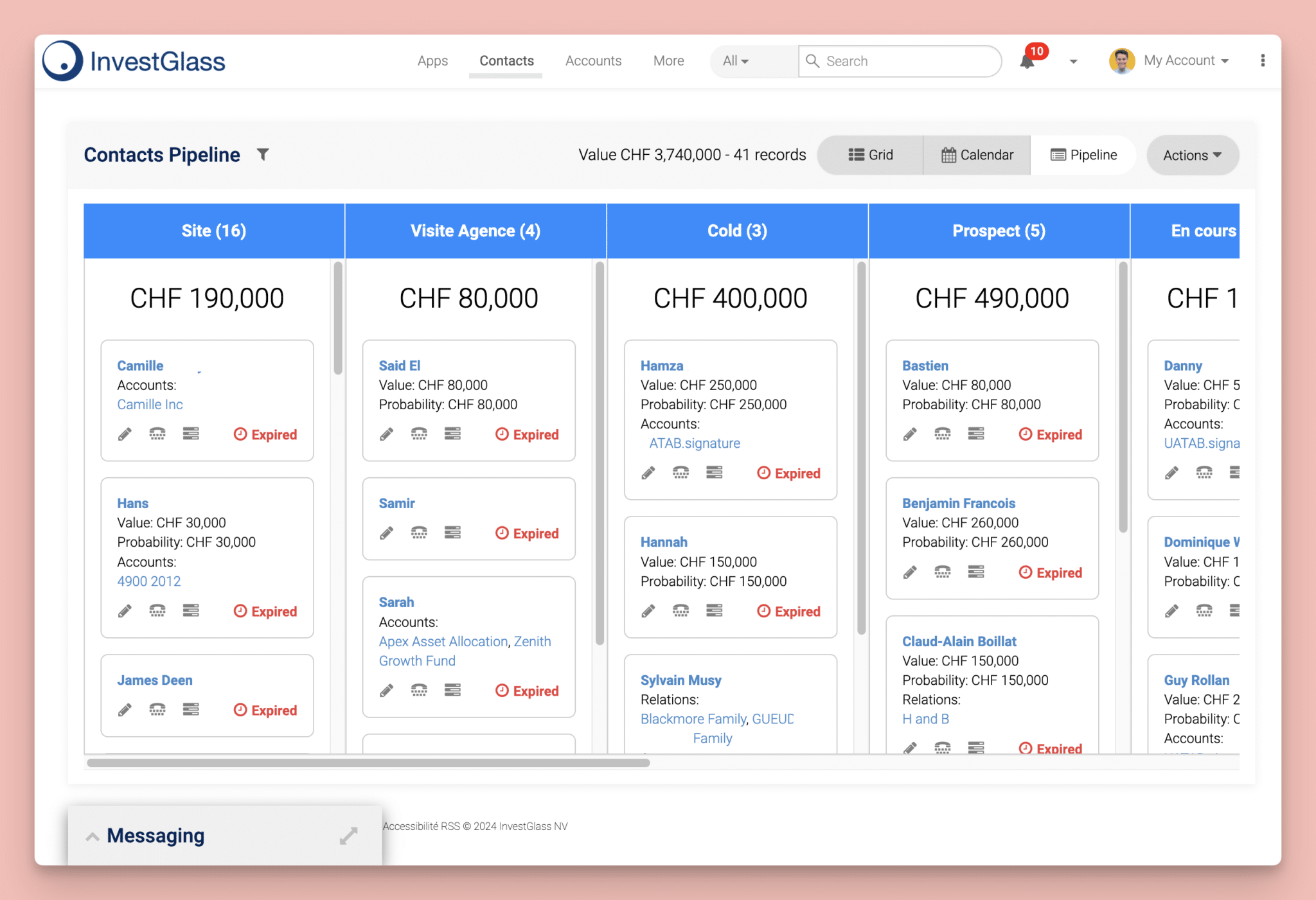

Risk Assessment and Analysis Tools

InvestGlass offers robust risk assessment tools, including risk registers, heat maps, and scoring mechanisms to prioritize risks by likelihood and impact. These tools help identify and evaluate potential risks efficiently.

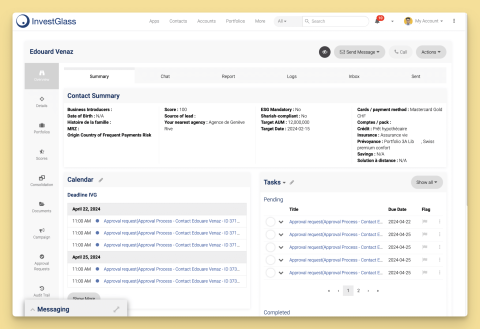

Incident Management

With InvestGlass, track and manage incidents seamlessly. Log incidents, conduct root cause analyses, and track resolutions to prevent future occurrences, ensuring comprehensive incident management.

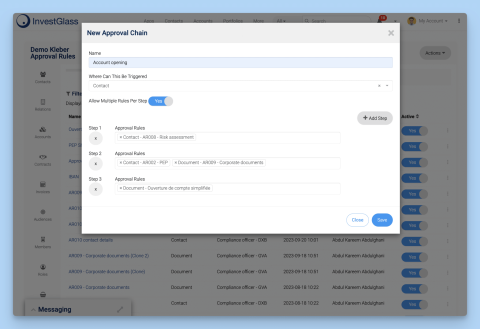

Compliance Management

InvestGlass ensures regulatory adherence with compliance management tools. Utilize compliance checklists, automated monitoring, and reporting features to maintain alignment with legal and regulatory standards.

Control Management

InvestGlass helps design, implement, and monitor internal controls. Perform control self-assessments and track control effectiveness to ensure risks are managed effectively over time.

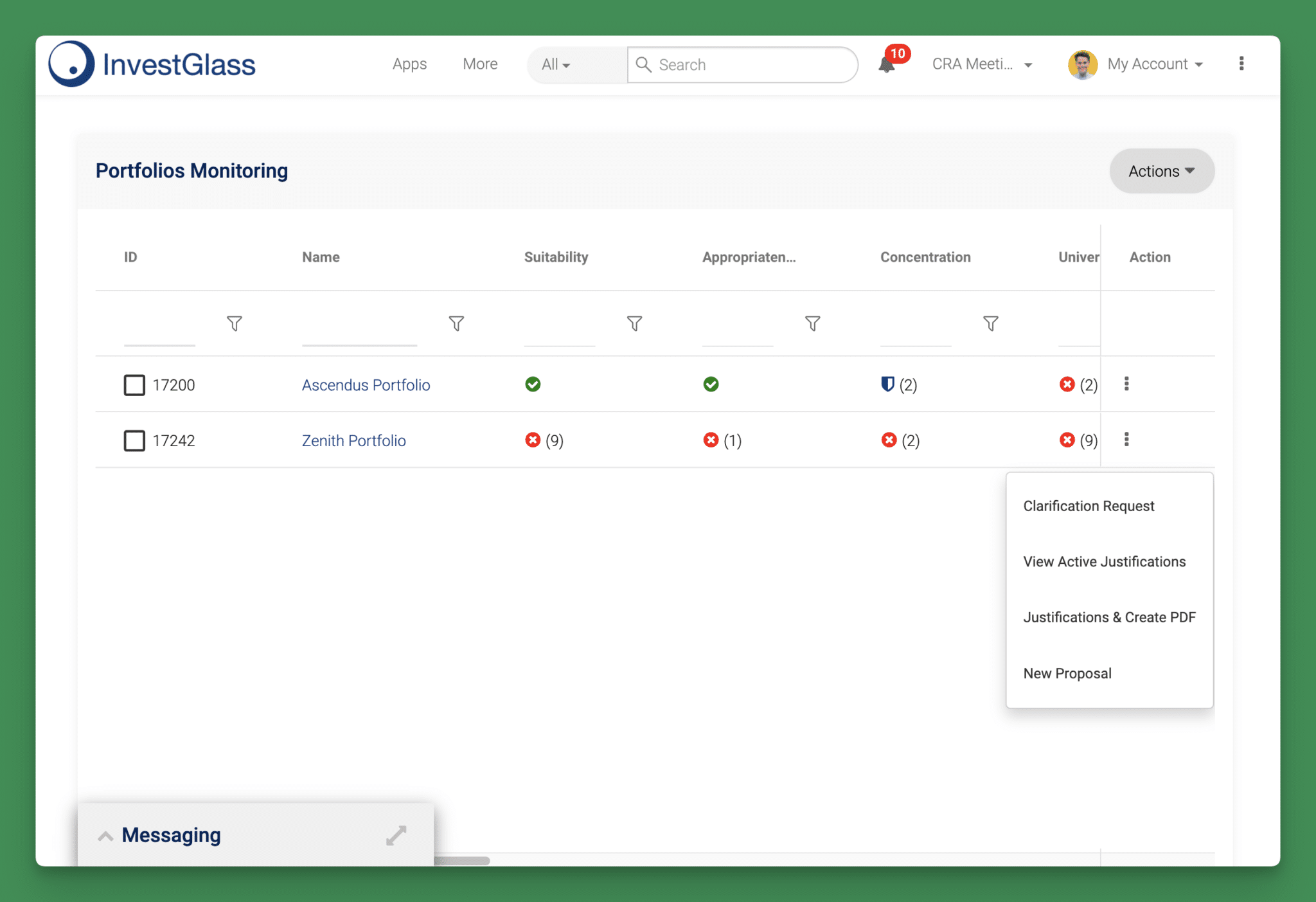

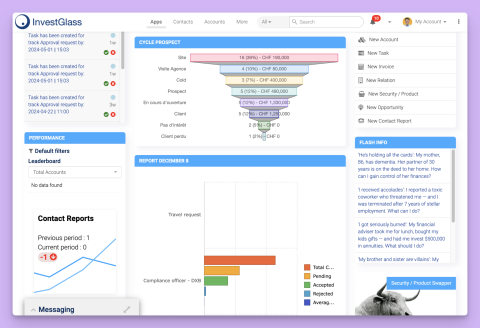

Reporting and Dashboards

InvestGlass provides customizable reports and real-time dashboards. Access visual analytics and key risk indicators (KRIs) for comprehensive insights into your organization’s risk landscape, aiding informed decision-making.