Top Choices for the Best Monte Carlo Retirement Calculator in 2025

The Best Monte Carlo Retirement Calculator UK: How InvestGlass Helps You Plan Smarter

Looking for the best Monte Carlo retirement calculator UK investors can rely on? This guide explores leading tools that harness Monte Carlo simulations to project accurate retirement outcomes. You’ll discover how they work, compare top free and premium calculators, and learn why InvestGlass retirement planning tools stand out for precision, automation, and flexibility. By the end, you’ll know exactly which platform can help you plan your financial future with confidence.

Key Takeaways

- Monte Carlo simulations provide a data-driven assessment of retirement goals by analysing multiple market scenarios and personal financial conditions.

- InvestGlass’s integrated portfolio and retirement tools combine advanced Monte Carlo analysis with automated data feeds and secure reporting.

- Selecting the right Monte Carlo retirement calculator depends on your personal goals, the level of analytical detail you require, and the range of customisation features available.

Understanding Monte Carlo Simulations in Retirement Planning

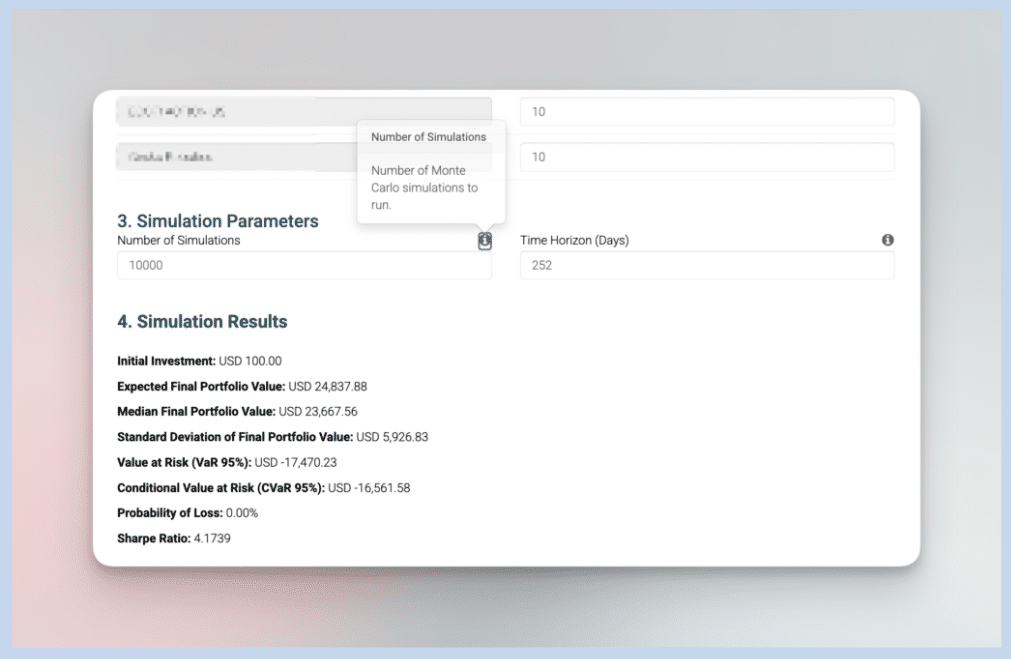

Monte Carlo simulations are sophisticated mathematical models used to assess the likelihood of achieving retirement objectives. They analyse thousands of potential market conditions and personal financial variables. The approach takes its name from Monaco’s famous casino, symbolising the element of probability built into every financial forecast.

By simulating countless possible outcomes, Monte Carlo models generate realistic insights into the range of future scenarios that could affect your retirement. The results often appear as a bell-curve distribution, showing the probability of different outcomes and helping investors understand the likelihood of reaching their goals.

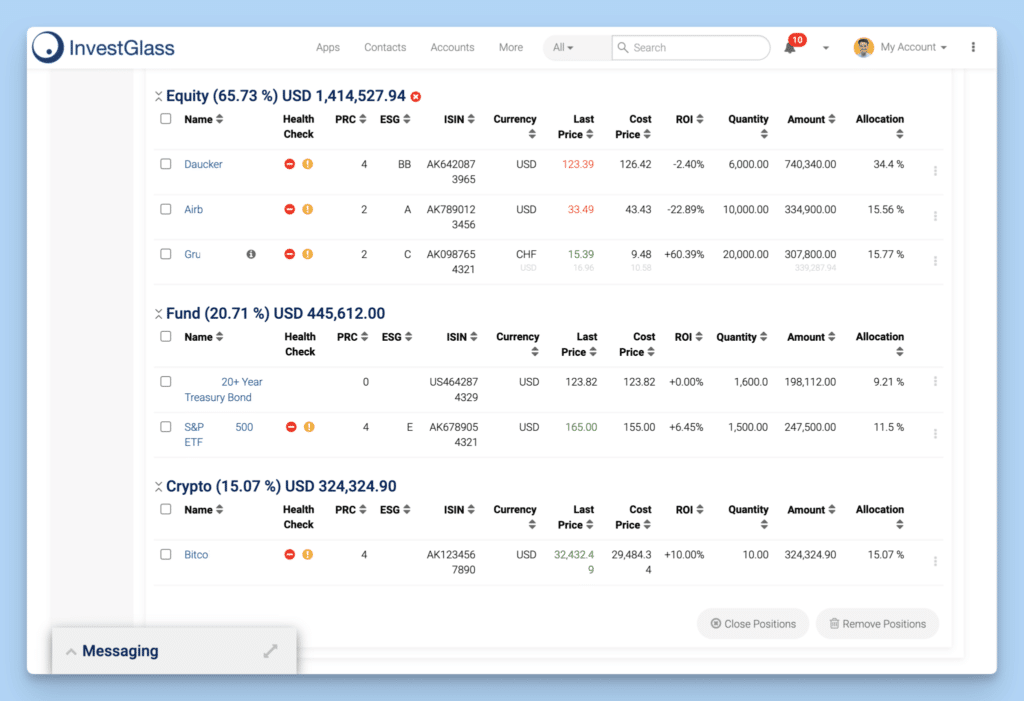

For instance, if simulations reveal a 30% chance of depleting savings too early, you might decide to increase contributions, shift your asset allocation, or delay retirement. InvestGlass integrates these probabilistic models directly within its client dashboards, allowing users to visualise outcomes and instantly adjust their strategies.

Although Monte Carlo models cannot perfectly predict rare market events, they remain one of the most effective tools for understanding potential risks. By combining simulation results with expert advice and diversified portfolios, users can achieve a more resilient financial plan. InvestGlass’s integrated wealth management platform enhances this process by automatically updating simulations with live market data, giving advisers and investors a continuous, data-driven view of their retirement readiness.

What Is a Monte Carlo Retirement Calculator?

A Monte Carlo retirement calculator estimates how likely you are to achieve your desired retirement income. It does this by running thousands of randomised simulations that account for uncertainty in investment returns, inflation, and spending.

Traditional calculators use static averages, but Monte Carlo tools offer far greater realism. They show how fluctuations in markets, inflation, and personal habits could impact your savings over time.

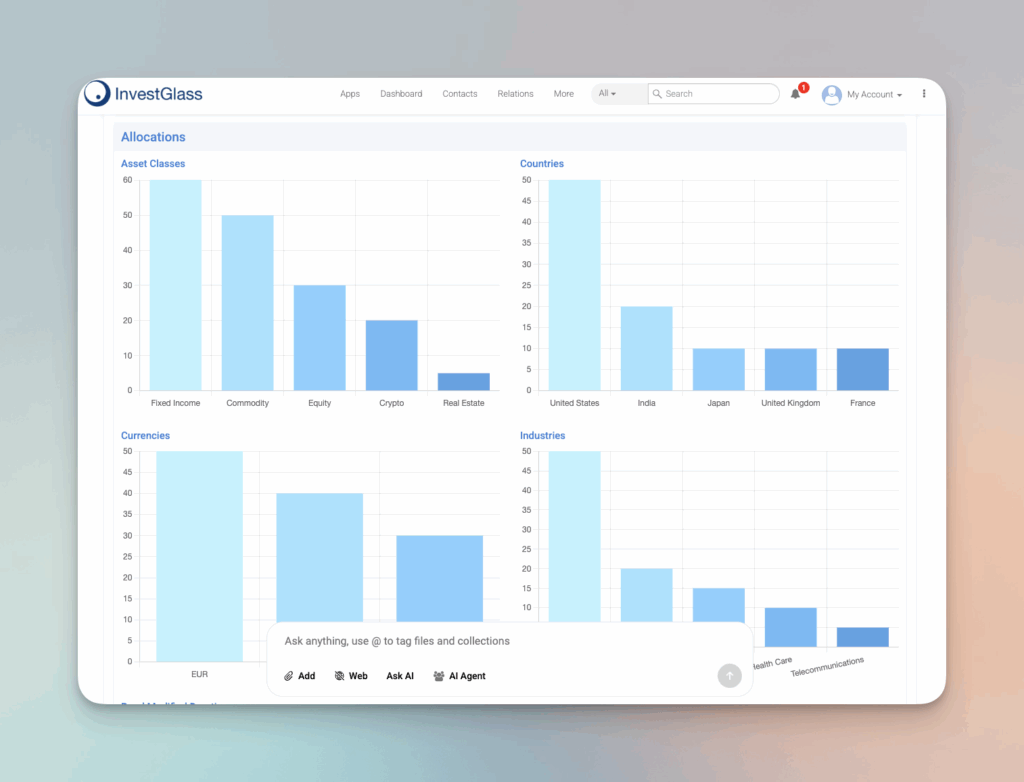

The InvestGlass retirement planning tool goes even further. It connects these simulations directly to your live portfolios, CRM data, and client dashboards. By syncing investments, income, and goals in one place, it produces real-time probability analyses. The result: users can explore multiple scenarios instantly, make adjustments, and automatically generate client-ready reports.

Whether you’re at the start of your journey or refining an existing plan, the Monte Carlo retirement calculator UK users trust most should offer clarity, flexibility, and integration — qualities InvestGlass delivers through its seamless ecosystem of financial and analytical tools.

FI Calc: The Leading Free Monte Carlo Retirement Calculator

FI Calc is one of the most popular free Monte Carlo calculators available. It helps users forecast how long their money will last based on current savings, spending habits, and investment returns. For anyone wanting a no-cost introduction to retirement modelling, FI Calc is a great starting point.

Yet, while FI Calc offers strong basics, InvestGlass provides institutional-grade precision. With InvestGlass, you can combine Monte Carlo analysis, goal tracking, and real-time data feeds to achieve far deeper insights. Advisers can manage multiple clients, build compliance-ready reports, and run simulations with professional-level accuracy — all within one secure platform.

FI Calc gives users valuable estimates, but InvestGlass turns projections into actionable intelligence. It merges performance analytics, portfolio optimisation, and automated documentation — ideal for wealth managers or individuals seeking comprehensive oversight.

Benefits of AI-Enhanced Monte Carlo Simulations

One of FI Calc’s most appealing features is that it delivers Monte Carlo projections for free, helping individuals visualise future financial possibilities. However, AI-powered solutions like InvestGlass amplify these benefits substantially.

InvestGlass integrates artificial intelligence to refine the accuracy of simulations. Its AI models analyse client behaviour, spending patterns, and macroeconomic trends to offer hyper-personalised outcomes. For example, instead of manually adjusting inflation or return rates, InvestGlass can suggest scenario ranges automatically based on real-world data.

The result is more precise forecasting, less manual input, and a more intuitive planning experience. Combined with its CRM and portfolio management capabilities, InvestGlass offers a unified system where Monte Carlo simulations become part of a continuous financial strategy rather than a one-off calculation.

Exploring cFIREsim for Comprehensive Scenario Analysis

cFIREsim is another advanced tool that uses historical data to run millions of retirement simulations. It allows detailed customisation, enabling users to adjust spending, asset allocation, and withdrawal strategies over time. The software provides a deep dive into potential future outcomes and success rates.

Still, cFIREsim operates as a standalone simulator, meaning you must manually input and update your data. By contrast, InvestGlass automatically synchronises market data and portfolio performance, removing the need for constant adjustments. Its simulation engine produces comparable analyses while linking every result to your actual investments and client records.

For advisers, this means faster reporting, centralised oversight, and greater compliance efficiency. For individuals, it means a single login that connects investment performance, retirement goals, and risk projections — all continuously updated through InvestGlass’s integrated wealth management suite.

Bogleheads’ Variable Percentage Withdrawal Tool for Flexible Spending

The Bogleheads Variable Percentage Withdrawal (VPW) tool helps retirees manage withdrawals dynamically. It adjusts spending based on current portfolio performance to prolong asset longevity. This adaptive approach is excellent for those wanting flexibility during retirement.

However, InvestGlass automates this principle, incorporating dynamic withdrawal models within its portfolio analytics. Users can see in real time how their spending strategy affects long-term outcomes. The system can even trigger alerts if withdrawal rates exceed sustainable levels, helping maintain financial discipline.

By combining Monte Carlo forecasting with AI-driven portfolio monitoring, InvestGlass delivers a more robust and user-friendly version of the VPW concept. Retirees and advisers alike benefit from automated insight, allowing for precise adjustments that protect income longevity.

Empower’s Retirement Planner: User-Friendly and Versatile

Empower’s Retirement Planner is celebrated for its intuitive design and flexibility. Users can simulate “liquidity events” such as property sales or inheritances and assess how these affect future wealth. It’s ideal for those who appreciate straightforward visual tools.

InvestGlass, however, extends this capability by integrating real-time data feeds, multi-portfolio tracking, and CRM features. Its platform not only runs simulations but also automates follow-up actions, compliance documentation, and client engagement workflows.

While Empower focuses on user experience, InvestGlass combines UX excellence with professional-grade analytics. This ensures that both financial advisers and individuals can analyse, forecast, and act — all within the same digital environment.

Evaluating Fidelity Retirement Analysis Tool for Tax and RMD Estimates

The Fidelity Retirement Analysis Tool is widely respected for its accuracy in calculating tax obligations and Required Minimum Distributions (RMDs). It provides a consolidated view of multiple accounts, helping retirees understand how different withdrawal strategies affect their tax exposure.

A particularly valuable feature is its ability to forecast RMDs based on account balances and retirement age. For many retirees, knowing when and how much to withdraw is vital for maintaining efficiency and avoiding unnecessary taxation. Fidelity’s tool delivers clear visualisations and projections that simplify these complex calculations.

InvestGlass, however, takes this further by automating tax and withdrawal modelling across all connected portfolios. Through its built-in simulation engine, users can see the long-term tax impact of various strategies instantly. It factors in UK-specific tax regulations and automatically adjusts Monte Carlo projections accordingly. This integration gives clients and advisers a complete, tax-aware overview of their retirement readiness, transforming what was once a static calculation into a continuous optimisation process.

Another advantage of using InvestGlass is that it consolidates all accounts — pensions, ISAs, savings, and investments — into a unified reporting framework. The automation reduces manual entry, improves accuracy, and ensures up-to-date insights. For wealth managers, this saves countless hours and supports compliance while offering clients a clearer, more strategic picture of their post-retirement finances.

Pralana Gold: Advanced Features for Detailed Retirement Planning

Pralana Gold remains one of the most advanced Excel-based retirement planning tools available. It’s favoured by detail-oriented users who want to model specific income streams, tax scenarios, and Roth conversions. Although the interface feels technical, the flexibility it offers appeals to financially savvy planners.

Priced at around $99, Pralana Gold delivers precision modelling for users who want control over every assumption — from inflation and investment growth to healthcare costs and spending patterns. The software also allows the comparison of up to three retirement scenarios simultaneously, helping users visualise how different decisions may impact their long-term outcomes.

While this depth of control is impressive, it requires substantial manual input and spreadsheet management. InvestGlass replaces this complexity with automation. Its built-in retirement planning module delivers equivalent analytical power through an intuitive interface, eliminating the need for Excel formulas and manual updates. The system automatically synchronises live portfolio data, inflation rates, and tax codes to ensure your forecasts remain accurate and actionable.

For advisers and individuals alike, InvestGlass’s simulation tools replicate Pralana Gold’s advanced modelling but with added benefits — automation, compliance documentation, and scalability. It transforms sophisticated analysis into a seamless experience suitable for both professional and private investors.

How to Choose the Best Monte Carlo Retirement Calculator

Choosing the ideal Monte Carlo retirement calculator UK users can depend on involves aligning features with your specific financial needs. A good calculator should balance accuracy, accessibility, and flexibility, while offering clear insight into probabilities of success.

When evaluating options, consider the following:

- Data integration: Does the tool connect with your investment accounts or require manual inputs?

- Tax awareness: Does it include UK-specific tax and pension rules?

- Scenario testing: Can you easily model different assumptions like inflation, spending changes, or inheritance?

- Automation: Does it update automatically with market data or need constant manual refreshes?

Free calculators like FI Calc are great starting points, but for professionals and serious investors, platforms like InvestGlass provide a more powerful, integrated experience. Its Monte Carlo engine connects directly with your financial data, so every projection is based on real portfolio performance. Combined with CRM, compliance, and portfolio management, InvestGlass becomes a complete ecosystem for retirement and wealth planning.

Unlike isolated calculators, InvestGlass enables real-time scenario adjustments and automated reporting, ensuring that every decision — from contributions to withdrawals — is data-driven and compliant. For advisers, it enhances efficiency and client trust; for individuals, it provides transparency and peace of mind.

Why Monte Carlo Simulations Matter

Monte Carlo simulations are essential for anyone serious about retirement planning. Rather than relying on single-point estimates, they help investors understand ranges of possible outcomes. This realistic perspective is crucial for making confident, informed decisions about saving, investing, and spending in retirement.

A typical Monte Carlo model runs thousands of randomised simulations using assumptions about returns, inflation, and risk. The results show how likely you are to reach your retirement targets under different market conditions. Tools like InvestGlass integrate these calculations seamlessly, enabling advisers and clients to visualise probabilities instantly.

Beyond forecasting, Monte Carlo simulations allow you to test different “what-if” situations — what if inflation rises? What if you retire five years earlier? What if you increase savings by 10%? These insights enable continuous refinement, something traditional calculators simply cannot match.

InvestGlass’s retirement planning tools build on this methodology by integrating AI analytics, risk profiling, and live market feeds. This combination gives users accurate, adaptive planning that evolves with their real financial situation — ensuring every decision remains relevant.

Summary

The importance of accurate, data-driven retirement planning cannot be overstated. Monte Carlo simulations provide a sophisticated, evidence-based way to evaluate financial readiness and reduce uncertainty. For UK investors seeking comprehensive solutions, InvestGlass represents the next generation of digital financial planning.

While tools like FI Calc, cFIREsim, and Pralana Gold each have strengths, none combine automation, integration, and compliance support quite like InvestGlass. By merging Monte Carlo simulation, AI forecasting, and CRM functionality, InvestGlass empowers users to plan smarter, act faster, and retire with confidence.

Whether you’re an independent investor or a financial adviser, adopting the InvestGlass retirement planning tool means embracing efficiency and foresight. You can simulate thousands of potential market outcomes, visualise risk probabilities, and create tailored retirement strategies that adapt dynamically — all without leaving the InvestGlass dashboard.

Frequently Asked Questions

What is a Monte Carlo simulation in retirement planning?

A Monte Carlo simulation models thousands of possible future market outcomes to estimate your likelihood of meeting retirement goals. It provides a more realistic picture of risk than static forecasts, helping you make smarter financial decisions.

Why should I use a Monte Carlo retirement calculator?

Because it quantifies uncertainty, letting you see how various scenarios could affect your future income. The InvestGlass retirement planning tool uses Monte Carlo simulations to provide personalised, adaptive projections for greater confidence.

Are there any free Monte Carlo calculators available?

Yes — FI Calc and Empower offer free versions. However, InvestGlass integrates similar simulation technology into a complete wealth management suite, providing professional accuracy, automation, and real-time updates.

Can Monte Carlo simulations predict rare market downturns?

While they can’t foresee black swan events, they illustrate a wide range of potential outcomes, including severe downturns. When combined with InvestGlass’s risk-modelling features, you can prepare for volatility and maintain portfolio resilience.

How do I choose the best Monte Carlo retirement calculator UK option?

Look for calculators that offer accuracy, flexibility, and automation. InvestGlass combines all three, giving you a unified system to plan, monitor, and adjust your retirement strategy efficiently.