Explaining What is EMI Electronic Money Institution: Navigating Digital Finance

Written by InvestGlass on .

If you’re navigating the digital finance market, understanding “what is EMI Electronic Money Institution” can be key. EMIs issue electronic money and provide payment services, reshaping how we manage our finances. This article unfolds their role, regulatory environment, services, and how they compare to traditional banking – offering a comprehensive guide to the digital financial services landscape.

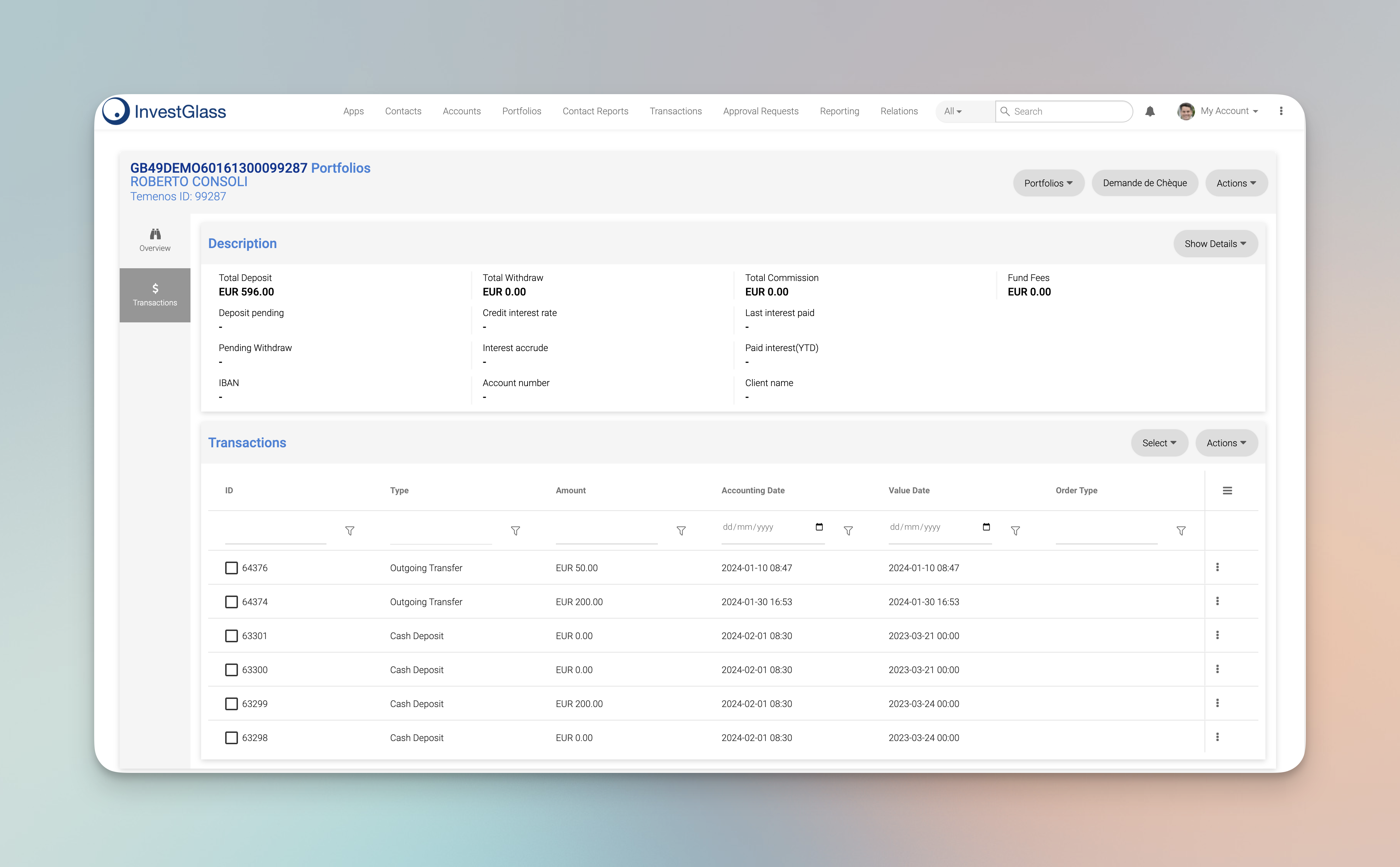

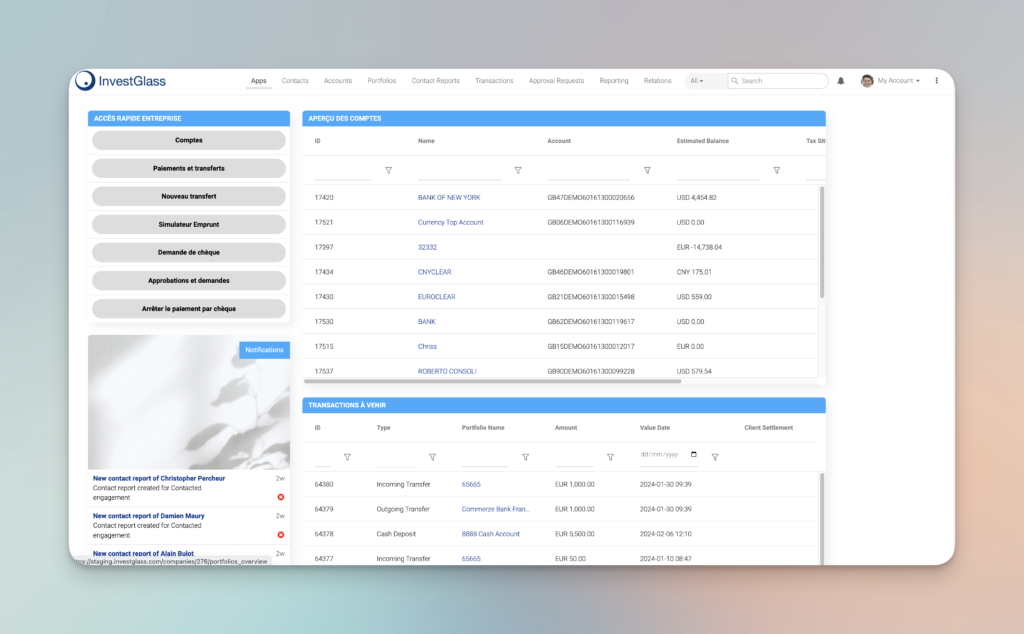

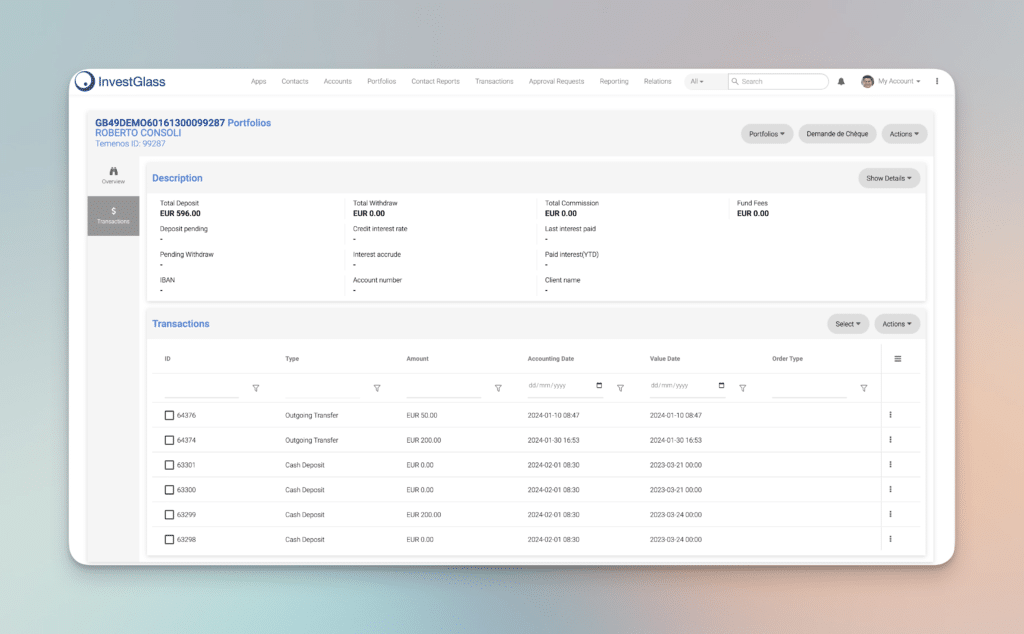

InvestGlass offers the perfect solution to build new financial institutions. The core system is built for any type of account: joint account, or separate account. The portfolio management system can be connected to third-party authorisation and core banking as well. This means that you will be able to see all received deposits, payment card API connection, minimum funds requirements alerts and safeguarding requirements will be automated. As a banking-friendly solution we can help you meet prudential supervision guidelines or any local strict rules.

InvestGlass offers also a digtial onboarding tool which will help you onboard new customers and monitor terrorist financing activities, clients funds origine, legal person KYC or KYB.

Key Takeaways

- EMIs, regulated by legal frameworks like the EU Directive 2009/110/EC, issue electronic money and offer payment services, facilitating digital economic growth and financial inclusion but cannot engage in lending or investment services.

- While EMIs provide international payment services and e-wallets efficiently, they lack deposit guarantees, relying on fund segregation and insurance arrangements to safeguard client funds.

- Traditional banks and EMIs cater to different needs; EMIs are better for streamlined and digital financial services, while banks provide physical customer interaction and traditional banking services, along with deposit insurance.

Understanding Electronic Money Institutions (EMIs)

Electronic money institutions, also known as EMIs, are key players in the digital financial ecosystem, given their authorization to issue electronic money and provide payment services. An electronic money institution, sometimes referred to as a money institution, accepts funds from users and, in return, provides an equivalent value of electronic money for their transactions. This electronic money, stored on devices like prepaid cards or mobile apps, facilitates cashless transactions and simplifies financial interactions.

The emergence of EMIs has revolutionized the financial landscape, driving competition and advancing financial inclusion. EMIs offer a range of payment instruments and services, including:

- Enabling payments and transfers without a bank account

- Providing alternative financial services

- Positioning themselves as crucial players in the digital economy

These services have made EMIs popular alternative financial service providers, contributing to the growth of e money institutions in the digital economy.

Legal Framework for EMIs

Given their responsibility for users’ funds, EMIs operate within stringent legal frameworks to maintain compliance and protect consumers. In the European Union, Directive 2009/110/EC provides the legal foundation for the issuance of both e money institution i-money by EMIs, defining electronic money as electronically stored monetary value. This directive allows EMIs to issue e money, ensuring a secure and regulated environment for users.

In the UK, the Electronic Money Regulations 2011 along with the aforementioned directive form part of the legal framework for EMIs. These institutions must adhere to the Financial Conduct Authority’s Principles for Businesses, which mandate fairness and integrity. The prominence of EMIs in Europe skyrocketed after 2009 with the introduction of the E-Money Directive, further strengthening the legal framework surrounding these payment institutions.

Types of Electronic Money Institutions

EMIs are not all created equal. Based on their capital holdings and transaction volumes, they are classified as authorized or small EMIs. Authorized EMIs are akin to banks, providing payment services and holding funds for clients without limitations on the volume of business.

On the other hand, a Small EMI is a more limited version with specific caps on e-money issuance and average monthly payment transactions. For instance, in the UK, to be classified as a Small EMI, institutions must not exceed a monthly average of €5 million in average outstanding electronic money amount. These institutions issue electronic money and offer various payment services, carving out their niche in the e-money landscape.

Services Offered by EMIs

EMIs’ appeal stems from their diverse, cost-effective, and innovative financial solutions. From e-wallets and payment cards to handling international transactions, EMIs cater to diverse financial needs. In the UK, for instance, EMIs are licensed to handle international transactions and offer services like multi-currency IBAN accounts and foreign currency exchange.

EMIs distinguish themselves through their adaptability and the customization of their services to meet distinct business needs. For example, Verified Payments provides tailored financial services and platform customization to various industries. Similarly, Payset offers comprehensive customer support, faster account setup, improved rates, and new services like debit cards and budget management tools for business accounts, demonstrating the versatility and customer-centric approach of EMIs.

Payment Transactions

One of the primary services offered by EMIs involves facilitating payment transactions. These transactions can take various forms. Credit transfers, for instance, involve sending funds directly from one account to another. This mechanism is often used for one-time payments or transferring money to another person’s account.

Another common form of payment transaction facilitated by EMIs is direct debits. Here, businesses are authorized by customers to withdraw funds from their accounts on a recurring basis. This is commonly used for subscription services or regular payments. Furthermore, EMIs provide third-party authorization services that allow businesses to process payments with the customer’s consent, enabling functionalities like online shopping basket payments and managing subscriptions.

Cross-Border Payments

In our interconnected world, the need for cross-border payments is more prevalent than ever. EMIs fulfill this need by facilitating secure and efficient international transactions through the SWIFT network. This network connects over 11,000 financial institutions in more than 200 countries, making cross-border transactions a breeze.

What’s more, EMIs often offer:

- Competitive exchange rates

- Lower fees for cross-border payments compared to traditional banks

- Multi-currency accounts that enable customers to hold, manage, and exchange multiple currencies within a single account

These features make international transactions more cost-effective and simplify the process of cross-border transactions.

Limitations and Restrictions of EMIs

Despite the numerous benefits of EMIs, understanding their restrictions is crucial. For instance, unlike traditional banks, EMIs cannot offer lending, investment services, or deposit guarantees. Their focus is primarily on providing payment and financial solutions.

For more extensive banking needs like cash management provide payment initiation or specialized treasury management services, traditional banks are often preferred over EMIs. Furthermore, EMIs are restricted from offering account information and payment initiation services without acquiring specific authorization, marking a clear delineation between the services offered by EMIs and traditional banks.

Safeguarding Client Funds

Even with these limitations, EMIs prioritize the protection of client funds. They employ various methods to ensure the protection of these funds. One such method involves the segregation of funds, where the client funds are placed in dedicated, bankruptcy-remote client-asset accounts with third-party credit institutions.

Another safeguarding method involves insurance or guarantee arrangements, which transfer users’ credit risk to third parties, ensuring against losses. Some EMIs may even opt for the low-risk investment method, investing user funds in secure, low-risk assets. In the event of insolvency, EMI customers’ claims on safeguarded funds are given precedence over other creditors’ claims, ensuring maximum protection for clients.

No Deposit Guarantees

One of the significant differences between EMIs and traditional banks lies in the lack of deposit guarantees offered for funds received by EMIs. EU-based banks typically provide protection for user-deposited funds up to €100,000. However, this protection does not extend to funds held with EMIs..

In the event of an EMI’s insolvency, customer claims are to be paid from safeguarded funds before any other creditors, but this does not equate to a deposit guarantee like those available in traditional banking and credit services. Therefore, while EMIs prioritize safeguarding client funds, the lack of deposit guarantees is a consideration for potential users of EMI services.

Comparing EMIs and Traditional Banks

After delving into the realm of EMIs, it’s worthwhile to contrast them with traditional banks. While EMIs provide payment services and issue electronic money, they don’t offer traditional banking services like deposit-taking, lending, or investment management. This delineation of services highlights the specialized role of EMIs in the financial landscape.

On the regulatory front, EMIs operate within a framework specific to electronic money, devoid of deposit insurance schemes such as FSCS, unlike banks which are subject to strict oversight and offer deposit guarantees. However, when it comes to the user experience, EMIs often provide cost-effective services, reduced international transfer charges, and faster transactions, making them a viable alternative to traditional banking.

Advantages of Using EMIs

Opting for EMIs brings a unique set of benefits. They often offer streamlined processes for online account setup and transaction processing, reducing paperwork and administrative hassles. Additionally, many EMIs provide seamless integration with online platforms and accounting services, catering to digital-native businesses and tech-savvy individuals.

EMIs operate primarily online, allowing for fully remote onboarding and making their services more accessible to clients abroad. This digital-first approach often translates into innovative features designed to appeal to users seeking cutting-edge financial solutions, such as budgeting tools and integration with digital wallets.

When to Choose a Bank

Nonetheless, situations exist where a traditional bank may be a more advantageous choice than an EMI. Customers who value personal interaction and the ability to visit physical branches for assistance would find traditional banks more suitable. Similarly, businesses with operations primarily within their own country may benefit from the services and potentially lower fees offered by traditional banks.

Traditional banks also have a long-standing reputation and history, which can contribute to customer trust, whereas EMIs may lack this established reputation. Nonetheless, the innovative features offered by EMIs, such as:

- real-time transaction notifications

- easy-to-use mobile apps

- quick and convenient account setup

- competitive interest rates

Our services offer a compelling alternative to traditional bank accounts within the financial system.

Regulation and Compliance for EMIs

Understanding the regulatory landscape governing EMIs is essential when exploring their realm. In the UK, EMIs are regulated by the Financial Conduct Authority (FCA), which oversees 59,000 financial services firms and markets. These institutions are required to adhere to anti-money laundering (AML) regulations and the Revised Payment Services Directive (PSD2), which mandates enhanced consumer protection and payment security.

EMIs also incorporate AML and Know Your Customer (KYC) operations into their platforms for secure client onboarding and to fulfill regulatory obligations. The regulatory landscape for EMIs is continuously evolving, necessitating current knowledge of changes in legislation and regulations to maintain compliance.

Obtaining an EMI License

Securing an EMI license necessitates fulfilling capital requirements and the submission of comprehensive documentation. An EMI license allows the institution to issue electronic money and provide various payment services, differentiating between authorized and small EMIs based on their capital holdings and business model.

The application for an EMI license requires a range of documents including:

- Company details

- Operations program

- Business plan

- Organizational structure

- Evidence of initial capital

The business plan must include proposed activities and detail the security measures in place to safeguard client funds and ensure a reputable management body.

Ongoing Compliance Requirements

After acquiring an EMI license, continuous compliance with regulatory standards is required. In the UK, these include retaining a minimum ongoing capital of 2% of the total issued electronic money.

EMIs also need to comply with updates related to sustainable growth and economic policies, as stipulated in the Electronic Money Act of 2011 and the Payments Act. To fulfill international compliance standards, EMIs often adopt advanced security features like two-factor authentication and end-to-end encryption, particularly for cross-border transactions.

Case Studies: Successful EMIs in Action

Real-world examples best illustrate the evolution and success of EMIs. Take Verified Payments, which provides professional consultation for activities related to creating electronic money in the EU. Another example is Payset, which offers services such as multi-currency IBAN accounts, foreign currency exchange, account information services and support for major payment networks.

In 2022, Payset processed over £1 billion through more than 200,000 client transactions, demonstrating their financial throughput. In October of the same year, Payset expanded into the Israeli market, capitalizing on new fintech-friendly regulations. These case studies serve as a testament to the growth and potential of EMIs in the digital finance sector.

Summary

As we conclude our exploration of Electronic Money Institutions, it’s clear that these entities have a profound impact on the financial landscape. Through their ability to issue electronic money and provide customers funds a range of payment services, EMIs have revolutionized the way we transact, making payments seamless and banking more accessible. However, while they offer numerous advantages, it’s essential to understand their limitations and the differences between EMIs and traditional banks.

In the end, whether to choose an EMI or a traditional bank depends on individual needs and preferences. Regardless of the choice, one thing is certain – in the digital age, financial services are evolving at a rapid pace, and institutions like EMIs are at the forefront of this transformation, crafting the future of finance.

Frequently Asked Questions

Is an EMI a financial institution?

Yes, an EMI, or electronic money institution, is a type of financial or payment institution, that facilitates digital transactions for its clients.

What’s an EMI in banking?

An EMI in banking stands for equated monthly installment. It refers to regular payments made to repay an outstanding loan within a specific time frame, with each installment being of the same amount.

What is the difference between a bank and an EMI?

Banks are deposit-taking institutions that provide lending and payment services, while EMIs represent the digitalization of financial services and are smaller businesses operating with different capital requirements and restrictions than central bank.

What services do EMIs offer?

EMIs offer a range of payment services, including e-wallets, payment cards, multi-currency IBAN, offer bank accounts elsewhere, and foreign currency exchange. These services are designed to meet the diverse financial needs of their customers.

What are the limitations of EMIs?

The limitations of EMIs include their inability to provide lending, investment services, or deposit guarantees, as they primarily focus on offering payment and financial solutions.